Can Bank of America make Green Bonds the New Black?

Bank of America is currently taking pole position in shaping how financial institutions tackle climate change. Is their effort alone enough to make a difference?

When thinking about climate change, banks are probably not the first companies that come to mind. Yet, in 2013, Bank of America (“BOA”) was the unlikely candidate that launched a $50 billion (increased to $125 billion in 2015) environmental business initiative, issued the first corporate green bonds, and continues to top the league table in underwriting green bonds since. There will be three parts to this blog post, firstly exploring the role of financial institutions in climate change, next zooming into how BOA has responded to climate change, and finally putting forth recommendations for BOA in advancing this cause.

The role of financial institutions in climate change, and the effects on their operating models

Climate anomalies continue to be on the rise globally, with 2015 not only being the 30th consecutive year with global temperature above the 20th century average, but also the hottest year in historical record[1]. We are currently on a CO2 emissions trajectory consistent with long-term global temperature increases of 2°C – 4.5°C, making irreversible climate change a reality[2]. To limit global temperature rise to the lower bound of the range (i.e. 2°C), the International Energy Agency estimates that US$48 trillion of investment to meet the world’s energy needs in 2035[3].

Given the high level of sovereign debt across the globe, governments of nations alone will not be able to solve this US$48 trillion problem. The private sector needs to be the bridge the funding gap. Given the role of financial institutions as intermediaries, banks are well-positioned to shape the way their clients approach business initiatives, and influence investment decisions in ways that best tackle climate change.

Steps that BOA has taken to address the effects of climate change on its operations

BOA made its first environmental business commitment in 2007, commenced its second initiative in 2013, and in 2015 increased their environmental business initiative to investing $125 billion in low-carbon business by 2025, through lending, investing, capital raising, advisory services and developing financing solutions for clients around the world.

Instead of setting aside these funds as merely another corporate social responsibility effort, this initiative has fundamentally changed BOA’s operations across various business units. In their lending business, BOA has made a concerted effort to finance low-carbon and sustainable businesses that address climate change, as well as finance the transition of companies to low-carbon initiatives. As at May 2016, they had already directed $53 billion in projects connected to clean energy, energy efficiency, and sustainable transportation[4].

BOA has also made significant changes to their investment banking business. BOA continues to shape and grow the market for green bonds (to fund projects that have positive environment and/or climate benefits). Apart from issuing two green bonds totaling $1.1 billion in proceeds, they have additionally been the top underwriter of green bond underwriter since 2013[5]. To help develop this industry, BOA also co-authored the Green Bonds Principles, which are guidelines to promote integrity of this nascent market.

Additional steps that BOA can consider

BOA’s efforts to take on the responsibility and tackle climate change are commendable, particularly since the industry does not seem to have a direct link to the problem. That said, more can always be done. I will focus on how BOA can enhance the green bond market in this section.

There are four phases that a new financial product goes through before gaining mainstream adoption, as set out in Figure 1 below[6].

Figure 1 – Phases of new product development

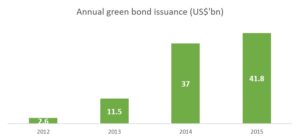

Starting from the “incubation” phase in 2007 where green bonds were first invented, the green bond market entered into the “excitement” phase in 2014, where bond issuance more than tripled from 2014 to 2015 (See Figure 2). Stakeholders across the industry are starting to take a keen interest in the space. For instance, Standard & Poor’s is now officially rating green bonds.

Figure 2 – Annual green bond issuance from 2012- 2015[7]

To progress to becoming mainstream, the green bond market would need to increase investor awareness of 1) what they are, and 2) the benefits of investing in them. Traditional investors only made up 15% of IFC’s February 2013 bond issuance[8], suggesting a significant potential for growth in the sales of green bonds among traditional investors.

As a market leader, BOA can cross-sell green bonds to both its institutional and retail clients. BOA can also consider issuing green bonds that are tailored to the specific investment needs of investors, e.g. green bonds sold exclusively to high net worth individuals. More broadly, as an intermediary, BOA should leverage on its vantage point to systemically influence behavior across various clients and industries to tackle climate change. (783 words)

[1] National Centers for Environmental Information website, Retrieved on 1 Nov 2016, https://www.ncdc.noaa.gov/sotc/

[2] “Fixing the Future: Green Bonds Primer”, Bank of America, 8 Sep 2014

[3] “World Needs $48 trillion in Investment to Meet its Energy Needs in 2035”, International Energy Agency, 3 Jun 2014, http://www.iea.org/newsroom/news/2014/june/world-needs-48-trillion-in-investment-to-meet-its-energy-needs-to-2035.html

