Breaking the walls with 3D printing

GE Aviation bets on 3D-printing to overcome trade barriers.

The connection paradox

There is a strange paradox between the simplicity to connect two individuals using today’s evolving technology and the complexity to connect two countries in today’s world. Technology has been widely used in the supply chain to support logistics planning and scheduling [1]. Meanwhile, the world is currently undergoing a period of cascading protectionism [2], caused by an uprising wave of nationalism in several countries [3]. This disconnect between the openness brought by innovation and the confinement instituted by protectionist governments prevents us to harvest the benefits of international trade, such as increased value-added and employment [4].

The $300 Billion “connection problem” of Aerospace

To exemplify how protectionism can affect an entire industry, let’s look into Aerospace. An airplane is assembled by combining over 300,000 parts, which come from hundreds of different suppliers spread out through several countries [5]. With the institution of protectionist measures by several countries, such as local content policies [6], the whole aerospace supply chain, and the value it creates, would be at risk.

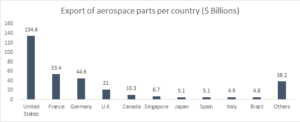

Exhibit 1: Value of aerospace products exports per country

Source: Worlds Exports [7]

In 2016, the Aerospace industry accounted for $328.7 Billion in exports among over 200 countries [7]. Exhibit 1 illustrates how much value each country produces directly from aerospace products exports.

John Flannery, recent elected CEO of GE, and David Joyce, CEO of GE Aviation, have a great challenge ahead of them. According to GE’s 2016 annual report, 85% of their revenue for aircraft engines and gas turbines have been sold abroad [8].

The global expansion playbook

To win in every country. It sounds too simplistic for a company with revenues of $120 Billion, but indeed that’s GE strategy: simplify [8]. In 2015 GE Aviation started its global expansion by creating roots in Europe, Canada, Brazil, and China, where they invested over half a billion dollars to create new facilities to produce turbines [9].

GE’s leadership believes that having a local footprint will help them navigate turbulent trade relations between countries and will help them establish partnerships with local governments [10]. Having a local facility is a well-known strategy to overcome regulatory demands in highly regulated industries such Banking [11] and Energy [12].

Breaking the wall – 3D printing

In 2012 GE Aviation made two notable acquisitions: Morris Technologies and Rapid Quality manufacturing [13]. Both companies specialize in producing additive manufactured (3D-Printed) parts for the aerospace industry. These acquisitions represented not only GE’s strategy to invest in emerging manufacturing technologies but also a strategy to overcome trade barriers.

Figure 1: 3D-Printer printing a jet engine part

Source: GE reports [14]

Additive manufacturing, or 3D-printing, is a technology capable of producing parts by deposing layers of material, one layer on top of the other [15]. This technology has the potential to produce lighter parts, with more audacious designs and using less material than conventional technologies [16]. Besides that, 3D-printing allows a distributed production process, meaning that GE Aviation can design the part in its headquarters in Ohio, send the file electronically to its factory in Brazil, print the part in Brazil and deliver it in the same day as a locally produced part.

The way forward

In the beginning of 2017, GE announced two main strategies to growth: Additive Manufacturing and Industrial Digitalization [8]. In the same year, GE Aviation acquires two major producers of industrial parts using additive manufacturing: Concept Laser Gmbh and Arcam AB [9].

With the acquisitions and investments in new facilities, GE Aviation is creating a network of factories capable of producing 3D-printed parts all over the world. This network will allow them to overcome trade barriers by just sending the CAD (Computer Aided Design) file of the part they need to produce to the country in which production needs to occur, and print the part without the need for specialized labor to be present in the facilities.

What else could be done?

To ensure that the global production strategy thrives, GE Aviation should pay attention to two major characteristics of the 3D-printing market:

- Build 3D-printing expertise – GE Aviation currently focuses its 3D-printing efforts on building turbine engine replacement parts. There are several other applications less critical to the functioning of airplanes and spacecraft, such as plastic parts, that could be produced via 3D-printing as well.

- Power of network – To produce 3D-printed parts and deliver it quickly it is necessary to have a production unit close to the customer. 3D-printing machines are usually inexpensive, compared to traditional machines, require low supervision and can produce multiple parts on just one machine. Thus, one way to be very close to your customer is to have a machine installed at your customer.

