ConEd: Adapting to New Regulatory & Physical Environments

How one of the country's largest utilities is coping with the physical and regulatory challenges of climate change.

On October 29, 2012, a transformer at Consolidated Edison’s (NYSE:ED; “ConEd”) power plant in Manhattan’s East Village exploded when the water surge from Superstorm Sandy flooded the facility. The explosion caused a blackout throughout lower Manhattan, with some areas remaining without power for over a week. All in all, Superstorm Sandy interrupted service to 1.4 million ConEd customers and cost the utility nearly $600 million in response and restoration1. In the aftermath, ConEd pledged to invest $1 billion of “storm-hardening” funds over 4 years to reinforce its energy delivery systems and reached an agreement with the New York State Public Service Commission (NYSPSC) to take climate change into account during operational and capital planning2.

Public utilities like ConEd face increasing pressure to reduce the impact of climate change on their businesses (and vice versa) and conform to new environmental regulations. These impacts and regulations have substantial implications for ConEd’s business.

Physical Impacts of Climate Change

Climate change’s environmental impacts have significant repercussions for ConEd:

- Significant investments in restoration and recovery. There is scientific consensus that rising global temperatures will cause changing weather patterns and increasingly extreme weather events. Like Superstorm Sandy, these weather events could erode ConEd’s infrastructure and force it to invest significant amounts of capital to fix and maintain its energy delivery systems.

- Increased operational uncertainty. As weather becomes more volatile, consumer energy demand could become harder to forecast. Utilities rely on accurate energy consumption forecasts to plan their power purchasing and operating activities, and uncertainty in forecasts could cause ConEd to build in additional buffers that may prove to be operationally and financially costly (e.g., store more electricity than is needed). Moreover, as temperatures become more extreme, energy demand could increase significantly and require additional operational and capital investments in energy-generating assets.

- Increased financial uncertainty. Utilities also often use demand forecasts to inform their power purchasing behavior and hedge energy price exposure (e.g., through financial securities like futures contracts). Studies estimate that better demand forecasts could result in tens of millions of dollars in savings per year; on the other hand, poorer forecasts could result in significantly increasing costs.

Regulatory Impacts

As a utility, ConEd is subject to significant regulations on both the state and federal level. In recent years and relative to the federal government, New York State has taken strong steps toward curbing climate change through the use of regulation. A sampling of recent regulations include:

- In August 2016, the NYSPSC approved the Clean Energy Standard, which mandates that 50% of New York’s energy come from renewable sources by 2030. In particular, the standard forces utilities to have an aggressive phase-in schedule, with 26.31% in renewable sources in 2017 growing to 30.54% in 2021.3

- In May 2016, the NYSPSC approved a restructuring of utility regulations to place greater emphasis on clean energy. In particular, these regulations incentivize utilities to develop distributed clean energy resources like solar, geothermal, and wind by providing financial rewards for investments in clean alternatives that show a tangible consumer benefit.4

The current regulatory climate makes it highly costly for ConEd to ignore clean energy alternatives, but also financially rewarding if it can successfully replace old energy sources with new renewable ones.

Path Forward

ConEd has made significant investments to mitigate the physical impacts of climate change and conform to applicable regulations. Going forward, ConEd should continue deploying capital across four primary avenues.

- Fortify and upgrade infrastructure. In 2015, ConEd invested $2.6 billion to upgrade or reinforce its existing energy delivery systems and is expected to invest over $3.2 billion toward this effort in 20165. Continuing to deploy capital in a preventive and intelligent way can reduce the costs of severe weather events down the road.

- Invest in smart technologies. Technologies like smart meters allow ConEd to predict when issues may arise with consumers and help them address issues before they occur. Increasing adoption of these technologies can help ConEd better predict demand patterns and efficiently allocate energy to the right areas in real time. To build these capabilities, ConEd should concurrently invest in analytics technologies (e.g., IBM, SAS) that allow it to sift through live data to glean additional operational insights.

- Invest in clean energy alternatives. In the long run, the best way for ConEd to mitigate the physical impacts of climate change and conform with regulations is to encourage the development of viable clean energy alternatives. ConEd should consider principal investments in companies that are developing clean energy infrastructure, and should also consider sponsoring renewable energy research (e.g., grants or awards).

- Offer incentives for energy saving behavior. By offering consumers incentives (e.g., discounts) for energy-efficient behavior, ConEd can reduce emissions and usage of non-clean energy sources. Furthermore, setting targets for consumers allows ConEd to influence end market demand, thus making it potentially more predictable.