[4] “Business Leadership on Achieving Climate Goals”, Bank of America, 18 May 2016, http://about.bankofamerica.com/en-us/global-impact/business-leadership-on-achieving-climate-goals.html#fbid=k0J-N3Ks6Va

[5] Bank of America 2015 Business Standards Report and Environmental, Social and Governance Addendum, 2015, http://about.bankofamerica.com/assets/pdf/Bank-of-America-2015-ESG-Report.pdf

[6] “How Green Bonds will Become Mainstream”, Stanford Social Innovation, Review, 18 Jul 2016, https://ssir.org/articles/entry/how_green_bonds_will_become_mainstream

[7] 2015 Green Bond Market Roundup, Climate Bonds Initiative, Retrieved on 1 Nov 2016, http://www.climatebonds.net/files/files/2015%20GB%20Market%20Roundup%2003A.pdf

[8] Next Season’s Green Bond Harvest – Innovations in Green Credit Markets, International Finance Corporation, June 2014, https://www.ifc.org/wps/wcm/connect/b1369b80446446d880588cc66d9c728b/Next+Season’s+Green+Bond+Harvest+final+paper+16+June+v3.pdf?MOD=AJPERES

I wonder how Bank of America’s default rates have been affected by their initiative to fund fundamentally riskier endeavors. I liken their move to a venture capital firm investing more in the sustainability space, which might expose the VC to greater financial risk in the form of unproven technology, long time horizons, and concerns around societal adoption that innovative “green” firms often face.

Bank of America has clearly identified a strong demand for capital and I applaud them for concentrating more effort into this global challenge we all face, but I hope it doesn’t leave them overexposed in the future, tempted to reverse this socially productive flow of capital.

I think that this is a commendable move by Bank of America, but as a former employee of the company, I seriously question the sustainability of their sustainability efforts. Banks are highly pro-cyclical businesses and generally feel the impacts of market turns earlier and more sharply than most institutions. It’s been a great few years in the markets which have allowed them to focus on things aside from their bottom line, but unless they can demonstrate that this is materially impactful to their profitability, I bet that it will be the first program to get cut when markets sour.

I agree with your comment, @LST. If companies are really interested in acting on Climate Change and on other Sustainability issues, shouldn’t they pursue this on a consistent basis, despite potentially lower returns? I think there are 2 main things they should do:

1. Be selective about their investments: shouldn’t Bank of America reject, for example, investments in companies and bonds that are harmful to the environment? This is a first basic step that should happen, followed by figuring out how to increase returns on the sustainable business.

2. Develop profitable businesses around sustainability: if these are not yet profitable, shouldn’t they be trying to drive this profitability to actually turn this funds very attractive?

The first thing which would come to an investor’s mind is the return which these bonds offer. Would it be similar to a comparable bond which invests in projects that are “not green”? If not, what is the difference and how will an investor get convinced to invest in a project with potentially lower returns? Can a business case be made for this to convince an investor?

I’d echo Siddharth’s comment here – I think in principle this is a great idea, but clearly the level of return promised by these bonds will be critical to expansion, or lack thereof.

Additionally, and to build on what LST has written, I would query whether banks are really best placed to design and sell these investment products. Clearly the resources and client base they have at their disposal are advantages, but I wonder whether more narrowly-focused firms might have a better incentive to work on green bonds than banks which already sell so many other products to investors. This new market reminds me a little bit of social impact bonds, which are also an emerging new class of investments. Goldman Sach’s attempted a large scale investment project to tackle prisoner re-offending, and encountered so many roadblocks along the way that the project failed. On the other hand, specialist firm Social Finance has had much more success with its equivalent projects. I wonder whether specialist environmental firms might be better placed to grow the green bond market in the long run, given the conflicting incentives and client needs that banks have?

Bank of America is well positioned and certainly set to benefit IF the “green revolution” truly takes off in a major way. With that said, we have learned that the market requires a certain level of return for a given level of risk and I fear that there will be continued market limitations to the progress of “green bonds” specifically. While Bank of America is trying to be a market leader in this segment of the market, I often find that financial products are lagging market indicators of a industry’s general life cycle. In other words, market products typically tend to proliferate as the market begins to mature. There are some key caveats to the aforementioned statement, but I wonder to what extent technology and cost reduction therein can play in the growth of this sector (as it should help to make projects bankable and more economical thereby justifying market returns).