Garmin- A Tale of Playing Catch and Copycat

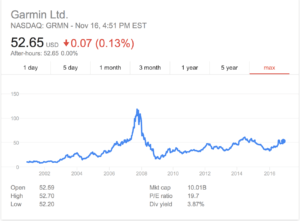

See that peak? Share price for Garmin hit $119.40 in September 2007, growing 7.5 times since its humble public offering in December 20001. Even as shareholders rejoiced in the success of Garmin’s personal navigation devices (PND) that used the (then) latest technology in Global Position System (GPS), strong headwinds were en route that would force the company to change strategy and product mix.

2007- Growth via New Product Launches

In 2007, Garmin launched many new variations of its nüvi® personal navigation device with real time updates on traffic, and gas levels, along with built in features such as an MP3 player, Bluetooth and the ability to program ‘points of interest’ in to the device2. Sales reached $3.2 billion (180% over sales in 2006), with 73.6% contributed by nüvi® in automotive/mobile category2, and the balance divided among Garmin’s other categories- outdoor/fitness, marine and aviation products.

2008- Economic Downturn and Competition

The 2008 recession brought with it a steep decline in sales across all industries especially automotive. The complementary nature of the relationship between buying new vehicles and buying PNDs meant that customers had little incentive to buy a $200-$499 Garmin device. Added to this pressure was the emergence of the increasingly popular and convenient smartphone and navigation apps by both Apple and Google that also allowed for real-time navigation. Needless to say, Garmin sales began to suffer, and investor confidence weakened leading to the precipitous decline in share prices.

From the 2007 10-K2, Garmin states that they believe they ‘compete favorably’ in the highly competitive market for navigation and communications, however out of their 9 principle factors for success, they never included ‘innovation’. Garmin also stated that they spent only 5% of sales on R&D in 2007. Both facts indicate a lack of foresight and proactivity to invest in further technological advancements during ‘peace-time’ to keep the Garmin PND relevant.

Reacting to SmartPhones and Map Apps

In reaction to the launch of smartphones, Garmin decided (rather hastily) that it should catch up. Garmin launched the Garminfone3 that failed to attract customers, especially compared to the more sophisticated Apple iphone and Google Android.

To its credit, Garmin was not discouraged, and launched its own navigational mobile app called StreetPilot3 that could run on most phone operating systems- but at a price of $40-$50. Needless to say, Garmin lost more popularity. By 2009, share prices were barely above their initial public offering of $14 (see top of blog).

Garmin HUD, New Nüvi® and Outdoor/Fitness

In early 2013, Garmin sales fell again by 22%, due to a slow down in automotive sales4.

That summer, Garmin launched an innovative product called the Garmin HUD5, or Heads-Up Device, with retail price of $130. This standalone device was kept on the dashboard, connected via Bluetooth to a smartphone with StreetPilot, and projected navigation instructions on the windscreen so the driver did not need to look down at his phone. However, Garmin failed to consider the plethora of smartphone stands available on Amazon that also helped with ‘heads-up’ capability at a fraction of the cost. It is not clear that Garmin HUD sold well.

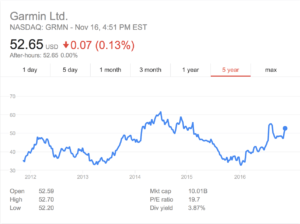

In 2014, Garmin relooked at their nüvi® PND6, and yet again made a failed attempt to ‘reinvent’ the smart phone, while being primarily an automotive aid. Stock prices were on the rise however, because Garmin began to shift strategies to compete in the ‘wearable fitness devices’ market. However, a quick view at PCMag.com, and the average consumer has trouble distinguishing between the customer value proposition of the Garmin Vivoactive7, Fitbit, Apple watch (with fitness apps), Apple Watch Nike+ and other players. Once again, Garmin was playing the copycat game.

In late 2015 when stock prices began dipping again (see image above), a Dougherty analyst said, “we are beginning to lose confidence in the company’s ability to react quickly to industry trends it should be capitalizing on8”.

Lessons Learned from Garmin

Changes in technology are fast and unforgiving. Garmin was definitely at the forefront in 2007, but was very quickly phased out. Garmin could have kept a closer watch on shifting trends and market demands to stay ahead, instead of constantly trailing behind and launching products after its competitors did. Admittedly, this is easier said than done, as even Apple is now feeling the pressure to make significant improvements in each subsequent iPhone.

