AXA: “the cost of climate change is too damn high!”

Insurance companies are paying the price of climate change. How can they survive when this price keeps going up?

“There is one thing which is absolutely clear: if the warming goes beyond 2 degrees, it’s going to become tougher and tougher and probably impossible for insurers to cope with damage to the environment” – Henri de Castries, CEO of AXA (second largest insurance company in the world) (1)

The cost of climate change

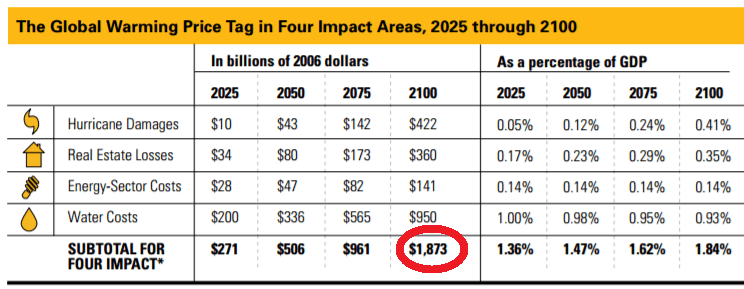

There’s no doubt that climate change is causing serious damage. Scientific research has shown that the current increase in global temperatures leads to more frequent and intense natural disasters (hurricanes, droughts, floods), rising sea levels and disruptions of the food chain(2). All these events turn into financial cost when infrastructure is destroyed, people are injured, tourism is diminished, agriculture is less productive and mass migrations are happening(3). In the US alone, it is estimated that this cost could reach at least $1.9 trillion annually by 2100, as shown in the table below(4).

With that being said, a question remains: who is paying for this?

The “insurance” business model

Insurance companies have built their business model around paying these costs on behalf of others. Their business model is very simple:

- The insurance company collects premiums from a large number of clients

- These premiums are gathered together to create a “buffer”

- The “buffer” does not sit idle: it is invested in the financial markets to generate returns

- Every time a customer experiences an accident, part of the buffer is used to compensate him from the damage he suffered. Premiums are sized accordingly so that the buffer is always sufficient to face the cash-out needed to compensate customers.

This model works because accidents are fairly rare and having a large customer pool enables risk diversification. It works so well that insurers are often very profitable businesses: AXA alone generates €6 billion profit per year! (7)

So, what is AXA complaining about?

Why insurers don’t like climate change

Climate change invalidates two very strong assumptions that make the “insurance” business model work. First, accidents are not rare anymore: natural disasters are more common and rising sea level is accelerating. This leads to an increased rate of accidents and with much larger financial impact. Second, there is much less diversification because accidents happen on a very large scale nowadays. A natural disaster could affect millions of people at once, and a single insurance company will certainly not have a big enough “buffer” to compensate all these people at the same time.

So what can insurance companies do?

How AXA is fighting climate change

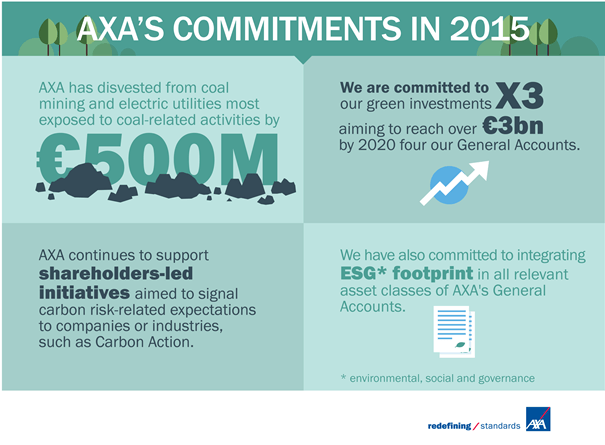

AXA is fighting the threats to its business model through a number of initiatives announced in late 2015: (5)

- Prevention: AXA is investing €3bn by 2020 in “green” companies that are environmentally friendly. This investment is aimed at fostering responsible behavior from other players and hence diminish the impact of climate change in the future. Likewise, AXA also participates in shareholder-backed initiatives such as “Carbon Action” that promote good environmental behavior from other companies.

- Resilience: AXA is also working with public and private partners to improve the resilience of infrastructure and people (e.g. AXA joined the African Risk Capacity to promote food safety and is working with the World Bank to help finance better infrastructure)

- Reaction: AXA is divesting €500m from coal-related companies. By doing so, their “buffer” is not invested in risky fossil-fuel assets anymore. AXA believes that the coal industry is declining, and the buffer needs to be invested in growing markets in order to generate returns and grow.

Despite these efforts, AXA is still suffering heavily from climate change and has been sanctioned by shareholders and analysts. Since announcing this plan, AXA share price has dropped 25%(6).

What else could AXA do to please its shareholders?

Potential next steps

I believe AXA should revisit the core principles of its business model:

- Use more re-insurance. One way to minimize the impact of the large-scale natural disasters who are hitting AXA is the use of re-insurance companies. Simply put, AXA can itself subscribe to an insurance that can cover the exceptional cost of large-scale events such as natural disasters.

