Betting on Photovoltaic Industry: Shinsung Solar Energy

Rapidly changing environment make many companies worried about their future. However, a few companies are trying to seize the opportunity in the midst of rapid change. Shinsung Solar Energy, small photovoltaic company located in Korea, is one of them.

Entering towards Photovoltaic Industry

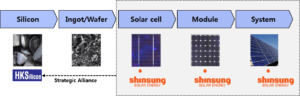

Shinsung Solar Energy(formally known as Shinsung Engineering) was established at 1977 to manufacture air conditioning facilities. The company grew steadily and finally listed in the Korean Stock Market at 1996. At 2007, the company made important decision; they decided to enter photovoltaic industry. As one of the first Korean company who entered photovoltaic industry, earlier than current Korean major photovoltaic companies such as Hanhwa Q cells(2011) and OCI(2012), they expanded their business gradually from solar cell business(2007) to module business(2010) and solar energy EPC business(2012). By doing so, the company was able to establish vertically integrated business model.

< Vertical Integration of Shinsung Solar Energy >

Climate Change and Photovoltaic Industry

One of the major factor that has boosted growth of photovoltaic industry so far is growing concern about climate change. Until now, large portion of demand for photovoltaic industry has depended on government subsidies which were provided as an effort to reduce greenhouse gas(GHG) emission.

While average global surface temperature rose by 0.9 degrees Celsius from 1880 to 2015(1), many scientists point out that increasing emission of GHG has caused this dramatic climate change. Primary sources of GHG emission are the fossil fuel consumption for electricity and heat production which account for 25% of total GHG emission.(2) To cope with rapid climate change, reducing fossil fuel consumption became important agenda in many countries and many governments have been looking for alternative, environment friendly energy sources. Such interest boosted growth of photovoltaic industry.

Future of Shinsung Solar Energy

Economic recession after 2008 financial crisis and increased facility investment in China significantly dropped the price of photovoltaic products for several years. Because of the market recession, Shinsung Solar Energy also have gone through difficult years. However, increasing concern of climate change and continued technical innovation in photovoltaic industry are expected to open new growth opportunity for Shinsung Solar Energy by booting future demand.

First of all, increasing concern about climate change reignited governments interest in renewable energy sources including photovoltaic energy. From 2012, Japanese government restarted government subsidies polity, FIT (Feed in Tariffs) policy, and many other countries are starting to increase government aid towards renewable energy. Despite constant efforts of reducing GHG emission from many countries, installment of photovoltaic energy system have been mainly concentrated on European countries because the first attempt to regulate each country’s GHG emission, Kyoto Procotal(1997), only impose obligations towards developed countries, even excluding the United States. However, growing concern about GHG emission alarmed many countries and finally, in 2015, 195 countries agreed to reduce GHG emission at the Paris Climate Conference.

Furthermore, continued technology innovation and lowed installment price are increasing economic feasibility of photovoltaic power generation. Market experts are expecting that photovoltaic energy could reach grid parity in the near future. According to the Export and Import Bank of Korea, generation cost of electronic power of photovoltaic energy is expected to drop from 140krw/kWh(2014) to 80krw/kWh(2020), which is similar to estimated future generation cost of fossil fuel energy in European countries.(3)

It is expected that increased government subsidiaries and increased economic feasibility will lead future market demand. As market grows, Shinsung Solar energy will be able to grow accordingly.

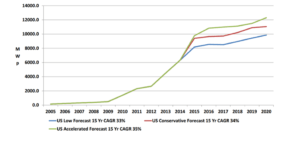

< US Photovoltaic Market Demand Forecast(4) >

To cope with expected increase in market demand, Shinsung Solar Energy have already executed capital investment in advance. They have constantly increased their manufacturing capacity and expected to increase overall capacity for solar cell from 350MW (2014) to 600MW until the end of 2016. (5)

However, to take full advantage of climate change in the future, Shinsung Solar Energy have to find a way to mitigate risks. First, due to several years of market recession and excessive investment, the company is exposed to financial risk. The company’s debt to equity ratio is more than 400% despite their recent issuance of new stock. Second, even though they achieved vertical integration of the solar system from solar cell manufacturing to installment of the system, the integration has not completed yet. They are still exposed to risks associated with changing price of raw materials such as ingot and wafer. Integration of preceding process of photovoltaic industry requires huge amount of investment. Therefore, addressing above mentioned risks would be difficult problem for Shinsung Solar Energy.

[ 746 words ]

(1) NASA’s Goddard Institute for Space(GISS), “Global Temperature,” NASA website, http://climate.nasa.gov/vital-signs/global-temperatrue

(2) “Climate Change 2014: Synthesis Report,” Intergovernmental Panel on Climate Change, 2014

(3) Industry review: Photovoltaic Industry, Export and Import Bank of Korea, 2015

(4) The 2016 Global PV Outlook, Renewable Energy World, issued at Jan.25, 2016

(5) 37th Annual Business Report, Shinsung Solar Energy, issued at Mar 28, 2016

Silicon is expensive and PV needs it in large quantities. Shinsung is exposed to the risk that silicon prices will rise as production increases. It is always dangerous to extend the market dynamics in a nascent market directly to full scale operations. Massive adoption of PV may require very different business practices. Fortunately, this may happen sooner than they think: growth predictions have consistently been below actual growth rates as analysts predict linear growth while exponential is achieved. The graph from figure 4 shows that trend; time will tell who is right.

This is a really interesting post and perspective on solar PV ! As you allude to in your post, the technological advancements and silicon price increases of the past decade that led to a significant decline in the cost of PV systems have posed a real risk to businesses such as Shinsung Solar Energy – in fact, in the US investing landscape, the collapse of these businesses is what has led to solar energy garnering an unfavorable reputation by some (a famous example is of President Obama’s investment in Solyndra).

It is interesting to know that Shinsung Solar Energy has made a significant investment to capture future growth in demand. How do they plan to ensure that their technology continues to be cutting-edge, and that they are not undercut by competitors in the future? In my opinion, they should also be making a significant investment in R&D.

The other strategy, which it seems they are doing only partially, is to be fully vertically integrated. Atleast in the US, the EPC business as well as the financing/leasing business is considered to be the most profitable part of the value chain. This is partly because of the subsidies available, and partly because these segments of the value chain benefit from lower PV prices.

While the PV business seems highly competitive, I agree that the demand continues to increases, and ultimately the competition is likely to drive grid parity, which will be a very exciting day for renewable energy !

Great post on solar energy industry! In Japan, when I conducted research on Japanese business investments in 2013, investment in solar energy industry was increasing most rapidly because Japanese government had restarted government subsidies policy in 2012, as the article mentions. Interestingly, a lot of non-energy companies were investing in this area to secure relatively stable revenue subsided by the government, as well as to diversify their business models. For instance, Softbank, one of the largest telecom carriers in Japan, aggressively invested in this area.

This post mentions two risks of Shinsung Solar Energysome’s business. However, another risk I think important is that solar energy industry still highly depends on governmental support. As far as I know, despite the technological innovation, the efficiency of photovoltaic power generation is much lower than traditional methods, such as thermal or nuclear power generation. Also, particularly in east Asian countries such as Korea and Japan, it is difficult to find a vast land with intense sunlight, which enables efficient power generation. Therefore, it would be a challenge for Shinsung Solar Energy to create a sustainable business model that can thrive without governmental support.