3D-printing has evolved and can now help GE Aviation overcome trade barriers. However, will the governments ever start regulating internet traffic to the point that designs made in the U.S. could not be produced somewhere else? Also, will local governments support the expansion of this technology that creates fewer jobs?

Word count: 800 words

[1] Zhong, Ray Y.; Huang, George Q.; Lan, Shulin; et al. A big data approach for logistics trajectory discovery from RFID-enabled production data. INTERNATIONAL JOURNAL OF PRODUCTION ECONOMICS . V. 165, P. 260-272. JUL 2015.

[2] Erbahar, Aksel; Zi, Yuan. Cascading trade protection: Evidence from the US. JOURNAL OF INTERNATIONAL ECONOMICS V. 108, P. 274-299. SEP 2017.

[3] Hopkin, Jonathan. When Polanyi met Farage: Market fundamentalism, economic nationalism, and Britain’s exit from the European Union. BRITISH JOURNAL OF POLITICS & INTERNATIONAL RELATIONS . V.19, Issue: 3 Special Issue: SI, P. 465-478. AUG 2017.

[4] Zhao, Yuhuan; Wang, Song; Liu, Ya; et al. Identifying the economic and environmental impacts of China’s trade in intermediates within the Asia-Pacific region. JOURNAL OF CLEANER PRODUCTION . V. 149, P. 164-179. APR 2017.

[5] NBC News. From NBC news website, http://www.nbcnews.com/id/36507420/ns/business-us_business/t/hundreds-suppliers-one-boeing-airplane/#.WgkM4GhSzIU. Accessed November 2017.

[6] Gautier, Luis. Local content and emission taxes when the number of foreign firms is endogenous. JOURNAL OF ECONOMICS . V. 122, Issue: 3, P. 239-266. NOV 2017.

[7] Worlds Exports. From Worlds Exports website, http://www.worldstopexports.com/aerospace-exports-by-country/, accessed November 2017.

[8] General Electric. Annual report, https://www.ge.com/ar2016/, accessed November 2017.

[9]Wall Street Journal. From Wall Street Journal Website, https://www.wsj.com/articles/ge-to-expand-aviation-operations-overseas-amid-ex-im-bank-debate-1442497525, accessed November 2017.

[10] Wall Street Journal. From Wall Street Journal website, https://www.wsj.com/articles/ge-the-ultimate-global-player-is-turning-local-1498748430, accessed November 2017.

[11] Buch, Claudia M.; Goldberg, Linda S. Cross-Border Prudential Policy Spillovers: How Much? How Important? Evidence from theInternational Banking Research Network. INTERNATIONAL JOURNAL OF CENTRAL BANKING . V. 13, Special Issue: SI Supplement: 1, P.505-558. MAR 2017

[12] Chen, G. Q.; Wu, X. F. Energy overview for globalized world economy: Source, supply chain and sink. RENEWABLE & SUSTAINABLE ENERGY REVIEWS . V. 69, P. 735-749. MAR 2017.

[13] GE Aviation. From GE Aviation website, https://www.geaviation.com/press-release/other-news-information/ge-aviation-acquires-morris-technologies-and-rapid-quality, accessed November 2017.

[14] General Electric. From GE website, https://www.ge.com/reports/secret-weapon-supersonic-blaster-rebuilds-jet-parts-flying-powder/, accessed November 2017.

[15] Gu, D. D.; Meiners, W.; Wissenbach, K.; et al. Laser additive manufacturing of metallic components: materials, processes and mechanisms. INTERNATIONAL MATERIALS REVIEWS . V.57, Issue: 3, P. 133-164. MAY 2012.

[16] Zhu, Ji-Hong; Zhang, Wei-Hong; Xia, Liang. Topology Optimization in Aircraft and Aerospace Structures Design. ARCHIVES OF COMPUTATIONAL METHODS IN ENGINEERING . V. 23, Issue: 4, P. 595-622. DEC 2016.

