Airbnb: Machine Learning to optimize the future of Gig Economy and the power of economy-sharing

Airbnb has focused in delivering a product that boosts the actual volatility, uncertainty, complexity and ambiguity of the market scenario by addressing the value in “experiences” for millennial generation

The Gig Economy and the customer behavior

The world of work has changed dramatically in the past decade, shaped by technological advances and a new generation of customer with very different ideas of what their employment should look.

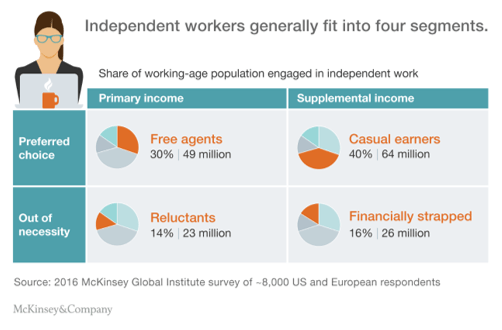

The gig economy—driven as much by the economic downturn of 2008-09 as by the influx of Millennials in the workforce [1]. According to the McKinsey Global Institute report “Independent work: Choice, necessity, and the gig economy”, up to 162 million people in Europe and the United States—or 20 to 30 percent of the working-age population—engage in some form of independent work.

The figure portrays that independent work is rapidly evolving as digital platforms create large-scale, efficient marketplaces that facilitate direct and even real-time connections between the customers who need a service performed and the workers willing to provide that service [2].

Airbnb maximizing potential of the Gig Economy offering lodging sharing

These part of the population in the gig economy are pursuing a different kind of success. One that comes from finding a balance between predictability and possibility, as well as viability and vitality [3]. There is a new social contract, or new business paradigm, in which customers, especially Millennials, are less incentivized to buy own houses, but are more eager to prioritize experiences and flexibility.

Millennials are prioritizing their cars and homes less and less, and assigning greater importance to personal experiences — and showing off pictures of them. It’s a trend that’s ultimately helping fuel growth of billion-dollar-plus start-ups like Uber, WeWork and Airbnb [4].

With his in mind, Airbnb “connects people with places to stay and things to do around the world. The community is powered by hosts, who provide their guests with the unique opportunity to travel like a local” [5]. They have 2.9 million hosts, around 800k average revenue per night via Airbnb, with 14k new hosts per month [5].

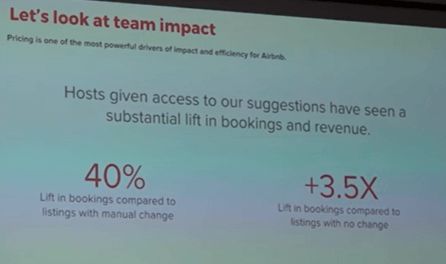

In order to maximize the matching between hosts and guests, Airbnb created many machine learning tool. One of them is called the “Price Tips” [6] in which the computer is suggesting to the host customized prices for each night instead of flat rates. Airbnb believes that dynamic pricing com offer competitive advantage where the host can offer to the guest a good value for money, and consequently maximizing the number of booking nights.

The tool help hosts to predict better prices. They use the machine learning to predict the probability of booking (based on a binary model). Given the output of this probability, the app gives a price suggestion. Below, are the results achieved for the hosts utilizing the “Price Tips” tool[6].

Not only has Airbnb managed to reach a scale equivalent to the top five hotel chains combined in less than a decade, but it is now worth twice as much as AccorHotels, with an equity value of $29.3B compared to a market capitalization of $14B (2017) [7].

Challenges of becoming a giant in the lodging sharing industry

It has been clear Airbnb success in maximizing the returns for hosts and guests. And has today a business of over 30 billion dollars, from which it is actually does not own properties, but the matching connectiveness among users. Currently, Airbnb accepts less approximately 5% of the owners who offer to be hosts.

However, Airbnb is now focused more than only the matching principle among users, and look towards Legal Challenges. In New York City, the state Attorney General found that, between 2010 and 2014, more than 300,000 Airbnb reservations violated the law, representing about $304 million in booking revenue, with about $40 million of that going to Airbnb [8]. Airbnb argues it cannot legally be held responsible for landlords that use the platform towards their government obligations8, and that they are merely a platform for communication among host and guest. If Airbnb does not adapt their matching machine learning tool, it could drastically influence its revenues.

Balancing the pros and cons..

It is unquestionable that Airbnb platform brought a new market for a generation of millennials who have greater importance to personal experiences. However, not all bonus comes without onus, and therefore some critical questions we should pose in regard to the subject:

1. In your opinion, should Airbnb have any responsibility in choosing hosts that are fully committed to tax payments?

2. Considering Airbnb success is grasping part of markets that already existed, who wins in the Gig Economy of lodging sharing, and who loses?

3.Is machine learning and the facility of the app connection enough to allow the users (hosts and guests) enough to engage loyalty brand to Airbnb and retain life time users?

