Making the capital-intensive oil & gas industry cost effective through 3-D printing.

Can technologies such as 3-D printing save the capital intensive oil and gas industry. Finding synergies and reducing cost in a low oil price environment has become extremely important for many oil & gas companies to survive, hence employing new technologies may help them reach that goal and stay afloat.

Digitalization has taken over the world and has changed the way we shop, eat, travel and live. However, one industry that has not yet fully reaped its benefits in spite of being heavily technology centric is the oil and gas industry. With the recent crash in oil prices traditional oil and gas companies initiated cost-cutting tactics through layoffs and facility shutdowns. However, with the shift in demand to renewable energy sources, the demand for oil and gas is declining. As a result, lower oil prices seem like the new norm, hence future incremental synergies can only be recognized if the supply chain is improved through adopting technologies such as additive manufacturing – also known as 3D printing.(5)(4)

GE Oil & Gas has been quick to adapt to the trend of digitalization. This company has made significant investment in data and asset performance management in order to plan preemptive maintenance of expensive oil and gas equipment. Their recent investment in 3D printing and robotics aims to drastically reduce the costs and logistical obstacles associated with the supply chain. (1)

Traditionally, the manufacturing of oil and gas equipment takes around six to eight weeks ex-works (till the plant site), after which the equipment is shipped to the necessary location adding another two to four weeks of delivery time to the overall lead time. Furthermore, these equipment, made of heavy metals, incur high transportation costs. Moreover, as precision is key in the manufacturing of these equipment, a few inches in deviation of specification may lead to multiple days of downtime, increasing the overall costs of rig operation. Industrial 3-D printing does not only drastically decrease the manufacturing cycle time but also allows higher accuracy and more intricate designs with less weight. Consequently, decreasing the transportation costs, lead time, and overall defect rate. (5) (3)

In 2016 GE Oil & Gas invested USD$11.2 million in two of their production lines in Talamona, Italy. One of the lines was equipped with fully automated anthropomorphic robotics arms to produce nozzles used in gas turbines. The other line employed the use of 3-D printing to produce end burners for turbines and compressors. Both these innovations were able to capitalize on the benefits of digitization such that they produce more precise, efficient and cost-effective products while increasing the plant capacity. (1) (2 (6)

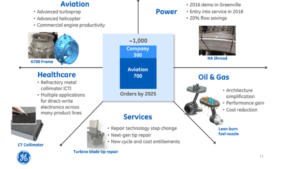

GE had already been working with 3-D printing, using it in their aviation and health care businesses, prior to leveraging the success of this technology in oil and gas. Lean manufacturing is a goal of every manufacturing firm and 3-D printing can improve many key parameters that help to make the production process leaner. First, as the product now has a shorter cycle time, less inventory is required. In 2011, 14% of the revenue of high-tech manufacturing firms was held up in inventory(3), hence 3-D printing allows companies to decrease the inventory quantities. Second, due to the nature of the operations and the uncertainty associated with the geology of the project site, companies usually pre-order multiple drilling products, for example; drilling bits in anticipation of encountering a different ground formation than what was expected. The benefit of 3-D printing is that in offering flexibility and products on demand, companies can better respond to the unpredicted variations at the project site. They can streamline the supply chain and experience cost savings associated with product delivery and planning. (1) (2) (3)

Furthermore since 3-D printing promises to reduce the number of links between different supply chain functions such as purchasing, operations, distribution and integration and bring production closer to consumers it can also decrease the overall variability in the entire supply chain. (3)

In the short term oil and gas companies can prioritize digitizing equipment that are smaller and have high variability in demand such drilling bits. While in the long term, the industry should invest in decreasing the overall links in supply chain by bringing suppliers closer to the end users.

Exhibit 2: GE’s 3-D printing portfolio

Future of the industry

While the prospects of 3-D printing in oil and gas industry seem exciting, in order for them to be sustainable there are still many aspects that need to be addressed.

- Can industrial 3-D printing be extended to all product lines with in the industry.

- In the low oil price environment, will companies invest in making significant changes in their current supply chain model.

