Bidgely: Named After The Hindi Word For Electricity, This Company Can Help You Save It

Imagine looking at a graph of your home’s energy usage and knowing exactly what's shaping it. Would you find this information valuable? Bidgely is betting yes and has the machine learning capability to deliver.

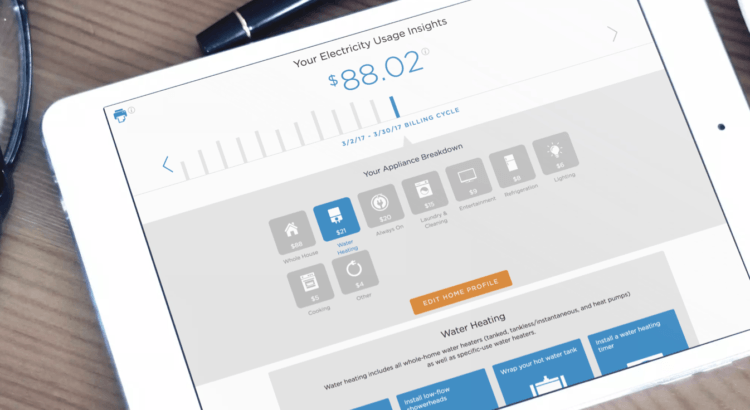

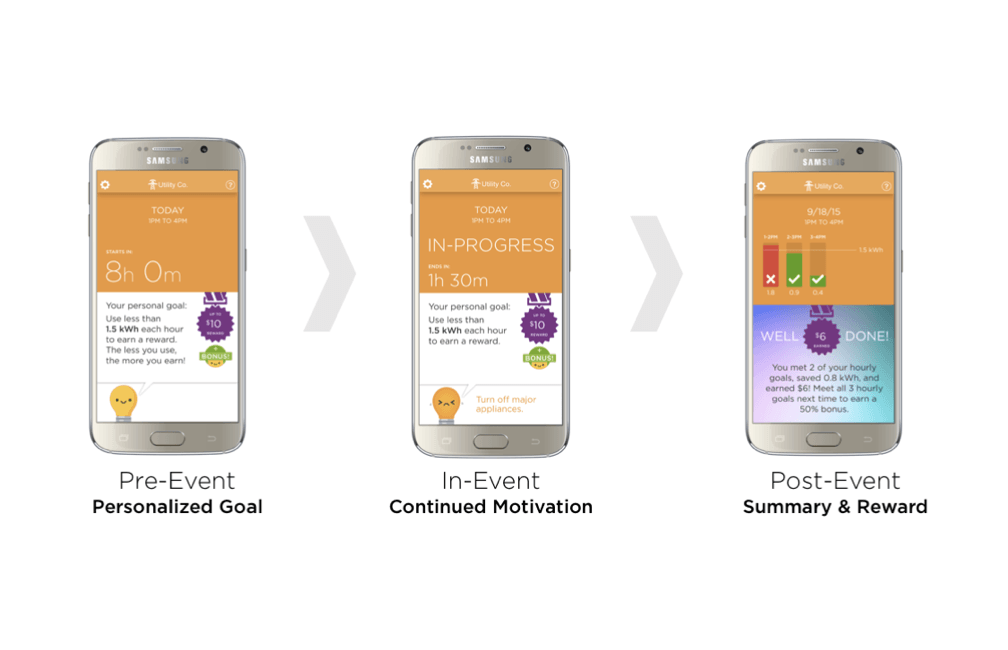

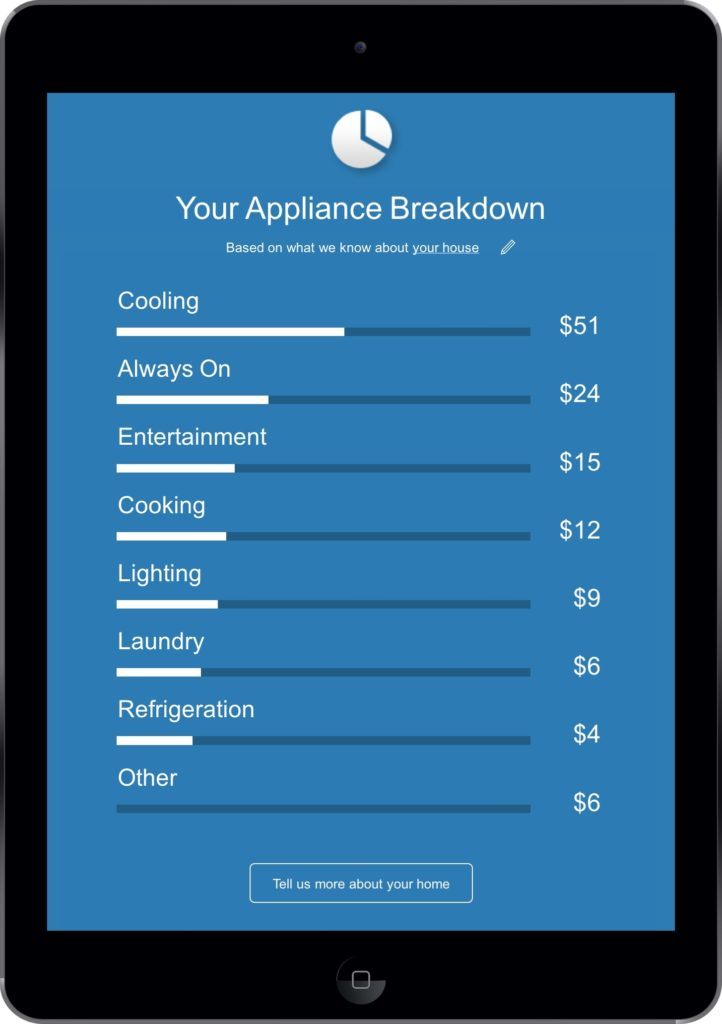

Founded in 2011, Bidgely uses proprietary machine learning algorithms to “disaggregate” or identify down to the appliance level what’s consuming energy in homes. It then generates personalized recommendations and behavioral nudges to help customers reduce their bills. This provides a duel benefit to utilities who can avoid expensive peak electricity demand periods. Having raised over $51 million through its Series C in January 2018, Bidgely has more than 10 million homes under contract through partnerships with 25 utilities across 12 countries.

Smart meters can only provide home-level energy usage data throughout the day. Bidgely is able to itemize consumers’ energy data into individual appliances by recognizing appliance “signatures” in smart-meter data readings. By leveraging its database of over 50 billion smart meter readings, Bidgely can also apply machine learning to provide itemization to non-smart meter homes. For the latter, a “matched peer” or a “matched region” machine learning model is used. This capability enables Bidgley to offer their solution at a fraction of the cost of hardware-based solutions and to reach 100% of homes, regardless of the types of meters being used.

Bidgely should also move beyond solely providing insights to facilitating automated actions that reduce energy consumption. The average customer thinks about her utility bill just 10 minutes a year [7]; increasing that number is difficult at best. Bidgely must interconnect with appliances and smart home devices to automatically make adjustments (e.g., turn off lights, modify heating cooling, delay washer / dryer loads) while providing customers an opportunity to opt-out if needed. Dependency on integrating with hardware poses a long-term risk which can be mitigated through merger, acquisition, or partnership. While companies like Tesla are installing battery storage devices (i.e. the Powerwall) paired with solar systems [8], Amazon and Google are ramping efforts to garner share of home connected devices (including voice assist and smart home products like Nest) [9]. Given the forays of these companies into artificial intelligence [10,11], it will be easier for them to develop capabilities similar to Bidgely’s than vice versa. As such, Bidgely should look into partnerships that enable them to develop their product in coordination with the hardware suppliers to offer customers the most optimal solutions.

Bidgely’s rapid growth and notable investments due to its advanced machine learning capability make it an exciting company to watch. Whether they’ll be able to maintain access to quality energy usage data provided by utilities, automate actions based on their insights, and provide a differentiated product in a world of proliferating interconnected devices remains to be, shall we say, disaggregated.

(Word Count: 750)

[1] Corpsitedev.bidgely.com. (2018). Bidgely Corporate Website. [online] Available at: http://corpsitedev.bidgely.com/solutions/ [Accessed 13 Nov. 2018].

[2] Digitalistmag.com. (2018). Connected Assets: How Machine Learning Will Transform the Utilities Industry. [online] Available at: https://www.digitalistmag.com/iot/2018/02/26/connected-assets-how-machine-learning-will-transform-the-utilities-industry-05921360 [Accessed 13 Nov. 2018].

[3] Cooper, A. (2018). Electric Company Smart Meter Deployments: Foundation for a Smart Grid. [online] Available at: http://www.edisonfoundation.net/iei/publications/Documents/IEI_Smart%20Meter%20Report%202017_FINAL.pdf [Accessed 13 Nov. 2018].

