Western Union: Leading or Lagging Digital Transformation?

As mobile payments and blockchain tech challenge the status quo of cross-border money transfers, Western Union must digitally transform itself at the right pace… or risk going the way of the telegraph.

Innovation or Extinction?

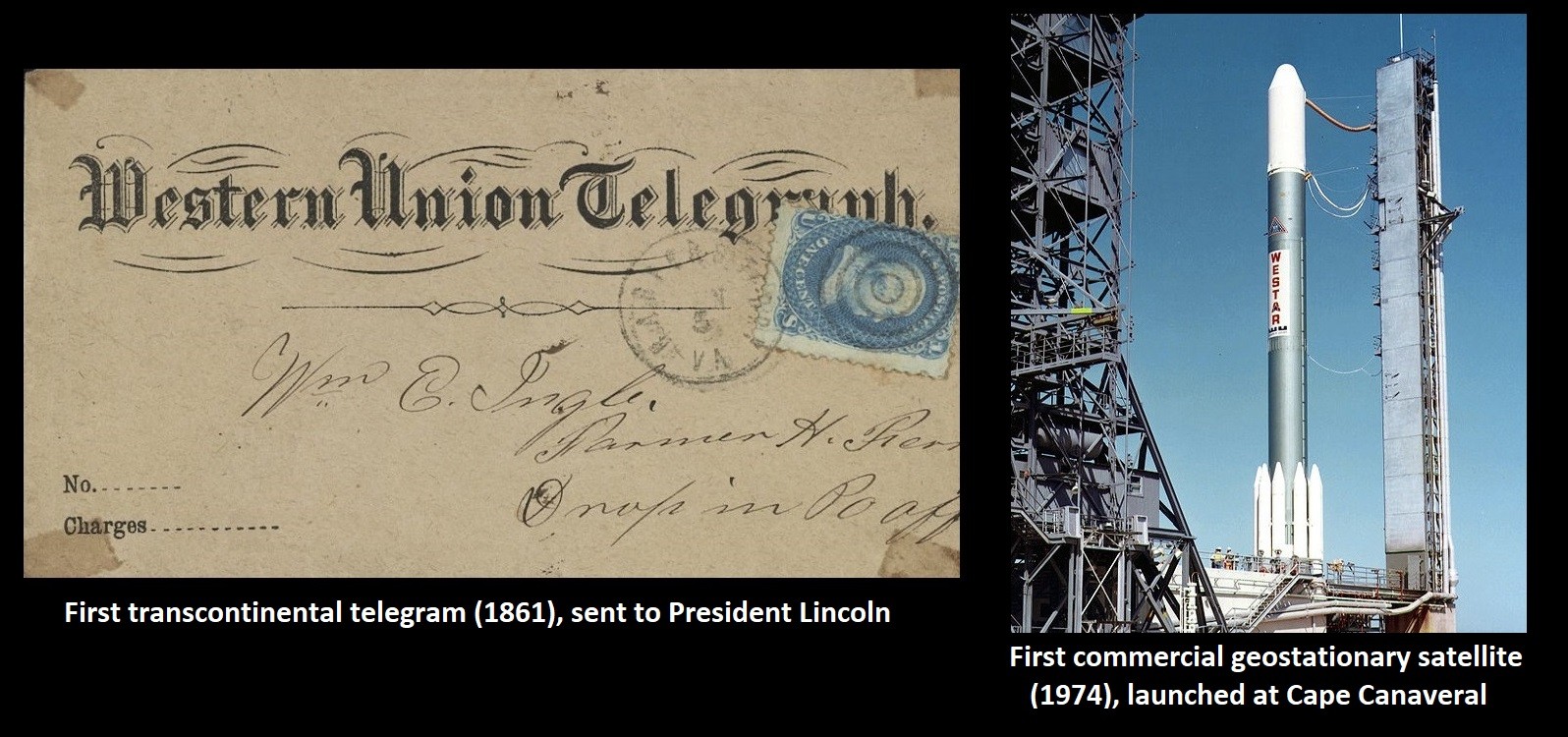

Western Union has innovated before. In 1861 it sent the first transcontinental telegraph. [1] One hundred years later, Western Union launched the first domestic commercial geostationary satellite (Westar 1). [2] But today, new technologies are threatening Western Union’s entire business model. And if Western Union doesn’t embrace and transform along with those technologies, it will fade away just like the telegraph. [3]