(Word Count: 797)

[1] Milligan, Susan. “HR THEN AND NOW: 6 trends that have shaped the workplace–and HR – over the past decade.” HR Magazine. August, 2017. https://www.shrm.org/hr-today/news/hr-magazine/0817/pages/6-trends-that-changed-hr-over-the-past-decade.aspx, accessed November 2018.

[2] Manyika, James; Lund; Bughin, Jacques; Robinson, Kelsey; Mischke, Jan; and Mahajan, Deepa. “Independent work: Choice, necessity, and the gig economy”. McKinsey Global Institute. October, 2016. https://www.mckinsey.com/featured-insights/employment-and-growth/independent-work-choice-necessity-and-the-gig-economy, accessed November 2018.

[3] Petriglieri, Gianpiero; Ashford, Susan; and Wrzesniewski, Amy. “Thriving in the Gig Economy”. HARVARD BUSINESS REVIEW. Mar/Apr2018, Vol. 96 Issue 2, p140-143. 4p. 2 Illustrations.

[4] Uptin, Saiidi. “Millennials are prioritizing ‘experiences’ over stuff”. CNBC. May, 2016. https://www.cnbc.com/2016/05/05/millennials-are-prioritizing-experiences-over-stuff.html, accessed November 2018.

[5] Airbnb, “About Airbnb”. https://www.airbnb.com/host/homes?from_footer=1, accessed November 2018.

[6] Airbnb, “Machine Learning”. https://www.airbnb.com/careers/departments/engineering/machine_learning, accessed November 2018.

[7] CB Insights. “Reinventing The Hotel: How One Of The World’s Largest Hotel Chains Is Meeting The Airbnb Challenge Head-On”. October, 2017. https://app-cbinsights-com.prd2.ezproxy-prod.hbs.edu/research/report/accorhotels-teardown-expert-intelligence/, accessed November 2018.

[8] Somerville, Heather; Bellon, Tina. “Airbnb’s Legal Challenges Get Real”. Money Magazine. October, 2016. http://time.com/money/4541529/airbnb-legal-challenges/, accessed November 2018.

The author asks whether AirBnB should have any responsibility in choosing hosts that are fully committed to tax payments. My answer is YES. AirBnB gained traction through a “you can sleep on my bed” share-economy rhetoric, but despite its fake altruistic and borderline-“communitaristic” rhetoric, AirBnB is the epitome of the most ruthless kind of rent-seeking that circumvents rules and regulation that were put in place to foster the common good. Yes, AirBnB should require hosts to register their tax IDs and potentially handle the tax contributions on their behalf. Inevitably, if they don’t take this step, they might face severe regulatory backlash.

This is a very interesting article! In respond to question 3, I believe once a user has a interacted with the site enough times, Airbnb can not only recommend the best house based on previous needs but also recommend the next destination based on previous behavior. I believe Airbnb can leverage its data (e.g. destinations visited, types of houses, number of guests, who are these guests, reviews posted, number of messages with hosts) to develop predictions and engage customers further by offering house suggestions, destinations suggestions and much more.

In addition, I believe Airbnb can capture more loyal users by launching a loyalty program. The company was considering launching this loyalty program but still didn’t go through with the plan. I believe by launching the loyalty program, the company can potentially leverage more data (e.g. by making sure loyal members reserve using their accounts not other accounts). The company could provide points to the users based on the number of times they booked, how many different locations did they visit, the number of helpful reviews they posted, the properties they own that have been ranked highly/ reviewed positively, etc. This can be helpful to boost brand loyalty (beyond the typical loyalty programs of hotels); however, appropriate weights should be assigned to each actibity-to-point conversion and key controls should be put in place to avoid/ detect fraudulent behavior.

Interesting article! I do think that Airbnb should be held accountable for its hosts’ compliance with tax law, as in some capacity they are the employer.

Long-term, I think the key way that Airbnb can maintain customer loyalty is by successfully matching customers with properties that meet their preferences quickly. In addition to using machine learning to help hosts with pricing, Airbnb currently does use machine learning to personalize search results for guests and more successfully match them with the right accommodation (https://www.businessinsider.com/machine-learning-is-driving-growth-at-airbnb-2017-6).

Perhaps Airbnb already does this, but it would be interesting for them to use machine learning to identify preferences from data gathered in guests reviews. From these reviews, they could determine components of a great stay that are actionable (snacks, cleanliness etc) and then share this information with hosts to help them increase their revenue and customer satisfaction.

An interesting take on the airbnb issue! In response to the first questions, I believe that hosts should pay taxes for the monetary gains their properties have enabled them to reap through hosting guests. Especially since Airbnb now wants to grant hosts shares in the company: https://www.nytimes.com/2018/09/21/business/dealbook/airbnb-hosts-shareholders.html I believe it’s a smart way to tie hosts’ interests to that of the company and use the lobbying power on their hosts to push their interests in congress and elsewhere: https://www.wweek.com/news/city/2018/06/12/airbnb-recruits-its-clients-to-lobby-against-new-taxes/