Digital Mayhem at the Gate – Is Allstate in Good Hands?

How is the 85-year old, largest publicly held property and casualty insurer in the US preparing for digital disruption in insurance?

Since Allstate started selling insurance through agents 85 years ago1, the insurance industry has rarely faced disruption on so many fronts and in such a scale as it does today2. The ubiquity of digital technologies in the recent years has enabled trends such as AI, big data analytics, Internet of Things, connected devices, mobility, miniaturization of tech, etc. that are affecting how insurance risks are underwritten, how insurance gets distributed and how consumers buy insurance2, 3. These trends are upending the moat of incumbent insurers and creating fresh new entry points for start-ups throughout the supply chain. Since 2015, insurtech start-ups across the insurance supply chain have attracted over $4bn in venture capital funding in over 300 early stage investments4. For a large insurer like Allstate, business going forward may not as usual. To maintain its leadership position in the new digital world, Allstate must innovate and disrupt its own ways of doing business before the new entrants do.

Among major insurers, Allstate has been on the forefront of embracing digitalization. In 2011, Allstate spent $1bn to acquire Esurance.com, an online only direct-to-consumer acquisition channel for its auto, home and life insurance lines, and Answer Financials, a carrier neutral insurance agency that allows comparability across insurance products from various insurers5. Since then, the Company has also launched other major digital initiatives, including:

- Drivewise, a telematic-based auto insurance program that uses a mobile application or an in-car device to capture driving behaviors and subsequently rewards customers for driving safely1

- DriveSense, a usage-based insurance product that gives customers flexibility to customize their insurance plan and pay based on the number of miles they drive1

- Arity, a separate insurtech company that leverages software, data, analytic and telematics to help better manage risks and is being adopted by both Esurance and Answer Financials and is also being marketed to non-affiliates1

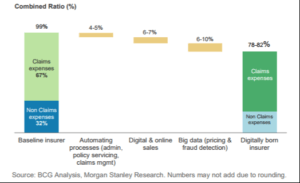

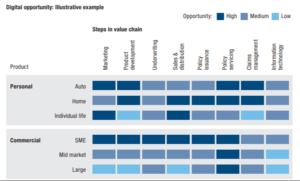

While these initiatives indicate significant steps towards digitalization for a legacy player like Allstate, they address primarily the more immediate sales and distribution challenges of a highly inefficient supply chain. Despite the investment in digitalizing distribution, Allstate still generated 90% of its 2016 insurance premium from its 34,160 licensed agents1. Industry observers note that digitalization unlocks significant value in almost every step of a legacy insurance supply chain – a vulnerability wide open for new entrants to exploit6 (Fig. 1). Therefore, for Allstate to hold on to its leadership position, the future roadmap needs to consist of not only incremental and immediate changes to parts of supply chain but a digital transformation of its entire supply chain.

Fig 1. 1-Combined ratio%: % profit generated6 Fig 2. Digital opportunities in insurance supply chain2

Allstate’s management agrees. Recently, Chairman and CEO, Thomas J. Wilson, declared, “Allstate is no longer an insurance company. Allstate is a software company7.” The VP of Allstate Claims Technology Services claimed that the company is now treating digitalization not as a threat but as an opportunity that not only unlocks embedded value from its existing business but also opens newer lines for growth. She detailed how Allstate is using “modern software development practices to build applications that make it easier for customers to self-serve” and is thereby hoping to “reduce the six million annual phone calls to claims by half7.” Allstate also recently introduced technology features to allow video appraisal of a claim and instant claim payment, becoming the first US P&C insurer to do so8.

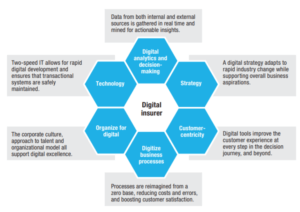

The true transformation of Allstate into a digital insurer [Fig 3] is a complex affair not simply because of the time and capital it requires but because of the conflicts it introduces with major value drivers of the legacy business model. For instance, Allstate’s direct-to-consumer initiatives are creating channel conflicts with Allstate 34k brokers5. Such transformation also requires a cultural convergence towards being more proactive, agile, experimentational and risk-taking – a behemoth thinking and acting like a digitally native start-up2,3.

Fig 3. Making of a digital insurer2

As Allstate forges ahead in its transformation from a legacy insurance company to a software company, many open questions remain.

Are the advantages of incumbency becoming tenuous or even a liability for Allstate? As it pushes its digital distribution channels, how will Allstate manage the conflict of interests with its 34k+ agents who currently produce 90% of its business?

What would be the basis for competition in the digital age? How can an incumbent with legacy IT, systems and culture reinvent itself to remain ahead of the digitally native new entrants? Being a public company, does it have the flexibility to trade-off current earnings for long-term value?