Multi-homing is a threat to current network effects

Western Union operates in three segments, with most of its revenues (79%) coming from the C2C segment: [4]

- C2C money transfers

- C2B money transfers

- B2B business solutions (cross-border and cross-currency)

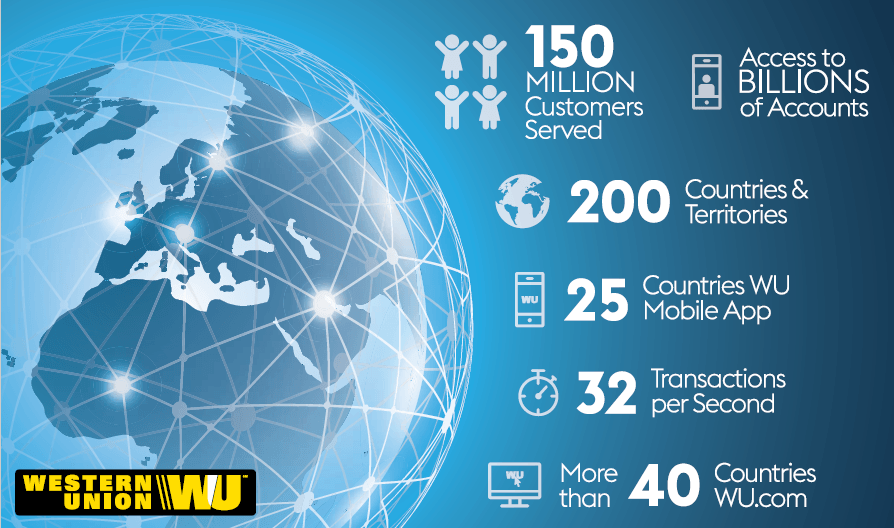

Western Union became the dominant player in cross-border C2C money transfers through a platform strategy—it connected people who wanted to send money across borders. Western Union built its platform by assembling a global network of third party agents. These agents typically manage retail stores across the world, and offer Western Union money transfer services in exchange for a commission. Western Union also opened franchise stores, which offer money transfer services as well as onsite currency exchanges. For decades, Western Union benefited from network effects as it added density and new geographies. Western Union now has more than 550,000 agent locations in more than 200 countries. [5]

But new innovators are highlighting a problem for Western Union: multi-homing is high with money transfers. Companies like Venmo (PayPal) and Zelle (joint venture by several large U.S. banks) have deep pockets, but so far are mostly competing in domestic payment markets. Meanwhile, innovators like Ant Financial (China) and M-Pesa (Kenya) are leveraging high mobile penetration rates in emerging markets, and are beginning to experiment with cross-border money transfers.

Blockchain products are bypassing regulatory barriers to entry

For decades, Western Union has defended its global position by investing in regulatory compliance. Governments pay close attention to cross-border money transfers, and heavily regulate these services to prevent fraud, tax evasion, and other criminal activities. In 2017, Western Union invested $200 million and 20% of its workforce on compliance functions. [6]

However, regulators can’t keep pace with the wave of new blockchain applications. Blockchain is technology that uses an open, distributed ledger to permanently verify and record transactions between two parties. [7] While cryptocurrencies are an obvious threat to Western Union’s cross-border money transfers, Blockchain also can be used in a range of imaginative ways. For example, De Beers is trying to create a diamond blockchain for registration and authentication, to prevent the spread of conflict diamonds. Others see blockchain as an opportunity to help emerging governments become efficient and transparent, for example, by serving as the official land title registration. [8]

Internal resistance to digital transformation

Western Union will likely face internal resistance from three sources. First, Western Union’s third party agents may try to thwart any concerted moves to digital platforms, seeing such a move as a threat to existing commission revenues. Second, Western Unions employees may not have the knowledge or training to effectively lead Western Union’s digital transformation, and may resist digital initiatives or operational changes. Finally, shareholders may punish Western Union for moving away from its higher margin core business to focus instead on simpler, lower-cost digital money transfers.

