A Digitally-Enabled Supply Chain in Bloom

How digitalization is eliminating waste and breathing new life into the cut-flower supply chain

What could be more romantic than a dozen roses from the supermarket for Valentine’s day? It’s fine that they may wilt before morning because it’s the thought that counts, right?

How about gifting a farm-cut bouquet from an eco-friendly Colombian grower that will last for weeks instead?

That’s the idea that has enabled Venice Beach-based online floral retailer The Bouqs Company to raise $43M in funding since 2013 (despite CEO John Tabis’ failed Shark Tank attempt in 2014) and to achieve positive cash flow and 200% annual growth [1,2].

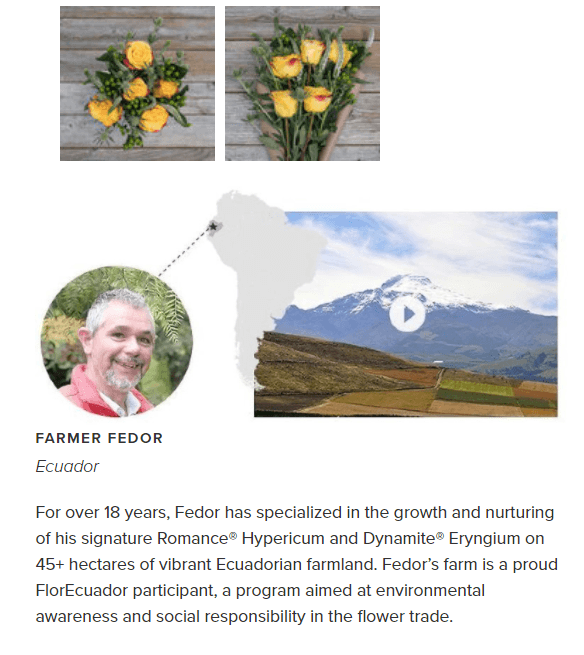

The company promises to deliver fresh-cut flowers to your door from “eco-friendly, sustainable farms from around the world so they last” [3]. Appealing to consumer preferences for sustainability and transparency [4,5], Bouqs customers purchase their arrangement online for a flat shipping-inclusive fee. Selecting from parameters like delivery window and source of origin including the “Volcanoes of Ecuador,” “The Hills of Colombia,” and “The Fields of the USA,” arrangements arrive as soon as the next day from California and in less than a week from South America [3]. The customer value is evident: flowers last longer – up to three weeks compared to days – and customers save 15 – 50% relative to traditional retailers (and up to 80% for weddings!) [6,7]. Bouqs also asserts that margins for their growers are better by 20% [7,8].

So, how has Bouqs done it and to what extent has digitalization been critical to their success?

First, it is important to understand the traditional supply chain that Bouqs is disrupting, which lacks transparency and often results in low-quality flowers and waste [8, 9]. Most cut flowers in the US come from South America – Ecuador and Colombia together account for 90% of stems imported in 2015 [10]. While conditions in these locations are ripe for growing (though sometimes at an environmental and social expense, which is another topic altogether), the challenge is delivering them to consumers before they deplete their food and water stores and wilt, a process which begins upon cutting [10, 11, 12]. Cold helps to slow the decline, necessitating cold-chain practices to maintain temperatures of 33-35 degrees [12, 13].

Flowers move from farm to wholesaler to retailer via trucks and planes and warehouses in a process than can take anywhere from 10 days to weeks [8, 12, 13, 14]. Hand-offs between different players in the supply chain increase the risk that refrigeration will lapse, reducing quality [12, 13]. These factors, together with long lead times which pose challenges to forecasting demand and a limited shelf life, result in 30 – 50% of stems wasted across the full supply chain and flowers near the end of their life upon delivery [9, 13].

Bouqs’ business model, centered on their supply chain, capitalizes on the opportunity to address these problems by shipping directly to consumers, bypassing middle men like brokers, distributors, and retailers, and getting flowers to consumers faster [2]. This is enabled by the implementation of proprietary technology at partner farms so that growers receive customer orders immediately and directly upon ordering. Flowers are cut just-in-time and packaged into the box in which customers receive their arrangement [1,2,3]. Bouqs optimizes supply and demand by collecting data on farmer crops and production and leveraging consumer preferences to adjust product offerings in real time [2,14]. Bouqs also uses historical data to predict and ensure supplier readiness to meet demand [2,14].

The result is that Bouqs holds no inventory and farmer wastage is nearly eliminated [15]. In this streamlined, direct-to-consumer model, suppliers have insight into end-consumer demand and Bouqs has the information and flexibility to respond to consumer preferences and changes in farmer production [15].

Moving forward, growth will undoubtedly be important to Bouqs, which currently only partners with roughly 50 farms [8]. As it grows, Bouqs’ current predictive abilities may be tested, as consumers face more choices around sourcing, for example. Bouqs will need to accurately anticipate customer demand via predictive signals and diffuse orders across farm partners.

While Bouqs has successfully leveraged technology to build a streamlined, transparent and responsive supply chain, additional opportunities may exist down the road to further optimize a flower’s journey from farm to consumer [16]. Innovations related to packaging, such as improvements in trackability and refrigeration, could increase end user transparency and mitigate additional risks to flower quality. While the automation of cutting and packaging flowers could also be up for consideration, the hands on, farm-to-table nature of the product seems central to Bouqs’ value proposition in my opinion.

In terms of innovation, I’d love to see Bouqs enable even greater customization. What if customers could create their own digital arrangements, which are then cut by farms and shipped? What other opportunities do you see for Bouqs to optimize their supply chain or product through digital solutions to sustain their competitive edge?