This is an incredibly interesting topic: using technology to overcome protectionist moves. However, what seems like a “simple” solution could be problematic from both a cost and taxation perspective. I think GE could successfully scale a global 3D printing and production organization, but the costs may simply outweigh the benefits, especially for a company going through a total transformation. Even if GE could afford the upfront investment for several of these industrial-grade 3D printers, I think the sourcing of raw materials/inputs would continue to pose an issue in a protectionist environment. Furthermore, my fear is that the sharing of IP across borders would introduce the additional complexity of IP licensing and transfer pricing, and with the focus on closing corporate loop-holes (GE has been a notorious user of international tax planning) both in the U.S. and abroad, this lofty program may not make “dollars and sense”. I do believe in the future of 3D printing and its industrial use, but perhaps GE is simply pushing too hard to get ahead of the curve.

While 3D printing / additive manufacturing has been the talk of late, I’m wondering if the disadvantages associated with it offset its advantages. 3D printing requires high upfront equipment costs, and quality assurance could be an issue since the surface finish and dimensional accuracy could be distorted during the process. Additive manufacturing also seems better suited for smaller batches of products so could be hard to scale; subtractive manufacturing seems more efficient and less expensive at scale. In addition, in-depth training is required to manage these highly-complex machines, and finding the right labor at various countries across the globe could prove to be an inhibitor. 3D printing technology is certainly in its infancy, and I wonder if over time it can improve to mitigate some of the risks associated with using it for mass production for companies like GE.

Thanks for your post, Caue! I was surprised to learn how enthusiastic GE is about additive manufacturing. In the article linked below, I found that GE has invested almost $3B in this technology to serve its various business units. In response to declining revenues in their core business segments, such as power, GE is investing in new technologies such as additive manufacturing to spur growth. I agree with you that this strategy could also benefit GE in the long-run by protecting them against trade barriers.

https://www.nanalyze.com/2017/11/general-electric-3d-printing-metals/

Regarding your questions about government regulation of additive manufacturing, the article linked below discusses how increased adoption of additive manufacturing will draw attention and scrutiny to legal and regulatory frameworks. As use of this technology is still developing, governments may decide to impose regulations related to product quality and safety, which could deter GE from expanding its investment in additive manufacturing.

https://www.sourcingspeak.com/2017/11/legal-issues-additive-manufacturing-technology.html

Thank you, Caue! This is a super interesting topic, and I love the title of your essay (and the featured picture)! I’m wondering which parts can GE manufacture by 3D-printing and which not? For instance, if 3D-printing can be used in most parts of a high-value machine/vehicle, the decentralized network and manufacturing sites will make a lot of sense! In addition, is materials, e.g. resins, the bottleneck of GE’s 3D-printing lines? Is there any report or data showing the improvement on the 3D-printing material side, which may potentially replace steel or alloy in complex parts in the aerospace manufacturing industry? To your concerns about the potential loss of local jobs, I guess raw materials development and production may help create more jobs vis-a-vis the loss of jobs in traditional parts manufacturing sites.

Thanks for this excellent and thought-provoking post, Caue! I think that you highlight a very interesting approach to ‘breaking the wall’. As for potential concerns, I am fairly optimistic that continued innovation will drive down the cost and increase the scalability/speed and ease of use of 3D printers over time. This PwC report highlights some of these trends: http://usblogs.pwc.com/emerging-technology/the-road-ahead-for-3d-printing/. GE might potentially be ahead of the curve, but it’s in my view only a matter of time until innovation makes 3D-printing a very attractive alternative. However, my main concern is, as you highlight above, that protectionist governments will further shift their attention from trade of physical goods to trade of IP/data, and impose barriers on e.g. cross-border sharing of CAD files. There are some indications that this is happening already (see e.g. report from nonpartisan think tank ITIF: https://itif.org/publications/2017/05/01/cross-border-data-flows-where-are-barriers-and-what-do-they-cost). While such a scenario might adversely impact GE’s effort to ‘break the wall’, there is in my view still merit in pursuing a long-term strategy focused on a global network of additive manufacturing capabilities, e.g. over time lower shipment costs and less variability in delivery times.

