Currenc-E: M-Pesa Transforms Kenyan Economy

Lauded as one of Africa’s greatest innovations, M-Pesa has revolutionized consumer spending in Kenya by introducing consumers to safe and reliable banking at a low cost.

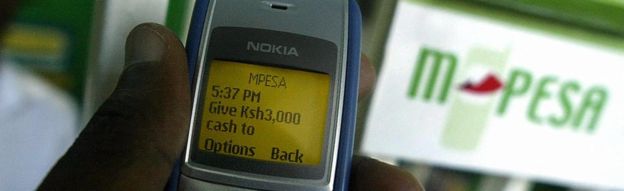

M-Pesa: The ‘M’ stands for mobile and ‘Pesa’ is Swahili for money. This simple yet sophisticated technology took Kenya’s economy by storm.

Digitally Democratizing Retail Banking’s Business Model

Upon initial launch as a microfinance product, Safaricom noticed consumers using M-Pesa for banking uses, and relaunched M-Pesa as a mobile payment platform. In 2010, 9 million Kenyans had accounts; by 2016, this number has swelled to over 21 million.[1]

By requiring only an SMS-enabled mobile phone and a national identification card, M-Pesa drastically lowered consumers’ barrier to banking entry. Value is also created for consumers in the form of safety: in Kenya and other emerging markets, it is common for consumers to be robbed of their physical cash, and M-Pesa eliminates this risk.[2] Additionally, although not intended to serve as a savings account, M-Pesa allows customers to save safely by eliminating the need for customers to store a large concentration of their lifetime earnings in their home, where the cash could be subject to theft or destruction (e.g. house fire). Lastly, M-Pesa provides rural consumers who are not near one of Kenya’s relatively scarce physical banks with closer access, as relatives are able to visit banks on behalf of family members and connect capital through M-Pesa.[3]

Safaricom is also reaping the benefits of M-Pesa by generating revenue through transaction fees. Each time a customer withdraws cash (e-float -> cash), the agent records a fee of 40 cents per transaction.[4] Agents are incentivized through a number of volumetric measures, and so an agent is driven to increase the number of customers who are both using and actively transacting through M-Pesa.

Agents Keep the Machine Going

M-Pesa’s operating model depends heavily on the quality and quantity of its agent network. As seen in Figure A, the agent serves as the intermediary between the customer and M-Pesa’s bank account. It is important to note that unlike a traditional retail bank, M-Pesa does not manage nor have custody of the assets in the bank account, as those funds become pooled and managed by two regulated banks.[5]

Figure A – Stanford University

The speed at which M-Pesa targets customer growth vs. agent growth is incredibly important for network effects to occur, as the system needs to be balanced at its onset. If there were disproportionately more customers than agents, customers would have longer idle times and churn would likely be greater.[6] On the other hand, if there were more agents than customers, agents would have higher lead times and the economic costs could outweigh gains and lead to agent churn. Since agents are compensated through volume, one-way M-Pesa can monitor this relationship is through transactions per agent per month, which optimally would hover near 1,000 transactions per agent (Figure B). A common issue that has led other mobile payment companies to fail is not maintaining this relationship.

Figure B – McKinsey & Co.

Though the M-Pesa structure is fairly efficient for consumers, there is room for improvement for agents. Unpredictable demand adds substantial liquidity pressure on the agent, and bank fees and transport fees can cut into margins. There are also scaling concerns – up until 2015, M-Pesa could only handle up to 320 transactions per second, and operations would slow on weekends and holidays.[7] This could lead to costly outages which would directly impact an agent’s revenue.

Improving Upon a Proven Operating System

M-Pesa clearly has a strong operating model; it was one of a handful of mobile payment systems to not only survive but also thrive in frontier and emerging market economies. Despite this success, I believe there are a few pain points in the operating cycle that M-Pesa can alleviate.

- Agent Operating Improvements

Keeping the agents happy is critical to sustaining growth in this model. One issue that M-Pesa should address is the liquidity pressure that the current operating cycle places on agents. Since there is little visibility on demand, agents may be limited by their liquidity buffers and how long they can wait before having to travel to the bank and convert cash and e-float. If M-Pesa could adjust the operating model to provide working capital to agents, it could vastly increase agents’ capacity.

Additionally, agents face high start-up costs when they first become licensed because they have to build a book of business. M-Pesa should help in sourcing customer relationships or subsidize agent start-up costs in order to lower agent churn.

- Increase Transaction Speed

Though M-Pesa recently invested in relocating servers from Germany to Kenya to reduce transaction speed from over 20 seconds to 6 seconds,[8] there is plenty of room to reduce that throughput time further. This is a bottom-line enhancement to system capacity and scalability, and can ensure sustainable growth.

