Capitalizing on Change: Nordic Bulk Carriers and the Northwest Passage

Climate change already presents numerous challenges for many businesses. But for some industries, does this cloud have a silver lining?

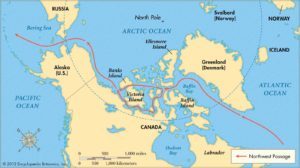

In 1903, Roald Amundsen completed the first nautical expedition through the Northwest Passage—a treacherous channel through Arctic ice which connects the Atlantic and Pacific Oceans to the north of Canada.[1] The voyage (conducted in a small, 70-foot vessel because parts of the passage were only three feet deep) took Amundsen and his team three years. Since then, merchant shipping companies have sought out ways to utilize this route for profit; however, the passage was impassible by large freighters until early in the 21st century.

The Northwest Passage refers to a series of waterways which connect the Atlantic and Pacific Oceans through the Arctic Ocean. For the past hundred years, merchant shipping with deep draft vessels (i.e. container ships) through the Northwest Passage was not feasible due to the presence of Arctic ice along the route: the channel’s width and depth precluded the passage of any large vessel through the passage. As climate change has led to the melting of Arctic ice in the past several decades, the routes through the channel have quickly opened up, leading to the possibility of a new, fairly direct trade route across the world.

Although there are many possible paths through the Northwest Passage, the most direct route from East Asia to Western Europe is approximately 13,600 kilometers (km) in length. By comparison, the quickest route through the Panama Canal is roughly 24,000 km,[3] requiring $80,000 more per journey (in fuel alone) for the average container vessel.[4] The Panama Canal is also impassible by both the largest container ships and smaller ships when fully loaded. Although there are ongoing efforts to deepen the canal, its width will always be a limiting factor in the number of ships that can pass through at any given time. The financial impact of decreased fuel costs, ability to use larger vessels, and shorter transit times are all factors that have shipping companies looking to the Northwest Passage.

There are many companies that are poised to take advantage of these new opportunities, but Northern Bulk Carriers (NBC) is better positioned than most. In 2013, NBC was the first shipping company to transit the Northwest Passage with a deep draft vessel, the Nordic Orion, which transited from Norway to China with a shipment of coal. This historic voyage—although controversial due to the risks that the company undertook to complete it—was a landmark event that served as a proof of concept for shipping through the passage.[6]

Although NBC made history with the Nordic Orion, it cannot afford to rest on its laurels. Other shipping companies are quickly identifying ways to capitalize on the newly-opened route. In addition, the Chinese government is already preparing to send ships through the passage, having recently published a document titled the Arctic Navigation Guide (Northwest Passage) to help its ship captains prepare for the journey.[7]

To maintain a competitive advantage in the waterway, NBC needs to allay concerns that customers have with contracting shipments in the Northwest Passage. Accordingly, it must do the following to remain ahead of the competition:

1) Continue to invest in the ships that are equipped to handle the challenges of arctic shipments. In the last two years, NBC has taken delivery of six new ice-class vessels.[8] As demand increases for more shipments, it must ensure that it can fulfill its orders.

2) Ensure that it maintains a strong safety record. Northern shipping is extremely hazardous, as 99% of Arctic waters are uncharted.[9] Since customers may entrust a merchant company with more than $5,000,000 on a single voyage, the margin for error is low.[10] As additional routes of the Northwest Passage continue to open, NBC should ensure that its routes follow as close as possible to locations with icebreakers and recovery vessels in the event of an emergency.

The Northwest Passage is a new opportunity that still bears considerable risk. If done correctly, though, Nordic Bulk Carriers can take advantage of these challenges while strengthening its position as a leader in arctic shipping.

(800 words)

Thumbnail Photo Source: World Maritime News. 2014. Resources Insufficient for Tackling Potential Disasters in the Arctic. [ONLINE] Available at: https://worldmaritimenews.com/wp-content/uploads/2014/10/Resources-Insufficient-for-Tackling-Potential-Disasters-in-the-Arctic.jpg. [Accessed 4 November 2016].

