Chubb: Rethinking the Insurance Supply Chain in Response to Wildfires

Examining an insurer’s use of private firefighters to protect client assets from worsening wildfires.

This post will analyze the response of Chubb Limited (NYSE: CB) to worsening damages caused by wildfires, a subset of the broader climate change megatrend. Chubb is a leading property casualty insurer, with products ranging from personal lines (e.g., home insurance) to commercial lines (e.g., workers’ compensation), and in 2016 had gross written premiums of $35 billion[1].

Why worsening fires are an issue for Chubb’s management team

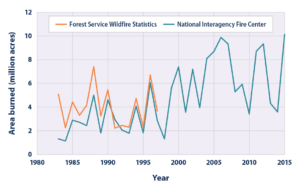

Insurers have always had to manage risk of wildfires, but in recent decades climate change has exacerbated the issue. As the graph[2] below shows, an increasing level of acreage has been burned by wildfires over time.

Research has suggested that an area equivalent in size to the states of Massachusetts and Connecticut combined has been burned due to human driven climate change[3]. The economic cost associated with the fires is enormous (the October 2017 California fires alone are estimated to have caused $85 billion in damages[4]), and property insurers like Chubb are heavily exposed. For example, The Travelers Cos, Inc., a primary competitor of Chubb’s, announced losses of $525 to $675 million (pre-tax) related to the California fires.[5]

What Chubb’s management team is doing to address the issue

As an underwriter, Chubb “assess[es], assume[s] and manage[s] risk with insight and discipline.”[6] The individual pays a known cost (premium) in exchange for handing off an unknown, possible cost. The ensuing value chain is as such:

Individual risk –> insurance distributor –> primary insurer –> reinsurance distributor –> reinsurer

Chubb manages this side of the equation through underwriting selection (picking the right risks) and price (estimating the risk of the aggregate pool and setting insurance premiums appropriately). But insurers also serve as risk managers, particularly in commercial lines (e.g., sending risk control engineers to mitigate future losses by removing things like hazardous chemicals). The coordination of this latter function, in combination with the payment of claims to customers, forms the insurance supply chain. While largely intangible, this supply chain comprises the deployment of capital from the capital markets to an individual to indemnify loss, and the deployment of risk management services to prevent loss:

Capital markets –> primary insurer –> loss prevention + loss indemnification –> individual risk

In response to the growing threat from wildfires, Chubb and other insurers innovated by introducing loss prevention into the personal lines space. Specifically, the company contracted with private firefighting services to defend its insureds’ homes. The company has engaged in this practice since 2008, and Chubb EVP Paul Krump says enrollment in the services has been “growing leaps and bounds.”[7] Private firefighters are deployed to at-risk homes to perform preventative services such as clearing debris, applying fire retardants, and extinguishing brush fires as they occur on the property. Chubb coordinates the delivery of this service via local “command” centers that partner with the California Department of Forest and Fire Services. The service is free to wealthy clients who enroll.7 This innovation represents a step towards a “vertical integration” of Chubb’s supply chain, in that it transforms an implicit loss control service (reliance on local public fire departments) into an explicit offering that is coordinated by the insurer itself. By rethinking its personal lines supply chain, Chubb lowers its exposure to the worsening fires.

Additional recommended actions for Chubb’s management team to consider

There are only so many levers Chubb’s management team can pull (reducing exposure to high-risk areas, increasing prices), and they are undoubtedly using all of them. Regarding the use of private firefighters, there are a few additional steps to consider. The first would be to “complete” the move towards vertical integration by bringing the service fully in house. Should the wildfire trend continue to worsen, it is reasonable to conclude that more insurers will attempt to use the private contractors. There is an interesting parallel here to claims service in the aftermath of a hurricane – demand for 3rd party claims adjusters skyrockets as insurers race to reach their clients, and the reliability of the service thereby worsens during the surge. A rival insurer, Travelers, innovated post-Katrina by bringing its catastrophe claims service fully in-house, cross-training its existing claims adjusters to respond to hurricanes.[8] This enables faster and more reliable time-to-customer. Given that the firefighters will only ever be in demand during “surge times,” this could be a logical action for Chubb to take. A corollary to this step would be to continue to invest in risk modelling and geospatial analytics to better identify at risk homes in real time and to integrate that intelligence into the deployment of the firefighters.

A second angle for Chubb to consider is to combat the root cause of the problem itself, climate change. Chubb is in a unique position to be an advocate here because it has a front-row seat to the costs associated with a changing climate.

Open questions for consideration

A key question raised by this article is the “fairness” of this service. As the economics are likely only favorable for the insurer to provide the service to high net worth clients, it effectively creates a “two-tier” system.[9]

Word Count: 795

[1] Chubb Company Website. “About Chubb.” https://www2.chubb.com/us-en/about-chubb/about-us.aspx. Accessed November 2017.

