An Ounce of AI-powered Prevention, A Pound of Cure: Cigna’s Use of Artificial Intelligence to Save Lives (and Costs)

Artificial intelligence is changing the way Cigna and other health insurers engage with users, enabling improved health outcomes and lower costs.

In the world of health insurance, performance is not only measured in bottom-line profits, but also in health outcomes. Artificial intelligence (AI) and machine learning technologies are rapidly transforming how patients, hospitals, pharmaceutical companies, and insurers across the ecosystem approach healthcare. For insurance companies, this pressure is compounded by industry trends including regulatory uncertainty,[1],[2] consolidation,[3] and new entrants.[4] While the rise of AI has increased risk from competitors, technology also offers the possibility to adapt. Carriers can create AI-powered products reducing the need for costly treatments while optimizing existing processes.

Among the insurance companies facing these pressures is Cigna—a global health service company with 95 million customers which has successfully navigated the landscape over the past 200+ years.[5] To maintain its market position through the technological arms race, Cigna must continue to innovate and adapt as competitors adopt AI and machine learning capabilities.

Quick wins: Driving customer education and engagement

To realize gains in the near-term, Cigna is focused on offering “easy to understand, affordable products.”[6] Like many carriers, Cigna offers a range of programs designed to improve customer satisfaction, health outcomes, and cost-efficiency through prevention and early detection. Educating and engaging users, however, presents a major obstacle in realizing the potential of these initiatives.[7] To combat knowledge gaps, Cigna has adapted its user-engagement processes and leveraged partnerships. Examples of these initiatives include:

- Answers by Cigna: AI-enabled voice offering on Amazon’s Alexa platform answering 150+ common questions[8] while personalizing and simplifying health benefits information.[9]

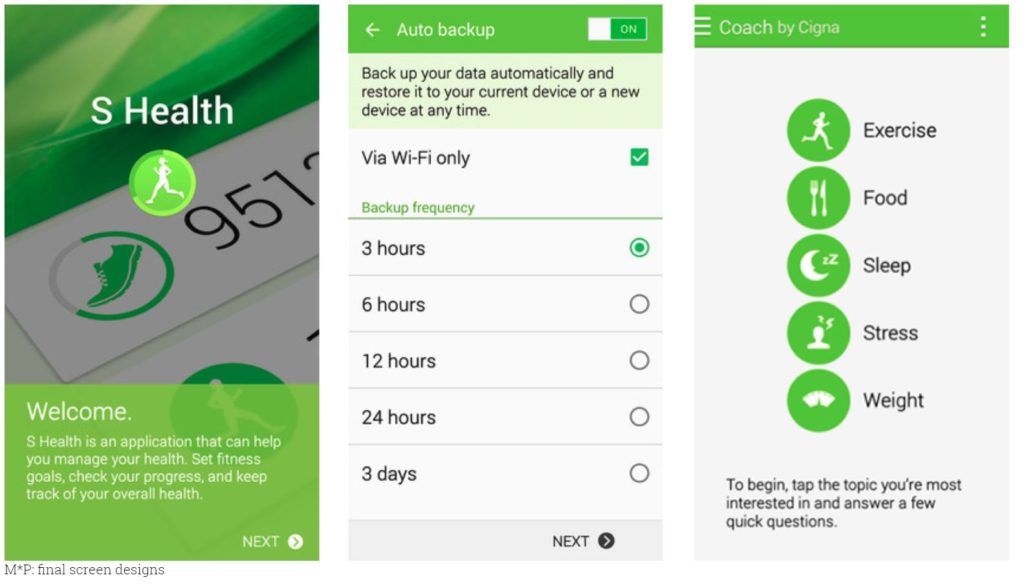

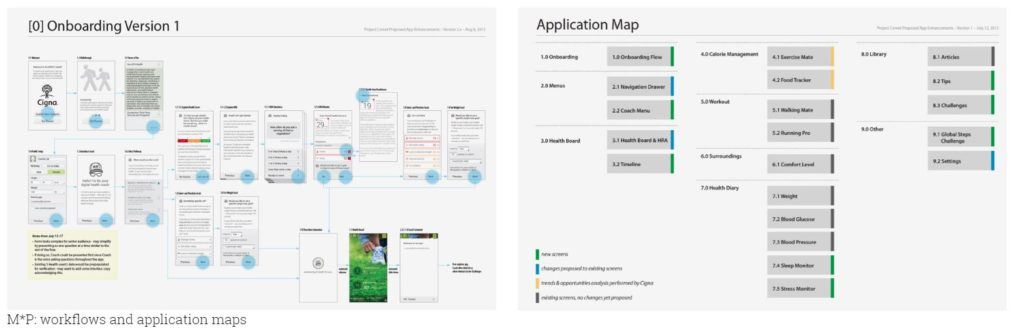

- Samsung S Health: App promoting healthy behaviors across 500 million devices worldwide.[10] Cigna collects biometric data from Samsung devices[11] and leverages its AI-analytics engine to personalize health recommendations including goal-setting and gamified accountability alerts spanning exercise, food, sleep, stress, and weight (see Exhibits 1 and 2).[12]