Currently, Garmin should invest in differentiation for the Vivoactive to ensure it is not phased out by better technology. Additionally, Garmin could revive its automotive revenue by partnering with car companies to incorporate HUD into the whole windshield, creating a futuristic look and adding convenience. To stay successful in the long term, Garmin should leverage and improve upon its GPS technology to carve out a niche for itself in perhaps the biggest connection initiative of all time- the Internet of Things. (798 words)

1 Nasdaq. “Garmin Ltd (GRMN) IPO,” http://www.nasdaq.com/markets/ipos/company/garmin-ltd-79286-7177, Accessed Nov 16th 2016

2 United States Securities and Exchange Commission, Form 10-K, Garmin LTD, for fiscal year ended Dec 29, 2007

3 Seattle pi. “Staying Relevant in a Smartphone Dominated World,” http://www.seattlepi.com/business/fool/article/Staying-Relevant-in-a-Smartphone-Dominated-World-4656831.php, Accessed Nov 16th, 2016

4 Market Watch. “Garmin net falls 22% on slumping automotive sales”, marketwatch.com.prd2.ezproxy-prod.hbs.ed. Accessed No 17th, 2016

5 All Things D. “ The Road Ahead: Garmin HUD Projects Directions Onto Your Windshield,” allthingsd.com.prd2.ezproxy-prod.hbs.edu, Accessed Nov 16th, 2016

6 United States Securities and Exchange Commission, Form 10-K, Garmin LTD, for fiscal year ended Dec 27, 2014

7 PCMag.com, “The Best Fitness Trackers of 2016”, Jill Duffy, Alex Colon. Accessed Nov 17th, 2016

8 Business Source Complete, “Garmin sinks on another full-year guidance cut”, Patrick Sietz, Written 10/15/2015. Access Nov 17th, 2016

MC, thanks for your insights on Garmin. I have to admit that this is a brand that we are quite familiar with in the military. A Garmin wristband with GPS technology has been a part of our uniform for the past ten years. Interestingly enough though, I am not aware of Garmin ever receiving a government contract for this gear. Rather, Soldiers either purchased the gear themselves or units purchased it with discretionary funds. I’m afraid this is just another example of a Garmin missed opportunity.

I completely agree with your idea of Garmin integrating themselves within the car industry. There is certainly a technological gap between our smartphones and our vehicles, and Garmin has much to gain from focusing future innovations on this area. In fact, I am quite surprised why their competitors haven’t done this already.

MC –

Great post! It is interesting to see how Garmin’s share price has evolved over time. I agree that the emergence of the smartphone disrupted Garmin’s hold on the personal navigation device market. With respect to its value proposition, I can’t see why anyone would purchase a portable navigation system when you could use Google Maps or Waze for free. I also think that Garmin’s push into “wearables” may be too little too late. Although, Garmin devices are compelling for athletic enthusiasts, such as triathletes, I think that advances in technology are leaving little room for device differentiation aside from software. Apple, Samsung, Fitbit, Jawbone, and other new entrants are making an aggressive push into this space. I am curious to see what this means for the future of Garmin. Nice work!

MC, thank you for a great read ! I first saw Garmin watches when I was out on the rigs in Abu Dhabi. Quite a few fitness enthusiasts and adventure seekers had it. I was so impressed with all the functionalities in the watch that I almost ordered one. This was at a time when Apple watches had still not been launched. I did not realize however that the company has not done particularly well. Your article has highlighted a few issues and the major one I think is that as a company in the technology business, Garmin does not have flexibility and ability to pivot at the right time. I was surprised by how low their R&D expenditure was. This gets accentuated due to their inability to integrate their offerings with other players in the chain ( Military, Car manufacturers etc).

I believe they might have an opportunity with the HUD device but time is already running out for them. They need to understand that standalone technology companies are almost a thing of the past. They need to invest into a relationship where the technology is developed in sync with car manufacturers. This integration will probably yield more value than simply creating products and hoping that they find traction.

Great read, thanks for posting! I’ve been a consistent user of Garmin GPS watches since 2008 for both fitness and work (military), and they have been seen as the leader in both of those segments for GPS accuracy and user-friendliness. Even though the competitors caught up to those advantages, Garmin is still the standard GPS device for the infantryman today.

Based on your article, it sounds like Garmin needs to figure out what they can be the best at and then focus their efforts and resources. An approach that tries to address “everything GPS” is too broad with the number of players that have entered the GPS industry in the last few years. I am also shocked by their low R&D expense — my only hope is that the low expense represent a more focused effort on making a few products great rather than many products ‘OK’.