Recommendations

Top-down prioritization of digital transformation. Digital transformation in Western Union must be driven from the top-down. Many CEOs are lured into spending too much time on legacy businesses, which don’t need CEO oversight. Western Union must adapt to an increasingly mobile world: if Western Union doesn’t develop low-cost mobile money transfers, Western Union won’t be able to compete with new competitors like Ant Financial and Zelle. Western Union also is uniquely positioned to explore blockchain applications in emerging markets by leveraging Western Union’s retail footprint, regulatory compliance learning, and global brand. These initiatives will likely change Western Union’s operating model, therefore they must be fully supported by CEO Hikmet Ersek and should occupy most of his time.

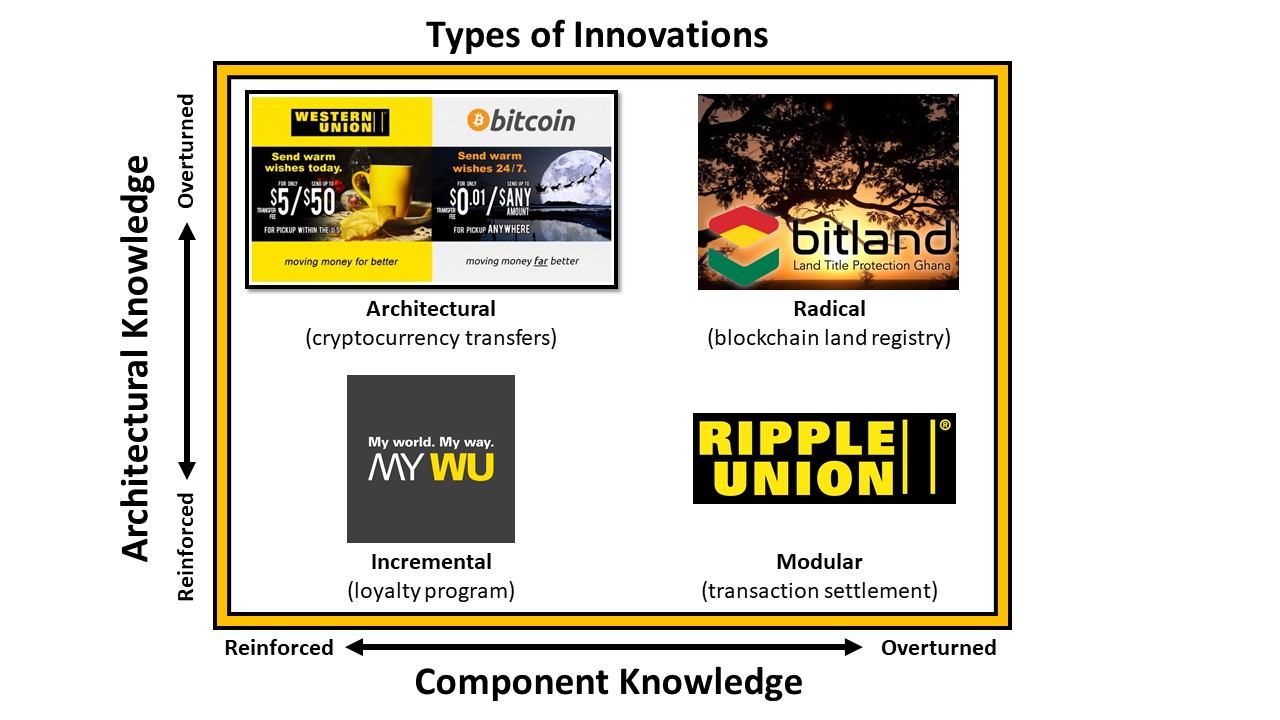

Reframe blockchain from a threat to an opportunity, by creating a new autonomous unit. [9] Western Union recently dipped its toes into blockchain. During its February 2018 earnings call, CEO Hikmet Ersek announced that Western Union “is experimenting with Ripple for settling transactions and for capital optimization,” and “is also testing Ripple’s native currency (XRP).” [10]

But Western Union is missing the true potential of blockchain for its business. Western Union is trying to use Blockchain as an incremental or modular innovation, when in fact it could be an architectural or radical innovation (see chart below) — introducing entirely new businesses that fit well into Western Union’s existing capabilities. [11] Western Union’s footprint of retail locations gives it a worldwide laboratory for experimenting with blockchain applications. For example, helping African countries develop official land registers could eliminate a huge barrier to investment and capital inflows (e.g., by resolving uncertain and disputed land titles). Western Union could use existing retail outlets as nodes on a land register blockchain, which could bring in new sources of revenue to those retail stores. Navigating complex land title issues would also leverage Western Union’s existing capabilities of dealing with a range of government regulations. This is just one example of how blockchain could be an opportunity for Western Union.