- If equipment can be printed on site, how will companies incorporate quality control of these equipment before they are used downhole.

Word count: 767 words

(1) https://www.ge.com/reports/secret-weapon-supersonic-blaster-rebuilds-jet-parts-flying-powder/

(3) Costs and Cost Effectiveness of Additive Manufacturing A Literature Review and Discussion Douglas S. Thomas and Stanley W. Gilbert http://nvlpubs.nist.gov/nistpubs/SpecialPublications/NIST.SP.1176.pdf

(6) https://www.ge.com/additive/

Very interesting essay! To answer your questions:

I do not think that industrial 3-D printing can be extended to all product lines with in the industry in the foreseeable future. I do believe some of the small and non-durable equipment can be printed, for example, plugs and drill bits. However, larger or durable equipment will be difficult. Especially when taking into consideration that most of the equipment producers/providers are not operators themselves.

Despite the oil price, most of the US companies have already invested significant amount of money and time in making significant changes in their current supply chain model since 2009. This industry move was initiated to accommodate the complicated planning for unconventional oil/gas operations to reduce operation time and costs. I would imagine with today’s low oil and gas price, companies would need to control costs even more to meet their targeted economic returns.

If equipment can be printed on site, the quality control of these equipment have to be done through third party (most API equivalent agency) to ensure product quality and operation safety before they are used downhole. Keep in mind that equipment manufacturing companies have to all meet standards that set by the industry regulatory agencies. Adding product lines with change in production sites will impose additional complications on the approval process. Thus, it might inccur even large expenses and more scheduling issues for oil and gas operation.

Super interesting article! As I read through this, something I would love more clarity on is the tradeoff between how ‘heavy’ and durable the materials needed for drilling are. You mentioned in your article that a big benefit of 3-d printing is that previously, the materials being shipped were made of heavy metals, and thus incur high transportation cost. I understand that there is a benefit in that industrial 3-d printing materials allows for less weight – but what are the implications for having a lighter product?

With respect to your main question – will companies invest in making these significant changes in using 3D printing in their current supply chain model, I am pessimistic. I see 3D printing still best used in cases where they are producing fast, less quality prototypes. Given that 3D printing is still developing, and oil and gas is an industry that relies heavily on precision and quality (anything not up to par could have outsized consequences), it seems like an unnecessary risk oil and gas companies would be taking on.

Fascinating article Anum! It should come as no surprise that GE is on the forefront of innovation in the oil and gas industry. Given the pressure that many public traded oil and gas companies face to hit production targets, any opportunity to reduce downtime is a chance for both operators and service providers to capture value. To address your second question, I would argue that low oil price environments are typically when companies have invested in changing their existing supply chain models. The de-bundling of hydraulic fracture services and the emergence of the self-sourced supply chain model for proppant and chemical additives over that last four years is a perfect example of this. In response to low commodity prices, operators have aggressively pursued ways to maintain margins. Now it is time for service companies to find ways to bolster their bottom line. I think GE will face significant hurdles convincing an operator to utilize 3D printed components below the surface. However, their recent combination with Baker Hughes creates an interesting dynamic, particularly given the large share of key markets they now control such as electric submersible pumps. As 3D printing technology continues to improve and reduce in price, I expect commercial applications in the oil and gas industry will grow.

To clarify, with the world’s population expected to hit 9 billion by 2040, the demand for energy is expected to rise by 25%, with a slightly higher percentage coming from oil and gas than today. [1]

Elliot is spot on with timing; oil and gas companies greatly reduced opex when oil prices were in the $20s last year and are going to keep having to innovate — we all got to see what happens when you cannot pull costs out of the system with Kerr-McGee.

I would enjoy learning more about the materials used in 3D printing — as DPI and Elliot mentioned, I would intuitively be afraid to place a man-made material into the subsurface (such as for a drill bit) at such high temperatures that would need to withstand such large forces. I think you would be fine to do quality control in a lab with a statistically significant sample size, which would allow you to trust placing this equipment on site. Current equipment has an API tolerance that can be problematic; it is exciting to think 3D printing could eliminate this small discrepancy.