3D printing has also had a profound effect on the healthcare industry, with several healthcare engineers utilizing 3D printing to construct some of the most innovative applications to date. As Ryan mentioned above, there are certain drawbacks however, that might inhibit companies from fully adopting 3D printing. The advantages are obvious; cost efficient, speed, versatility, customization, significant return on investment, etc. However, several healthcare companies have not been able to realize these full effects due to stringent regulatory concerns, and a conservative industry with incumbent management teams weary of switching to an early stage technology. There’s also the question of mass production and the capital intensity of a technology that has not been able to ramp up production on a larger scale. It will be interesting to see how this technology innovates over time to become even more enticing for management teams who will soon have no choice but to switch over to a supply chain that incorporates 3D printing.

Source: https://www.mdtmag.com/article/2014/10/3d-printing-revolutionizing-medical-world-we-know-it

Caue, thanks for the very thought-provoking and timely post.

Regarding GE’s ability to use additive manufacturing (AM) to de-risk or overcome growing protectionist policies, I wonder if some of the characteristics of the engine supply chain prevent the viability of the investment GE would need to make to distribute industrial AM capabilities across its multinational footprint. Currently, GE does not have the physical capacity or engineering know-how to produce all of its engine parts in-house, and relies heavily on external suppliers for its current & next generation of engines (i.e., LEAP, GEnx), which is just ramping up production with next generation Boeing and Airbus planes and should drive the business for the foreseeable future. Changing the engineering specifications for these engines now likely isn’t viable. Further, for new engines, GE will need to deliver to the Boeing and Airbus facilities where the planes are being assembled, so a more distributed footprint likely doesn’t benefit the original equipment market.

Thus, any continued growth in AM capabilities are likely limited to replacing engine parts in the aftermarket. The problem I see, however, is that MRO shops and independent airlines typically first look to repair aftermarket parts or replace them with used parts over purchasing new parts at list price because it is significantly cheaper. Perhaps the reduced cost for new 3D-printed parts will allow GE to reduce prices to become competitive, but I am skeptical. All of these factors, I believe, likely limit the effectiveness of a highly distributed AM network, as – to Drew’s point – the benefits may not justify the cost to achieve.

However, I still believe additive manufacturing to be a significant driver of continued innovation in the aero-engine market over the longer-term. An important determinant in the viability of engine parts is the ability to perform under stressed heat conditions in the hot section of an engine, which can be in the thousands of degrees. Critics have been skeptical of the ability to achieve this for the hot section using AM for a while, but earlier this year Siemens – GE’s primary competitor in the industrial gas turbine space – achieved the first successful test of AM blades under full conditions. GE’s 2016 acquisition of Arcam AB in 2016 also adds titanium aliminate (TiAl) capabilities to its AM manufacturing, which may enable it to enhance its hot section AM capabilities. [Links to articles below]

Siemens 3D Gas Turbine Blades: https://www.siemens.com/press/en/feature/2014/corporate/2014-03-3d-druck.php?content%5B%5D=CC

GE Report on 3D Printing: https://www.ge.com/reports/epiphany-disruption-ge-additive-chief-explains-3d-printing-will-upend-manufacturing/

I think that the overall cost reductions and efficiencies of AM that you describe in your report, coupled with GE’s search for alternatives to casting suppliers Precision Castparts and Arconic who have significant pricing power right in the supply chain right now, will ultimately drive GE to continue its push to broaden its use of additive manufacturing on future engine platforms. It’s a very interesting time in the aero-engine supply chain.

I also believe that technologies based on 3D-printing will revolutionize the production plants and industry networks of future. However, I also believe it will, as well, change the type of walls built around countries. Even today, based on various reasons, governments control internet connections and monitor IP traffic. And, it happens even without any tax concerns! With tax concerns in play, I believe there will be even more restrictions. The best example to this would be the hotel booking websites. Internationally active websites, like kayak.com or booking.com, make revenues by selling hotel rooms in countries, where they do not even have offices. And, there are many examples of such countries, blocking those web services and forcing international companies to establish offices, pay taxes, and acknowledge laws locally – which might be a reasonable thought for most people. In the scenario you drew with your essay, governments will have significant interest conflicts; one country’s company is selling files and the other’s is producing goods to be sold locally without employment of labor. To my ears it sounds too good to be true; I expect (unfortunately) higher taxes for automated production lines and no less internet regulation in the future.

