Alipay: Wining the Payments Game in China

12 years into business, Alipay has grown into the world's most valuable fintech services provider and the unquestionable leader of China’s online payment market. In 2014, Alipay processed 140 million transactions per day, while the banking system in China handled 170 million non-cash transactions on average every day (this includes bills, cards and electronic transfers). What did Alipay do to disrupt and win the payment market?

China Back in 2000s

Emergence of E-commerce

Before 1999, payments in China were mostly made with cash in brick and mortar stores. Seldom did consumers know e-commerce as a purchase channel, let alone using online payment services. Jack Ma founded Alibaba, the first official business-serving e-commerce platform, in his apartment in Hangzhou in 1999. Riding on the initial success as a B2B platform, Alibaba expanded into C2C and B2C segments to serve a larger client base. With the development of technology and increase of disposal income, more consumers were inclined and open to the idea of purchasing online.

Deficit of Trust

However, payment remained as the biggest barrier to grow the business. Consumers in China were so used to pay after transaction and sellers wouldn’t ship the product unless payment was made. A creditable and trust-worthy payment system was called for to address the issue and protect the benefits of both parties in a transaction. Jack Ma gave Alipay as the answer.

What is Alipay?

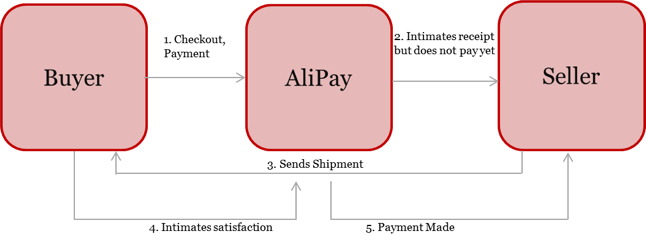

Business Model – Tackling the Issue of Trust

Alipay offers an online escrow system. Consumers’ payment is made to and held by Alipay until he or she have received the product. The merchant has confidence the cash is there before dispatch, and only receives payment if consumers do not complain within 7 days of delivery. Real-time payment and delivery information are tracked and shared with both consumers and merchants.

Unlike PayPal, Alipay is free for smaller users of its platform. Alipay is operating as a facilitator and effectively “subsidizing” smaller users. It profits mainly from cash flow (consumers pay to Alipay once an order is placed and Alipay pays to merchants weekly or monthly), advertisement and other value-added services.

Exhibit 1 – Alipay’s Escrow System

Operating Model – Wrapped around Online and Offline

The original operating model is centered around online payment facilitation on Alibaba. Now Alipay becomes a go-to-place that covers a great variety of payment needs in people’s daily life and it is still evolving through mobile development, partnership and innovations.

- Expediting Mobile Development

According to report released by the state-backed China Internet Network Information Center (CNNIC), more than half of China’s 1.37 billion population is connected to the Internet and more than 90% of users access the Web by smartphone.

Alipay tapped into the opportunity and made its various services available on a single smartphone application—Alipay Wallet. The user experience on Alipay Wallet is designed based entirely on actual usage scenarios. Users can easily add to and tap their savings, pay water bills, transfer money to family members and even go Dutch at dinner with a feature that helps them split the check.

- Exploring Partnership

Alipay now provides payment solutions in China for more than 500,000 external merchants for online retail, virtual gaming, digital communications, commercial services, air ticketing and utilities fee payment transactions. No matter you shop in big retailors like Carrefour, or small convenience stores or even restaurants like KFC, you can always pay with Alipay Wallet on your smartphone.

Exhibit 2 – Alipay’s Point of Sales Communication at Counter

- Driving Innovations and Convenience

Alipay is also constantly innovating the payment methods to create more value and convenience for consumers. In any store that partnered with Alipay, consumers can pay by simply having the QR code of Alipay account scanned by merchant or even through an ultra-sound signal sent by the smart phones of the merchant.