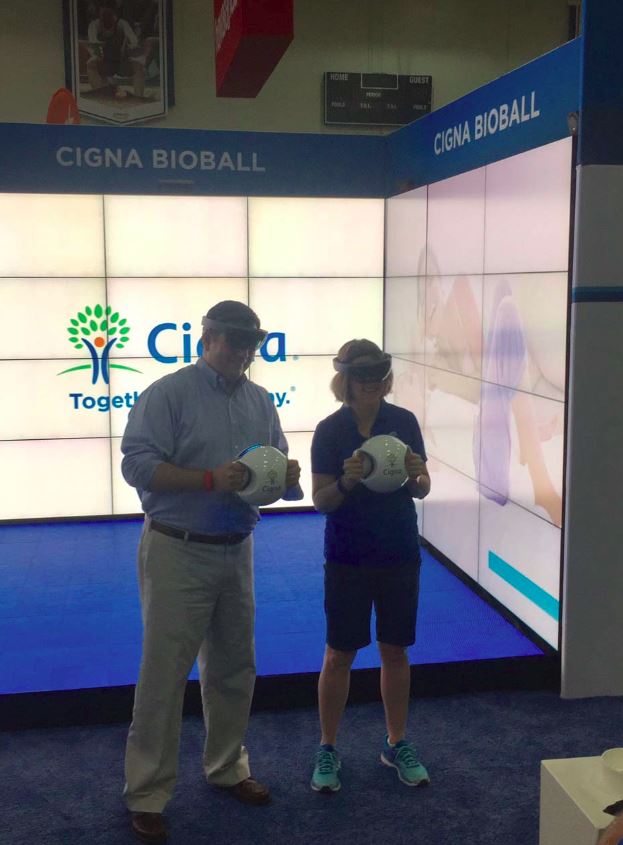

- Microsoft Hololens: Virtual reality game, BioBall, measures key health indicators accounting for “the majority of preventable chronic disease and health care costs.”[13] Through gameplay, enrollees are given personal vital-statistics and offered suggestions to reduce health risks (see Exhibit 3).

Together, these initiatives are helping transform Cigna from a commodity carrier to a personal engagement platform. Alongside Cigna’s broader user-engagement program, One Guide, the company saw 34% more interactions and 20% higher customer satisfaction in 2017.[14]

Long-term gains: Prediction and prevention through artificial intelligence

Rather than developing internal processes for building AI tools, Cigna merged with Express Scripts and launched Cigna Ventures, a $250 million fund, to invest in start-ups.[15] Key long-term investments include:

- Express Scripts: Cigna acquired Express Scripts for $52 billion in September 2018.[16] Integrating drug databases enabled Cigna to adopt AI-powered approval processes for specialty medications, decreasing operating costs. Additionally, AI-identified patients with adherence challenges are funneled to medication adherence education programs. Boosting compliance minimizes insurance payouts in the long-term by improving patient health.[17] Cigna’s “Opioid Likely Overdose Risk Model”[18] uses this AI engine to identify cases of misuse and has reduced opioid use among customers by 25%.[19]

- Prognos: Prognos applies AI to lab diagnostics to refine “approaches to risk adjustment, clinical quality, and care management.”[20] Using its clinical diagnostics information database (14 billion medical records; 180 million patients), Prognos identifies patient needs early, enabling low-cost treatments and improved outcomes.[21]

- Omada Health: Cigna led a $50 million investment round in Omada Health which uses machine learning to prevent diabetes by influencing patient diet and exercise.[22] Behavioral changes trigger computer-generated suggestions screened by coaches as the system “learns” to influence patient behavior. Omada Health has helped users lose 4.7% of their body weight on average, saving ~$2,650 per beneficiary over 15 months.[23]

What comes next?

While Cigna has made significant strides in its adoption of AI technologies, there are still gaps in its capabilities where competitors have made progress. Recommendations for Cigna include:

- Integrate offerings: Consolidate user-engagement products. Linking BioBall, S Health (expanding to iOS), Answers, and the Cigna platform will enrich insights, simplify the user experience, broaden the user base, standardize data collection, and inform macro-level decisions across geographic, demographic, and psychographic segments.

