A Pricier Pint: How Tighter Borders Could Increase Your Bar Tab

Diageo Plc, owner of Guinness, must create a plan to mitigate the looming trade effects of Brexit.

A 6-pack of one of the world’s oldest and favorite beers, Guinness Stout, could soon cost more due to Brexit-driven trade complexities. On December 31, 1759, Arthur Guinness signed a 9000 year lease on a building in Dublin, Ireland that would become the home of one of the most recognized beers in the world. The beer from this brewery would go on to be exported around the world, and the brand would become an icon of its native country.1 Today, Guinness brewed in Ireland is shipped to many countries, including the rest of Europe and the United States.2 The owners of Guinness, London-based Diageo PLC, will need to find a solution to avoid or mitigate these increased costs or consumers around the world could see a rise in price at the store.

Trade Changes due to Brexit

When British citizens voted to leave the European Union, which includes Ireland, they also voted to make trade to and from the UK much more complex, potentially leading to these higher prices for end consumers. Pre-Brexit, there were open borders among the EU countries, meaning that countries could import and export goods across borders without needing to go through a time-consuming customs process or pay tariffs. Post-Brexit, the UK will need to develop new trade agreements with all EU countries, as well as countries outside of the EU.3 This is the first time in 43 years that the UK will have the ability to create its own trade agreements; it is also the first time in 43 years that customs delays and tariffs will change the way products are currently transported between the UK and EU countries. This change will likely lead to increased costs, longer lead times, and changes to supply chains that could ultimately pass additional costs to the consumer.4

Guinness Supply Chain Spans Borders

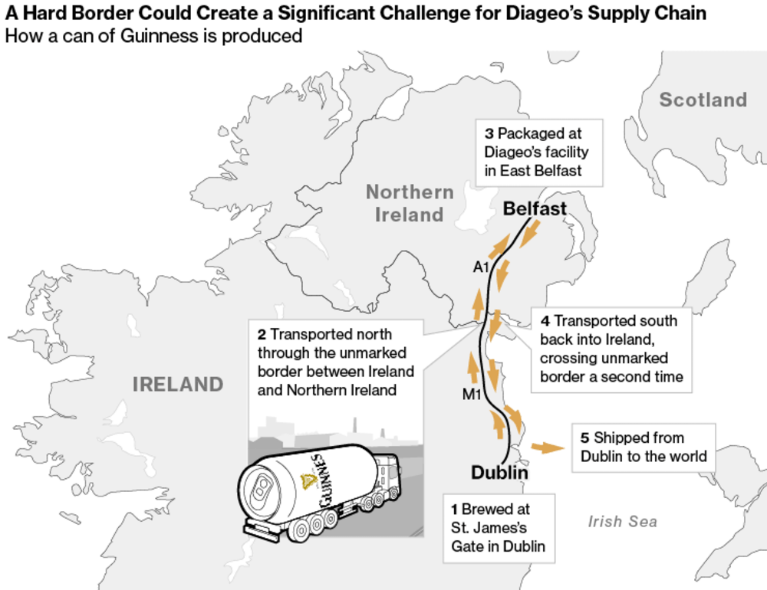

Guinness is one of many globally-recognized products that will feel the constraints imposed by these changes in trade. The supply chain of the beer coming from this brewery was developed in a time of open borders and driven by spatial constraints in the city of Dublin. Today, the production of Guinness begins by bringing ingredients from all over Ireland to Dublin for brewing. Once brewed, the liquid is loaded into large tanker trucks, dubbed “silver bullets” and transported north to East Belfast, part of the UK, for packaging. Once packaged, the product is shipped back into Ireland to be loaded onto a boat and shipped to its end destination.5

This process currently requires approximately 13,000 border crossings per year. Even a short delay at the border for customs checks could lead to additional costs of €1.3M per year.6 Diageo uses another packaging site, Runcorn, which is in England, for some of its Guinness variants. This site could experience similar cost increases due to tariffs.7 Another well-known Diageo product, Bailey’s Irish cream, is also at risk. The ingredients for this product travel across the border three times before being blended and shipped around the world.6

Diageo Must React

Diageo is currently working with authorities in Britain and the EU to lobby for favorable trade terms.6 They have created a cross-functional steering group that is monitoring and reviewing ongoing risks of the UK exit from the EU. Thus far, Diageo does not believe that this change will affect the viability of the company as a whole, but has included this as a risk in their 2017 annual report. They have executives, including the CEO, working in market to mitigate locally.8 However, no publicly disclosed material action has been taken at this point.

