DONG Energy: Transforming the Renewable Energy Industry

Transformation of DONG Energy from a traditional energy player into the largest offshore wind power operator globally

DONG Energy: Company Overview

DONG Energy, founded in 2006, is one of the leading energy groups in Northern Europe. The company has four business units: (1) wind power, (2) bioenergy & thermal power, (3) oil & gas and (4) distribution & customer solutions. The company is listed in 2016 on the Copenhagen Stock Exchange with a current market capitalization of $16.0bn. Major shareholders include the Danish Government (59%) and Goldman Sachs (18%).

Exhibit 1: Asset Location of DONG Energy

DONG Energy’s Transformation into Renewable Energy

Established through the merger of 6 leading Danish companies, DONG Energy’s original existence can be traced back to 1857. Until 2006, the company was primarily engaged in producing and distributing power and energy through traditional energy sources. Driven by the heightened awareness of climate change, DONG Energy joined the UN Global Compact, supporting its ten principles on human rights, labor rights, environment and anti-corruption. As a leading energy company, it focused specifically on resources preservation and environmental sustainability.

Since 2008, the company pivoted itself strategically by entering into the wind power industry. To date, the company has installed 17 offshore wind farms with a total capacity of 3.0GW, with another 3.3GW capacity in the pipeline in Germany and UK. It currently represents 25% of the global offshore wind capacity.

As of 2015, the company recorded $2.4bn revenue and $0.9bn EBITDA from the wind farm operations, representing 20% and 34% of the company’s total revenue and EBITDA respectively.

Exhibit 2: Segment Financials of DONG Energy

DONG Energy’s Success in ESG (Environment, Sustainability and Governance)

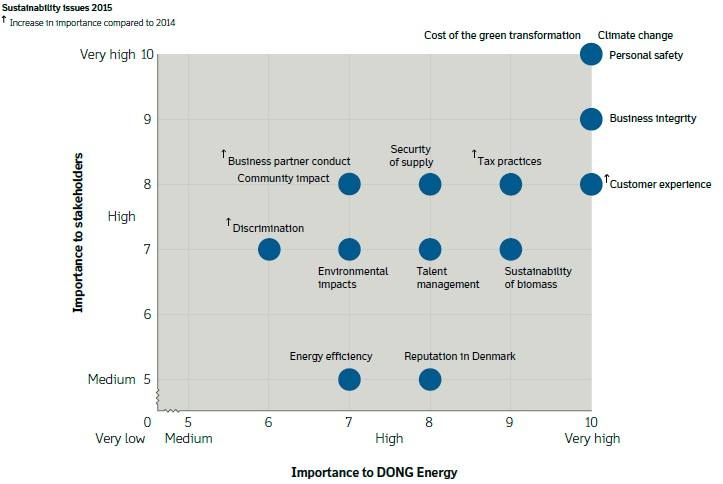

DONG Energy has identified 12 sustainability issues in 2015, of which both “cost of the green transformation” and “climate change” are ranked as most important to both stakeholders and DONG Energy.

On the climate change issue, stakeholders (i.e. NGOs, politicians and investors) focused extensively on the recent COP21 framework and increased expectations for companies to reduce their CO2 emissions. For DONG Energy, significant reduction of its CO2 footprints strengthens the company’s position in the green energy technology space, which in turn attracts competences and capital to the company’s business.

On the cost of green transformation issue, stakeholders, including politicians, industry associations and customers, focused primarily on the cost reduction of green energy, especially for offshore wind power which currently requires heavy government subsidy. For DONG Energy, it is also important to continue focus on technology improvement and long-term project economics without government subsidies.

Exhibit 3: Sustainability Issues 2015

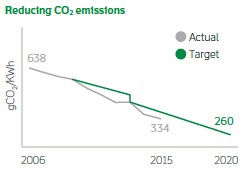

As the company shifts its business from traditional energy supply to renewable energy, the company successful managed to reduce CO2 emission from 638gCO2/KWh in 2006 to 334gCO2/KWh in 2015, or 48% decrease, which in aggregate equals to the removal of carbon emission from 7mm cars in a year. The decrease is mostly driven by the construction of offshore wind farms and conversion of its power station to use sustainable biomass.

During the same time, renewable energy in the company’s power and heat generation portfolio increased from 15% to 55%.

Exhibit 4: DONG Energy Carbon Emission by Year

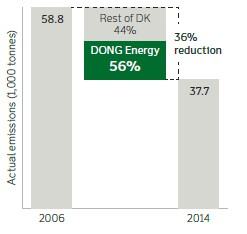

With its dedicated focus on lowering carbon emission, DONG Energy itself managed to account for 56% of the total CO2 reduction of Denmark from 2006 to 2014.

