An End to the Walmart Era?

Walmart is the biggest retailer with 10.6% US market share in 2016. With increase in digitalization, consumers are shifting their behavior to online ecommerce as they seek for convenience and low costs. Will Walmart be able to prove that they can dominate in the digital age?

Can Walmart Dominate in the Digital Age?

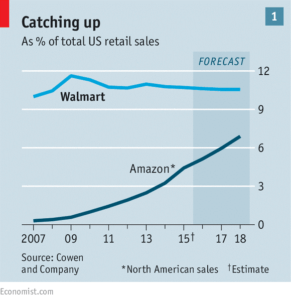

Walmart is the biggest retailer with 10.6% US market share in 2016. It has been seeing steady growth but with increase in digitalization, consumers are shifting their behavior to online ecommerce as they seek for convenience and low costs. Ecommerce, especially Amazon, is posing a great threat to Walmart as it grows at 30% in 2015 (See figure below for Walmart versus Amazon market-share). This trend is also reflected in the rising figure of customers shopping at both Walmart and Amazon rising from 8% in 2014 to 12% in 2016.[1] With this increase in competition can Walmart prove that as a traditional retailer they can dominate in the digital age?

Walmart’s Integrated Retail Strategy

Walmart has leveraged the synergy between its physical stores (90% of Americans live within 10 miles of its stores[2]), and its online store through an integrated retail strategy. This allows Walmart to increase customer convenience whilst maintaining low costs.

In the short term, Walmart has transformed its physical stores into ecommerce fulfillment centers through programs such as the associate delivery program, in-store pick ups, and scan and go initiative.[3] These programs allow Walmart to reduce costs in its last mile of delivery. The associate delivery program encourages associates to drop off customers’ orders during their commute to and from work. Online discount incentives for picking up orders in store or at curb pick up stations also help to reduce shipping costs for Walmart.

The introduction of Walmart Pay allows customers to scan the products on-shelf, receive product information and pay through a mobile barcode at checkout. This integration of technology not only helps to increase customer convenience but also Walmart’s customer behavior data collection. This allow Walmart to track customer behavior, create personalized experiences and improve inventory management and information flow across its supply chain system.

In the medium term, Walmart has made several acquisitions to increase product assortment and build its army to fight Amazon. Its acquisition of jet.com and several other ecommerce platforms have increase customer assortment to 35 million which is four times the number of assortment they had four years ago but only a fraction of Amazon’s[4]. Through this Walmart is also able to acquire different customer and vendor profiles. Walmart has also acquired “Parcel,” a delivery service which allows same day delivery in certain areas. Partnerships with Google has also allowed Walmart to increase its data collection and online presence.

Recommendations

With an increasingly fragmented customer base, in the short term I suggest that Walmart carry an analysis on the fundamental tradeoffs with each incremental cost of adding assortments and ensuring its availability. I would also recommend that Walmart focuses on its grocery segment as Walmart holds 21% of US grocery market share and only 33% of consumers shop grocery online.[5] Amazon recent acquisition of Whole Foods, suggests its aggressive pursuit of this sector.

With increase in low price competitors I question Walmart’s ability to maintain its comparative advantage in this field. In the medium term, I recommend that Walmart work with suppliers to improve its entire supply chain. The supply chain is no longer a linear factory to store model but a consumer supply system where every location is a possible e-commerce distribution node.[6] To increase efficiency and productivity of the suppliers, Walmart may need to share information and improvement tactics, or send in Walmart’s team to help improve their system.

Walmart also needs to increase its brand loyalty and retention. According to the American Consumer Satisfaction Index, Walmart has the lowest shoppers’ satisfaction among big retailers[7]. Walmart will need to improve its shopping experience and connect with customers on a greater value proposition other than price. They should increase their sustainability efforts and corporate social responsibility. With increase in technology, maintaining trust is also crucial. Walmart should implement strategies to ensure transparency and prevention of price discrimination.

Walmart also needs to find a way to integrate seamlessly into customers’ lifestyle and make the shopping decision frictionless. Amazon has launched several initiatives such as Amazon Dash that allows customers to order items without accessing a phone or laptop and shopping straight from the cupboard.[8] Walmart needs to find a way to do the same and be the top of mind and increase their customer retention.

Questions?

Will Walmart be able to sustain the price-game or is this a downward spiral? Is the e-commerce landscape just a battle between convenience and assortment?

Word Count: 738 words

[1],[2] Economist.com. (2017). Thinking Outside the Box. [online] Available at: https://www.economist.com/news/business/21699961-american-shoppers-move-online-walmart-fights-defend-its-dominance-thinking-outside [Accessed 14 Nov. 2017].

