Allianz: Is the insurance industry insured against climate change?

What are the threats that climate change poses to Allianz and how is the insurance sector responding to the challenges and opportunities posed by global warming?

Climate Change Impact on the Insurance Industry and Allianz

The insurance industry is one of the largest global industries (EUR 3.5 trillion as of 2015) and accounts for 5.7% of global economic output. [1] Allianz Life Insurance (“Allianz”) is one of the oldest and most reputable global providers of insurance products and has over 85 million customers in 70 countries. [2] In its essence, insurance is a risk management tool used to hedge against the risk of an uncertain loss in the future and as such it is very susceptible to any developments that fundamentally increase the risk profile of the underlying assets that are being insured. Therefore, as one of the largest players in the space Allianz is particularly exposed to the impact of environmental trends in a couple of different ways.

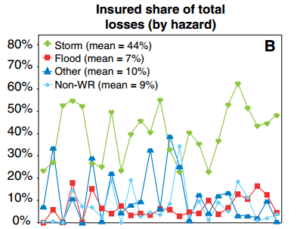

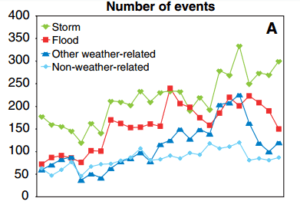

On the one hand, global warming is affecting Allianz’ life insurance business because increases in global temperatures are leading to an uptick in death rates and life insurance claims. [3] On the property insurance side, rising sea levels are likely to contribute to increased property losses [4] and commercial liabilities are also expected to increase as consumers start to hold businesses accountable for climate changes. As losses increase, weather-related claims on previously purchased insurance instruments will increase as well over time [5], as evidenced by the trends in the last couple of decades (see Exhibit 1).

Exhibit 1. Trends in (A) global numbers of weather-related events and (B) insured share from 1980 to 2004. [6]

This trend of increasing number of weather-related claims will make current levels of insurance and disaster risk management inadequate if droughts, floods, heatwaves and rising sea levels continue to increase at this rate or at an accelerated rate because of greenhouse gas emissions, which is a major threat for the industry. [7] At an operational level Allianz uses historical data and risk analysis to assess, price and underwrite new insurance policies. [8] However, climate change is forcing Allianz and other insurance players to re-evaluate that approach. Some of the main challenges that need to be addressed include how to forecast and price the increased amount of risk caused by climate change, how to hedge against new liability exposures, such as increasing number of health claims due to expanded disease ranges, and how to maintain profitability while adjusting product offerings to meet the increased risk profiles of the underlying assets.

The future of Allianz and the insurance industry in a ‘warmer’ world

While climate change is posing significant challenges to Allianz and other insurance companies, it also offers insurance providers like Allianz the opportunity to play a leadership role in the efforts to reduce the impact of climate change by using their risk management expertise to refine their assessment techniques, develop innovative products to cope with this emerging risk and share knowledge and expertise with other organizations and the public to create more awareness. [9] In the last three decades, Allianz has been working to better understand potential losses from single catastrophes and has created a limit framework for natural catastrophe risk that is reported bi-annually. [10] Additionally, the company has continued to invest in refining its flood scenario risk models by using simulations and by acquiring global data sets of flood maps. Allianz has also used its expertise in risk modeling to create new products, such as the NatCat bonds, which serve as an alternative to traditional catastrophe reinsurance. Allianz also provides rapid flood maps after instances of natural disasters to immediately assess the impact on the underlying insured assets, which also helps mitigate the impact of the flood in real time. Finally, Allianz has implemented companywide green strategies and has partnered with the World Wide Fund for Nature on a research project to quantify the direct and indirect effects of climate change.

As climate change effects continue to impact individuals and industries using insurance products in the future, Allianz should continue to improve and leverage its rich databases and modeling and simulation expertise to innovate and create better predictive models and insurance risk pricing strategies to account for higher risks. The company can also consider partnering with research institutions to ensure that its forecasting methodology is not only based on historical data but also expected future metrics (storms, floods, etc.), which will more accurately reflect the expected variability in underlying risks relative to Allianz’ current portfolio.

Word count: 793 words

————————————————-

[1] Kathrin Brandmeir, Dr. Michaela Grimm, Dr. Arne Holzhausen, “Allianz Economic Trend Watch: Global insurance markets – Current status and outlook up to 2026”, April 2016, https://www.allianz.com/v_1462283952000/media/economic_research/publications/working_papers/en/GVM26Apr2016e.pdf, accessed November 2016.

[2] Allianz Life Insurance Company, “Allianz Overview”, https://www.allianzlife.com/about, accessed November 2016.

[3] Insurance Information Institute, “Climate Change: Insurance Issues”, September 2014, http://www.iii.org/issue-update/climate-change-insurance-issues, accessed November 2016.

[4] Rebecca Henderson, Sophus Reinert, Polina Dekhtyar, Amram Migdal, “Climate Change in 2016: Implications for Business”, Harvard Business Review, October 2016, https://hbp.app.box.com/s/nvq1l6fepuym2y52qxtsjigwuxsjsymk, accessed November 2016.

[5] CNBC, com, “Insurers and investors will be affected by climate change”, November 2015, http://www.cnbc.com/2015/11/18/insurers-and-investors-will-be-affected-by-climate-change.html, accessed November 2016.

