D-Risk Oil and Gas Solution for Risk Management of Capital Projects

Risk Assessment Solution for CapEx projects in Oil and Gas that will derisk a budget by at least 13%.

-

- [Ryan, CDA] “Hello John I heard you just sanctioned another capital project….Good for you and your team!

-

- [John, Customer] Yes, we are in the process of picking an EPC company, but I tell you this is going to be a tough one the economics are tight, and the timeline is tighter.

-

- [Ryan, CDA]. John, as you know I work for Crimson Data Analytics and …

-

- We have developed a cloud based, data-driven solution for assesses and D-risks large capital projects in Oil & Gas. We have a database of historical projects and through our research we have determined that there are 23 key factors in the success of a project. Our solution uses data analytics and ML algorithms. Our solution very quickly and robustly:

-

- -Identifies your project’s key risk factors

-

- -Correlates these factors against historical project performance

-

- -Predicts the factors likely to negatively impact your project performance

-

- -Proposes unique high-impact actions your team should focus on to minimize overall project risk and prevent cost and schedule overruns

-

- With D-Risk you can expect a savings of 13% or more on your overall project budget while maintaining schedule. I can have my team conduct a free, preliminary project review that allows you to benchmark your project’s competitiveness within a couple hours. Should we set something up for, say, next Tuesday?

- [John, Customer] That sounds great, please do so.”

Ryan Roper – Product Director and SME on Risk Management for Capital Projects

Demet Tatar – Lead Data Scientist and a Founder of Crimson Data Analytics, and Crimson Innovation Lab software start-up

Karim Moti – Business Development Manager, oil & gas SME, and serial entrepreneur

The team is backed by a set of Advisors

Sadi Kuleli, MIT PhD in Geophysics, Saudi Aramco

Bilgin Altundas, PhD in Applied Mathematics – Modeling- Schlumberger

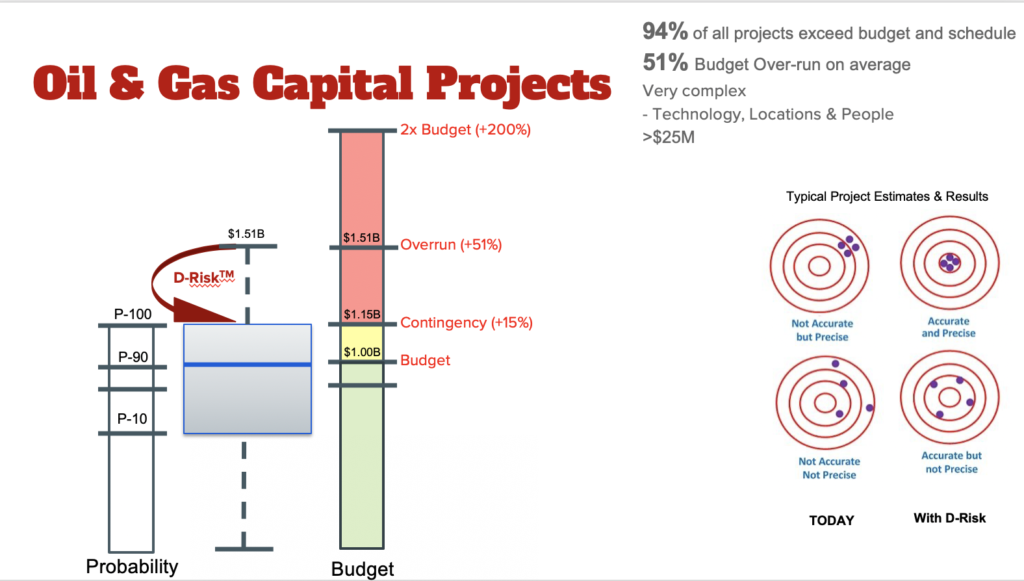

Capital Project are 94% of the time over budget by 54.4% on average

Identifying the highest Risk Factors – The Risk Assessment Process does not identify root factors quantitatively to take action

Scarcity of Required Resources – With the aging workforce there are gaps in senior resources (>20+ years of experience) who are required for Mega Projects

The mindset of the industry is insular in its use of resources and methodologies – yielding the same negative results

Lessons Learned are rarely learned

No standardized approach to project comparisons to benchmark them

Projects are not compared against performance of past similar projects

Project Risk Assessment is static and can be heavily influenced

The Risk Assessment process often requires face-to-face meetings

Because the process is heavily influenced by the facilitators / team member bias, the results may not be repeatable

