East Africa is disrupted as Israeli Startup, nFrnds, is innovating for those who really need it.

Social enterprise or clever business? Perhaps both! Mobile innovation has left many behind, but for nFrnds this has not gone unnoticed!

As the digital revolution continues to unfold, we have seen a shift from web-based innovation to mobile technology. With the ingenuity of smartphones led by Apple, Samsung and Google, much of the world’s engineering, design and inventive capability has gone toward servicing the large and fast-growing mobile market. But not all of us are benefiting from this.

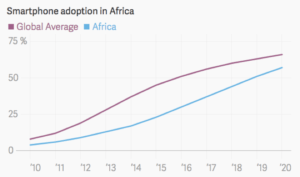

Smartphone penetration in Africa has grown exceptionally over the past few years, but is still relatively low. Estimates suggest that roughly 25% of population in sub-Saharan African countries own smartphones, leaving nearly a billion people without access to digital technology. [1] Meanwhile, mobile phone penetration is believed to be at 83% of Africa’s population, meaning that there are approximately 700 million people with access to regular mobile phones but without the technology that enables internet access. [2]

Figure 1 – Estimated historical and future smartphone adoption percentages in Africa. [1]

Whilst some estimate that by 2020, up to 50% of Africa’s population could benefit from mobile internet access, there is no denying that Africa is longing for mobile innovation today, and that entrepreneurs need not look very far in order to find the pain-points that technology can address.

Enter nFrnds, a startup that enables the connectivity of millions of regular mobile phones users across multiple countries in East-Africa, to practical applications that we in the western-world, have gotten accustomed to having literally at our fingertips.

Without the need for mobile data, those that were once “unconnected” can use nFrnds technology to enjoy access to financial services, agricultural information, digital medical records, and interactive instant communication. [3] Using ‘Un-Structured Supplementary Data’ (USSD) technology that exists in all mobile phones produced in the last 15 years, the company has enabled access to valuable applications typically only available through mobile data. [4]

The value that nFrnds creates for its users is enormous yet it can be difficult to quantify. Some examples of significant value creation include:

1. Ability to send money electronically regardless of location.

This allows a member of the family to take a job far away from his/her home, without worrying about how to send the money back to the rest of the family.

2. Access to agricultural information such as weather and market prices.

Famers are able to obtain information relating to weather conditions and market information such as prices for different agricultural goods.

3. Affordable instant communication.

Communication is an important enabler for many businesses and it provides efficiency for others.

… and all of this value is created for just $1 per month!

Differentiation

nFrnds decided to go after the market in which they can create the largest value, in an affordable manner, thereby capturing value in the process. The company is constantly looking for ways to create additional value for their base of the pyramid (BoP) customers, by creating partnerships that enable them to offer applications that are common in the western world. Recent global partnerships for nFrnds include Microsoft and Mastercard, who use the platform to connect with the BoP market. Others are local organizations such as rural pharmacies, religious groups, and micro-merchants. [5]

Figure 2 – nFrnds educating local entrepreneurs on potential benefits for their business. [5]

Additional steps to implement in the future:

Since its founding in 2014, nFrnds has proven that there is a market in emerging countries for the connectivity that they provide to their customers. So what’s next?

1. Growth Strategy:

As we approach 2017, nFrnds should consider their growth strategy with regards to their total addressable market. As smartphone penetration increases and price for mobile data decreases, there may be less demand for their services. nFrnds should therefore look to expand their services to other countries through partnerships with additional mobile networks. In addition, whilst they do have patented technology, USSD capability of mobile phones can be used by other entrants who could secure valuable partnerships in countries not yet entered by nFrnds.

2. Staying relevant through R&D:

Although they are currently serving a large market, nFrnds must think about the long term sustainability of their business. Staying relevant as smartphones and data packages become more affordable and widespread will be a challenge – particularly due to the inferior nature of the applications on USSD technology in comparison with typical mobile apps. nFrnds must therefore leverage their relationships with BoP consumers on the one hand and partnering companies on the other, to continue creating and capturing value for the stakeholders in their ecosystem.

One potential area of focus is to move towards the more rural communities where mobile data is less of a threat. In these communities there is a huge need for more holistic streamlining solutions in the agricultural sector. nFrnds could position themselves as partner to the smallholder farmer, providing real-time agricultural advice, facilitating cooperatives, and allowing for organized sales and distribution of farm-inputs.

(800 Words)

[1] http://qz.com/788657/a-chinese-aid-project-for-rwandan-farmers-is-actually-more-of-a-gateway-for-chinese-businesses/

[2] http://www.pewglobal.org/2015/04/15/cell-phones-in-africa-communication-lifeline/

[3] http://www.nfrnds.com/services/sectors/

[4] https://vc4a.com/ventures/nfrnds/pdf/

[5] http://community.businessfightspoverty.org/profiles/blogs/a-platform-for-partnerships-how-a-tech-start-up-is-enabling-loc-1

Great article Adam. The value add for rural settlers is tremendous here. I am curious about the infrastructure that nFrnds uses to deliver these services. Do they have to rely on major telcom companies such as MTN in order to deliver services to mobile phones? If yes, I’ll be curious as to how nFrnds will have a net positive cash flow by being so affordable to end users. If the company doesn’t rely on any telcom company network, I’ll imagine that MTN will be strongly considering this market. If they do, MTN appears to have “unlimited” resources to become a formidable competitor to nFriends. Will be interesting to hear your thoughts.