Can Chemical Manufacturers Take the Heat?

“Companies that do not prepare for a carbon-constrained future are putting long-term shareholder value at risk” [1]

Dow Chemical

Dow Chemical is the second largest chemical company in the world. With $48.8 billion in revenue and $68 billion in assets, it comes as no surprise that Dow also emits in excess of 35 million metric tons of greenhouse gas emissions per year2. Chemical companies like Dow contribute to greenhouse gas emissions in many ways; they combust hydrocarbon waste and emit greenhouse gas products. They release quantifiable amounts of volatile organic compounds, such as methane, a potent greenhouse gas. But their largest contribution to greenhouse gas emissions is their consumption of fossil fuels, both as feedstocks and as energy 3. How can a company like Dow, which is so tied to greenhouse gases, survive in a world that increasingly will not tolerate it?

Taking Action

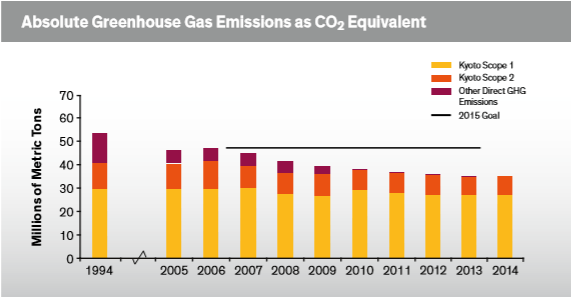

Recognizing the shifting regulatory and social landscapes of climate change, Dow Chemical has already started to take ownership of its carbon footprint. In fact, vice chairman Jim Fitterling says, “Dow is always looking for win-win solutions – good for the environment and good for business” and that “adding large scale renewable energy… is just one smart move… [for] improving our overall carbon footprint.” Dow has committed to invest in new wind farm technology and infrastructure for its largest production site located in Freeport, Texas, which will position itself as the third largest corporate buyer of wind energy in the US. Dow believes that this move will give the company a cost-competitive advantage in the future by hedging its energy portfolio4. Dow has also committed to maintaining greenhouse gas emissions at or below 2006 levels on an absolute basis. This means that as the company grows, it will continue to decrease its consumption of fossil fuel based energy sources2. So far, the company has managed to exceed this goal and deliver on its promise (see Figure 1 below).

Figure 1: Dow Chemical’s Greenhouse Gas Emissions2

Is it Enough?

However, shifting a portion of the company’s energy portfolio from fossil fuels to renewables will not eliminate greenhouse gas emissions. Recently, Dow has divested from renewable chemicals research, plant based feedstocks that would have a much smaller carbon footprint over their value chain lifetime5. Dow argues that the economics of these renewables did not make sense for the company, it was simply too costly and ineffective. That very well might be the case. However, by not reinvesting in other R&D categories that could reduce greenhouse gas emissions, Dow is doing itself a disservice. Assuming increasingly stringent greenhouse gas emission regulations into the future, the company will eventually have to adopt technology to fundamentally change how it processes chemicals and how it destroys waste. This adoption process will most likely be slow and costly: taking a more proactive approach today will prevent an accumulation of insoluble costs tomorrow.

So is there a Win-Win?

Spending in research and development for new technologies should yield “win-win” solutions for Dow over a long enough time horizon, which is in line with the company’s strategic position on how to tackle climate change within industry. For example, carbon capture and re-use technologies are currently inefficient and ineffective. However, with sufficient R&D investment, there is reason to believe that breakthroughs are possible and potentially imminent6. These types of investments in technology, if successful, would provide companies with a real competitive advantage – the ability to capture and re-use carbon. Dow is particularly advantaged by such technologies because of its size. For every waste stream that can be efficiently recaptured and reprocessed for additional value, the savings are magnified by the scale of the company.

Ultimately, most for-profit businesses will only invest in projects and technology that stand to deliver shareholder value. Dow Chemical’s method of addressing climate change by looking for win-win solutions within the company that make the most impact is a great starting point – in fact, it’s a required starting point. Dow now needs to take the next step to look at long term R&D investments as opportunities and even as necessities. The chemical industry, in its current state, is built around the consumption and emission of carbon and greenhouse gases. In many ways, a fundamental shift in the way we think about climate change will eventually require a fundamental shift in the operations within the industry. That change will not happen by simply shifting energy portfolios. It will require a dedication to research, an investment in new technology, and time.

