NextEra ready for the Next Era of Electricity?

Climate change is greatly impacting the electricity supply chain. Is the utility that is the leading producer of renewable energy in the world ready?

Perhaps no industry has been impacted as much by climate change, and the associated government policy, as the utility industry with organizations such as NextEra Energy, Inc having to completely rethink the way they provide electricity to consumers. These effects have the potential to continue to greatly disrupt the electricity supply chain in two ways. First, in the fuel mix of the generation, and second, with the shift to distributed generation.

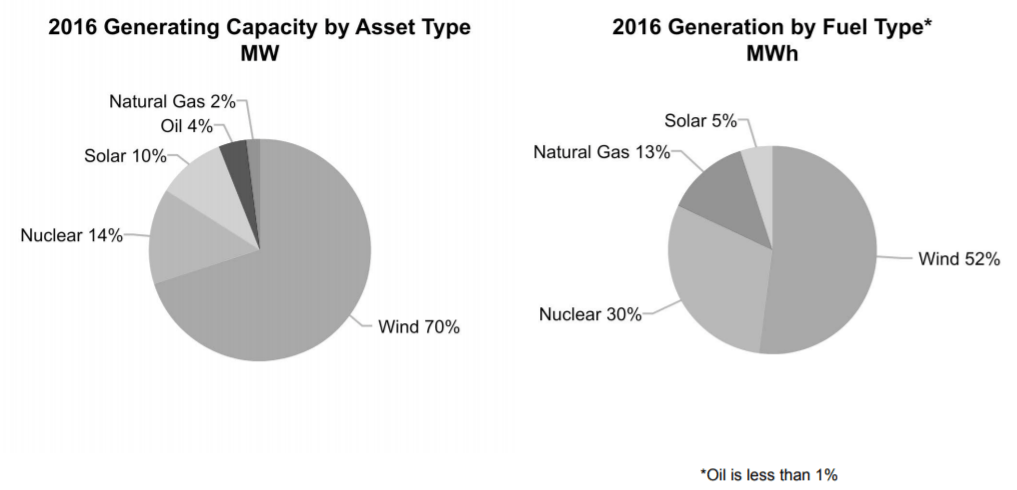

The supply chain for electricity can be categorized into three functions: generation, transmission, and distribution. Power supply in the United States is generated from a diverse fuel mix including coal, natural gas, nuclear, hydro, wind, and solar. North America is broken into four distinct grids, or combined transmission and distribution networks [1]. These grids are comprised of centralized and distributed generation sources that must work together to match supply and demand. The distinction between centralized and distributed is defined by the generation capacity and proximity to the end user (Fig. 1).

Figure 1. Distributed vs Centralized Electricity Sources

NextEra Energy, Inc (“NextEra”) is comprised of two principal subsidiaries: Florida Power & Light (“FPL”) and NextEra Energy Resources, LLC (“NEER”). FPL is one of the largest rate-regulated utilities in the United States, serving 4.9 million customer accounts in Florida. NEER, together with its affiliated entities, is the world’s largest generator of wind and solar electricity [2]. In 2016, 67.4% of overall revenue and 59.3% of the net income was attributed to FPL, whereas 30.3% and 38.6%, respectively, was attributed to NEER [3].

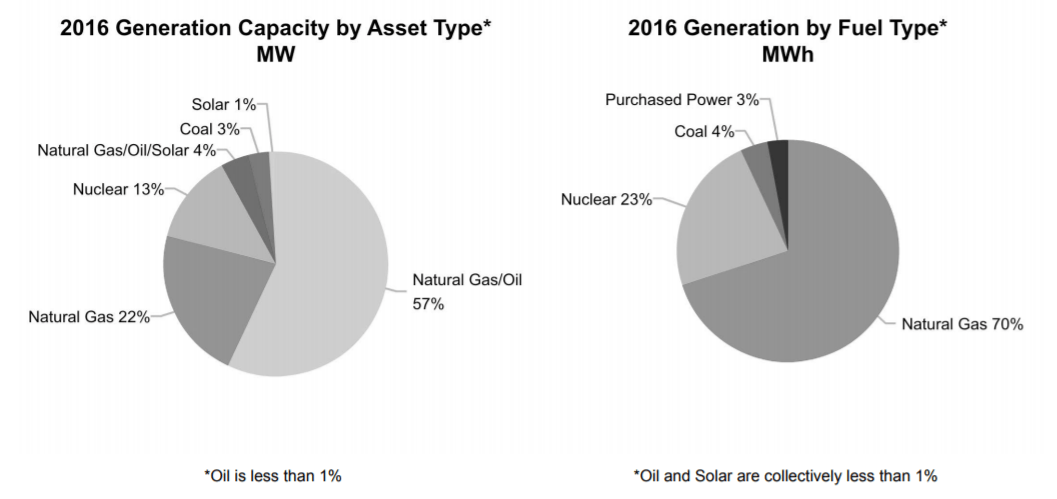

At the end of 2016, FPL’s capacity was almost 27,000 MW. The breakdown by asset type is shown in Fig. 2.

