EasyJet entering the battle of maintenance digitalization

EasyJet is currently embracing maintenance digitalization by acquiring as much data as possible and sharing it with its entire supply chain: death wish or wise move?

Digitalization will be a major cost leverage in the intense competition of the airline industry

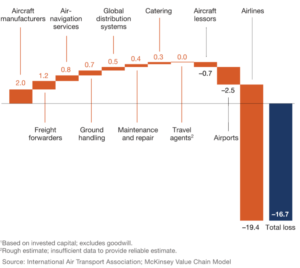

The airline industry is growing at an average annual rate of 5%, yet it lost $16.7 billions annually over the 2007-2014 period (exhibit 1, [1]). The oligopoly of the aircraft manufacturers manages to catch most of the value while airlines, subjected to fierce competition – are accountable for $19.4 billions losses. Remarkably, EasyJet, a low-cost European carrier, managed to make a £495 millions profit before tax in 2016 [2].

Exhibit 1: average yearly economic profit, 2007-14, $ billion

Exhibit 1: average yearly economic profit, 2007-14, $ billion

EasyJet was able to perform well mainly through a drastic cost control policy and, among all expenses faced by the airline industry, EasyJet performed particularly well in the operation of its aircrafts. This sector represented more than 16% of EasyJet cost advantage compared to legacy carriers [3], which makes it a major differentiator for the company.

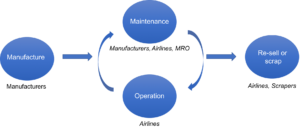

Due to the complexity of aircraft operations, various specialized players are part of the aircraft lifecycle, including manufacturers and Maintenance and Repair Operation (MRO) specialists (exhibit 2). EasyJet is a pure airline player and its maintenance is realized by MRO specialists. Interacting with all these players must be planned and controlled carefully to restrict costs.

Digitalization in aircraft operation consists in data collection and management throughout the whole lifecycle. This can result in the creation of an integrated data driven sequence of activities at any time of the lifecycle especially in the maintenance supply chain. In other words, digitalization in the maintenance supply chain allows airlines to improve the responsiveness of their maintenance to reduce operation cost. In that effect, digitalization in maintenance and operation can be seen as the new battlefield for cost reduction and loosing that battle could put even the most efficient airline at risk [4].

EasyJet intends to play a major role in this revolution

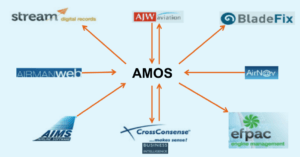

On the short term, EasyJet is digitalizing all its paperwork in maintenance and flight operation [5], meaning that the crews have a quick access to the most up to date version of their action/checking list. In addition, EasyJet is creating a new data management system, AMOS [6] that centralized information from all IT systems in one place (exhibit 3). Thanks to paperless work and to AMOS, EasyJet and its suppliers reduces the maintenance time and improves quality of operations.

Exhibit 3: The AMOS centralised IT system

Exhibit 3: The AMOS centralised IT system

Additionally, EasyJet wants to use drones instead of operators to improve reactivity and to shorten inspection time (exhibit 4). Drones can also gather more data than an operator thanks to different embedded sensors [7].

On the medium term, EasyJet aims at requiring all its suppliers to use AMOS to enable the whole supply chain to better communicate and share information. A direct access to information should let all players to be more proactive. This could even lead to an innovative preventive maintenance system and avoid on the spot repairs (exhibit 5) or unexpected aircraft unavailability. However such level of data sharing requires a strong level of trust between all partner.

Could EasyJet take other steps to keep its advantage?

Data management: share it or keep it to yourself?

Data is key on digitalization and its value will grow with its importance. Actors performing several activities in the aircraft lifecycle can have a larger grasp on data management. In that context, digitalization may advantage more vertically integrated players such as airlines [8] and manufacturers [9] [10] that are already very active in the field. Via sharing its information with suppliers, EasyJet might not only allow them to catch the digitalization value, but it can also serve its competitors as the suppliers serve other airlines. In order to address it, EasyJet should consider either enforcing drastic controls over its suppliers or consider vertical integration to perform maintenance itself.

Discussions with regulatory agencies to allow more fine-tuned repairs

Currently, the maintenance requirements stated by the regulation agencies are very high as we used to have very little information on the product life. Thus, lot of “over maintenance” was required for conservative reasons. Now that digitalization enables to know how every equipment is used, we could imagine replacing or repairing an equipment only when necessary, based on its wear and not its age. This would require heavy negotiations will regulatory agencies but the savings can be significant.

Further thoughts…

EasyJet is currently trying to tackle the challenge of digitalization. However, in order to take the most out of digitalization, data management and ownership are key. Does it mean the end of pure specialized players such as EasyJet? Will this new trend reinforce even more the strength of aircraft manufacturers or will it allow airlines to finally be profitable?