Exhibit 5: Denmark Carbon Footprint, 2006 vs. 2014

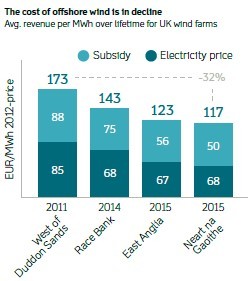

Despite the success in developing windfarms, the company still needs to address the issue related to project economics. Although the price of offshore wind power is in decline (32% from 2011 to 2015), over 40% of it is government subsidy. In fact, the company success in offshore wind could largely be attributed to the generous renewable energy subsidy schemes of Northern European countries.

Exhibit 6: Cost of Offshore Wind Power (2011-2015)

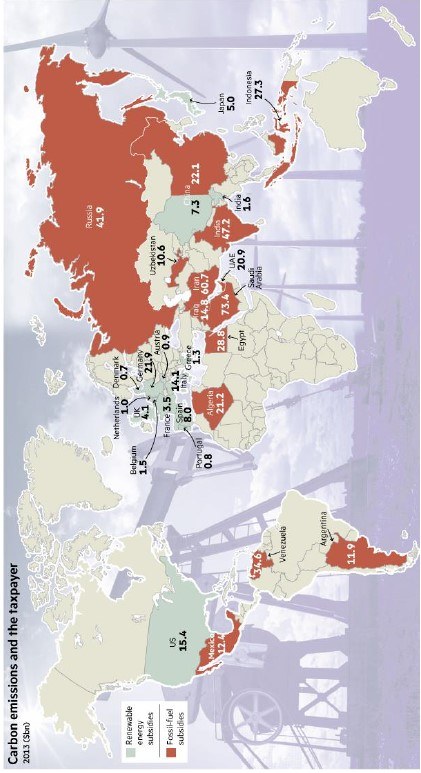

Exhibit 7: Fossil Fuel and Renewable Energy Subsidies Worldwide, 2013 ($bn)

Dong Energy 2020

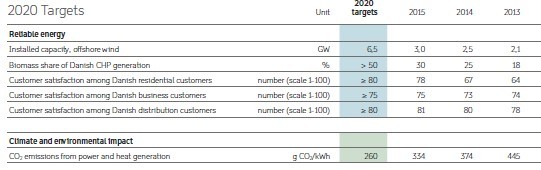

DONG Energy has adopted a long-term strategy of converting its energy supply to 100% eventually, through replacing traditional gas-fired power plants gradually by offshore windfarms. The company targets to have 6.5GW of installed capacity for offshore windfarm, representing 2.2x increase from current capacity, and enough to provide over 16mm Europeans with green power. To achieve that, the company identified that “green must be cheaper than black”, or that the projects must be able to generate sustainable returns without government subsidy and beat traditional fossil fuel on price. Going forward, the company would need to focus on the following areas to achieve their 2020 goal:

- Develop standard models for offshore wind farm that offers scalability and standardized implementation

- Improve turbine technologies that further increases energy conversion rate and adapts to a wider range of tidal

- Collaborate with upstream turbine manufacturer to reduce equipment cost

- Improve analytics capacity on project location, i.e. easier to find locations with optimal wind speed, distance to the coast, sea depth and seabed conditions

Exhibit 8: Dong Energy’s 2020 Targets

Word Count: 800

Reference:

[1] Dong Energy, Annual Report 2015

[2] Dong Energy, Sustainability Report 2015

[3] Dong Energy, Sustainability Performance 2015

[4] S&P Capital IQ Database, data retrieved on Nov 4, 2016

[5] Harvard Business School Case N2-317-032, “Climate Change in 2016: Implications for Business”

I tend to agree with the author that–although wind energy has the potential for further growth–its growth may be impeded without government mandate, especially given the recent low oil price. Off-shore wind farms may make sense in Denmark and Spain, where governments tend to be very supportive of such initiates. In the US, however, wind contributes only a mere 5% of all energy generated–this can be explained, in part, by the strong oil and gas lobbying presence in DC. According to a report compiled by Oil Change International and U.K. based think tank Overseas Development Institute: “[N]ational subsidies to oil, gas and coal producers amount to $20.5 billion annually in the U.S., with almost all of those being received in the form of tax or royalty breaks. Federal subsidies amount to $17.2 billion annually, while subsidies in a number of oil-, gas- and coal-producing states average $3.3 billion annually.” The figures are for 2015 and are expected to grow further in 2016 and onward.

While DONG’s initiative to convert 100% of its generation to renewable sources by 2020, some conventional generation may be warranted given the intermittent nature of wind generation. For example, if wind generally blows more strongly during the nighttime (off-peak), how would DONG plan to provide electricity during during on-peak hours? It is encouraging to see the decline in the cost of wind farms, which surely will continue, particularly as countries such as Germany are also pushing for increased wind generation (and offered a Feed-In-Tariff to this effect). It would be great to see these benefits cross the Atlantic and be applied to the U.S., but another challenge is that most of the large offshore wind farm EPC (engineering, procurement and construction) companies are located abroad, so the transportation costs to get equipment across the Atlantic is another impediment to increasing offshore wind generation in the states.