(740 Words without citations)

[1] Burr, B. B. (2006). BP, DuPont tops in dealing with climate change risk. Pensions & Investments, 34(7), 28. Retrieved from http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/223003463?accountid=11311

[2] Dow-Q3-2015-Sustainability-Report-DIGITAL-Final. Retrieved from http://www.dow.com/-/media/dow/business-units/dow-us/pdf/science-and-sustainability/dow-q3-2015-sustainability-report-digital-final.ashx

[3] Parrish, M. (2015). How chemical companies are part of the solution — and problem — for climate change. Industrial Maintenance & Plant Operation, Retrieved from http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/1680506407?accountid=11311

[4] Chemical companies; dow to become one of the largest industrial buyers of renewable energy. (2015). Energy Weekly News,152. Retrieved from http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/1666333814?accountid=11311

[5] Kilman, S. (2007, Apr 19). Chemical plants: A bio-plastics revival makes gains at cargill; high oil prices drive interest in soy, corn; wal-mart wants in. Wall Street Journal Retrieved from http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/398958514?accountid=11311

[6] Cormos, C. (2011). Evaluation of power generation schemes based on hydrogen-fuelled combined cycle with carbon capture and storage (CCS). International Journal of Hydrogen Energy, 36(5), 3726-3738. doi:http://dx.doi.org.ezp-prod1.hul.harvard.edu/10.1016/j.ijhydene.2010.12.042

Thanks Brian, excellent article addressing Dow’s need to reduce its footprint. It does seem likely that Dow will continue to face more stringent regulatory requirements into the future and will have to continually adopt new sustainable technologies. However, I would be interested to know whether Dow’s R&D department is capable of creating next generation carbon capture technology on its own? It seems possible that they might be able to purchase this type of technology from a third party vendor rather than produce it in house. It also seems that they could potentially benefit in this area by partnering with other companies who are working on similar issues. For instance, on Dow’s website they note that they are partnering with Alstom Power to jointly develop new CO2 capture technology. (http://oilandgas.dow.com/applications/power/co2_capture.htm).

Brian, I couldn’t agree more. There seems to be pattern of shortsightedness by many of our public companies. As you mentioned, the inevitability of future, more stringent and all-encompassing regulations and social pressure is high, yet many of our public companies, like Dow, are still setting small goals to provide the facade of progress and not really working towards a resolution for the root of the problem. In my opinion, it would be unwise to assume that public companies would sacrifice shareholder value when there is not an incentive to do so. For this reason, I believe the government must fill this void and provide the proper incentives to push companies like Dow in the right direction. Thanks for sharing.

Brian – Thanks for sharing. I agree that R&D spend could lead to future win-win technologies; however, it is also interesting to hear the progress that Dow is making on its footprint goals in the near-term. It seems the pressure to reduce their footprint has led to a shift in purchasing patterns for energy for their manufacturing operations, such as utilizing local wind-farms to sustain their Freeport, TX facility. In my prior role, I worked briefly on Greenhouse Gas Reporting across the DuPont manufacturing sites and often these “indirect” emissions from sourcing energy for operations amount to a more substantial portion of a facilities’ GHG impact compared to “direct” emissions from the facilities’ own processes [1]. As a result, Dow’s focus on the near-term footprint may in fact address the bigger piece of their GHG impact. At the same time, I’m also a bit conflicted because this approach almost shifts the responsibility to external parties, such as their partner Bordas Wind Energy who is running the wind farm. An entity with the scale and scope of Dow should be able to do more to address the technology landscape, because simply reducing their GHG metric may not truly address the underlying issue in the industry. i.e. It would be interesting to see if Dow’s commitment to cleaner sources of energy actually shifts the overall production levels of different forms of energy in the region.

[1] Greenhouse Gas Protocol – Corporate Standard. Accessed from: http://www.ghgprotocol.org/standards/corporate-standard.

[2] Dow to Become One of the Largest Industrial Buyers of Renewable Energy. Dow Press Release. Accessed from:

http://www.dow.com/news/press-releases/dow%20to%20become%20one%20of%20the%20largest%20industrial%20buyers%20of%20renewable%20energy.

Great article Brian, thanks for sharing. Dow is definitely in a difficult position due to their dependence on reliance on greenhouse gases. It sounds like Dow is only pursing opportunities that are financially beneficial for the organization in the short-term. However, I think they are missing a key part in their financial assessment: the financial burden on the company if government regulations prevent Dow from operating at current capacity due to their significant CO2 emissions. The losses in sales and immediate investments required to react to even a small restriction in capacity could be debilitating. I agree that their current approach is extremely shortsighted. Investment in R&D with respect to sustainability now will likely result in enormous saving in the future, not to mention a better environment for the rest of us. There is much improvement to be made at Dow — hopefully they can attract the right talent to address these challenges!