Allianz: Underwriting a Sustainable Future

Aligning Allianz’s operational strategy with its vision for a sustainable future

On August 25, 2017, Hurricane Harvey made landfall, rocking southern Texas and causing catastrophic flooding. Less than one month later, Hurricane Irma made landfall in the Florida Keys, marking the first time that two Atlantic Category 4+ storms have made landfall in the continental U.S. within a single hurricane season.[1] Some sources estimated Hurricane Harvey to be the costliest weather disaster in U.S. history at $190 billion; damage from Hurricane Irma was estimated to be $100 billion.[2] Much of these economic costs will be absorbed by property & casualty (P&C) insurers that provide liability coverage to protect policyholders against unexpected losses.

The Allianz Group is one of the world’s leading insurers, having generated €76 billion (~$90 billion) of gross written premium in 2016.[3] By nature of its diversified P&C business, Allianz is exposed to extreme weather events, the likes of which include Hurricanes Harvey and Irma.

Climate Change Represents a Strategic Challenge

Over recent decades climate change has resulted in increased prevalence of extreme weather patterns, including hurricanes, cyclones, flooding, and droughts.[4] The U.S. Climate Extremes Index (CEI) indicates that the number of extreme climate events in any given year has been rising over the last four decades (see Figure 1).[5] According to research by ClimateWise, a network of 29 insurance companies convened by the University of Cambridge, the frequency of weather-related catastrophes has increased six-fold since the 1950s, with economic losses growing at a similar rate to $170 billion.[6]

Insurance carriers underwrite catastrophic risks based primarily on historical data. Unless underwriting methods adapt to the changing nature of climate patterns, the increased prevalence of extreme weather events will result in increased losses and will hinder insurance carriers’ ability to offer affordable coverage.[7] Allianz is exposed to climate change risks as both an insurer that writes policies covering damage caused by natural disasters and as an institutional investor with €1.9 trillion invested in companies affected by changing weather patterns.

Aligning Operations for a Sustainable Future

Allianz has developed a comprehensive climate change strategy that integrates protection into the core business.