Word Count: 750

1 The Allstate Corporation, http://www.allstateinvestors.com/phoenix.zhtml?c=93125&p=irol-SECText&TEXT=aHR0cDovL2FwaS50ZW5rd2l6YXJkLmNvbS9maWxpbmcueG1sP2lwYWdlPTExNDA3MTk3JkRTRVE9MCZTRVE9MCZTUURFU0M9U0VDVElPTl9FTlRJUkUmc3Vic2lkPTU3, accessed November 2017.

2 Tanguy Catlin, Rob Hartman, Ido Segev and Ruxandra Tentis, “Making of a Digital Insurer,” McKinsey & Company.

3 Michael Lyman, Marc Carrel-Billiard & et. al, https://www.accenture.com/t20170322T024212__w__/us-en/_acnmedia/PDF-47/Accenture-Strategy-Allstate-DiscussionDoc.pdf, Accenture LLP.

4 www.cbinsights.com, https://cbi-blog.s3.amazonaws.com/blog/wp-content/uploads/2017/01/earlystage2016ins.jpg, accessed November 2017.

5 Wells Media Group, Inc, https://www.insurancejournal.com/news/national/2011/05/18/199061.htm, accessed November 2017.

6 Michael Niddam, Jon Hocking, et. al., “Insurance and Technology: Evolution and Revolution in a Digital World,” https://www.the-digital-insurer.com/wp-content/uploads/2014/10/372-evolution-revolution-how-insurers-stay-relevant-digital-world.pdf, The Boston Consulting Group, Morgan Stanley, p. 1-7.

7 https://builttoadapt.io/two-insurance-companies-learn-how-to-operate-like-a-startup-and-so-can-your-enterprise-3d6fb1a522d2, video accessed November 2017.

8 The Allstate Corporation, “Esurance Reinvents Insurance Claims Experience with Real-Time Video Appraisals,” https://www.esurance.com/company/news/2014-esurance-reinvents-insurance-claims-experience-with-real-time-video-appraisals.

Allstate’s greatest challenge to digitization may be internal resistance. While re-inventing its systems and business model will create incredible growth in jobs, these openings may come at the expense of some reductions on the agent side. On a day-to-day basis, channel conflict between the D2C business and the traditional agent business will frequently increase ire and anxiety from the agents.

Two solutions for Allstate, at least in the intermediary term, may be to clearly segment its business between D2C and agents and to build tools to help the agents. Clearer delineation of go-to-market segments will reduce agents’ daily frustrations of seeing customers “stolen” by D2C. Digitization that directly empowers the agents via better tooling may also help the agents see digital disruption in a positive light.

As a consumer, I think the digitization of the insurance industry is absolutely necessary. The brick-and-mortar agent model seems outdated in today’s day and age. One concern I have is around the implications this may have on the level of underwriting risks insurance companies make take on as the process becomes increasingly digitized and automated. As we saw in the financial crisis, the innovation and automation around mortgage approvals lead to an increase in banks risk tolerance and we all know how that turned out. As All State continues to transform itself into a digital software company, how does it ensure it properly manages risk in a digital world?

Very interesting read! Insurance is often hailed as the next frontier for digital disruption within financial services, and rightfully so – the possibilities from underwriting to customer acquisition to distribution chain efficiencies that can be unlocked through digital are endless. My concern with radical digital transformation, however, is not only that it might alienate existing agents, as highlighted, but also customers, a number of whom may still value the human relationship and personalized nature of physical, agent-led insurance distribution.

I believe that AllState should very much leverage digital to rapidly expand its middle and low-income, “mass” segment, who are likely quite price-sensitive and therefore much more amenable to transacting with a player that leverages digitalization to lower costs and in turn, the premiums these customers are required to pay. However, for upper-middle to wealthy segments, it may be worth analyzing in more depth whether digitalization of the insurance purchase experience might actually turn such customers, whose complex insurance and risk management needs may not be answered by a simplified digital portal, away. Here, AllState could perhaps take a more incremental approach on the front-end (while maximizing the use of digital on the back-end), such as empowering the agent with all the digital tools she needs to enhance the service experience rather than eliminating her altogether.

Very interesting read. There are clearly a significant number of challenges facing Allstate given the breadth and depth of change that they are exposed to across the value chain. Many of the previous comments have hit on the major concern of how digitization will impact the product offering, and consequently the employees / agents and the customer. There appears to be an implicit assumption that the agent model is likely to die given high cost, or at least be forced upward in the wealth band of customers as a premium experience.

I wonder if there isn’t an alternative way for Allstate to leverage digitization internally to harness the cost savings and efficiency of digitization within the existing agent model, and thereby create a differentiated cost-competitive model with broader appeal, while avoiding becoming a niche product or competing directly with direct to consumer online options. A choice to do the latter on a broad scale could be problematic, as low cost may not support the brand investments (i.e. Mayhem) that have enabled Allstate’s recent success.