Can machine learning provide a solution to CNP frauds?

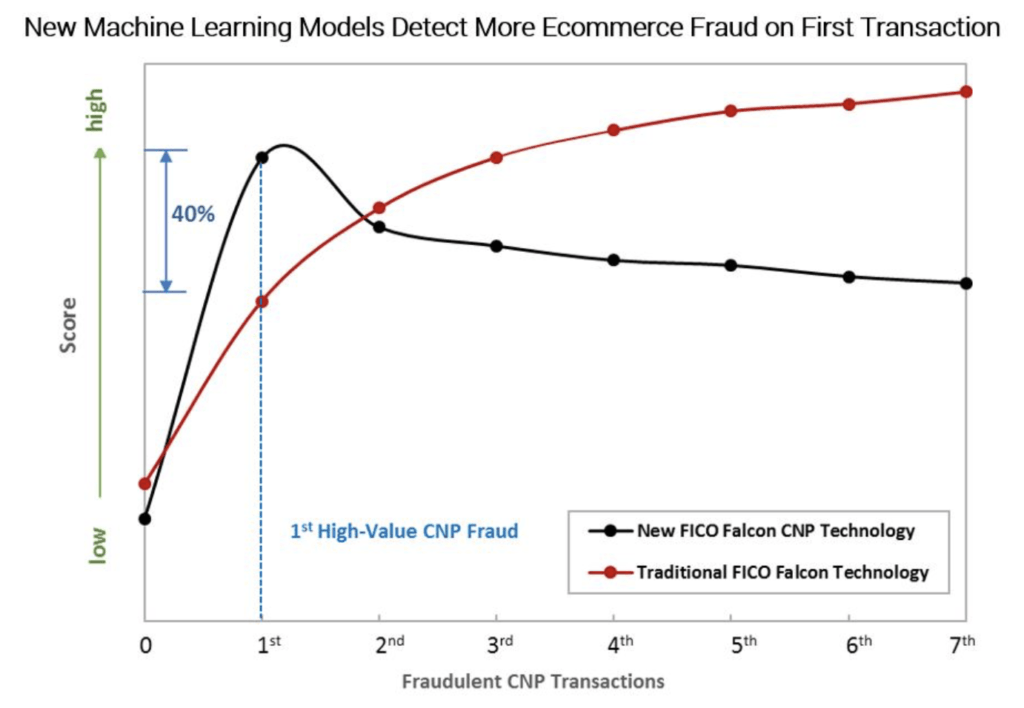

FICO Machine Learning Algorithms Improve Card-Not-Present Fraud Detection by 30% – About a year back, FICO, a software firm announced that its new Falcon consortium models for payment card fraud detection include machine learning innovations that improve card-not-present (CNP) fraud detection by 30% without increasing the false positive rate, a standard metric for fraud model performance. This was truly a breakthrough moment in CNP fraud detection.

Figure B. FICO’s simulation shows clients can expect an average score increase of 40% in the first high-value CNP fraud transaction using the new enhanced CNP machine learning models.

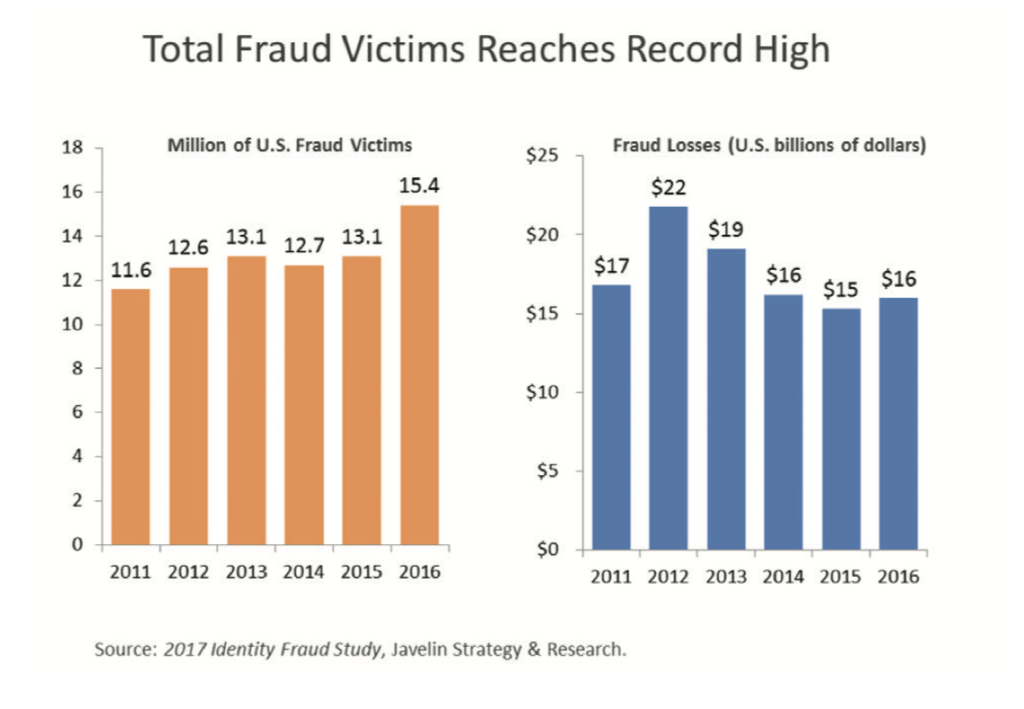

Card-not-present fraud is a type of credit scam in which the customer does not physically present the card to the merchant during the fraudulent transaction. It is theoretically harder to prevent than card present fraud because the merchant cannot personally examine the credit card for signs of possible fraud, such as a missing hologram or altered account number. Card not present(CNP) fraud is a problem for online merchants in particular, as customers are by definition physically not present at the point of sale. The problem is increasingly growing, with a huge rise in US CNP fraud: the US Payments Forum predicts a rise in CNP fraud to $6.4 billion in 2018.