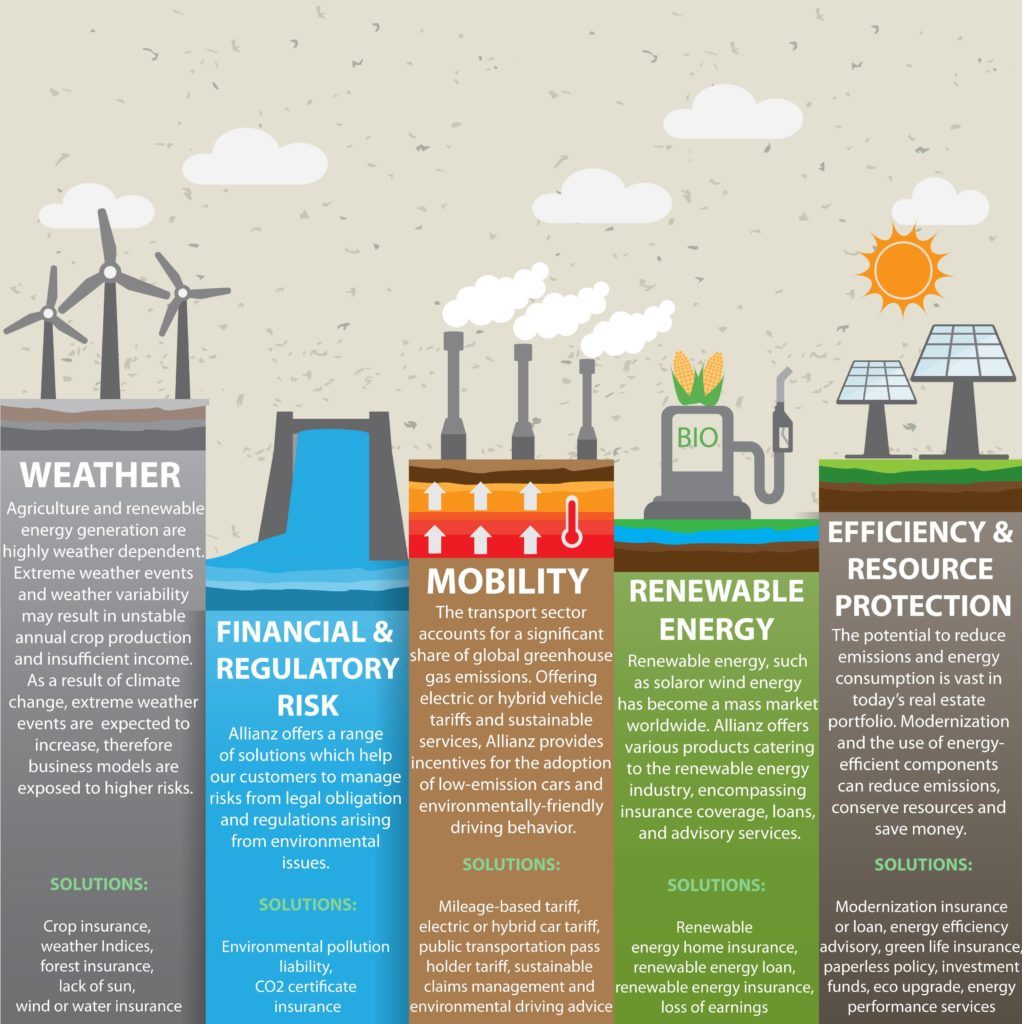

As an insurer, Allianz designs insurance products that incentivize customers to take preventative measures and to encourage environmentally-friendly and socially-responsible business practices.[8] The portfolio of products include solutions related to weather, financial and regulatory risk, mobility, renewable energy, and resource protection (see Figure 2). [9]

As an institutional investor, Allianz applies comprehensive environmental, social, and governance (ESG) guidelines for all investment decisions. These ESG considerations were developed jointly with various NGOs and are based on 37 different parameters, including carbon emissions, energy efficiency, and environmental footprint. In addition, Allianz proactively invests in renewable energy, with €4.6 billion invested in wind farms and solar parks located across Europe and the United States.[9] Allianz also avoids investments in assets that contribute to climate change. Inspired by the Paris climate negotiations, Chairman & CEO Oliver Bäte announced in November 2015 that Allianz will no longer invest in coal-based business models.[10]

Figure 2: Allianz’s Portfolio of Environmental Sustainability Solutions

Preparing for an Uncertain Future

While Allianz has done a commendable job aligning its insurance product and investment portfolios with its vision for a sustainable future, there is more work to be done.

For Allianz to remain competitive in the future, the company must invest in climate expertise. In the short term, Allianz should look to engage with climate change experts in governmental agencies and university research departments to build more predictive climate risk pricing models. Over the long term, Allianz might look to insource meteorology and climatology expertise. There is an opportunity for Allianz to enhance its underwriting of climate risk by leveraging scientific expertise and big data analytics. For example, Aviva Insurance individualizes pricing on flood coverage for coastal homes by leveraging topographical data, distinguishing between homes located at higher elevation from those located at sea level.[11]

Allianz would also benefit from formalizing its climate risk management program. The company should consider the creation of a Supervisory Board committee dedicated to the oversight of climate risk, the appointment of directors with relevant expertise, and the appointment of a senior executive with dedicated responsibility for climate risk management initiatives.

Despite its best efforts, Allianz may never be fully prepared for future climate-related risks. Questions remain as to the extent to which Allianz should advocate for public policy changes supporting climate sustainability. Should Allianz pursue catastrophe risk securitizations that would transfer risk from insurance markets into the capital markets? Given the uncertainty and magnitude of potential climate-related claims, is appropriately underwriting climate risks even possible? If so, can it be done at a price that maintains the insurance product’s affordability?

Fortunately for Allianz and its stakeholders, managing uncertainty is the company’s core competency.

(782 words)

References

[1] The Weather Channel. (2017). Hurricanes Irma and Harvey Mark the First Time Two Atlantic Category 4 U.S. Landfalls Have Occurred in the Same Year. [online] Available at: https://weather.com/storms/hurricane/news/hurricane-irma-harvey-landfall-category-4-united-states-history [Accessed 13 Nov. 2017].

[2] Accuweather.com. (2017). AccuWeather predicts economic cost of Harvey, Irma to be $290 billion. [online] Available at: https://www.accuweather.com/en/weather-news/accuweather-predicts-economic-cost-of-harvey-irma-to-be-290-billion/70002686 [Accessed 13 Nov. 2017].