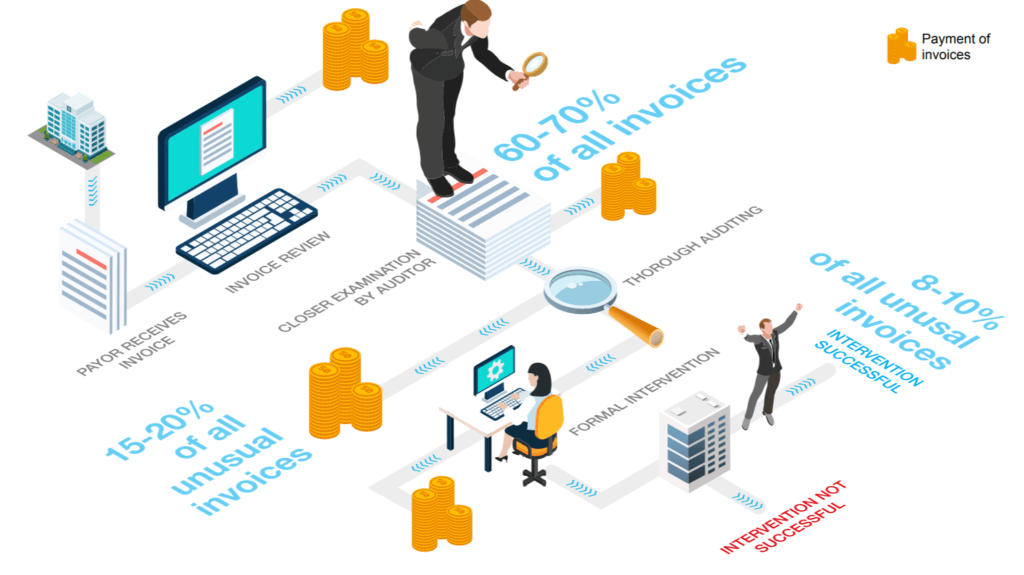

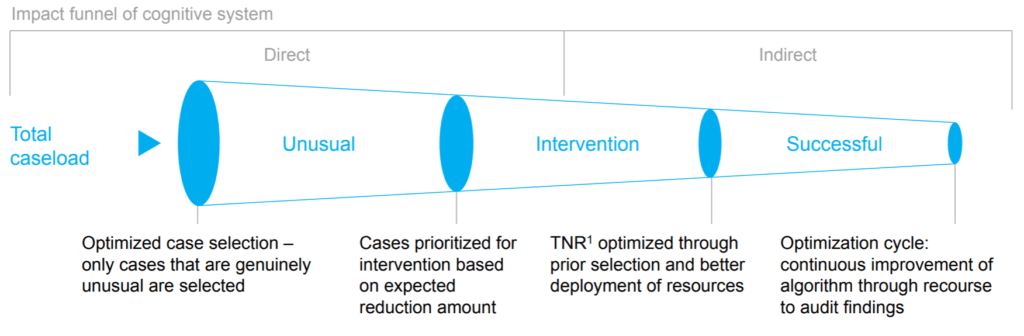

- Optimize claims-processing: About 8-10% of claims are filed incorrectly[24] and an estimated “tens of billions of dollars each year” are fraudulent claims.[25] Like its competitors, Cigna should develop AI-powered claims-processing[26] which can automate the complex process (see Exhibits 4 and 5) and reduce division operating costs by 70-90% by 2030[27] or ~$15 million per 100 FTEs.[28]

- Redesign organizational structure: Though Cigna has created a Global Chief Data and Analytics Officer role,[29] the organization should adopt a matrix structure including AI-experts in each division.

While Cigna implements these recommendations, it must also consider the ramifications of AI on the evolution of healthcare. For Cigna, are acquisitions a good substitute for R&D investment? For Cigna’s users, will trust erode as risk-adjusted models leverage user health data to raise premiums?

The answers will have a significant impact on the industry for years to come—affecting insurance companies and the people who depend on them.