As Brexit nears, and the date of official EU withdrawal approaches, Diageo will need to begin to act. Perhaps they will choose to move their packaging operations to Ireland, as moving the Guinness brewery is not an option. This change would be a significant investment, both in time and money, as other packaging sites would be closed, new sites opened, and all regulatory filings updated to reflect this. Diageo should continue to work with officials in the UK and around the world to understand risks of increased border security and mitigate as much as possible by lowering or eliminating border tariffs. There are several current trade agreements between the UK and non-EU countries that allow free or easy trade; it would be in Diageo’s best interest to work with the UK government to try to implement one of these types of trade agreements with Ireland.4

Considering the looming changes to the border between Ireland and the UK, should Diageo be taking a more proactive stance by moving packaging operations sooner? With the growing trend of isolationism and increasing border security and trade complexity around the world, should Diageo be moving away from their practices of cross-border supply chains and production?

Word Count [794]

Sources

- “The History of Guinness.” Guinness.com, Guinness, 2016, www.guinness.com/en-us/our-story/. Accessed 13 Nov. 2017.

- Brandon. “Cheers! 14 Fascinating Facts About Guinness Beer.” Reader’s Digest, Trusted Media Brands, Inc., 2017, www.rd.com/culture/facts-about-guinness-beer/. Accessed 14 Nov. 2017.

- Walker, Andrew. “Post Brexit: The UK’s trade deal challenges.” BBC News, BBC, 25 June 2016, www.bbc.com/news/business-36617656. Accessed 14 Nov. 2017.

- “Five Models for Post-Brexit UK Trade.” BBC EU Referendum, BBC, 27 June 2016, www.bbc.com/news/ uk-politics-eu-referendum-36639261. Accessed 14 Nov. 2017.

- “Why Brexit could mean a pricier pint of Guinness.” The Economist, The Economist Newspaper Limited, 15 July 2017, www.economist.com/news/britain/ 21724934-harder-irish-border-would-cause-delays-and-add-costs-many-agri-food-products-why-brexit. Accessed 14 Nov. 2017.

- Dara. “Photographer: Simon Dawson/Bloomberg Trouble Is Brewing for Guinness After Brexit.” Bloomberg, Bloomberg LP, 7 Apr. 2017, www.bloomberg.com/news/articles/2017-04-07/ guinness-exposes-debate-over-a-hard-border-with-ireland-after-brexit. Accessed 14 Nov. 2017.

- “Diageo Runcorn visit reveals impressive plant improvements.” Society of Operations Engineers, 1 June 2010, www.soe.org.uk/news/iplante-news/item/ diageo-runcorn-visit-reveals-impressive-plant-improvements/. Accessed 14 Nov. 2017.

- Diageo Annual Report 2017. Report no. 23307, London, Diageo Plc, 2017.

Diageo is in a tough position. Because no country has exited the EU before, no one really knows what the impact will be, and it is incredibly hard to prepare for the unknown.

I do not think that Diageo should move their packaging operations to Ireland. The investment is considerable, and because there is so much uncertainty about the future, Diageo could potentially make the investment for naught.

I do think that Diageo should split their time and resources between two areas. First, they need to continue to work as closely as possible with officials in the UK and around the world to understand what the future could look like. Doing so will allow them to prepare as best they can and play a part in creating trade agreements. Second, Diageo should look inwards and invest in creating operational efficiencies that will benefit them regardless of the external political climate. In other words, they should find ways to cut costs and streamline their supply chain. By becoming more disciplined about their own business, Diageo will be better prepared for the future, no matter what it brings.

This was a really interesting look into the beer brewing industry: Guinness (and Diageo) seem to be in an incredibly unique position due to their cross-Europe presence. Although EN, in their comment, brought up the idea that the investment could be for naught, the packaging as it stands seems to be an incredible time and cost burden on the supply chain because traveling to Belfast in order to package, and then returning seems incredibly inefficient. In a time when Guinness could receive some sort of remuneration from the government due to the change in policy, it seems like a great time to make the line more efficient by bringing packaging at least closer to the factory and the docks. It would save them investment in travel, and time. If Guinness invests now, the long term benefit could be huge.

In addition, the cost of shipping externally, especially with huge isolationist movements, will have a global toll on the beer market. Working with policy makers, as EN pointed out, will be an extremely efficient way of dealing with these changes and to understand how better to prepare.

You bring up some great points on how Brexit is going to impact Guinness in the short, medium, and long-run. I would imagine that Guinness is not alone in this situation and that the entire beer-making industry is impacted, given how globalized supply chains are. If I were an executive at Guinness within Diageo, I would focus on two key activities to make sure that the company is insulated from the added costs of realigning the supply chain:

1. Raising prices to pass costs on to the consumer – as a lone actor in the beer industry, this would be a hugely detrimental move to my competitive position. However, if the entire industry is aligned in this manner and simultaneously raises prices to pass on cost increases to the consumer, I can see a situation in which Guinness is able to recoup at least some level of costs from this change. Doing so would require canvasing to align the entire industry on raising prices, which might be difficult.