However, Western Union would be wise to form a new, separate unit for exploring blockchain services. If Western Union tries to grow its blockchain capabilities within current operations, internal resistors may directly or indirectly sabotage the initiatives. Instead, Western Union should fund and fully staff a separate unit that has preferential access to Western Union’s resources, but is not restricted by legacy operators within Western Union. This would help Western Union objectively pursue new blockchain opportunities, even if those opportunities eventually cannibalize or destroy its existing C2C business.

Continue to partner with popular digital platforms to provide legacy C2C money transfer services. Western Union has recently partnered with other digital platforms to expand its digital offerings. For example, in 2016 Western Union integrated money transfer options with messanging apps WeChat and Viber, allowing users to send small amounts of money through the apps. Recipients can choose to pick up the sent money at a Western Union location, or send the money to a digital wallet or bank account. [12] These kind of digital initiatives are good pursuits for current operational leaders, since they represent incremental or modular innovations to Western Union’s existing product offerings.

Sources for images: Western Union vs. Bitcoin, Bitland, MyWU, Ripple Union,

[1] The first transcontinental telegraph was sent on October 24, 1861, from the Chief Justice of California to President Abraham Lincoln. Sydney Mahan, “The First Transcontinental Telegram was sent to DC 155 Years Ago,” Washingtonian.com, Oct. 25, 2016.

[2] “Westar 1,” Wikipedia, accessed April 2018.

[3] Shelly Freierman, “Telegram Falls Silent Stop Era Ends Stop,” NY Times, Feb. 6, 2006.

[4] Form 10-K for the year ended December 2017, p.7.

[5] 2017 Annual Report—CEO Letter (noting Western Union has expanded its fund payout network to billions of bank accounts).

[6] 2017 Annual Report—CEO Letter.

[7] For a helpful overview of how Blockchain is being used in emerging markets, see Vinay Gupta & Rob Knight, “How Blockchain Could Help Emerging Markets Leap Ahead,” Harvard Business Review, May 17, 2017.

[8] David Thomas, “Beyond the Hype: What Blockchain could mean for Africa,” African Business Magazine, Feb. 26, 2018.

[9] Clayton M. Christensen & Michael E. Raynor, The Innovator’s Solution: Creating and Sustaining Successful Growth (Boston, MA: Harvard Business Review Press, 2003), Ch. 8 (“Managing the Strategy Development Process”).

[10] Jeff John Roberts, “Western Union is Testing Ripple and XRP for Money Transfers,” Fortune, Feb. 14, 2018.

[11] See generally Rebecca M. Henderson & Kim B. Clark, “Architectural Innovation: The Reconfiguration of Existing Product Technologies and the Failure of Established Firms,” Administrative Science Quarterly Vol. 35, No. 1 (March 1990), pp. 9-30 (describing four types of innovations — incremental, modular, architectural and radical — classified by their impact on a business’ core components and the relationships between those core components).

[12] Josh Constine, “Western Union Brings Money Transfer and Its Tricky Fees to Chat Apps,” TechCrunch.com, Feb. 4, 2016.

Thank you for this great post, Hans. This seems to be a typical BSSE case in which it is hard for the incumbent to disrupt its business, since the innovation may threaten the current profitable business. And the new business model may require a very different RPP (traditional money transfer process vs. transfer via blockchain). I also agree with you that the competitive advantage of Western Union is a broad network of retail footprint across the world. Most of the customers for remittance service (e.g. Filipino workers abroad), they need to bring physical money somewhere, and most of the fintech companies in remittance space don’t have their own channels (they often partner with local kiosks). Western Union can leverage such physical presence to win this new innovative space.

Unless they can feasibly use technology to improve their cost structure, I’m super bearish on Western Union. Their bread and butter business is charging hefty fees on remittances and their core advantage was a network of retail outlets and agents across the US and partners around the world to get cash from one family member to another. That system is fine in a cash based economy, but is becoming increasingly cumbersome as digital payments take hold in emerging markets. Furthermore, a chain of retail outlets is expensive. Western Union charges high fees since they need to cover rent and labor overhead. Meanwhile, new fintech players like Transferwise are able to offer cash transfer services for a fraction of the price since their operations are 100% online.