[3] Allianz SE (2017). Allianz Group Annual Report 2016.

[4] United States Environmental Protection Agency (2016). Climate Change Indicators in the United States. Fourth Edition. pp.7-8.

[5] United States National Oceanic and Atmospheric Administration. (2016). Global Climate Change Indicators | Monitoring References | National Centers for Environmental Information (NCEI). [online] Available at: https://www.ncdc.noaa.gov/monitoring-references/faq/indicators.php [Accessed 10 Nov. 2017].

[6] University of Cambridge Institute for Sustainability Leadership (2016). ClimateWise launches two reports that warn of growing protection gap due to rising impact of climate risks. [online] Available at: http://ClimateWise launches two reports that warn of growing protection gap due to rising impact of climate risks [Accessed 10 Nov. 2017].

[7] United Nations Environment Programme (2013). GEO-5 for Business. Impacts of a Changing Environment on the Corporate Sector. UNON/Publishing Services.

[8] Allianz SE (2017). Climate Change Strategy of Allianz Group. [online] Available at: https://www.allianz.com/v_1504716410000/en/sustainability/media-2017/Allianz_Climate_Strategy_09_2017_final.pdf [Accessed 10 Nov. 2017].

[9] Allianz SE (2017). Tackling Climate Change. [online] Available at: https://www.allianz.com/en/press/news/commitment/environment/170314_tackling-climate-change/ [Accessed 10 Nov. 2017].

[10] ClimateWise (2016). Closing the Protection Gap. ClimateWise Principles Independent Review. [online] University of Cambridge Institute for Sustainable Leadership. Available at: https://www.cisl.cam.ac.uk/publications/publication-pdfs/Closing-the-protection-gap-ClimateWise-Principles-Independent-Review-2016.pdf [Accessed 10 Nov. 2017].

[11] Kahn, M., Casey, B. and Jones, N. (2017). How the Insurance Industry Can Push Us to Prepare for Climate Change. Harvard Business Review. [online] Available at: https://hbr.org/2017/08/how-the-insurance-industry-can-push-us-to-prepare-for-climate-change [Accessed 10 Nov. 2017].

I was really impressed by the increase in catastrophic events cause by climate change. Empirically we all have noticed that the amount of hurricanes and other events seemed very high, but actually seeing data that confirms it is nonetheless impressing. It makes me remember a graph that showed that most people think that climate change exists but that it will not affect them, not realizing that its effect is already there. As for Allianz, it was interesting to see how they are creating incentives to try to mitigate these risks. One item that I got curious about after reading the article would be to see the actual losses insurance companies had because of the array of hurricanes this year. I also think is that these initiatives will probably not be enough to shield Allianz from further risks and am now interested to see the next steps they take in this direction.

The insurance business here is something I find really interesting because of the risk and pricing debates that I could see stemming from this. For example, a basic pricing model may simply say that those policy holders that “choose” to live in areas such as Texas and Florida that are most exposed to these types of catastrophic events should bear the burden of that risk through increased premiums; while those who “choose” to live in areas less risky should continue to pay their current or even lower premiums. For me what makes this proposal challenging is the fact of which that the actions taken by the policy holders in “less risky” climates can have huge impacts on the other policy holders who are living in the “risky” climates.

Playing this out, if one policy holder in Florida is taking every action possible to reduce their impact on global climate change while another policy holder in Chicago is significantly contributing to global climate change – how can an insurance company price their product appropriately so as to drive behavioral changes in the Chicago policy holder given that the risk exposure of the insurance company is by many accounts a combination of both of these individuals?

Really interesting article. I’ve always known that insurance companies carefully price into their insurance products the impacts of climate change, including extreme weather events and sea level rise. However, I never knew before reading this article that insurance companies themselves actually invest in renewable energy and sustainability projects. It’s a bit surprising to me as these types of investments do not have a directly measurable benefit to the Allianz’s bottom line.

As to your question about whether Allianz should invest in advocacy for public policy changes to deal with climate change risk: I absolutely believe this is a necessary investment for the long-term success of the insurance industry. As you said, unpredictable weather events pose an enormous risk for these companies and without innovative policies, such as carbon pricing or cap-and-trade programs, the negative externalities of carbon emissions will not be fully valued in the market. This is critical to slowing climate change and critical for the future of insurance companies.