Word Count – 800

[1] Daily Nation, “M-Pesa transactions rise to Sh15bn daily after systems upgrade,” http://www.nation.co.ke/news/MPesa-transactions-rise-to-Sh15bn-after-systems-upgrade/1056-3194774-llu8yjz/index.html

[2] Jack, William & Suri, Tavneet, Georgetown University & MIT Sloan, “The Economics of M-PESA,” http://www.mit.edu/~tavneet/M-PESA.pdf

[3] Jack, William & Suri, Tavneet, Georgetown University & MIT Sloan, “The Economics of M-PESA,” http://www.mit.edu/~tavneet/M-PESA.pdf

[4] Jack, William & Suri, Tavneet, Georgetown University & MIT Sloan, “The Economics of M-PESA,” http://www.mit.edu/~tavneet/M-PESA.pdf

[5] CGAP, http://www.cgap.org/blog/10-things-you-thought-you-knew-about-m-pesa

[6] McKinsey & Co, “Mobile money: Getting to scale in emerging markets”, http://www.mckinsey.com/industries/social-sector/our-insights/mobile-money-getting-to-scale-in-emerging-markets

[7] Daily Nation, “M-Pesa transactions rise to Sh15bn daily after systems upgrade,” http://www.nation.co.ke/news/MPesa-transactions-rise-to-Sh15bn-after-systems-upgrade/1056-3194774-llu8yjz/index.html

[8] Daily Nation, “M-Pesa transactions rise to Sh15bn daily after systems upgrade,” http://www.nation.co.ke/news/MPesa-transactions-rise-to-Sh15bn-after-systems-upgrade/1056-3194774-llu8yjz/index.html

I remember when Lesley Stahl did a 60 Minutes segment on M-Pesa – this is a super interesting topic and it’s great to know more about their business model. One thing I wonder about is how M-Pesa will adapt as banking systems become more sophisticated and people become richer in emerging market countries. M-Pesa is improving the economic situation of so many, but as regulation emerges and citizens become richer/able to afford newer technology, will M-Pesa survive?

Thanks, Nicole! I think there are two reasons for optimism with M-Pesa. 1) No matter how much wealth creation occurs in emerging markets, transportation is a real issue and the gap between brick and mortar banks and residents is sufficiently large, even if geographic proximity improves (aka more banks are built). The convenience of mobile banking is a huge win here. 2) There are plenty of frontier markets for M-Pesa to target where economic growth is just beginning, and traditional banking lags.

M-Pesa is a very interesting success story as it helped Kenya and other emerging countries experience the basic form of technology. However, M-Pesa is presenting a clear dichotomy between a) educating people on the use of technology and b) supporting low-tech people with their daily transactions. PwC Global Entertainment and Media Outlook: 2015-2019 forecasts smartphone penetration to become around 70% in 2019, making M-Pesa platform almost obsolete (see: https://www.theatlas.com/charts/NJWtEIoP). Moreover, with Facebook and Google working heavily on connecting the 2/3 of the population that is not connected to the internet, M-Pesa will suffer even faster. Although M-Pesa like platforms are very important in jumpstarting the digital ecosystem of an emerging country, they needs to modify their offering to capture the market when the technology becomes more mature.

Thanks for a super interesting post, David! I <3 M-Pesa, and haven't thought about it from this perspective, so this is really cool. One question that I've been struggling with recently involves the potential for abuse of M-Pesa by terrorists and other illicit actors. There are allegations that al Shabaab and other al Qaeda affiliated groups have used M-Pesa to transfer funds across borders and within countries in east Africa. As a result, some of the banks that underly the system have begun to think about how to limit their exposure, in large part because American and European authorities have become increasingly aggressive in holding banks accountable for violating anti money laundering regulations. Do you think M-Pesa will be able to develop effective ways to a) know and verify their customers and b) monitor transactions for suspicious activities, both of which would add significant friction to the system?

Great article, David. M-Pesa has been a leader in making the previously unbankable, bankable, and accelerating the penetration of financial markets in developing countries, a key component in building economic growth. Given the technology and regulatory risks outlined above by Ben and Wiss, should they revisit offering a microloan product and start underwriting and issuing consumer or small business loans? This would cement its position and likely make the company more profitable, if they are able to offer interest rates that more than cover default rates.

Hi David, great to see a post on M-Pesa. Clearly branchless banking is an important tool for increasing financial inclusion. However, what fears do you have with respect to financial products and infrastructure such as M-Pesa sitting outside of the financial regulators purview? in Kenya, the Telecommunication Commission regulates Safaricom, under which M-Pesa sits. Safaricom could in fact change the monetary supply in the Kenyan economy (10% of GNP flowing through their product) by changing the units of exchange from, for example, 1 M-Pesa unit to 1 KSh, to 1.2 M-Pesa units to 1 KSh.

How do you think other countries with low levels of financial inclusion should address this issue?

Thanks for writing about M-Pesa, David.

Kenya’s largest bank, Equity Bank, also has an extensive agency network and a mobile payments system. I’m not an expert on M-Pesa, but I believe that the company lacks a retail branch network in Kenya. What are the implications of this operating model difference between Equity Bank and M-Pesa? Assuming Equity Bank’s mobile payments system is of a similar quality to M-Pesa’s, why would a customer not prefer the option that gives her access to the country’s largest branch network?