Wow, there’s something counter-intuitive to me about 3D printing parts for an airplane that will be flying hundreds of thousands of miles, but your explanation makes a lot of sense! However, I was wondering do you see a risk in having these factories in other countries as well? I agree with you that it makes sense to physically get a footing in as many places as possible while also vertically integrating. However, wouldn’t GE’s factories around the world be subject to similar taxation (import/export) and regulatory issues as a different company GE might purchase from?

I like the idea of having the 3D printing machines as close to the customer as possible to minimize transportation costs as I see this being the biggest issue for trade barriers – and a huge value-add for customers! 3D printing is particularly interesting for prototyping which could offer GE another competitive advantage. GE reports it’s using rapid prototyping for its appliances division [1], but I’m not sure why they couldn’t apply the same thinking to airplane manufacturing.

[1] https://www.ge.com/reports/5-ways-ge-changing-world-3d-printing/

Caue,

Thanks for an interesting read! To your question on local government support, I don’t necessarily agree with your implicit assertion that the proliferation of this technology will actually reduce jobs in a given area. As GE officials have pointed out, the firm wouldn’t be able to win many of the contracts it does were it not able to source from a broad pool of global suppliers [1]. It’s possible that while the efficiency of the process improves and labor per unit declines, this enables GE to win more business and create even more work for these local factories, in which case the local governments which are most supportive of the new technology might actually stand to gain the most. Either way, it will be fascinating to see how adroitly GE is able to navigate such tricky political terrain as it pushes for lower costs abroad.

[1] http://www.foxbusiness.com/features/2017/06/29/ge-ultimate-global-player-is-turning-local-2.html

3D printing seems to be an incredible solution for many of the production and procurement issues that companies are having these days. However, 3D printing still has some critics and it is said to have a long way to improve. In spite of being around for more than 35 years, 3D printing still presents some issues that hampers its disruptive potential. For example, some of the users disapprove the extensive time that it takes to run the process, and others say that it’s difficult to use in variable or complex products.

For example, Adidas was using 3D printing for the development of its shoes; however, the company noticed that they needed more speed and flexibility on the process. They are now working with a company that has developed a 4D printer, that its way more faster and allows for more customized products. So, what does the fourth D represents? It represents humans.

I think it is important to remember that even when companies start using these technologies, they will still need a big component of human intervention to detect possible issues and to identify improvements in the process. Companies should be aware that, if they decide to set up a 3D printing operation in other country, they should first guarantee that they will have the required pool of talent in that location, who will at the end lead them to thrive.

Source: Isabel Flower, “Is Mass Customization the Future of Footwear? The partnership between Adidas and 3-Dprinting startup Carbon Inc. could usher in a new era of bespoke shoes”, Wall Street Journal, October 24, 2017. http://search.proquest.com.ezpprod1.hul.harvard.edu/docview/1954373604?accountid=11311 , accessed November 2017.

I think your article brings up an interesting question on whether 3D printing will result in industry taking action to localize production to demand. To take this question one step father–do you think 3D printing will result in companies like GE getting out of manufacturing entirely? For instance, imagine a situation where the producer and maintainer of the aircraft (Boeing, or even an airline themselves) has their own 3D printing capabilities, and GE simply sells them the intellectual property needed to print out a jet turbine? Or, could this create an entirely new kind of manufacturing industry–a manufacturer who simply has a factory full of 3D printers, each making parts for a different end user? Could this create a multi-facing market for all manufacturing? Some interesting possibilities.

Given the shocking amount of inputs required for airplane assembly, a whopping 300,000 parts, I agree that 3D printing brings a lot of advantages to GE, primarily in regards to lead time reduction. One thing I worry about is the debugging and testing process, and the cost of scrapping failed parts. Suppose the printed part fails quality inspection and needs to be modified, will the manufacturers be able to rework the part so that it passes or will it have to scrap the entire part? If the latter is true, the costs will add up quickly. Furthermore, one of the advantages of 3D printing is lower headcount and thus labor costs, but if parts fail and need to be debugged, who is responsible for this? Is the assumption that this will be somehow automated as well? It will be interesting to see how GE introduces mechanisms to ensure that the integrity of the design is rigorously upheld to avoid costly mistakes and debugging.

