Venmo: What’s Cash?

Venmo replaces cash and checks with a digital peer to peer transfer app and is spurring the shift towards the digital wallet

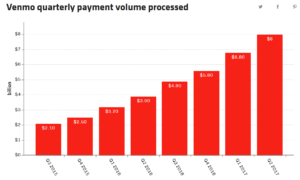

It’s hard to imagine attending business school in a pre-Venmo world. Today, Venmo has become so routine among millennials that it’s easy to forget the days of “which bank do you have?” “Let me search for my checkbook” or “I owe you $10 when I get cash.” To “Venmo” has become a verb and this year $40B in transactions is expected to be “venmoed”.4 To get to this point was not an easy ride, however. It was one filled with credit card fraud, money laundering, and skeptical users. But what could be so compelling that users are willing to give all of their bank account information to a startup? Walking through the customer experience of transferring money through a bank account verse through Venmo illustrates why.

Source: Recode.net

Transferring through a bank account

A group of friends share a dinner and the restaurant cannot split among five cards. One friend pays and the others promise to pay her back. At a best case scenario, the friends all have the same bank. Each friend logs into their bank account entering username and password information, goes through a few clicks to get to transfer, look up the friend’s phone number and triple checks to make sure the number is correct, then transfers the money. If the friends don’t all have the same bank, they may have to pay transfer fees and wait several days for the money to clear. Chances are at least one friend forgets to transfer leaving the friend that is owed money in an awkward position.

Transferring through Venmo

In the same scenario, the friends don’t even ask to split the check. One friend offers to pay, everyone else immediately pulls out their phones and without logging in, transfers money in a few clicks, picking fun emojis to represent their. Because most people login through Facebook or use the “friend” feature, finding friends is easy and you can assure you have the correct person based on their picture. Friends who you interact with most rise to the top of the list making it even easier. Money is immediately deposited into your Venmo account at no cost and is ready to use. If that one forgetful friend does not pay right away, the friend who paid can send a Venmo request for the amount owed as a gentle reminder. Friends can then see a live feed of off their friends’ transfers making it a fun social experience. There is also a virality aspect to it in that no one wants to be the one friend that doesn’t have Venmo so even people who are concerned about security breaches are often peer pressured into downloading the app.

Moving beyond peer to peer payments to caputre value

Venmo was acquired by Braintree in 2012 for $26.2M1 which was later acquired by Paypal in 2014 for $800M2. It has since become clear that Venmo will not stop at peer to peer payments. They announced in October that users can shop and pay with Venmo at over two million online US retailers3. Venmo will offer purchase protection on items purchased. The Venmo feed will then display the retailers name and logo providing valuable exposure to the retailer. Venmo will charge the retailers for this service. This is a significant shift toward their goal of becoming a digital wallet and helping “consumers spend wherever and however they want to pay, regardless of device.3”

Venmo’s value stretches beyond typical retailers as well. Service providers can accept tips from customers who do not carry cash and charities can accept donations with the click of a button making it easier than ever to donate3.

While Venmo is currently winning in the peer to peer payments space, the question remains if they can sustain their spot at the top. A consortium of top banks including Bank of America, Wells Fargo, and JPMorgan Chase have created their own peer to peer system called Zelle5. While they claim that almost 100,000 consumers are downloading the app every day, it is unclear if they will be able to steal share from Venmo5. As of today, Zelle is unheard of by many and has a rating of 1.7 stars in the Android store as opposed to Venmo’s 4.7. With little to no friction in the Venmo user experience it will be interesting to see what angle the large banks take in order to steal share.

Sources:

- https://techcrunch.com/2012/08/16/online-payments-service-braintree-acquires-venmo-for-26-2m/

- http://fortune.com/2016/07/13/paypal-venmo-millennials/

- https://techcrunch.com/2017/10/17/venmo-users-can-now-shop-online-anywhere-paypal-is-accepted-in-the-u-s/

- https://www.recode.net/2017/7/26/16044528/venmo-8-billion-transaction-volume-growth-rate-chart

- https://techcrunch.com/2018/01/29/u-s-banks-venmo-alternative-zelle-moved-75b-last-year-says-100000-people-enroll-daily/

I think you bring up a really interesting point about whether Venmo will be able to maintain its current position. Whenever I see my bank prompt me to download Zelle, I think to myself “Why would i do that. I have Venmo”, but to your point, perhaps at some point, apps such as Zelle will have more credibility. To that point, I wonder if Venmo would consider partnering with any of the larger banks?