Figure 2. 2016 FPL Generation Capacity by Asset Type and Generation by Fuel Type [4]

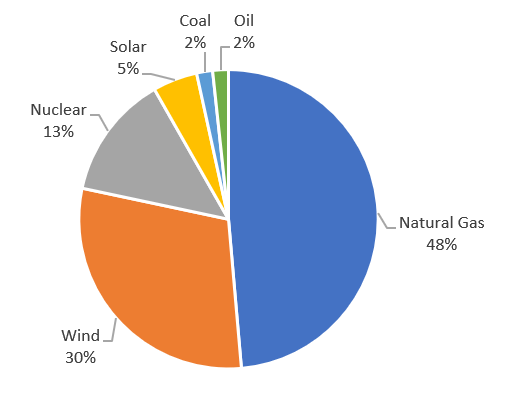

Similarly, NEER’s capacity was almost 20,000 MW with the breakdown shown in Fig. 3.

Figure 3. 2016 NEER Generation Capacity by Asset Type and Generation by Fuel Type [4]

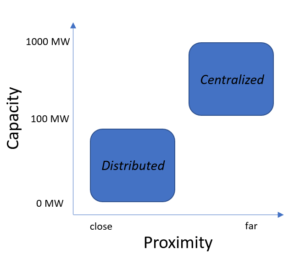

Combining the capacities yields NextEra’s overall capacity (Fig. 4). Almost half of the combined capacity is from natural gas and another 13% from nuclear. Both are typically highly centralized.

Figure 4. 2016 NextEra Generation Capacity by Asset Type and Generation by Fuel Type. Numbers are approximate and based on estimates/assumptions

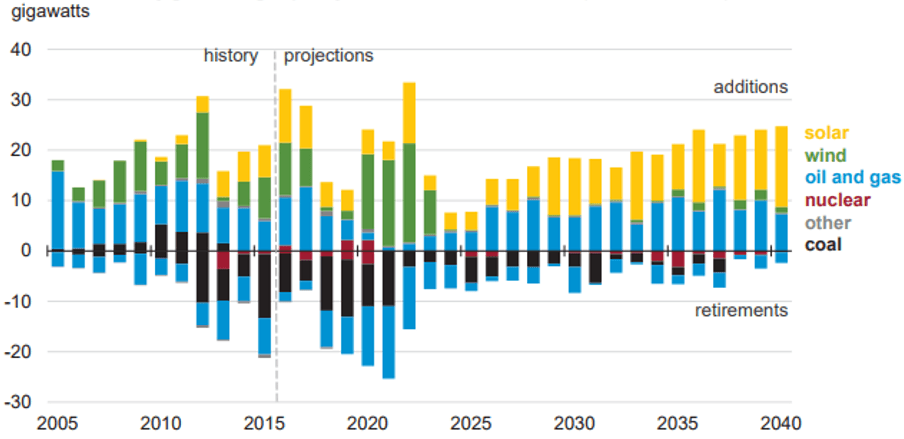

While this mix has resulted in NextEra being highly competitive, are they prepared for projected shifts in the industry? Figure 5 shows the EIA’s projections for additions and retirements over the next 30+ years. Nearly 70 GWs of new wind and solar capacity is projected to be added from 2017-21 and more solar than any other source will be added to the grid over the coming decades [5].

Figure 5. Annual Electricity Generating Capacity Additions and Retirements [5]

In the short term, management appears to be making the necessary investments in wind and solar projects. They plan to add up to 4,100 MW (+30%) of additional wind capacity in 2017-2018. Additionally, they are investing in repowering up to 1,600 MW (+12%) from their existing wind portfolio. Repowering is the process of upgrading older wind turbines with newer innovations. On the solar front, they plan to add up to 1,300 MW (+58%) in 2017-2018 [4].

Beyond the next couple years but within the next 10, management’s plans for renewable energy projects is greatly impacted by government incentives, including production tax credits (PTC) and investment tax credits (ITC). The PTC is determined based on the amount of electricity produced by the wind facility during the first ten years of operation and is on a phase-down schedule. Just 40% of the credit will be paid for wind projects with construction beginning in 2019, the last year of the PTC. Likewise, the wind ITC, which is determined based on the cost of the wind facility, is also on its own phase-down schedule ending in 2019 at 12%. The Solar ITC will remain at 30% through 2019 before phasing-down to 10% during its last year in 2022 [5]. It is uncertain whether any type of credit will be available beyond 2022. However, many do not believe they will be necessary due to how competitive solar and wind already are with conventional sources.