[6] Evan Mills, “Insurance in a Climate of Change”, Science Magazine, Volume 309, November 2005, http://evanmills.lbl.gov/pubs/pdf/insurance_and_climate.pdf, accessed November 2016.

[7] Standard and Poor’s Global, “Climate Change will Likely Test the Resilience of Corporates’ Creditworthiness To Natural Catastrophes”, April 2015, http://www.climatechangenews.com/2015/05/06/sp-warn-climate-change-will-hit-corporate-credit-profiles/, accessed November 2016.

[8] Dave Grossman, United Nations Environmental Program, “Impacts of the Changing Environment on the Corporate Sector”, 2013, http://web.unep.org/geo/sites/unep.org.geo/files/documents/geo5_for_business.pdf, accessed November 2016.

[9] Geneva Association, “The insurance industry and climate change – Contribution to the global debate”, July 2009, https://www.allianz.com/media/responsibility/documents/insurance_industry_and_climate_change.pdf, accessed November 2016.

[10] Allianz Life Insurance Company, “Sustainability Strategy”, https://www.allianz.com/en/sustainability-2014/sustainability_report_2014/sustainability_strategy/climate_change_strategy.html/, accessed November 2016.

If the insurance industry continues to see an increase in claims, particularly after a catastrophic disaster, will insurance policies eventually become too costly to purchase? Certainly consumer demand would increase as natural disasters increase, but either massive insurance policy claims would bankrupt companies, or rates would sky-rocket and be unaffordable, and therefore deteriorate the entire supply/demand chain. Maybe another consideration would be to diversify insurance portfolios by location or insurance type to avoid massive pay outs.

To add on to Anja_A’s note regarding the possibility of unaffordable insurance policies, I can foresee three potential future scenarios (of many):

Scenario 1 (optimistic): Insurance costs rise in high-risk areas –> residents of high-risk areas move to lower-risk areas –> economies of high-risk areas decline –> governments are forced to invest in greater risk mitigation mechanisms to curb the effects of climate change

Scenario 2 (base case): Insurance costs rise in high-risk areas –> residents of high-risk areas move to lower-risk areas –> economies of high-risk areas decline –> governments redirect funds towards higher population density areas and neglect high-risk areas due to population decline

Scenario 3 (pessimistic) Insurance costs rise in high-risk areas –> residents of high-risk areas stay and opt to not purchase insurance policies –> massive damages and human casualties ensue

Given the lack of political on the issue of climate change I suspect scenarios #2 and #3 are more likely. What can we do as a society to light a fire under the feet of our political leaders to make scenario #1 more likely to occur?

While the above comments on the risk posed to Alliance and insurance companies given the climate change are valid, on the flip side, insurance companies can view this new trend as an opportunity to create more innovative products and extend their reach. Also, I do not think the climate change would drastically impact profitability of insurance players, as they can increase insurance premium accordingly and lower payout ratio discreetly to compensate for the additional risk. Adjusting specific payouts or adding certain features to their existing products and repackaging them is part of the insurance companies’ business model, and they have enough analytical tools and manpower to benefit from the increasing concerns surrounding the climate change.

If anything, this can be a good growth catalyst and additional source of innovation for insurance players. Also, it is important to note that the aforementioned risk of rising payouts and claims will be limited to the scope of existing products that did not incorporate the potential impact of climate change at the time of launch. With actuarial input and payout mechanism adjusted, Alliance and other major players can appeal to a larger population with more products that can meet their varying needs.

Thanks Kristina, for the great post! I agree with you that climate change offers the opportunity for insurance companies to innovate and take the lead in addressing the risks posed by climate change. There’s already been a great example of this with ‘pandemic insurance’, in light of the recent Ebola and Zika outbreaks and their direct links to climate change (specifically that extreme weather events and rising temperatures changes the ecology and migratory patterns of animals and insects, putting humans in closer contact with infected species). In May of this year, the World Bank launched the Pandemic Emergency Financing Facility (PEF) – a global financing mechanism to quickly disburse funding in times of pandemics – which will create the first ever insurance market for pandemic risk (1). This will be a stark move away from previous practices, where financing for large outbreaks has been poorly coordinated and mostly done on an ad hoc basis, which as we saw in the Ebola outbreak, significantly slows down the response time and increases the mortality rate. Pandemic risk is presumably incredibly hard to price, but I personally hope that the PEF encourages private sector involvement in pandemic financing and overtime improves disease modeling, lowers the cost of insurance, and makes pandemic insurance affordable for countries that are most vulnerable to the health consequences of climate change.

(1) http://www.worldbank.org/en/news/press-release/2016/05/21/world-bank-group-launches-groundbreaking-financing-facility-to-protect-poorest-countries-against-pandemics

Kristina – this is a marvelously researched post and well-written article. I absolutely adore how this is a pristine example of an effect we’ve seen dominate numerous conversations in class: predicting the future with statistical data is only realistic when the future looks like the past. While I believe that many actuaries do incorporate some fundamental analysis in their current models (to account for changing trends), it appears as though significant research will be required to allocate a higher proportion of the insurance model towards fundamental analysis as opposed to statistical. This is incredibly interesting and is it a significantly harder problem to solve. I greatly look forward to how Allianz and its competitors fare in the coming decades.