Who’s Eating OpenTable’s Lunch?

Providing restaurants with an integrated electronic booking and table management system is no longer enough. In order for OpenTable to maintain its market leader position, the Company needs to increase its value proposition for both its online users and restaurant partners.

OpenTable was founded in 1998 by Chuck Templeton as one of the first major online reservation platforms for restaurants. Chuck had noticed how difficult it was for his wife to book a dinner reservation, as most restaurants at the time did not have computers and took reservations by phone. Through OpenTable’s online platform, consumers can now search through thousands of available restaurants in their local areas by party size, time, type of cuisine and seamlessly book a reservation without interacting directly with a restaurant. Furthermore, consumers can sign up for an OpenTable account that enables them to post reviews and accumulate points after each reservation to earn restaurant vouchers.

For the restaurants, OpenTable’s “Electronic Reservation Book” (ERB) replaces the physical reservation book, allowing managers to monitor their occupancy rate in real time via a computer terminal or iPad. The electronic system can also be integrated into restaurants’ POS system, which can collect customer information and tie reservations to sales. As a two-sided platform, OpenTable’s source of revenue comes from the restaurants. The Company’s most comprehensive product “GuestCenter”, charges a monthly subscription fee of $249/month and $1 /booking[i]. Customers can also opt out of the monthly subscription and OpenTable’s software management system and simply pay a referral fee of $2.50 / booking. OpenTable connects 25 million diners to over 45,000 restaurants each month[ii], offering diners (consumers) ease of booking and information gathering while providing restaurants with an integrated reservation management system.

OpenTable’s rapid growth, however, has come to a halt. Its parent company Priceline, which acquired OpenTable in 2014 for $2.6 billion, was forced to take a $941 million write-down on the Company in 2016.[iii] Over the last few years, companies like Reserve, Resy and Tock have come onto the restaurant scene claiming to provide more advanced technology platforms that are more customizable, easier to integrate and offered at a more reasonable price than OpenTable. Many of these new reservation companies offered a flat fee structure with no additional booking charge[iv], which could make a significant impact on the restaurant’s bottom line, considering that the average profit margin of US restaurants is ~5%.[v]

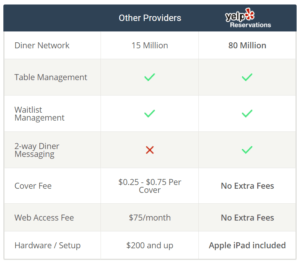

Perhaps the biggest elephant in the room has been success of Yelp, an online restaurant review platform with over 77 million monthly active users[vi]. Yelp ended its partnership with OpenTable in 2014 after acquiring NoWait and SeatMe, which allowed diners to make online reservations and signup for virtual waitlists of popular restaurants directly from the Yelp website. These acquisitions have helped Yelp expand its product offerings for restaurant owners to include not only marketing and advertisement but also an integrated reservation system for a flat fee of just $249/ month.

In order for OpenTable to maintain its market leader position, the Company needs to increase its value proposition for both its online users and restaurants.

- Offer free technology upgrades, reduced fees, and high-touch consulting services. As multi-homing on the restaurant side has become increasingly prevalent due to the free upfront system installation offered by the competitors, OpenTable needs to keep its existing restaurant partnerships by providing free software upgrades and eliminate $1 cover fees. The Firm can also unlock the massive potential of its database and provide more customized analytics services and insights for its restaurant customers beyond high level demographic and transactions data.

- Integrate with 3rd party review sites and improve its online reward system. Because most users access Yelp reviews first before making any reservation decision, OpenTable needs to improve the quality of its restaurant reviews. For example, OpenTable could aggregate reviews from credited food review sites and partner with companies like Google (which owns Zagat) to help online users make more informed decision during the research process. Furthermore, OpenTable can sponsor well known food critics to write about their favorite restaurant spots and encourage existing users to post in-depth reviews by offering tiered levels of rewards and perks. The addition of online users will encourage more restaurant signups and further fuel its online ecosystem.

Sources:

[i] OpenTable Website. https://restaurant.opentable.com/products

[ii] OpenTable Global Fast Facts. http://press.opentable.com/

[iii] Skift. “Priceline takes $941 million Write-down on OpenTable”. November 7, 2016. https://skift.com/2016/11/07/priceline-takes-941-million-writedown-on-opentable/

[iv] New York Times. “OpenTable Began a Revolution. Now It’s a Power Under Siege”. August 29, 2017. https://www.nytimes.com/2017/08/29/dining/opentable-restaurant-reservations.html

[v] Harvard Business School. “Optimization and Expansion at OpenTable HBS”. March 9, 2015.

[vi] Yelp Website. Company Factsheet (Q4, 2017) https://www.yelp.com/factsheet

Thanks for the great article, Cyou. I think there is an opportunity for OpenTable to increase revenue through ads. Just like Google, OpenTable could sell sponsored ads to restaurants for their brands to gain prominence in search results and be top-of-mind with consumers. For example, when a user searches for “Italian Food”, the first two or three hits could be specific restaurants that paid OpenTable for sponsored results for those key words. The additional revenue from a service like this could help OpenTable reduce or eliminate the cover fees that you mentioned are pushing restaurants to other platforms.

This is a timely discussion—Google just announced that it is selling off Zagat, finding essentially that its own restaurant ratings and information now adequately suit its needs. While Zagat was first to the aggregated restaurant reviews game, it looks like they won’t ultimately be the winner. OpenTable has often provided a valuable service as a way to easily search where there are options to eat for a specific group size at a given time—but that’s a relatively weak network effect when compared with better tech for the restaurant users, who generally don’t want to think of themselves in being in a commoditized business. While first to the aggregated reservations market, they may wind up being a similar loser to younger companies with better tech—or, as you suggest, they could partner or merge with Zagat.

Very interesting article. I really like how Opentable created value for both the diner and the restaurant. Although I can see cross-side network effect with more restaurants attracting more diners, as you pointed it multi-homing on both sides is very easy, especially on the diner side. This makes it very easy for a company like Yelp with a very good network to tap in it and produce the same service and value creation benefits as Opentable. I would be very curious how it pans out. As those platforms capture less and less value, the platform offering reservations might become an ancillary service.