Given the shocking amount of inputs required for airplane assembly, a whopping 300,000 parts, I agree that 3D printing brings a lot of advantages to GE, primarily in regards to lead time reduction in a global supply chain. One thing I worry about is the debugging and testing process, and the cost of scrapping failed parts. Suppose the printed part fails quality inspection and needs to be modified, will the manufacturers be able to rework the part so that it passes or will it have to scrap the entire part? If the latter is true, the costs will add up quickly. Furthermore, one of the advantages of 3D printing is lower headcount and thus labor costs, but if parts fail and need to be debugged, who is responsible for this? Will GE be able to debug remotely or do they need to rely on their global manufacturing partners? It will be interesting to see how GE introduces mechanisms across countries to ensure that the integrity of the design is rigorously upheld to avoid costly mistakes and debugging.

Thanks for the post, Caue! The paradox you point out initially of technology connecting the world while governments attempt to become more isolationist is striking, and I agree that GE is innovating to overcome this isolationism.

I believe even opening factories in local markets is an example of GE innovating to succeed in its environment, however I do have some concerns about this method. I would argue that the net number of new jobs would be welcomed by the host country, even if the presence of 3D printing machines has a negative effect on that number. At the same time, moving a plant to a host country may introduce competition unwelcomed by GE’s customers other suppliers. Regardless of government regulations, nationalist sentiment among the host countries may still encourage customers to remain with suppliers native to their country, rather than a U.S. company.

The idea to install machines at your customer is smart. You could lease machines and then sell high-margin designs. This way, you reduce risk of backlog and your customer bears the responsibility and costs of producing parts. Your customer also benefits from what essentially resembles Just-In-Time ‘delivery.’ My one concern here is GE may still needs to lease or sell the 3-D printing machines to the customers, which may be hindered by trade barriers.

Really enjoyed reading and thinking about this post, Caue. 3D printing at once seems like an easy, intuitive fix to high-friction borders and at the same time an utterly unscalable solution. At first glance, I’d be more likely to agree with the former, but reading some of the previous comments and some of the literature on the matter make me more bearish on the ability of 3D printing to comprise a significant portion of GE’s manufacturing. Potentially if GE were able to use 3D printing selectively for a few parts produced out of country, then 3D printing could overcome protectionist barriers in this fashion, but my sense from your post is that airplanes and spacecraft are comprised of hundreds of thousands of parts produced across quite a diffuse geographical network. In that light, I wonder about the implementation difficulty, not to mention the cost, of spreading 3D printing capabilities across GE’s global manufacturing network… if you need the plane delivered in Brazil, then printing the part in Brazil is all well and good, but if you need to deliver the plane to France, the part in Brazil isn’t very useful. If instead GE is using its recent acquisitions to own more of the manufacturing process, that would prevent the company from capturing the benefits of outsourcing this incredibly complex manufacturing operation, price shopping different suppliers, optimally managing transportation costs of raw materials and WIP inventory based on final delivery destination (enabling geographical and supplier flexibility based on the order), etc. Becoming more dependent on a few 3D printing enabled suppliers or taking on more manufacturing responsibility would be quite risky for the company and contrary to its current strategy. Moreover, reading this HBR article [1] made me more skeptical that 3D printing will be cost effective and revolutionary for manufacturing in the near or medium term. For parts that are not highly customized, it’s hard to imagine 3D printing effectively competing on cost with conventional machinery: there are not only upfront capex costs but also significant pre- and post-printing costs, training costs (in the factory) to teach workers how to use the less conventional equipment, and labor costs (to develop these 3D printing schematics). 3D printing is fascinating and revolutionary, but its use case may be limited to highly custom parts, which may limit its ability to solve GE’s cross-border friction problems.

[1] https://hbr.org/2015/06/the-limits-of-3d-printing

Thank you, Caue for a very interesting article. To me, this reads as GE utilizing an asset light model to circumvent protectionist barriers, which represents a solution that may turn out to have significant drawbacks. The manufacturing industry is predicated on the fact that few players can reach the scale necessary to make this capital intensive business economical. By creating this asset light model, you destroy all the barriers to entry in the space.

As you correctly outline, 3D printing machines are incredibly polyvalent. The transition to a GE asset light model may lead to unintended consequences where clients realize that they are better off investing in those relatively cheap printing machines themselves to use for not only turbine replacement parts, but also all other manufacturing needs that may lend themselves to 3D printing technology. Customers would then only rely on a player like GE for its IP or engineering solutions, as WRK identifies above, and have the capability to produce on site. At that point, what stops them from poaching GE’s engineers to save themselves some external consulting fees? Would this eventually lead to a flurry of engineering consulting firms competing with each other for client business?

