Can ArcelorMittal Steel Itself Against Climate Change Regulations ?

The steel industry has been trying to cut down its Carbon Dioxide emissions for some time now. Can Arcelor Mittal, the world’s largest steel producer, lower its emissions further and reduce its carbon footprint?

Steel production and CO2 emission

Human activities over the past century have increased the amount of CO2 in the atmosphere significantly.

Source: http://climate.nasa.gov/vital-signs/carbon-dioxide/

Increase in CO2 in the atmosphere leads to an increase in the greenhouse effect and thus increasing temperatures on earth. Rising temperatures are the cause of rising water levels, melting of polar caps and erratic weather patterns.

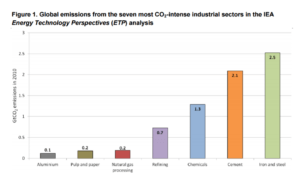

Around one fifth of the emissions are from industries such as cement, iron and steel, chemicals and refining. Over the next few decades this is expected to grow with output. The process of making steel from iron ore involves heating the ore with carbon. Carbon dioxide is produced as a by-product of this process.

Source: http://www.cleanenergyministerial.org/Portals/2/pdfs/GlobalActiontoAdvanceCCS.pdf

ArcelorMittal is the world’s largest steel producer, with annual production capacity of approximately 114 million tonnes of crude steel. Steel shipments in 2015 totaled 84.6 million tonnes. It has steelmaking facilities in 19 countries, and is the leader in all the main steel markets. A large number production sites for ArcelorMittal are present in Europe.[1]

Regulations

The European Union uses the emissions trading system (EU ETS) as a primary tool to limit climate change. A cap is set on the total amount of certain greenhouse gases that can be emitted by installations covered by the system. Companies can receive or buy emission allowances which they can trade with one another as needed. They can also buy limited amounts of international credits from emission-saving projects around the world. After each year, a company must surrender enough allowances to cover all its emissions, otherwise heavy fines are imposed. If a company reduces its emissions, it can keep the spare allowances to cover its future needs or else sell them.[2] While the steel industry has not been impacted by specific stringent regulations, there is a chance that in the future they will be asked to comply to emission norms which are tighter than the current norms.

The implications of ETS and future regulations are multi- fold for European steel companies like ArcelorMittal.

- They must find innovative ways to cut down on emission to avoid getting on the wrong side of regulations.

- They must compete in an economy where the playing field is not level since steel producers in Asia are not yet subject to the same types of regulations. This means that efficiency in processes becomes imperative.

- Demand for steel is affected by EU regulations related to automobiles. Automobile manufacturers are veering towards aluminum and manganese alloys to producer lighter and more efficient vehicles.[3]

What has ArcelorMittal done?

ArcelorMittal has recognized the need to become more energy efficient and has invested in researching newer and more efficient methods to produce steel. The company is also designing products which have a lower carbon footprint during their lifetimes rather than just focusing on the production processes. It is partnering with customers to ensure that its products will help reduce global carbon emissions over a longer time. Carbon footprint can also be reduced indirectly by using decarbonized electricity(hydroelectric power, nuclear power plants or power from renewable energy sources).[4]

The future for ArcelorMittal

The steel industry in Europe has managed to cut down its emissions by about 14 percent from 1990 to 2010. There is however a limit to how much efficiency can be increased with current technology. There is need for either a major disruption in the production technology or to find ways to remove carbon dioxide produced. A couple of measures in this regard are listed below:

- Technology disruption: In 2013, a process developed at MIT produced only oxygen as a by-product. It does away with the blast furnace. While this process’s scalability is low, it does highlight the potential to change an industry which will need it desperately once the carbon emission norms are tightened.[5] The project at MIT was funded by NASA which was looking at methods to synthesize oxygen. ArcelorMittal needs to invest in studies out of the traditional realm if it wants to be ahead of the curve in steel production.

- Carbon sequestration: A lot of research has been happening over the last decade in carbon sequestration. ArcelorMittal needs to actively locate processes which are more cost efficient and partner with the companies that can help them reduce their CO2 An interesting company which has made great strides in this arena is Carbon Clean Solutions(CCS) which patented a process in 2009 for carbon sequestration. CCS has product designed for the steel industry which can help companies like ArcelorMittal reduce their carbon footprint.[6]

The future of the steel industry is contingent on how countries around the world react to climate change and what regulations are put into place. In addition, the demand for steel is also susceptible to different materials that can potentially disrupt dependent industries. Companies can ArcelorMittal need to be aware of the challenges ahead and start working proactively to counter these effects.

Word Count: 798

References

[1] http://corporate.arcelormittal.com/what-we-do/steel

[2] https://ec.europa.eu/clima/policies/ets/index_en.htm

[4] http://corporate.arcelormittal.com/sustainability/our-10-outcomes/energy-and-carbon/climate-change

[5] http://news.mit.edu/2013/steel-without-greenhouse-gas-emissions-0508

[6] http://www.carboncleansolutions.com/tgr_steel.html

Interesting read, though it does make me wonder what is stopping most companies, including ArchelorMittal, from relocating steel plants outside the EU and thus the ETS? The main impediments I could imagine to this (outside the obvious major time delay / fixed cost of new facilities) would be that they’re expecting more stringent regulations similar to the EU to come into force in other major markets (primarily Asia) in the near term, or that the EU bars imports of steel from foreign markets that isn’t accounted for under an ETS system. Is either of those things the case? It’ll be interesting to see how such ETS systems evolve however, since the ramifications are both huge for companies like ArcelorMittal, but also so many other manufacturers.

Well-written post! I think the two suggestions for potential technological improvements are very interesting, and agree that focusing on the product instead of just the production process is a key to success. One of your last thoughts brought up in the post was that this industry is susceptible to different materials that could decrease demand- do you think that they should start exploring diversifying into additional materials like aluminum as well or do you think that would be a mistake given the different processes?