(798)

Sources:

- “The Bouqs Company Raises $24 Million in Series C Funding,” January 20, 2017, PR Newswire, https://www.prnewswire.com/news-releases/the-bouqs-company-raises-24-million-in-series-c-funding-300398241.html, accessed November 2017.

- Zack Friedman, “Happy Valentine’s Day: ‘Flower Tech’ Disruptors Continue To Bloom,” February 9, 2017, Forbes, https://www.forbes.com/sites/zackfriedman/2017/02/09/flowers-technology-disrupt-start-up/#3d12fae24a12, accessed November 2017.

- The Bouqs Company, “Our Difference,” https://bouqs.com/pages/our-difference, accessed November 2017.

- “Green Generation: Millenials Say Sustainability is a Shopping Priority,” November 5, 2015, Nielsen, http://www.nielsen.com/us/en/insights/news/2015/green-generation-millennials-say-sustainability-is-a-shopping-priority.html, accessed November 2017.

- Kenny Kline, “Here’s How Important Brand Transparency Is for Your Business,” September 7, 2016, Inc., https://www.inc.com/kenny-kline/new-study-reveals-just-how-important-brand-transparency-really-is.html, accessed November 2017.

- Guadalupe Gonzalez, “Floral Startup Bouqs Lands a Shark (3 Years After Its Prime-Time Pitch),” September 26, 2016, Inc., https://www.inc.com/guadalupe-gonzalez/bouqs-shark-tank-deal.html, accessed November 2017.

- Ky Trang Ho, “Shark Tank Company Saves You Up To 80% On Flowers Yet Pays Farmers More,” November 4, 2016, Forbes, https://www.forbes.com/sites/trangho/2016/11/04/shark-tank-company-saves-you-up-to-80-on-flowers-yet-pays-farmers-more/#2626ee701726, accessed November 2017.

- Sara Ashley O’Brien, “From farm to mom: Meet Bouqs, the startup picking the freshest flowers,” May 3, 2016, CNN Tech, http://money.cnn.com/2016/05/03/technology/bouqs-mothers-day-flowers/index.html, accessed November 2017.

- Alex Silady, “The Economics of Flowers: A Mother’s Day Must?,” May 3, 2016, Smart Asset, https://smartasset.com/insights/the-economics-of-flowers, accessed November 2017.

- “Cut Flower Imports (FY 2015), February 2016, US Customs and Border Protection, https://www.cbp.gov/newsroom/spotlights/cut-flower-imports-fy-2015, accessed November 2017.

- USDA Foreign Agricultural Service, GAIN Report: The History of the Colombian Flower Industry and Its Influence on the United States, Michael Conlon, Global Agricultural Information Network, February 6, 2015, https://gain.fas.usda.gov/Recent%20GAIN%20Publications/The%20Colombian%20flower%20industry%20and%20its%20partnership%20with%20the%20U.S._Bogota_Colombia_2-6-2015.pdfhttps://smartasset.com/insights/the-economics-of-flowers, accessed November 2017.

- John McQuaid, “Chances are the bouquet you’re about to buy came from Colombia. What’s behind the blooms?” February 2011, Smithsonian Magazine, https://www.smithsonianmag.com/travel/the-secrets-behind-your-flowers-53128/, accessed November 2017.

- Deborah Abrams Kaplan, “The hidden supply chain behind Valentine’s Day flowers,” February 14, 2017, Supply Chain Dive, https://www.supplychaindive.com/news/flower-supply-chain-Valentines-Day/436140/, accessed November 2017.

- Linda Rosencrance, “Sensor data boon spurs supply chain analytics applications,” Tech Target, http://searcherp.techtarget.com/feature/Sensor-data-boon-spurs-supply-chain-analytics-applications, accessed November 2017.

- “The Bouqs Company Inks $12M,” VC News Daily, February 4, 2016, http://www.vcnewsdaily.com/the-bouqs-company/venture-capital-funding/qsmrwhcwkc, accessed November 2017.

- Alicke, K., D. Rexhausen, and A. Seyfert, “Supply Chain 4.0 in consumer goods,” McKinsey & Company, https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/supply-chain-4-0-in-consumer-goods, accessed November 2017.

Great post! As you alluded to the key to success for this company will be finding a competitive edge before other flower companies simply start to copy their model. There are already some other players disrupting the flower delivery industry (such as BloomThat, BloomNation etc). It will be really important for Bouqs to grow quickly and dominate the market – they seem to be doing that, with a lot of venture money already pumped into the company. If they achieve that, they could use the data they are collecting on customer preference to galvanize their position. I think the idea of allowing customization is a good one as long as relatively few people use it so that they don’t run into inventory issues. They could also use the customized bouquet data to optimize their own offerings.

JH, thanks for the great post! I think you highlighted the ways in which Bouqs has been able to use digital tools to remove the middle man in the flower business, delivering a better-quality product to their customers. What I worry about is customers need to have instant gratification. Although the flowers at the store may die sooner, they’re also available to me right now. How will Bouqs overcome this consumer behavior? I hope they won’t be sucked in to opening “pop up shops” or other brick and mortar stores, which would require them to hold inventory and compromise their value proposition. My suggestion for a competitive edge for Bouqs would be to form partnerships with a more geographically diverse set of farmers to decrease the time from customer order to delivery, as well as enable global expansion. If they are looking to enter the Asian markets for example, I suggest they create a network of Asian flower farmers. I believe their model could be most impactful for consumers in close proximity to the farmers.

Love this post. I had no idea flowers were shipped all the way from South America — that seems so illogical given the risk of spoilage. I think you did a great job of laying out the additional opportunity areas for the company, but I do think increased customization could be risky. While customization would be a great value add for customers, customization would presumably increase costs for producers. The nature of Bouq’s two-sided business model means that it has to cater to both of these constituencies and carefully balance their respective preferences and needs.