Sophisticated technology can detect many instances of attempted card-not-present fraud. For example, credit card companies have methods of detecting credit card purchases that are likely fraudulent given the account holder’s typical card usage. However, they cannot easily detect a type of card-not-present fraud called online shoplifting or friendly fraud. In this scenario, the criminal will make a purchase online or by phone, receive the merchandise, then file a dispute with the credit card issuer saying that the merchandise is inferior or that it never arrived. The issuer initiates a chargeback, and the merchant has to refund the dishonest customer.

The prediction is that the cost of data breaches and cyber crime will increase to almost four times the estimated cost of breaches in 2015 to $2.1 trillion globally by 2019. In a business environment where everything is increasingly digital and shared, these staggering figures imply that companies need advanced analytic techniques like machine learning to combat bad users. Machine Learning is heralded as one of the best ways to deal with the growing volume of transactions in order to detect fraud arising from identity and data breaches and protect organizations against losses.

Why Machine Learning?

Real-time investigation

With the increase in overall number of transactions and developments in real time payments, the traditional rule-based fraud detection solutions have come under pressure. Financial institutions and merchants have only milliseconds to determine whether a transaction is genuine. Such scenarios can make legacy rule-based fraud detection ineffective, as human screeners may be likely to impose hard and fast rules on all transaction patterns. The resultant inadequate fraud scoring process bring to the fore the problem of false declines in stores or online.

Ingest large and varied data sets

Industry reports suggests that nearly 2.5 quintillion bytes of data is created everyday, with nearly 90 percent of the world’s data created in last two years.. Manual screening for fraud in this scenario is expensive and massively time consuming. Through Machine Learning, computers can learn from this ever-growing data. It can take the place of humans to obtain insight and help in knowledge discovery.

Ability to predict and adapt to newer frauds

The major factors making Machine Learning a reality in fraud prevention include availability of large repositories of labelled data sources that are great for learning, increased computational power for processing information in split seconds, and algorithms that have become more and more reliable. The modern Machine Learning models are appropriately placed to help determine normal and abnormal behaviour from user transactions in milliseconds.

Way forward –

As industry is investing towards faster & easier payment and new technology & platforms are driving innovation, key for ensuring a safe payment experience and bringing operating cost down is building a robust & agile fraud detection model that adapts with the pace of payment.

While technology seems like an effective, efficient way to screen credit card transactions, and it is way better than the manual review system, it’s not without its flaws. Online merchants can actually increase their false decline rate (and also reduce sales) by using inflexible algorithms that don’t consider how new data and special circumstances affect a transaction’s legitimacy — like when customers make purchases on an overseas vacation.Machine learning can also hamper fraud detection during the period between when fraudsters develop a new tactic and the AI learns how to recognize it, leading to windows of opportunity for fraud to occur.

So, what is the best solution going forward? Only AI can do the job or we need a hybrid of AI + Manual intervention?

(Word Count – 789)

Zoldi, Posted. 2018. “Machine Learning Improves CNP Fraud Detection By 30%”. FICO. https://www.fico.com/blogs/analytics-optimization/machine-learning-improves-cnp-fraud-detection-rates-by-30/.

Newswire, PR. 2018. “FICO Machine Learning Algorithms Improve Card-Not-Present Fraud Detection By 30%”. Prnewswire.Com. https://www.prnewswire.com/news-releases/fico-machine-learning-algorithms-improve-card-not-present-fraud-detection-by-30-300529629.html.

“Machine Learning And Fraud Detection | Verifi”. 2018. Verifi. https://www.verifi.com/in-the-news/machine-learning-fraud-detection/.

Samant, Kedar. 2018. Edgeverve.Com. https://www.edgeverve.com/finacle/appcenter/wp-content/uploads/2018/03/Machine-Learning-The-Secret-Ingredient.pdf.

Zilenovski, Sarah. 2018. “Machine Learning Or Manual Fraud Protection? Which Is Better?”. Blog.Clear.Sale. https://blog.clear.sale/machine-learning-or-manual-fraud-protection.

“Machine Learning: Key To Preventing E-Commerce Fraud – Nuwireinvestor”. 2018. Nuwireinvestor. https://www.nuwireinvestor.com/machine-learning-key-preventing-e-commerce-fraud/.

“Artificial Intelligence At The Changing Face Of Payment Fraud”. 2018. Finextra Research. https://www.finextra.com/blogposting/15472/artificial-intelligence-at-the-changing-face-of-payment-fraud.

This was a really interesting read because we dealt with this problem in numerous ways at my old job. One way that payments companies approach CNP transactions is to charge higher and often fixed fees surrounding CNP to buffer themselves from fraud loss or chargeback losses. It was interesting to learn about what FICO was doing, given the breadth of their customer credit data, and likely sophisticated understanding of the buyer and their purchasing and credit patterns. At Square our Data Science team devoted significant resources to develop risk models around fraud for CP/CNP transactions, particularly around clustering of risky buyer/merchants, and tree mapping of related parties to detect sketchy actors who are mapped to the transaction within certain degrees of separation.