(794 words)

[1] Con Edison: – Investor Relations – Annual Reports. 2016. Con Edison: – Investor Relations – Annual Reports. [ONLINE] Available at: http://investor.conedison.com/phoenix.zhtml?c=61493&p=irol-reportsannual. [Accessed 03 November 2016].

[2] Con Ed Agrees to Climate Change Plan. 2016. [ONLINE] Available at: http://blogs.ei.columbia.edu/2014/02/24/con-ed-agrees-to-climate-change-plan/. [Accessed 03 November 2016].

[3] Governor Andrew M. Cuomo. 2016. Governor Cuomo Announces Establishment of Clean Energy Standard that Mandates 50 Percent Renewables by 2030. [ONLINE] Available at: https://www.governor.ny.gov/news/governor-cuomo-announces-establishment-clean-energy-standard-mandates-50-percent-renewables. [Accessed 03 November 2016].

[4] Public Service Commission Approves Restructuring of Utility Regulations to Combat Climate Change & Achieve Nation-Leading Clean Energy Goals. https://www3.dps.ny.gov/pscweb/WebFileRoom.nsf/Web/9B4FB5513905CB5985257FB8006DAD48/$File/pr16028.pdf?OpenElement. [Accessed 03 November 2016].

[5] Con Edison: – Investor Relations – Annual Reports. 2016. Con Edison: – Investor Relations – Annual Reports. [ONLINE] Available at: http://investor.conedison.com/phoenix.zhtml?c=61493&p=irol-reportsannual. [Accessed 03 November 2016].

Of the four suggested actions, I’m the most torn over the investments to upgrade existing infrastructure. To be through, no doubt will we need to coordinate research efforts to develop smarter grid management and renewable sources. Even demand manipulation, social or technological, is a no-brainer, why shouldn’t we consume less if we can afford it? Upgrading infrastructure presents a dilemna in a way these other three suggestions do not: now or later?

As we have seen with some government-supported urban utility infrastructures installed in the late 60’s and 70’s, their 30-year project timelines are all but expired. Why hasn’t congress appropriated the funds necessary to do these overhauls and upgrades? One argument is political, the other transcends party lines and is that there simply isn’t money to do it and that costs need to be deferred. How long can we defer? How long can the private sector defer? These questions make me wonder if we will start seeing wide-spread failures in our bridges, sewers, reservoirs and other public utilities bases. IF we are to upgrade, when? Are there going to be dramatic improvements in infrastructure technology and construction/planning efficiency in the next coming years such that it might make sense to delay? From what I can tell, electric grid and distributed storage/generation seems to be one of the likely places where this innovation may occur. Thanks for writing.

It’s easy to think that climate change happens “somewhere else” like melting at the polar ice caps or flooding in poor, remote islands. I am guilty of this too and it’s understandable to think that climate change is a theoretical concept until it impacts your life. Hopefully Superstorm Sandy’s arrival in Manhattan was a wake-up call to Americans, especially in the northeast.

It is interesting for me to read about all of the direct actions ConEd is taking. From investing in infrastructure, smart technology, clean energy, and reaching out to consumers through incentives, I am impressed how ConEd is extremely targeted in its plan. I am most excited about ConEd reaching out to its consumers and the ways that ConEd can publicize its actions so that consumers can educate themselves and their communities. ConEd could transform from just a utilities company to an energy education company. Apartment renters and homeowners all want to reduce their costs, so if ConEd helps create an easy system for consumers to reduce costs through environmental action then I think they make significant progress.

Like the frog who doesn’t realize the water in the pot is boiling until it’s too late, I hope that we can take decisive actions now. No single company or person can reverse the trend, but we also can’t do it without every single person and company’s help.

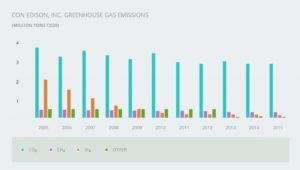

In the figure 2, I notice there are some drop of greenhouse gas emission during the past decade, especially the emission of SF6. Does this mean ConEd installed cleaning facility to reduce the emission of certain greenhouse gas or was gradually switching to alternative source that has less impact of greenhouse gas? Was the overall electricity generation of ConEd increased or decreased during the same period? It would be useful to find out ConEd’s timeline towards fulfilling regulatory target by 2030 relatively to its generation growth or decline. As the previous commenter mentioned, reducing greenhosue gas isn’t one company’s duty. If we can significantly reduce the demand of electricity for the next two decades, the combined effect will be much more profound.