[4] Businesswire.com. (2018). Bidgely Closes $27 Million Series C to Grow Disaggregation Solutions for Utilities. [online] Available at: https://www.businesswire.com/news/home/20180116005769/en/Bidgely-Closes-27-Million-Series-Grow-Disaggregation [Accessed 13 Nov. 2018].

[5] Greentechmedia.com. (2018). Utility-Branded Marketplaces Offer DER Services to 32 Million Metered Customers. [online] Available at: https://www.greentechmedia.com/articles/read/utility-marketplaces-der-services-customers-gtm-research#gs.i8WtSDw [Accessed 13 Nov. 2018].

[6] Grzywaczewski, A. (2018). Training AI for Self-Driving Vehicles: the Challenge of Scale | NVIDIA Developer Blog. [online] NVIDIA Developer Blog. Available at: https://devblogs.nvidia.com/training-self-driving-vehicles-challenge-scale/ [Accessed 13 Nov. 2018].

[7] Mezger, S. (2018). CUSTOMER CENTRICITY: MUST-HAVE OR A WASTE OF ENERGY? (ACCENTURE). [online] Available at: https://www.accenture.com/t20180612T094240Z__w__/pl-en/_acnmedia/PDF-65/Accenture-Customer-Centricity-Must-have-Waste-Energy-POV.pdf [Accessed 13 Nov. 2018].

[8] Smart Energy Homes Provide Multiple Grid Benefits. (2017). [online] Available at: https://www.tesla.com/sites/default/files/pdfs/en_US/Tesla_SCE-Powerwall%20Case%20Study-2017.pdf [Accessed 13 Nov. 2018].

[9] Wang, F. and Holden, C. (2018). How Utilities Are Combining Voice and Analytics for Customer Engagement. [online] Greentechmedia.com. Available at: https://www.greentechmedia.com/articles/read/utilities-explore-customer-engagement-via-voice-and-analytics#gs.783DKVU [Accessed 13 Nov. 2018].

[10] Tesla (2017). Solar + Powerwall Support Distribution Capacity. [online] Available at: https://www.tesla.com/sites/default/files/pdfs/en_US/Tesla_PG%26E-Case%20Study-2017.pdf [Accessed 13 Nov. 2018].

[11] Utility Dive. (2017). UK’s National Grid eyes Google AI unit to balance power supply and demand. [online] Available at: https://www.utilitydive.com/news/uks-national-grid-eyes-google-ai-unit-to-balance-power-supply-and-demand/437981/ [Accessed 13 Nov. 2018].

[12] P. MacDougall, A. M. Kosek, H. Bindner and G. Deconinck, “Applying machine learning techniques for forecasting flexibility of virtual power plants,” 2016 IEEE Electrical Power and Energy Conference (EPEC), Ottawa, ON, 2016, pp. 1-6.

As a consumer, this product seems incredibly useful for both cost savings and reducing footprint, but I would be more inclined to do a 1-time diagnostic rather than continue to pay for the product over time. I’d image that large family households with fluctuating energy uses may benefit from long-term use, but ultimately once behaviors shift towards more optimal usage, the product’s value diminishes significantly. In what way can this product continue to meet customer needs over time? Perhaps there is opportunity to expand beyond appliance energy monitoring and bundle with other products such as home security software.

Lol to your last pun. Thanks for an interesting article.

I think Bidgely’s reliance on utility companies is a risk – but it is also a competitive advantage if they were able to lock-up exclusive access. In order to retain this access Bidgely will need to create the highest quality product that actually effects change. As you pointed out consumers hardly think about their electricity bill (unless you are my father, who posts energy consumption on the fridge every month to brag about how low his consumption is), and Bidgley’s is only valuable to both consumers and utility companies if it effects changes in consumer behavior. Offering knowledge isn’t enough. In order to cause this Bidgely needs to become more consumer-focused. They should have monthly, weekly, daily reports that offer suggestions to consumers on how to change their behavior. They should have notifications and use AI for projections of what their bill / usage could look like if users did ‘xyz’ changes. And ultimately they should go into hardware to forcibly effect change (with consumer sign-off of course) but having lights set to off, Air set to change, etc. is ultimately what Nest was aiming to do – but without the link to energy consumption insights that would offer the hard data to incentivize these changes. A partnership (perhaps with Nest) would offer real impact for Bidgely in the home by allowing them to move from just information to action.