I worry that this is the classic example where customers would hold too much power.

Great work!

Thanks for this article, Caue.

Other commenters have mentioned the high capital expenditures associated with 3D printing, and is an important consideration. Rather than purchasing bespoke machinery from 3rd party manufacturers, or organically building the printers in-house, a rental option has become a possibility. Several B2B 3D printing companies like Carbon utilize a subscription-based revenue model, where the major value proposition is software push-outs (similar to the Tesla model) and shipment of polymers, resins, etc.; the 3D printing company retains ownership of the equipment [1]. I am curious to see if this model becomes commonplace for industrial-scale printing jobs, or if it is only suitable for prototyping (the current popular use case).

Source: https://s3.amazonaws.com/carbon-static-assets/downloads/pricing/Carbon_Pricing.pdf

Great topic Caue, and definitely something I hadn’t considered before. I have similar concerns to Marissa regarding the scalability of the 3D printing approach. It solves some issues, but I question whether the magnitude of its effect when there are parts that simply cannot be printed. Also, given the nature of aircrafts, I am concerned that it’s a big risk to be producing these parts. Additively manufactured components currently have lower mechanical performance and durability [1]. Although technology has improved, this leads me to believe that there may be more significant capital investment necessary in order to get this many parts up to scale.

[1] https://www.roboticstomorrow.com/article/2014/08/scalability-and-the-commercial-reality-of-3d-printing-in-the-future/4458

Interesting article on the challenges posed by protectionist government measures, and the paradox this creates with globalization. 3D printing seems like an innovative and effective solution, and demonstrates the power of technology to overcome some of these measures. I wonder whether automation into supply chains and increased data visibility will have any impact on where companies source from, potentially even encouraging local manufacturing. As we enter into a world led by digitization, automation, and big data, there will be more pressure for companies to reduce costs and become more competitive, therefore introducing a whole new set of challenges. It is interesting to think about the motivations behind government regulations, and how those will change as the manufacturing process itself changes.

I had never thought of 3D printing as a way for companies to overcome isolationism until now – thanks for the fascinating post, Caue! Overall, I agree with the sentiments above that 3D printing in general has tremendous potential to transform a range of manufacturing processes across a number of industries. That said, I’m also a bit skeptical about the potential for 3D printing to truly de-risk GE’s supply chain in the face of trade restrictions. For one, 3D printing still requires a range of raw material inputs, of which some would presumably still need to be imported into the foreign country where the 3D printer was being operated. Second, while I’m admittedly no expert in 3D printing, I suspect that this technology would be most useful for printing relatively small parts and sub-assemblies. Thus, producing large aircraft engines and gas turbines abroad would still demand a bit of “conventional” manufacturing when it comes to assembling 3D-printed WIP into a finished product. This article I found seems to support that concern [1]. Even if that’s not the case—that is, even if GE’s intention is truly to use 3D printers large enough to produce an entire finished product at once—then I would expect the importation and/or construction of the 3D printers themselves would introduce even more risk in the face of trade restrictions. All this being said, your article is a great impetus to learn more about this exciting topic. Well done!

[1] https://qz.com/667477/ge-fires-up-worlds-largest-commercial-jet-engine-using-3d-printed-metal-parts/

This is a fascinating read Caue! I’ve worked with 3D printers in the biomedical setting before but never considered this application to combat global trade barriers before. I think it is a creative way to at least retain the skilled labor (CAD designing) within the United States and only outsourcing the manufacturing of the products in other countries.

A few concerns I would have would be around the quality of parts made by these 3D printers, the security of sending confidential designs over the internet, and the global collaboration that could slow down prototyping. Specifically, you mentioned 3D printers are usually relatively inexpensive. However, as designs get more exact and 3D printed parts require higher levels of resolution, especially for aerospace applications, I would expect these costs to go up. Additionally, newer technological innovations would require further capital investments in printers at all production sites. Further, rapid prototyping is often a competitive advantage for companies like GE. Having the design and manufacturing split across geographies could hinder the speed at which this could be done for new product development. However, these could be offset by the speed advantage 3D printing technology provides when it comes to producing these prototypes [1].