[3] Forbes.com. (2017). Is Wal-Mart Prepared To Face The Amazon — Whole Foods Combination?. [online] Available at: https://www.forbes.com/sites/greatspeculations/2017/06/19/is-wal-mart-prepared-to-face-the-amazon-whole-foods-combination/#26e8d58c3c43 [Accessed 14 Nov. 2017].

[4] Fortune. (2017). What Walmart’s CEO Wants In an Acquisition. [online] Available at: http://fortune.com/2017/03/14/walmart-tech-2/ [Accessed 14 Nov. 2017].

[5] Forbes.com. (2017). Is Wal-Mart Prepared To Face The Amazon — Whole Foods Combination?. [online] Available at: https://www.forbes.com/sites/greatspeculations/2017/06/19/is-wal-mart-prepared-to-face-the-amazon-whole-foods-combination/#26e8d58c3c43 [Accessed 14 Nov. 2017].

[6] Digital Commerce 360. (2017). How e-commerce will change the grocery industry. [online] Available at: https://www.digitalcommerce360.com/2017/02/02/how-e-commerce-will-change-grocery-industry/ [Accessed 14 Nov. 2017].

[7], [8] Economist.com. (2017). Thinking Outside the Box. [online] Available at: https://www.economist.com/news/business/21699961-american-shoppers-move-online-walmart-fights-defend-its-dominance-thinking-outside [Accessed 14 Nov. 2017].

Before reading this article, I thought that the brick & mortar Walmart, and other retail stores, were doomed in the upcoming digital era. Without acquiring ecommerce platforms (like Walmart bought jet.com), it would be really difficult to compete against them. I however may see a bright future for them, or at least for Walmart. I hadn’t though about the use of their footprint as fullfilment centers, an advantage that if levereged correctly would overturn Amazon’s reign. By having 90% of the US population in a 10 mile radius, Walmart should be able to create “instant” deliveries products and threaten Amazon’s Prime & Now products.

There is a phrase attributed to Jeff Bezos (Amazon’s founder and CEO) that says: “Keep our competitors focused on us, while we stay focused on the customer” and the article touches on this central point that, in my opinion, is the main reason why Amazon has gained so much share in the recent years while retailers like Walmart lost ground. The most efficient supply chain, the most capilar distribution network, or even the most diverse assortment of goods loses much, if not all, of its value if customers have a poor shopping experience. Therefore, I would argue that customer experience should be the first, second and third priority for Walmart.

As highlighted in the article, though, Walmart has a huge potential to further leverage its network of stores, its negotiation power, and its offerings expertise to compete on a level playing field with Amazon and avoid the referred (and extremely dangerous) downward spiral pricing-game. The e-commerce war is far from over, Walmart still have a dominant market share of the US retail market, but it is time to Walmart start fighting the right battles before it is too late.

Great article. For me, it seems that the only real strength that Walmart could leverage over Amazon is their store network that essentially provides a huge number of distribution centers closer to customers than Amazon. However, Amazon is already setting up a deep Amazon Now network that will match the customer proximity Walmart has. For me, I wonder if there is any alternative for Walmart other than to replicate Amazon’s operations, acquire similar capabilities (e.g. jet.com) and become an “me too” Amazon competitor in the e-commerce space.

I wonder if Walmart’s strategy makes sense if they and Amazon are not exactly competing for the same customers. You mentioned that Walmart is trying to innovate and invest more heavily in digital solutions to ‘fight’ Amazon, but Walmart’s average shopper is a 50 year-old female with annual HH income of ~$53K (http://www.businessinsider.com/meet-the-average-wal-mart-shopper-2014-9) while Amazon’s average customer is 37 years old (https://nypost.com/2017/08/19/guess-how-old-the-average-amazon-customer-is/). It makes sense that Amazon’s innovations resonate with the new crop of technology-savvy consumers but perhaps digital solutions such as cashless payments are too early and not the right fit for Walmart’s typical shopper. Therefore, how much should Walmart really focus on digital innovations vs. (as Bruno mentioned) potentially more crucial issues such as improving customer service? Maybe Walmart should take a step back, employ some design thinking, and truly understand their target market so they can ensure that they meet the needs of their core customer instead of Amazon’s.

This is a really interesting article Nam! The battle between Wal-Mart and Amazon is just beginning and it will be fascinating to see how this plays out over the coming decade. Wal-Mart have such strong pricing power and relationships with suppliers which have enabled them to undercut all competition on price to date which is their core competitive advantage. However, as you highlight, I think sustaining this price advantage will be challenging as Amazon continue to grow their scale, without the legacy cost base from brick and mortar stores that Wal-Mart have. You outline how they have started to develop a digitisation strategy by leveraging their brick and mortar stores which is an interesting proposition. However, it seems like they don’t yet have coherent strategy or proposition to compete with Amazon and they will need to consider how their legacy cost base will impact their ability to compete on price.