2. Raise subsidies from the government – the beer industry is not only a significant contributor to capital generation in Ireland, but is also a considerable employer. As an executive at Guinness, I would try to negotiate subsidies from the government to cover the costs of altering my supply chain.

I agree with Ashiana that the time and cost to transport the product “round trip” for packaging does at first seem to be incredibly inefficient and costly to the company so I wonder why they do this to begin with? I tried to search online to find out more as to the rationale but came up empty handed. Let’s thus assume that there are cost-savings or reasons for them having chosen this option and I have to side with EN above – again, this assume they are rationale and maximizing their profits. So removing the option that they have just been operating poorly for years, I too think that the investment to move facilities now is premature and they should really start pushing hard for legislation and trade agreements.

This push for trade agreements is of course very complicated – more so for Ireland and the UK than the UK and the general EU. I say this for a number of reasons:

1. They are connected by land (obviously)

2. Much of Northern Ireland (UK)’s goods are shipped out of the port of Ireland — huge disadvantaged impact on this part of the UK

3. In absence of EU requirements, the UK and Ireland would very easily come to agreement (I would argue) that the border remain open and free for trade; however, the EU requires Ireland as a member to enforce a border and customs so the two are not allowed to have their own bi-lateral arrangements in my understanding

Given this, I think Ireland and Diageo (UK) really need to start pressuring the EU to think through some of this as well while working bi-laterally under the assumption EU gives them permission for some sort of special status.

As EN mentions above, Brexit creates an unprecedented situation and it will be interesting to see how companies like Diageo will react (nice article!). I think Diageo needs to be proactive on this front and ensure that it negotiates favorable trade agreements so that it can cross borders as quickly and easily as possible.

As others mention above, moving operations to accommodate trade barriers would be extremely costly for Diageo and doing so would also disrupt their supply chain in other parts of the world. Similarly, as with other spirits (bourbon, tequila) and wines (Bordeaux, Napa Valley) that can only be produced in certain parts of the world, companies like Diageo will be forced to work in certain locations if they want to distribute those products, so working with the local governments and regulatory bodies is a must. A possible solution that Diageo should consider beyond working with local governments is to structure their supply chain in a way that increases the size of shipments and thus decreases the quantity of border crossings. This of course also implies more efficient operations that yield higher production so larger shipments can be achieved, as well as a shipping network that can accommodate these larger shipments.

Diageo must move as fast as possible to prevent any delays in its supply chain operations. In a market where beer consumption is slowly decreasing while craft beer’s market share within the beer segmented increases, Guinness will need to compete fiercely. [1]

Furthermore, any cost increases should be absorbed by Diageo: the brand has already been experiencing declining sales as a result, Diageo shouldn’t be giving its consumers any other excuse to pass Guinness for another drink.

[1] “It’s no longer Guinness time,” The Economist, March 2016, https://www.economist.com/news/business-and-finance/21646577-spite-its-st-patricks-day-marketing-sales-guinness-are-fallinglike-rest, Accessed December 2017

In a world of whip-sawing national governments, rising populism, and protectionism, global supply chains make less sense than they used to. I’m guessing the reason for the inefficiency of shipping product to Belfast and back again has to do with some sort of tax benefit that the UK government gave Guinness to package the product in N. Ireland. People above say they researched for the answer and came up empty, but this smells like a classic race-to-the-bottom tax break to me. If that’s the case, then Guinness should absolutely begin making immediate plans to move their packaging facility to Dublin. Put the N. Irish government and the UK on the defensive and make them reckon with the job loss potential of their isolationism. It’ll make the negotiation easier. If the government calls Guinness’s bluff, go forward anyway. You’ve paid a small price for supply chain certainty in what looks to be a volatile next decade.

A great example of a supply chain that will be directly affected by the current ongoing Brexit negotiations concerning the Northern Ireland/ Ireland border. However, the potential EUR1.3M annual extra cost that would result from a short delay on the Northern Ireland/ Ireland border is relatively insignificant in relation to Diageo’s annual net profit (GBP2.7B [1]). On the other side of the argument, Diageo could potentially implement a range of cost savings as a result of moving the Guinness packaging plant close to its Dublin brewery. A cost-benefit analysis of the pros and cons of this decision could potentially result in the company creating a packaging plant close to the brewery.

[1] Diageo Annual Report 2017: https://www.diageo.com/pr1346/aws/media/3960/diageo-2017-annual-report.pdf