Risk on a project is very dynamic and complex because factors are continually changing, the current methodology is a based on a snapshot and is stale as soon as anything changes

Solutions

A robust database of information from historical projects detailing specific features known to impact project success/failure can provide the ‘big data’ required for analysis of comparator projects. The larger the database, the more likely it is to identify analogous risks and develop correlations that can be applied on a new project. A large database essentially creates a larger ‘crowd’ from which know-how, experience and general wisdom can be accessed to positively impact new capital projects

Development of an analytical approach that is structured, repeatable and can be used by organizations across the industry, provides global access to a wider assortment of ways of doing work and outcomes that are not usually shared across organizations. This independent perspective allows a greater amount of learning, reduced bias due to institutionalized methods and provides a consistent bias upon which project performance can be measure for the industry. Additionally, because all projects are unique, the D-Risk tool will possess levels of flexibility that allow incremental value addition and modifications based on the specific requirements of the project team

Risk assessment generally provides a snapshot perspective of uncertainty on a project. It is then heavily reliant upon specific members of the project team to track, monitor and effectively close these risks. The D-risk tool is will decrease reliance upon subjective analyses of risk reduction and quantify this using a more data driven and transparent approach to risk reduction using an online, real-time dashboard that can be readily accessed and used for flexible and more accurate decision-making.

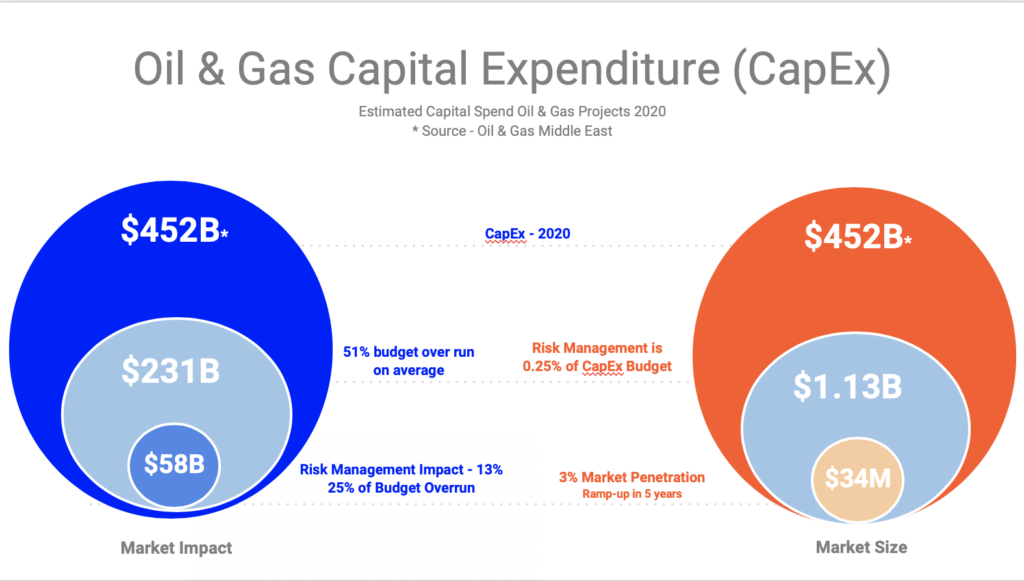

From sources approximately 6% of projects are under budget and the remainder are over budget by 51% resulting about $231B in cost overruns. With proper risk management the overruns can be reduced by at least 25% – which is $58B which is approximately 13% of the overall budget.

To look at Market size – we know that on average a project will spend ¼% of the budget yielding $1.13B spent on Risk Assessment. We believe that in the first two years we will be able to ramp up to 3% market penetration which is $34M.

Oil & Gas

Digital & Cloud Support – Working with our server provider to ensure continuous, safe and secure access to our software tool

Data Visualisation and Comms – Working with our clients to create bespoke reporting tools and real-time services at varying levels to meet customer decision-making needs

Business Development – Driving the sales, consumer awareness and client capture to ignite and maintain profitability

The above process becomes a ‘check-in-the-box’ exercise and a numbers game – moving the dot from the red section of a mostly arbitrarily assigned risk matrix towards a less red area of the risk matrix. At the end of the project, the dot may have moved into a green area, yet both the risk and the cost and schedule impacts associated with the risk have been realised, not flagged to management and is a complete surprise where the organization has no choice but to accept its fate. “We’ve already come this far!!”