[1] PBS News. Roald Amundsen. [ONLINE] Available at: http://www.pbs.org/wgbh/amex/ice/peopleevents/pandeAMEX87.html. [Accessed 2 November 2016].

[2] Britannica. 2016. Northwest Passage. [ONLINE] Available at: https://www.britannica.com/media/full/420084/171475. [Accessed 4 November 2016].

[3] Hofstra University. The Geography of Transport Systems. [ONLINE] Available at: https://people.hofstra.edu/geotrans/eng/ch1en/conc1en/polarroutes.html. [Accessed 3 November 2016].

[4] NBC. 2013. NWP Project. [ONLINE] Available at: http://www.nordicbulkcarriers.com/services/nwp-project. [Accessed 4 November 2016].

[5] Latein Amerika. 2016. Panama Kanal . [ONLINE] Available at: http://www.lateinamerika.de/Reisen/images/panama/Panama-Kanal.jpg. [Accessed 4 November 2016].

[6] John McGarrity and Henning Gloystein. 2013. Big Freighter Traverses Northwest Passage for 1st Time. [ONLINE] Available at: http://www.reuters.com/article/us-shipping-coal-arctic-idUSBRE98Q0K720130927. [Accessed 3 November 2016].

[7] Nathan Vanderklippe. 2016. China reveals plans to ship cargo across Canada’s Northwest Passage. [ONLINE] Available at: http://www.theglobeandmail.com/news/world/china-reveals-plans-to-ship-cargo-across-canadas-northwest-passage/article29691054/. [Accessed 4 November 2016].

[8] Tomas Kristiansen. 2015. Christian Bonfils resigns from NBC. [ONLINE] Available at: http://shippingwatch.com/carriers/Bulk/article7373257.ece. [Accessed 4 November 2016].

[9] Christian Mollitor. 2016. Hazards and Risks of Arctic Shipping and implementation of the polar code. [ONLINE] Available at: http://www.offshoreinvestment.com/pages/index.asp?title=Hazards_and_Risks_of_Arctic_Shipping&catID=14381. [Accessed 4 November 2016].

[10] Quandl. 2016. Iron Ore 62% Fe CFR China,CME. [ONLINE] Available at: https://www.quandl.com/data/COM/FE_TJN-Iron-Ore-62-Fe-CFR-China-CME. [Accessed 4 November 2016].

[5]

[5]

This is highly fascinating. Assuming the melting of Arctic ice continues and commercial carriers are able to safely utilize the Northwest Passage as a more efficient route between Asian and Europe, I wonder what the expected impact on Panama’s revenue would be. Separately, I would love to better understand the current dialogue around who lays claim to these waters. As much as I understand the downsides of climate change, I appreciate that this post highlights a scenario in which global warming is inarguably providing a specific benefit by increasing efficiency in shipping across continents.

This is an extremely interesting issue and is a refreshing take on the opportunities represented by climate change. Given that the passage is currently not a commercial route, and that ownership of the northwest passage is under considerable debate among several nations, I would be curious to know what type of international legislation would be agreed upon to manage use of the channel. Furthermore, what types of effects would this passage have on the resident wildlife? Would the start of commercial shipping also open up the passage for other types of industries such as fishing? Definitely a great topic to keep exploring as it progresses!

One thing to keep in mind is that the economic benefits of Arctic sea routes are, to a large extent, driven by cost savings on fuel. The Northwest passage could shave off USD 80,000 per journey in fuel in a world where oil is at USD 90 – 100 per barrel (as it was in 2013, the year in which that figure was calculated), but in today’s USD 40 – 50 per barrel world this number is probably closer to USD 40,000. Moreover, transporting cargo through the arctic will require investments in specialized equipment and contracting ice-breaker vessels, further driving up costs. Perhaps NBC would be wise to wait until the Arctic waterways along the Northwest passage clear a little further before making this risky bet.