[1] http://corporate.exxonmobil.com/en/energy/energy-outlook/highlights/

Very interesting read, I’d like to comment on your questions:

3-D printing might not be practical to apply to all product lines within the industry. However, by disrupting a few critical product lines, this can prove a relevant advantage. Especially for fast-paced drilling operations, like unconventionals, operators will benefit from avoiding drilling stops due to lack of equipment.

Of course there are challenges ahead, as you mentioned, regarding printed materials quality control, as well as limited cash availability to invest in this kind of technologies. However, even if 3D printing develops slowly and in for a very limited number of uses, this would be a very attractive opportunity to reduce drilling time (and therefore cost), an imperative requirement for Oil & Gas companies in this hard days.

Very insightful opinion piece Destiny! I appreciated reading this article as I got to learn a bit about an interesting industry. I agree with all three comments above and would just like to add my answers to the questions you posed:

Firstly, I do not think it is presently feasible to roll out 3-D printing to a lot of the industrial applications. As you rightly point out, it is very useful for manufacturing smaller parts, which require lighter materials and do not have to endure too much pressure (heat, friction, etc). The majority of processes in the oil and gas industry are exactly the kind that you cannot manufacture with delicate materials.

To your second question, I think it is a matter of survival for oil and gas companies to more effectively manage their cost structure down (especially in this low price environment). This is especially true for U.S. companies where exploration and production costs are significantly higher than for other oil producers. And as stated in the above comments, companies are already making investments to reduce the costs of operating.

Lastly, I think the 3-D industry will develop to a point where specialized companies with requisite scale will dominate the market, although I also think there is an opportunity for some operators to carry out their manufacturing in-house, if it makes sense scale-wise, as there are really no significant barriers to entry into the 3D printing industry at the moment (1)

(1) Fragmentation in the 3D printing industry will augment its growth.

https://seekingalpha.com/article/2691755-fragmentation-in-the-3d-printing-industry-will-augment-its-growth

Great article! Very thought provoking.

I am a big fan of 3D printing in general but I do think its application in oil and gas has challenges.

On benefits:

I think 3D printing as it is now is still enjoying the best use case for rapid prototyping. I can tell you after seeing 3D printing from a Makerbot in action that the process is still fairly time consuming and not currently meant for mass production, where other methods such as injection molding dominate. As a result, I see 3D printing finding more applications in parts of the industry that require custom solutions and more complex geometries rather than in product lines that are higher volume/ more standardized.

https://www.forbes.com/sites/ricksmith/2015/06/29/7-ways-3d-printing-is-already-disrupting-global-manufacturing/#591a76181c0f

I do think QC is also an issue. I am not as familiar with how metals bind in a printed process versus the traditional production process. Given the various industry standard now regarding things like welding, there will likely be friction to validate safety and integrity. A lot more technical qualification will be needed before the industry will embrace 3D printed parts.

Despite all this, the future is bright. 3D printing decreases material waste (additive) and may eliminate some of the assembly that goes on in traditional manufacturing. The cost savings may outweigh the capital cost of acquiring enough machines. Where that takes us remains to be seen! https://www.mbtmag.com/article/2016/01/how-3d-printing-will-impact-manufacturing-industry

Very interesting article! Since downtime in oil and gas operations is so expensive, being able to reduce lead time for repair parts has huge upside. For this reason, I think 3D printing could have a lot of application in O&G. One concern I have is that since 3D printed parts will not have the same material properties as their conventionally manufactured counterparts, making these parts meet specifications may require some design changes. This may reduce interchangeability between 3D printed and conventional parts, which makes it more difficult to roll out new parts without expensive redesigns.

I also agree with your concerns about quality control of 3D printed parts. The way I would mitigate this is to look for applications where on-site QC capabilities are already available (e.g. pressure test). The supply chain benefits of 3D printing can be demonstrated using existing equipment (even on a narrower set of applications). That would make it easier to build a business case for buying new equipment and expanding to new product areas later.