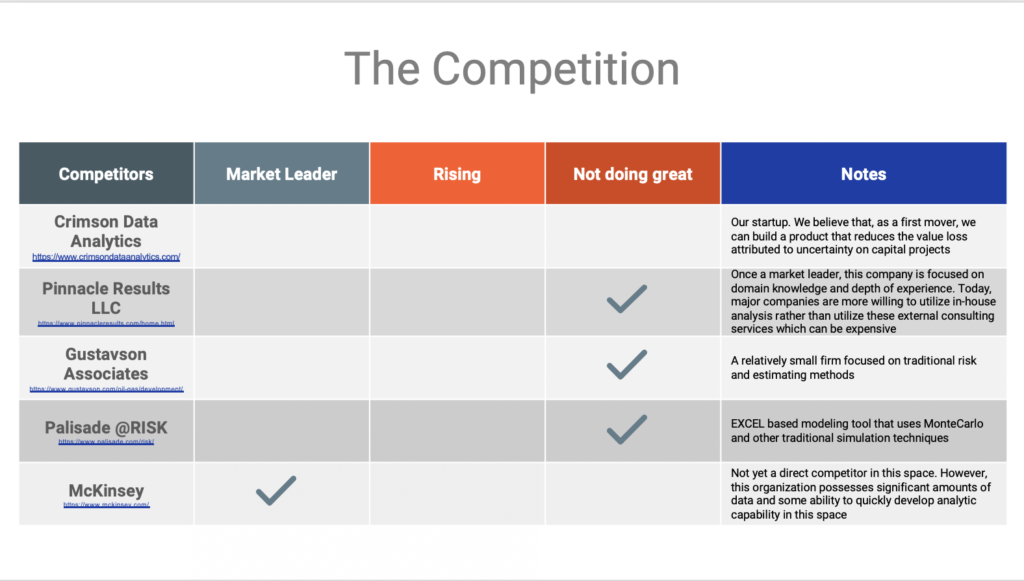

Pinnacle, Gustavson and @RISK all follow the above process in a repeatable and consistent approach. Client companies have begun to recognise the failures of this approach and, over the last 3-7 years have been attempting to develop in-house capability around the quantification of risk management and understanding how to correlate risk to cost exposure and drive more effective decision-making.

The company will launch in October 2020 (M1).

We have identified 3 major milestones

Month 3 (Dec ‘20) A local install of a simple web-based tool with a database of 100 capital projects – The database will evolve while working with clients, accessing their ways of working and gaining access to privately-owned historical data. Focusing on development in parallel with consultancy to build a customer base and garner input from the clients to feed the development

Month 9 (Jun ‘21) A cloud based version of D-Risk with a Project database of at least 300 capital projects. This product will be offered to companies as a subscription and will offer training workshops and consultancy to get them aware. They will use this through major milestones of a project Pre-Feed, Feed, Detailed Design and Construction Commencement

Month 12(Sep ‘21) D-Risk will include real-time tracking capability that analyzes uncertainty throughout the project lifecycle and provide continuous, actionable reporting and analysis

OVERVIEW OF THE SOLUTION

Today’s risk management process combines qualitative and quantitative approaches but with a focus on the qualitative.

Qualitative analysis today identifies risks and mitigating actions through access to knowledge in the room. However, this comes with bias from workshop facilitators, institutional focus and limited experience of attendees

Quantitative analysis today utilizes a Risk Matrix methodology to classify risk using consequence and likelihood estimates

Crimson inverts today’s risk management process to an agile, data-driven, quantitative focus.

Our approach brings accuracy through data analysis, repeatability and standardization and provides a clear, actionable path towards increased probability of project success. Through Crimson’s D-Risk™ cloud based solution, historical capital projects are analyzed to identify the key factors impacting Capital Projects and adapting these to your unique project.

Savings of 13% or more on overall project budget while maintaining schedule would be great accomplishment.

Would you primarily focus on upstream participants? or how downstream would this product/solution venture?

Great question Rebecca! Our intent is to start with upstream Oil & Gas projects. However, this process is ripe for scaling and subsequent phases of our analysis and offer (D-Risk) can be expected to address projects across multiple segments and industries.