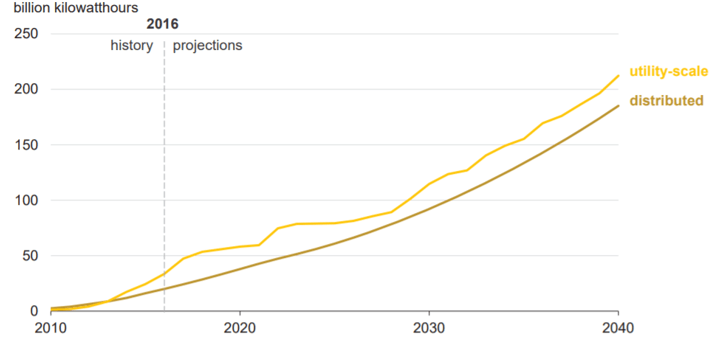

Additionally, management needs to focus on the impacts of the expansion of residential rooftop solar. This distributed form of electricity generation, especially when coupled with a battery for storage, has the potential to greatly disrupt a utility’s business model. The U.S Energy Information Association projects approximately half of the solar generation will be distributed as opposed to utility-scale (Fig. 6). This affects the electricity supply chain in two ways. First, it alters the generation sources. Second, and more importantly to the way NextEra makes money, it can remove customers from the grid or greatly reduce their demand. Once again NextEra has the potential to be impacted by policy related to climate change. States have various forms of net metering, and may move more towards a feed-in-tariff system, both of which require various degrees to which utilities must use and/or purchase excess power from distributed systems.

Figure 6. Solar Electricity Generation [5]

Is the projected scale of distributed solar enough to truly concern NextEra at the enterprise level? Can management find a way to not only survive the transition to distributed solar but also profit from it?

Word Count: 797

References

[1] S. Department of Energy, United States Electricity Industry Primer (July 2015)

[2] NextEra Energy. “Our Company: Fact Sheet.” http://www.nexteraenergy.com/company/factsheet.shtml, accessed November 2017

[3] NextEra Energy. NEE-12.31.2016 Final Financials for Press Release. http://www.investor.nexteraenergy.com/phoenix.zhtml?c=88486&p=EarningsRelease4Q16, accessed November 2017

[4] NextEra Energy. 2016 Annual Report. http://www.nexteraenergy.com/pdf/annual.pdf, accessed November 2017

[5] U.S. Energy Information Administration, Annual Energy Outlook 2017 (January 5th, 2017)

It seems like the global precedent is yes, be afraid, be very afraid. My completely outside-in perspective of the generation space is that it is driven by politics first and sound utility management decisions second. Wind and solar initiatives are pursued and subsidized for political reasons that obscure the potentially debilitating effect that the variability in supply that they introduce can have on grids. The variability of these sources means that much of the original baseload power generation capacity is still needed and must be funded from a reduced revenue base. So if I were a utility and I had to look forward to a future where I had to keep most of my big gas turbines running with fewer customers paying me for the privilege, yeah I’d be worried.

Everett- great piece on renewable energy. Well written, researched, and fun to read.

In response, a few of my thoughts:

1. Depending on who you ask, the distribution of generation fuel sources in the next few decades can become significantly more dominated by renewables. Certain technology improvements are needed to enable it and drop the installation costs. I think we already see this with panels costs. However, wind power costs have also been dropping over time (https://www.lazard.com/perspective/levelized-cost-of-energy-2017/) and overall wind and solar sources have the potential to become much cheaper in the coming decades (https://www.csis.org/events/bloomberg-new-energy-finances-new-energy-outlook-2017) and become competitive.

2. While distributed solar can be a threat, not every situation will be suitable for it. This includes cities, where the demand for electricity in a single building might outpace its surface area for panels. Distributed solar also likely requires a market for excess generation, installation, and different infrastructure. Rather than see it as a threat, NextEra can become a service provider in this space to provide maintenance and storage solutions.

3. Both policy and infrastructure have friction points. One thing I see as an issue is curtailment of renewables that are generated, kind of related to storage. Because traditional base load is harder to turn down, renewables are “curtailed” instead, which raises costs. Would definitely be interested to see how technology and law might be employed here in the future, but the grid will probably look different.

Thanks for an interesting read and opening up an enlightening dialogue! Do you know if Exhibit 5 is on a national level? I would imagine Florida would have a much larger market for distributed solar than any other source of power and would look very different from the national mix as a result. Also, I think it’s import to consider that the EIA’s projections are a reflection of the choices NextEra and other utility companies make rather than a variable management considers when making production decisions. As the above comments already noted, those projections are driven by the government’s current and future energy policies and could end up being radically different than reality depending on what assumptions the EIA used. On a separate note, I’m wondering if some level of distributed power might actually be helpful for an energy company. Distribution networks seem expensive to maintain and it might be in NextEra’s interest to have rural residents produce power independently. If NextEra can also capture some of the solar installation and maintenance business, it could be in even better shape!