[2] Environmental Protection Agency, https://www.epa.gov/climate-indicators/climate-change-indicators-wildfires

[3] John Abatzoglou and A. Park Williams, “Impact of anthropogenic climate change on wildfire across western US forests.” 2016. http://www.pnas.org/content/113/42/11770.full. Accessed November 2017.

[4] Brian Lada, “Devastating California wildfires predicted to cost US economy $85 billion; Containment may take weeks,” Accuweather, October 15, 2017, https://www.accuweather.com/en/weather-news/devastating-california-wildfires-predicted-to-cost-us-economy-85-billion-containment-may-take-weeks/70003000. Accessed November 2017.

[5] “In Advance of Its Investor Conference, Travelers Estimates Range of Catastrophe Losses from California Wildfires,” press release, on November 9, 2017, Travelers website, http://investor.travelers.com/file/Index?KeyFile=391021355. Accessed November 2017.

[6] Chubb Company Website. “About Chubb.” https://www2.chubb.com/us-en/about-chubb/about-us.aspx. Accessed November 2017.

[7] Leslie Scism, “As Wildfires Raged, Insurers Sent in Private Firefighters to Protect Homes of the Wealthy,” WSJ, November 5, 2017, https://www.wsj.com/articles/as-wildfires-raged-insurers-sent-in-private-firefighters-to-protect-homes-of-the-wealthy-1509886801?mod=trending_now_4. Accessed November 2017.

[8] Travelers Company Website. “Catastrophe Response.” https://www.travelers.com/claims/catastrophe-response/index.aspx. Accessed November 2017.

[9] Leslie Scism, “As Wildfires Raged, Insurers Sent in Private Firefighters to Protect Homes of the Wealthy,” WSJ, November 5, 2017, https://www.wsj.com/articles/as-wildfires-raged-insurers-sent-in-private-firefighters-to-protect-homes-of-the-wealthy-1509886801?mod=trending_now_4. Accessed November 2017.

Very interesting and well written article! As I was reading, my first thought was about the risk of creating a “two-tier” system that you identify as a discussion question at the end. I think that is a tough question, and Chubb needs to tread carefully so that they don’t create backlash. They need to frame it that they are providing an extra service in exchange for a higher price, and make sure that the media does not frame it that they are letting poor people’s homes burn because they’re not profitable. They can do this by pointing out that they are still insuring non-wealthy clients (assuming they pay the applicable fee). I am curious to know if Chubb has also lobbied or invested in measures to be proactive about preventing the effects of climate change from happening in the first place. Their current actions are reactive measure to battle the effects of climate change.

It’s interesting to think about a company like Chubb in the context of the other supply chain challenges faced by other organizations due to climate change. Specifically, as various extreme weather events (like wildfires) are on the rise, it creates more and more instances where a supply chain could be at significant risk. For example, think of the challenges that any organizations faced this past year with a part of the supply chain in or around the Houston, TX area.

With Chubb’s increased need to focus on loss prevention, is there a role for an insurer to support organization’s in better assessing and preventing supply chain interruptions due to these extreme events? Is that a value add that could increase revenues for Chubb? And to what extent can extreme events even be protected against for supply chains that so often necessitate the span of multiple geographies?

The point that you bring up regarding the perceived unfairness of a 2-tier system is certainly one that has the potential to be a public relations nightmare for Chubb. As a way of combatting this negative perception while also actively taking steps to reduce risk would be to incentivize not only customers but whole communities to mobilize and take the action necessary to reduce the wildfire risk. Essentially, Chubb would need to be more transparent about its pricing models to make customers/communities understand fully and in detail which levers they can use to reduce risk and thus prices. The onus will need to migrate to the citizens and communities to contract a private firefighting force in this example, but that would appropriately shift the responsibility to the customers and would correct the perception problem.

Very interesting perspective and well written article. It is interesting to see how insurers are taking measures to reduce the risk of claims. On the point about vertical integration, however, I have a different view: while climate change leads more extreme weather conditions and causes more surge claims, I do not think it justifies bringing capacity in-house to serve surge demand. I think the criteria for bring services in house is frequency of usage and room for improvement. Chubb has limited expertise in firefighting and utilization of additional claim adjusters to cover surge demand could be very low. Therefore, I think Chubb should focus on its strengths – mitigating, forecasting and pricing risk in this new context of climate change.

I find Chubb’s response very innovative to the wildfire problem that it is facing. In the essay, it’s mentioned that Chubb is in a unique position to address climate change costs given its role as an insurer. However, I wonder how governments and scientists would respond to their position given that they appear to be making money off of climate change with new services such as in-house fire fighting. I think this raises a very interesting question – Is Chubb actually doing something to address climate change and alleviate its effect or is it just responding with new products to commercialize its effect?