Word count: 792

REFERENCES

[1] “Buying and flying: Next-generation airline procurement” by Alex Dichter, Andreas Juul Sørensen, and Steve Saxon, McKinsey&Company. https://www.mckinsey.com/industries/travel-transport-and-logistics/our-insights/buying-and-flying-next-generation-airline-procurement (accessed November 2017)

[2] “FY 2016 Analyst & investor presentation”, Easyjet http://corporate.easyjet.com/~/media/Files/E/Easyjet/pdf/investors/presentations/fy-2016-results-presentation.pdf (accessed November 2017)

[3] “Airline Cost Performance” by Mark Smyth and Brian Pearce, IATA https://www.iata.org/whatwedo/Documents/economics/airline_cost_performance.pdf (accessed November 2017)

[4] ”Airline Economic Analysis“ by Tom Stalnaker, Khalid Usman, Aaron Taylor, Oliver Wyman. http://www.oliverwyman.com/content/dam/oliver-wyman/global/en/2016/jan/oliver-wyman-airline-economic-analysis-2015-2016.pdf (accessed November 2017)

[5] “innovating our way to lower maintenance costs” by Swaran Sidhu, EasyJet https://www.iata.org/whatwedo/workgroups/Documents/MCC-2014-ATH/D2/1050-1130-our-way-to-lower-mtce-costs-easyJet.pdf (accessed November 2017)

[6] “EasyJet’s Next Steps Toward A Paperless Maintenance Environment” by Hannah Davies, MRO-Network http://www.mro-network.com/maintenance-repair-overhaul/easyjet-s-next-steps-toward-paperless-maintenance-environment (accessed November 2017)

[7] “Innovations in Aircraft Maintenance at EasyJet” by Gareth Thomas, easyJet https://www.swiss-as.com/files/news/easyjet_AMOS.pdf (accessed November 2017)

[8] « Totally digital », Lufthansa technic https://www.lufthansa-technik.com/predictive-mtc (accessed November 2017)

[9] “Airbus Wants to Continue Digital Effort” by Woodrow Bellamy, Aviation today http://www.aviationtoday.com/2017/02/22/airbus-wants-continue-digital-efforts/ (accessed November 2017)

[10] “Airbus Selects Unabiz to Advance Research in Digitalization of Aircraft Maintenance Operations” Unabiz press release http://markets.businessinsider.com/news/stocks/Airbus-Selects-Unabiz-to-Advance-Research-in-Digitalization-of-Aircraft-Maintenance-Operations-1001876136 (accessed November 2017)

Really interesting article! Particularly enjoy the discussion at the end about how this may shift the structure of the airline industry (e.g. vertical integration) and the density of profits in different parts of the value chain.

The biggest question I had after reading this was, how are they possibly affording this? Doing a quick search, I found some interesting information about similar digitalization efforts at EasyJet which exemplify power this movement can have, especially in a high-capital cost industry such as aviation where, as you point out, over-maintenance is common (and thus costly).

In this case, EasyJet Head of Engineering Ian Davies discussed a new app to improve the replacement process for a plane’s fan blade (the typical EasyJet aircraft has 36 such blades). This software cost ~$20,000 to develop, but each individual fan blade costs ~$40,000. By improving replacement efficiency on this one component EasyJet estimated $2M annual savings. This example really hit home for me the power that data can have in a capital intensive, safety critical industry such aviation, and now my biggest question is why isn’t everyone doing this? (Operational complexity and lack of required skill-set is my current hypothesis but would be interested in alternative ideas!)

http://aviationweek.com/mro-enterprise-software/technology-investments-paying-easyjet-maintenance-cost-cutting

You are perfectly right CL !

The reason why everyone isn’t doing this is that in the engine maintenance business, manufacturers are intensively investing on technologies to kill any form of competition on the maintenance. Moreover, manufacturers bundle the engine itself with a maintenance contract so the customer is locked in for several years to maintain its engines by the manufacturer. Thus, on that precise area, engine manufacturers seem to have win the consolidation battle.

For example, Rolls-Royce now mainly sell its engines through a TotalCare contract: they sell both the engine itself and the maintenance of it for several years.

https://www.rolls-royce.com/sustainability/performance/sustainability-stories/totalcare.aspx

http://www.mro-network.com/maintenance-repair-overhaul/no-afterthought-rolls-royce-and-aftermarket

This was a very interesting read, thank you Marc. I have always considered EasyJet as the efficient incumbent, threatening the high cost, high priced production chains of flag carrier airlines to rapidly gain market share. In my mind, the central issue they are facing is “how to reduce costs in order to boost profits”. As a low budget airline, they can’t compete on ‘customer experience’ vis-à-vis competitors. They must compete on price. This is the lens through which I am reading your article. When you mention the paperless work and AMOS reducing maintenance time and drones instead of operators to reduce inspection time – I imagine that means more planes can get into the air, increasing the capacity/capability of each aircraft to ultimately (and hopefully) reduce the amount of aircrafts needed to carry out the same number of flights. The data management question you pose is equally stimulating. Again, here I wonder if another element is in play: politics. The airline industry is so competitive and aggressive to one another that the sheer fear of EasyJet data getting into the hands of, say, British Airways, may paralyze any data from leaving the company.

Given EasyJet’s position as the lowest-cost carrier, I wonder if they would care about sharing data if it meant they were able to access data from other carriers. Larger datasets would provide more value to EasyJet as they optimize operations, and they may even earn outsized impact relative to other carriers given their more limited route maps and their tailored value proposition. Could EasyJet consider selling its software products to other airlines and sharing the data more widely across all users? Partners along the supply chain could utilize a broader set of information, allowing EasyJet to remain pure play.