Thank you, your point of you on this topic is refreshing. To add the the discussion, I believe there are two biggest next steps to this matter: first, it’s how fast this new possibility can be introduced to current bulk carriers standard shipping routes. Normally, to fully develop port infrastructure and to reduce freight costs to economically viable, carriers need to include the route in its scheduling which is a large investment from their point of view. With that, overall cost for companies are largely reduce since ships became more heavily utilized. Second, it would be interesting to see what kind of impact this could have in terms of the commodities market. Canada, Russia, USA and Northern Europe as strong producers of oil and minerals and having this route could eventually re-balance the market.

A quote attributed to Churchill commands us to seek for opportunities in times of difficulties. I believe your post strongly speaks to this point: whereas most companies are on a survival mode regarding climate change (in fact, many have yet to acknowledge the challenges), NBC has been seeking ways to benefit. My belief, however, is that most projections for sea level and Arctic Sea ice decline are still rather uncertain, having changed drastically in the past 10 years or so. In NBC’s place, therefore, I would be extremely cautious in investing, being cognizant of more conservative studies, which may pose challenges to traffic on the Northwest Passage. In addition, similar to Ann Yih’s comment above, it would be interesting to further investigate competition of the Passage with the Panama Canal, since the latest expansion of the latter has included the possibility that O&G vessels, NBC’s primary product, traverse as well. Lastly, O&G bulk carriers are a very verticalized and consolidated industry, with major companies, such as Vopak and Odjfell, controlling great part of the supply chain, from vessels, to terminals to ducts. Competing with these companies will not be an easy task for NBC.

This is a really interesting post on the Northwest Passage and actually aligns really nicely with Dori’s post on the Panama Canal! You bring up great points about how NBC can best position itself to take advantage of the opportunity on the Northwest Passage. However, do you have any concerns about the viability of the Northwest Passage? You focus on the positives that climate change affords for travel through the Northwest Passage, but how do you think the interplay between political concerns will impact travel on the Northwest Passage? The article below references disputes between the US and Canada on how the Northwest Passage should be viewed and indicates that there has been a lack of investment in the route. Additionally, a lot of capital has been invested to expand the Panama Canal for the new generation of ships. Do you believe that the melting of the ice caps are enough to make the Northwest Passage a viable shipping route or do you think that the political and capital investment issues around the Northwest Passage may also pose significant challenges to NBC’s business model?

How the Arctic Ocean could transform world trade

http://www.aljazeera.com/indepth/opinion/2013/08/201382273357893832.html

Great post Joe. What are some of the most common major hazards in shipping that far north? Are the ice-class vessels not in fact very resilient to ice contact, or is it a matter of getting stuck / frozen in somewhere? And if the worst should happen, are the vessels and cargo insured? I notice you mention the cargo could be worth up to $5M; if that’s lost, I assume the cargo cost is recouped.

One another note, is there an opportunity for a caravan-style arrangement while the volume continues to ramp and routes are still being defined? You mention staying close to recovery vehicles, but my question would I guess be around how valuable are the trade routes themselves, and would it be mutually beneficial even for competitors to trail one another through the passages and offer assistance?

Joe, very interesting topic and approach to the prompt. Typically when we think of climate change we link it to problems and negative effects on businesses but as you point out there are some businesses that may actually benefit from this. I am curious what the carriers position on climate change is since they stand to benefit from it but obviously this is not a good thing for the world.

You mentioned how there has been investment in the new ice-class vessels and I am curious as to how that will affect the entire industry. I ask this because I know that there had been a huge build up of large carrier vessels and that supply has completely outpaced demand sending prices cratering and the industry into crisis. How do the carriers justify adding even more supply even though that supply is cheaper to operate?

Interesting article, and something that I did not know excited! I agree with the points above about how risky the business may be in an environment we know little about and that is constantly changing with the impact of climate change, but I also would like to better understand what the environmental impacts are on opening up this shipping route for the world to flood into. It seems that an environment such as this is already in an extremely fragile state, and I worry that in seeking to use it for financial gains we are going to result in even larger impacts on the environment by quickening the impact global warming is having in the artic. I cannot imagine that with numerous countries trying to begin chartering the waters of the artic that the impact is negligible.