[795 words]

Exhibits

Exhibit 1: Screenshots of Samsung S Health App [10]

Exhibit 2: Experience map for Samsung S Health App

Exhibit 3: Cigna BioBall event with Microsoft Hololens [30]

Exhibit 4: Process map for claims-approval [24]

Exhibit 5: Funnel for AI-powered automated claims-processing [24]

Note: TNR is Total Net Reduction

Endnotes

[1] Amy Goldstein, “Trump administration rewrites ACA insurance rules to give more power to states,” Washington Post, April 9, 2018, https://www.washingtonpost.com/national/health-science/trump-administration-rewrites-aca-insurance-rules-to-give-more-power-to-states/2018/04/09/94b738fa-3c0f-11e8-a7d1-e4efec6389f0_story.html?noredirect=on&utm_term=.815e809e46a1, accessed November 2018.

[2] Cigna Corporation, 2017 Annual Report, p. 23, https://www.cigna.com/assets/docs/about-cigna/Investor%20Relations/cigna-fourth-quarter-2017-form-10-k.pdf, accessed November 2018.

[3] Angelica LaVito, “DOJ gives preliminary approval to CVS merger with Aetna, potentially changing how consumers access health care,” CNBC, October 10, 2018, https://www.cnbc.com/2018/10/10/department-of-justice-approves-cvs-merger-with-aetna.html, accessed November 2018.

[4] Paul La Monica, “What merger mania means for health care,” CNN Business, March 8, 2018, https://money.cnn.com/2018/03/08/investing/health-care-mergers-cigna-express-scripts-consolidation/index.html, accessed November 2018.

[5] “About Cigna,” Cigna Corporation, 2018, https://www.cigna.com/about-us/, accessed November 2018.

[6] Cigna Corporation, 2017 Annual Report, p. 10, https://www.cigna.com/assets/docs/about-cigna/Investor%20Relations/cigna-fourth-quarter-2017-form-10-k.pdf, accessed November 2018.

[7] Victor Villagra et al., “Health Insurance Literacy in Connecticut,” Health Insurance Literacy Survey Report (April 2017), UConn Health, https://health.uconn.edu/health-disparities/wp-content/uploads/sites/53/2017/04/HIL-Brief-4_2017.pdf, accessed November 2018.

[8] Cara Livernois, “Cigna to answer more than 150 benefits-related questions via Amazon Alexa,” AI in Healthcare, March 14, 2018, https://www.aiin.healthcare/topics/artificial-intelligence/cigna-answer-more-150-benefits-related-questions-amazon-alexa, accessed November 2018.

[9] Abrar Al-Heeti, “Amazon’s Alexa can answer your health care questions,” CNet, March 13, 2018, https://www.cnet.com/news/amazons-alexa-can-answer-your-health-care-questions/?mc_cid=b166a0e9d4&mc_eid=04115f520b, accessed November 2018.

[10] “Bringing Digital Health Coaching to 500 Million People,” Mad-Pow, 2018, https://madpow.com/work/cigna, accessed November 2018.

[11] “Samsung and Cigna Release New Health and Fitness Application,” Samsung Newsroom, May 18, 2015, https://news.samsung.com/global/samsung-and-cigna-release-new-health-and-fitness-application, accessed November 2018.

[12] Taylor Holland, “Corporate Wellness Programs Get a Boost from S Health and Coach by Cigna,” Samsung Insights, October 13, 2015, https://insights.samsung.com/2015/10/13/corporate-wellness-programs-get-a-boost-from-s-health-and-coach-by-cigna, accessed November 2018.

[13] Gloria Barone, “With BioBall, Cigna Becomes First to use Microsoft Hololens Technology to Turn Health Screenings into Fun Gameplay,” Cigna, February 28, 2017, https://www.cigna.com/newsroom/news-releases/2017/with-bioball-cigna-becomes-first-to-use-microsoft-hololens-technology-to-turn-health-screenings-into-fun-gameplay, accessed November 2018.

[14] “One Guide,” Cigna, 2018, https://www.cigna.com/employers-brokers/why-cigna/one-guide, accessed November 2018.

[15] Bruce Japsen, “Cigna Launches $250M Fund to Invest in Start-Ups,” Forbes, September 12, 2018, https://www.forbes.com/sites/brucejapsen/2018/09/12/cigna-launches-250m-fund-to-invest-in-start-ups/#3444aeb798c1, accessed November 2018.

[16] Reed Abelson, “Merger of Cigna and Express Scripts Gets Approval from Justice Department,” New York Times, September 17, 2018, https://www.nytimes.com/2018/09/17/health/cigna-express-scripts-merger.html, accessed November 2018.

[17] Michael Solomon, “Combining health Insurers and Pharmacy Benefit Managers: Bringing Down the Information Silos,” Point of Care Partners, May 18, 2018, https://www.pocp.com/combining-health-insurers-and-PBMs-part-2, accessed November 2018.