Very interesting post! In addition to Zelle it feels like there are several other start-ups trying to capture value in this space (e.g., Splitwise). Tough when you have to navigate competitive threats from both well-capitalized incumbents (e.g., the partnership of the big banks) and scrappy start-ups. I am particularly struck by the valuation expansion between the Braintree and Paypal acquisitions — hopefully the founders kept reasonable equity in the initial transaction — drives home the concept of value capture not just from the company perspective, but also from the entrepreneurs perspective.

Super interesting post JC.

I guess, from my own personal perspective as an international student : Venmo is “THE” american innovation that made my daily life easier.

That being said, it also prompted the question of why such a great model has been exported yet. As of today, Venmo only works in the U.S.

I wonder whether this has to do with market dynamics or Venmo’s strategy. For instance, in Europe bank transfers are completely free across Euro countries (result of European commission’s regulatory pressure). Would Venmo still try to make the jump though ? Would love to hear your thoughts.

In my opinion, it all comes to “friction”. The US market had lots of it, enter Venmo to solve the problem. But does Venmo has an actual competitive advantage in a market with slim-to-none friction. How many people will install yet another app given that they already have a bank app on their phones that does it all. Is Venmo “constrained” to its domestic market then ?

Thank you for sharing. I always find fin-tech very fascinating. I think it will be very interesting to see Venmo expand their service coverage even further. I believe Tencent pioneered this already with WeChat. In China people not only make payment and send money using WeChat. The application also allow people to save money and earn interest. Furthermore, there is also an option for people to invest their money through WeChat. However, given the nature of the customer I’m not sure if Venmo could move into that direction. It will be interesting to see them partner with someone and offer such service.

I am addicted to this app!! To your point, it has revolutionized the peer-to-peer payment world in ways that PayPal was unable to do. Despite PayPal’s global reach, in my opinion, it missed the mark on the “ease of payment” factor. Venmo took that extra step to make it more convenient and “fun” for people to find each other and pay (the social factor). After acquiring Venmo for $800 million, I am still surprised to see that it has yet to launch its application (or a similar one) into international markets. I believe this has much to do with the restrictive regulatory landscape in different countries and the liability that comes at a cost of convenience. There are many fintech start-ups that are trying to penetrate the P2P space, my guess is that once these small companies manage to navigate the regulatory hurdles, there may be room for acquisition opportunities, especially in emerging markets where mobile penetration is significant.

Thank you for the interesting post. I really see this as a great example of how incumbents (i.e. large banks) failed to respond to disruptive innovation. Banks are generating revenue through transaction fee via transfers among banks, therefore building business like Venmo will hurt their profitability. It is also challenging for them to come up with a system in which other banks can agree on, and that is why it took a long time for them to launch Zelle. My only concern on Venmo is profitability. Although they are expanding their business scope as you mentioned, I’m not sure shopping via Venmo will attract consumer needs. So many e-commerce players already exist in the market and I don’t see a strong reason to use Venmo instead of such services.

Thanks for your sharing! I do think that venom makes my life easier! I agree with you that Venmo is a winner in peer to peer payments market, and so glad to see that they are also moving to retails by cooperating with two million online US retailers. I am wondering that whether Venmo also has interest in expanding the offline payment market. Unlike Alipay and Wechat Pay are transforming China into a cashless society, it seems that the offline payment market via mobile is still an untapped market in US.

Thanks for a great post! Glad that Venmo is finally finding a sustainable way to monetize by moving into the retail space. This may amp up the competition from banks though who may feel that Venmo is encroaching too far, especially if consumers are holding large balances on their venmo account and foregoing transactions on cards. Definitely want to reiterate your concerns at the bottom — Zelle may be a new service but it has already moved $75B in 2017. Further, Zelle has the advantage of being bank to bank transfer — meaning the money shows up in your account the same day or the next day– which can be valuable for customers who want to keep a minimum balance in their bank or for customers who want to manage their pool of money from one location. