Vitality: A data-driven approach to better health

If you were rewarded to engage in healthy behaviors, would you take better care of yourself?

Vitality, founded in South Africa, is the world’s first health insurer to use behavioral economics and data analytics to incentivize customers to live healthier. In a world where insurance companies predominantly pay for sickness, Vitality’s innovative approach to pay for wellness is changing the industry.

Data analytics

Vitality follows a 4-step, data-driven approach to encourage healthier behavior:

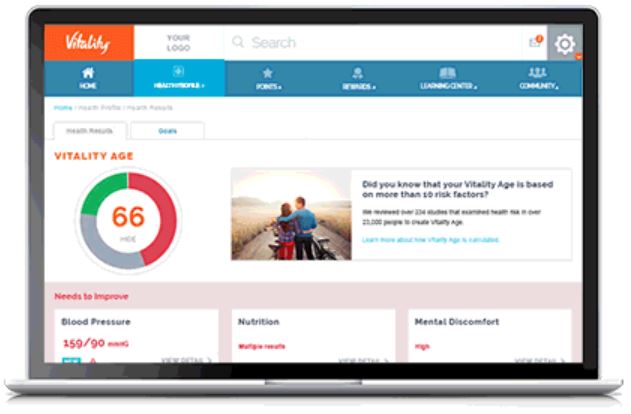

- Assess: A member’s first interaction with Vitality is typically a Health Risk Assessment that asks them questions on lifestyle behaviors (e.g., exercise level, eating habits, smoking, alcohol intake, mental wellbeing) and biometric markers (e.g., height, weight, blood pressure, fasting glucose, cholesterol) to calculate the member’s Vitality Age—a risk-adjusted age that takes these factors into consideration. 79% of people surveyed in the US have a higher Vitality Age than their actual age; a factor that serves as a powerful motivator for members to take corrective action to improve their health.

- Improve: Using the data gathered from the assessment, each member receives an individualized action plan called a Personal Pathway to make healthier choices. Members are empowered with the tools and resources needed to reach their goals. For instance, Vitality has a network of health and wellness partners that provide discounted access to Vitality members, thus making it easier for members to stay healthy and making it easier for Vitality to track members’ progress (more in step 3 below).

- Track: Vitality validates members’ progress through data. Vitality has integrated data feeds with all its network gyms, grocery stores, and biometric screening partners, enabling it to track customer behavior and health outcomes in real time. Furthermore, Vitality integrates with over 100 wearable technologies including Apple Watch, thus adding to the wealth of data that it gathers from its network partners to track members’ health.

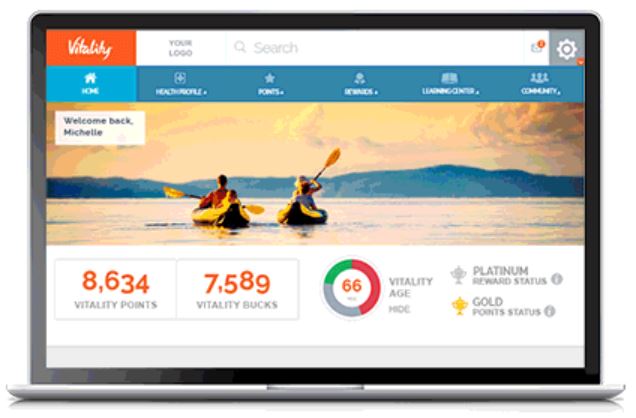

- Reward: Vitality rewards member engagement with Vitality Points, which can be redeemed for incentives including gift cards. Vitality believes that providing immediate rewards mitigates people’s bias to not take action due to the perception that making healthy lifestyle choices now carries an immediate cost while the benefit of improved health is only evident in the future.

Value creation

Vitality claims that their model leads to healthier lifestyles, better health outcomes and reduced costs. Increased engagement leads to reduced chronic risks, resulting in decreased medical visits and subsequently lower medical costs. Members and their employers (Vitality’s direct customers) benefit from improved financial wellbeing as a result. Vitality has found that their incentive-based solution can lead to a 40% reduction in hospital admission costs, 14% reduction in costs per patient, and 25% reduction in hospital stays. For instance, McKesson, one of Vitality’s customers, experienced the following benefits:

Value capture

Vitality captures value through its shared-value insurance model. Vitality measures health engagement clinically and actuarially, thus enabling it to dynamically price mortality, morbidity, and health risks. In other words, the data allows more accurate pricing at the start of a policy and premium adjustments based on a member’s engagement. This enables Vitality to provide lower price points, thus attracting healthier lives and encouraging sustained positive behaviors, thus leading to lower claims rates and subsequently lower costs. This has resulted in a “significant margin uplift” for Vitality based on Discovery’s annual report (Discovery is Vitality’s parent company).

Challenges

As a first mover in the incentive-based health enhancement space, Vitality will likely begin to face stiff competition, especially as healthcare moves towards value-based care in many countries. Another issue that Vitality might face is the notion of fairness—is it fair to reward individuals who are genetically predisposed to being healthy (vs. someone else who might be more engaged but not experience the same health improvements)? Finally, questions might arise on the extent to which Vitality leads to lower costs. While it makes logical sense that healthier lifestyle choices should lead to better health outcomes and reduced costs, I wonder about the extent to which there is selection bias on the company’s stated metrics. It is possible that patients who do well in this program are patients who are healthier to begin with. I would be curious to see more detailed results among subpopulations of patients with particular diseases and the extent to which they benefit from this program.

Sources

Discovery Annual Reports. https://www.discovery.co.za/corporate/investor-annual-report.

Vitality US Website. https://www.vitalitygroup.com/

Vitality UK Website. https://www.vitality.co.uk/

The Vitality Group: Paying for Self-Care. https://www.hbs.edu/faculty/Pages/item.aspx?num=38451