[1] http://www.stratasys.com/resources/case-studies/aerospace

Caue, this was a great read and thought-provoking post. I’m quite interested in the 3D printing space; at face value, it has the potential to disrupt so much of traditional manufacturing, from small electronics and chips to giant pieces of machinery such as airplanes as noted here. It was surprising to me that the digitization of mechanical parts can have such far-reaching implications as a potential defense to isolationism in the international trade area. To your point about the increasing expertise and power of the network, I believe that as 3D printing becomes more common, it will produce a snowball effect; greater usage of 3D printing will entice technology companies to increase the pace of technological innovation on the equipment, resulting in price drops, which then incentivize customers to shift more manufacturing process to 3D printing, and on.

To the final question that you posed, I am fairly skeptical about the risk that government pushback against digital printing poses. Any issues of IP will not change, whether in a manufacturing plant or in a 3D print shop. And while local governments may not embrace the concept of fully-automated processes that may remove the need for traditional labor-intensive factories, I believe that it will be very difficult to pursue a regulatory response.

Thanks very much for the interesting topic Caue. I found this topic rather thought provoking and was encouraged to hear industry leaders such as GE actively investing in bring their global community closer together in a time of increasing isolationism and protectionism. Naturally so a new and innovative space brought up more questions for me; specifically how can 3D printing further decentralize a company’s supply chain. In shifting towards a digital information economy, AM allows companies to more efficiently move ideas and innovations around the world as changes in the regulatory landscape effect their business. Couple with the idea of renting facilities – as suggested by some of our peers above – I think this has the potential to enable a more interconnect and flexible supply chain which is also more decentralized.

Great article Caue, I think it is a very refreshing way to analyze international trade. It was really interesting to learn how technology advancements have the ability to tackle some of the protectionism regulations off.

I agree with you on the benefits of 3D printing in terms lowering the barriers for free-flowing labor and product designs. However, I firmly believe this kind of developments could have two major consequences:

i. On the one hand, this “post-modern” international trade would certainly be addressed by governments more sooner than later. I expect to see new regulations from those more protectionist administrations you mention, trying to catch up to these practices and building walls to hinder such transactions.

ii. On the other hand, these same technological improvements could become a threat for GE itself. If we consider the future massification of 3D printing, and the proliferation of experts and/or standardized models worldwide, GE could loose its competitive advantage to customers acquiring this technology.

Caue, thank you so much for such an interesting topic. I had never thought too deeply about 3-D printers, but your article made me really think about how disruptive this technology can be in many ways.

First of all, it was very interesting to look at 3-D printing from a perspective of overcoming trade barriers. It is just scary to think about how complex it will be to deal with transfer pricing in multinational companies, and how so many conflicts could arise between countries in trying to understand and distinguish the values that lie behind the tangible and intangible aspects of the products made by 3-D printers.

Also, the idea of 3-D printer made me wonder what kind of players will become the winners in the world of 3-D printers. If anyone can make a certain item as long as they have a 3-D printer, will the players with the intellectual properties become the winners?

And lastly, you mentioned how local governments might not support this technology as it could create fewer jobs due to automation. But considering the fact that there will be fewer movement of physical goods throughout the world, it is not only a local manufacturing issue. It would be interesting to see how much impact 3-D printing may have on the shipping/transportation industry.

This is very insightful Caue! Free enterprise creates a social benefit of job creation, but that job creation is not mandated by the government. I don’t think the government will impact the expansion of this technology because free enterprise encourages the innovation 3D printing enables. However, governments could enter trade agreements on shared export rights since GE’s designs would be American-made, but parts would be manufactured abroad.

GE is definitely making strategic moves to better position themselves to compete globally without huge increase in operating expenses due to logistics of suppling engines all over the world. In the future, I think more companies will evolve their operating model to reach more customers in the most efficient manner possible as GE has.

Also, governments are generally reactive towards regulating free enterprise, but there are two additional questions I would pose. Do you think GE will continue to “fly under the radar” until government proposes a new regulation on manufacturing IP? Will GE deploy lobbyist to get in front of this issue and influence the policy making?