[18] Cigna Corporation, 2017 Annual Report, p. 7, https://www.cigna.com/assets/docs/about-cigna/Investor%20Relations/cigna-fourth-quarter-2017-form-10-k.pdf, accessed November 2018.

[19] Mark Boxer, “Cigna uses artificial intelligence to sift through big data ‘noise,’” Managed Healthcare Executive, February 8, 2018, http://www.managedhealthcareexecutive.com/mhe-articles/cigna-uses-artificial-intelligence-sift-through-big-data-noise, accessed November 2018.

[20] Yuliya Kutuzava, “Prognos, Healthcare AI Company, raises $20.5 Million Towards Predicting Disease the Earliest,” Globe Newswire, November 30, 2017, https://globenewswire.com/news-release/2017/11/30/1212178/0/en/Prognos-Healthcare-AI-Company-Raises-20-5-Million-Towards-Predicting-Disease-the-Earliest.html, accessed November 2018.

[21] Kumba Sennaar, “Data Mining Medical Records with machine Learning – 5 Current Applications,” TechEmergence, July 25, 2018, https://www.techemergence.com/data-mining-medical-records-with-machine-learning-5-current-applications, accessed November 2018.

[22] Mary Caffrey, “Cigna Leads $50M Round of Financing for Omada Health,” AJMC, June 14, 2017, https://www.ajmc.com/newsroom/cigna-leads-50m-round-of-financing-for-omada-health, accessed November 2018.

[23] Laura Lorenzetti, “This Company Is Tackling Diabetes with ‘Digital Therapeutics,’” Fortune, April 22, 2016, http://fortune.com/2016/04/22/omada-digital-health-diabetes/, accessed November 2018.

[24] Steffen Hehner et al., “Artificial intelligence in Health Insurance,” McKinsey and Company, September 2017, https://healthcare.mckinsey.com/sites/default/files/Artificial%20intelligence%20in%20Health%20Insurance.pdf, accessed November 2018.

[25] “The Challenge of Health Care Fraud,” National Health Care Anti-Fraud Association, 2018, https://www.nhcaa.org/resources/health-care-anti-fraud-resources/the-challenge-of-health-care-fraud.aspx, accessed November 2018.

[26] Steven Melendez, “Insurers turn to artificial intelligence in war on fraud,” Fast Company, June 26, 2018, https://www.fastcompany.com/40585373/to-combat-fraud-insurers-turn-to-artificial-intelligence, accessed November 2018.

[27] Ramnath Balasubramanian et al., “Insurance 2030—The impact of AI on the future of insurance,” McKinsey and Company, April 2018, https://www.mckinsey.com/industries/financial-services/our-insights/insurance-2030-the-impact-of-ai-on-the-future-of-insurance, accessed November 2018.

[28] Susan Morse, “How artificial intelligence can save health insurers $7 billion,” Healthcare Finance, August 10, 2018, https://www.healthcarefinancenews.com/news/how-artificial-intelligence-can-save-health-insurers-7-billion, accessed November 2018.

[29] Mark Brohan, “Cigna ponies up $250 million to invest in digital healthcare and data,” Digital Commerce 360, September 12, 2018, https://www.digitalcommerce360.com/2018/09/12/cigna-ponies-up-250-million-to-invest-in-digital-healthcare-and-data/, accessed November 2018.

[30] “With BioBall, Cigna Becomes First to Use Microsoft HoloLens Technology To Turn Health Screenings into Fun Gameplay,” Cigna, February 28, 2017, https://www.multivu.com/players/English/8033651-cigna-bioball-health-screenings-game/, accessed November 2018.

This essay is an interesting overview of Cigna’s internal initiatives and acquisitions related to artificial intelligence. In response to the questions posed, the acquisitions are a good substitute for R&D investment, because the acquisitions are affecting Cigna’s core business of predicting and (in this case) averting risk. Their strategy of trying to prevent bad health outcomes is a potent combination of saving money for Cigna and gaining the trust of their customers by showing that they are trying to promote better health and not just trying to make money by increasing premiums.

I’m curious if or when artificial intelligence will completely take over the risk prediction and premium determination and what sort of ramifications that will have in terms of discrimination based on intrinsic factors (race, sex, etc.) as well as behavioral factors. Most would agree that determining premiums based on intrinsic factors is unfair given that many health inequities between race and sex can be traced back to structural inequality. However, is it ethical to raise premiums based on behavioral factors? Rising premiums would be a potent motivator to start exercising and eating healthy, but are the ability to do those things also divided unequally throughout the population.