- Revisit prediction models. The premiums charged by AXA to its customers are calibrated according to models that predict how often customers will be hit by accidents. Today, these models need to be revisited to include the impacts of climate change. It is particularly challenging to stay up-to-date when new models and research is published daily. Hence, I believe AXA should partner with universities and research centers to help build new models and use them in their predictions.

- Revisit the “buffer size”. Not all the buffer owned by AXA is available at all time. AXA indeed invests its buffer in different financial assets, and some of them are not liquid. Given the strong variability that has been introduced in the system because of climate change, AXA should consider increase its buffer size, i.e. have a more liquid balance sheet so that the buffer available is always big enough to compensate customers.

Sources

(2) http://earthobservatory.nasa.gov/Features/RisingCost/rising_cost5.php

(3) http://www.climatehotmap.org/global-warming-effects/economy.html

(4) https://www.nrdc.org/sites/default/files/cost.pdf

(5) https://group.axa.com/fr/newsroom/actualites/changement-climatique-un-ceres

(6) http://www.boursier.com/actions/cours/axa-FR0000120628,FR.html

(773 words)

Thank you for the post, Raphael. I feel your piece highlights how companies are being forced to invest in climate change solutions, even when that is not their declared business. I do, though, find it hard to believe that insurance companies will bare the brunt of the impact of climate-change. Did you see any search about the changes in AXA’s average premiums? A quick view of the companies website actually shows that their EPS was up nearly 10% over FY ’14. This does not seem to be congruent with what the corporation is saying.

Raphael, good piece! Jess wrote something similar, but for AIG. I would like to know your opinion in the comment I made suggesting the use of CAT bonds as another potential solution. To avoid repeating myself here is the link:

https://d3.harvard.edu/platform-rctom/submission/aig-underwriting-the-risk-of-climate-change/

What do you think the role of the public sector is going forward? You mention that AXA is working with public and private partners to strengthen infrastructure in key areas. Could you imagine more creative partnerships down the line? For example, I imagine hurricane insurance premiums in coastal areas in the U.S. will have to rise if current climate trends continue. Perhaps insurers will have to lobby for government subsidies to help lower the cost to customers. I wonder if there’s an opportunity for innovative state and city goverments to enter into risk sharing agreements with local insurers to cover part of damages payment in exchange for some of the investment returns from the buffer.

Interesting piece – I hadn’t realized AXA share price had been hit so hard! I completely agree with your assessment of potential next steps including revisiting buffer size and prediction models. However, I’d like to push back on the increased use of reinsurance. Is this not simply passing risk further down the line? There is perhaps an argument to be made around increased diversification of the risk pool. However, I don’t think this measure really removes the risk inherent in the system. Regardless, I’m glad to hear that AXA is actually taking steps to help reduce the risks stemming from climate change rather than simply revisiting risk models and buffer sizes!

Awesome review Raphael. As a shareholder of an insurance company (albeit a extremely small shareholder), I have been worrying about the sustainability of the industry. The idea of reinsurance is of particular interest to me. My question is, if these insurance companies take out reinsurance, who bears the cost? Is there a separate industry for reinsurance?

My other concern is that there is an inherent tension between companies vying for market share by competing on price and coverage coupled with a world where extreme weather events are increasing in both frequency and ferocity. I think that we could begin to see insurance companies as the climate becomes more unstable…… Maybe I should get out while I can 😉

Raphael,

Thank you for the well thought-out post: I also find this industry very interesting as P&C insurance companies are truly on the “front line” of shouldering the costs of climate change. I wrote a similar piece about AIG, and it was interesting to compare their initiatives to AXA’s (many of them are the same). The reinsurance option is interesting, and Andres and Ilan asked me for my opinion on CAT bonds specifically. I definitely think that bundling different levels of risk exposure together to achieve diversification in the reinsurance market is an innovative way for companies such as AXA and AIG to free-up capital and provide higher-risk customers (a good example was Amtrak who operates the train system in the Northeast United States) the ability to get coverage.

My question for AXA specifically is if they are rewarding new policyholders who implement “greener” alternatives in their business or property with lower premiums? AIG and some other U.S. insurance companies are providing products known as ‘Green Replacement’ policies that seem like an interesting preventative solution.

Thanks once again for a very informative post,

Jess

Thanks for the post Raphael, it is very informative for me to read about climate change affecting insurance business. In fact I was quite impressed to read the steps that AXA is taking to fight the threats to its business model. Incentivizing companies to adopt greener technology by means of investments shows the long term view on behalf of the company wherein most parties in regards to this issue are caught in free riders problem and not ready to take any costs unless mandated by regulations.

The suggested methods for shareholder value, perhaps I am not thinking correctly, seems to me in the long run as the disruptions become severe will eventually lead to collapse of the insurance business. If the premiums become too high that they become a high entry barrier for enrolling and then only very prone to damages like coastal areas may seek insurance which will start a downward cycle.