Exhibit 3 – Merchant Scanning QR Code to Collect Payment

Next Steps

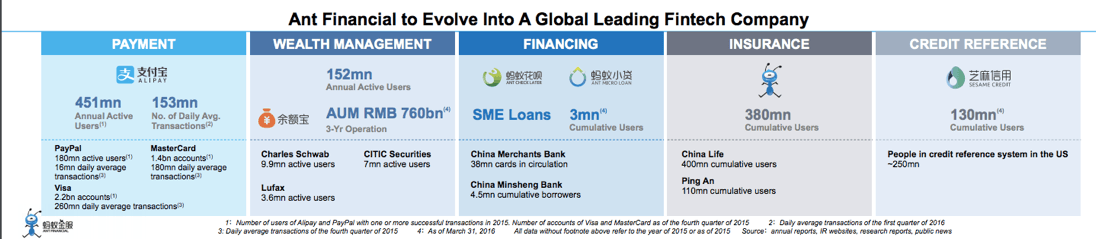

Expansion in Financial Services

Alipay now is operating under Ant Financial, which is a separate entity from Alibaba and offers various financial services to individuals and business owners in China. Targeting at the large user base accumulated from the payment services of Alipay, its parent company offers wealth management, financing, insurance and credit reference as a holistic and self-sustaining ecosystem.

Exhibit 4 – Ant Financial

Expansion in Footprint

Alipay’s expansion plan starts with serving three sets of customers:

- Chinese consumers who shop from abroad: Alipay works with Borderfree to enable leading retailers and brands like Macy’s and Neiman Marcus to provide cross-boarder shopping for Chinese consumers

- International consumers who shop from China: Clients can enjoy the same “Guarantee Payment” service provided by Alipay

- Travelers: Alipay works with international duty free stores to accept Alipay Wallet as one of the payment methods

Do you see more opportunity for Alipay to target at consumers in the United States? What could potentially be the barrier for Alipay?

[Word Count: 776]

[1] China-focused Leadership and Business Analysis, http://knowledge.ckgsb.edu.cn/2015/08/05/finance-and-investment/can-alibabas-ant-financial-disrupt-chinas-financial-industry/

[2] China Internet Network Information Center, https://www.cnnic.cn/gywm/xwzx/rdxw/2015/201601/W020160122639198410766.pdf

[3] Wall Street Journal: Payment Service Alipay Holds Key to Alibaba’s Growth, http://www.wsj.com/articles/SB10001424052702303678404579535840686151748

[4] Wall street Journal: More Than Half of China’s Population is Online — And Most Use Smartphones http://blogs.wsj.com/chinarealtime/2016/01/26/more-than-half-of-chinas-population-is-online-and-most-use-smartphones/

[5] Tech News: Alipay Mobile Payment Available in KFC in China http://technews.co/2015/07/02/alipay-mobile-payment-available-in-kfc-in-china/

[6] iResearch: China’s Online Third Party Payment Market GMV Topped Four Trillion Yuan in Q1 2016, http://www.iresearchchina.com/content/details7_23437.html

[7] TechAsia: Why Alipay is more than just the Chinese equivalent of PayPal , https://www.techinasia.com/talk/online-payment-provider-alipay-chinese-equivalent-paypal

Great article! I agree that Alipay’s next step in the United States is to target U.S. merchants who want to reach the Chinese middle class. According to Jingming Li, president of Alipay’s U.S. parent, Ant Financial Americas, Alipay, “represents a great opportunity. In a matter of a year or two, we will have 400 million users. If you have an online presence like Macy’s, it’s really about payments and logistics to be solved, which we help with. There’s no reason why you wouldn’t want to sell to 350 million members, which is bigger than the U.S. population in general” [1]. Alipay brings a mutually beneficial proposition to U.S. merchants who want to increase their customer base while Alipay can start to increase brand recognition against giants (i.e. ApplePay) in the U.S. I am unsure if Alipay in the future will take over ApplePay as U.S. consumers are so entrenched in the Apple brand. Time will tell!

[1] Leena Rao, “Alipay’s US chief talks expansion, Uber China partnership and more,” Fortune, June 19, 2015, http://fortune.com/2015/06/19/alipay-china-uber-alibaba/,accessed November 2016.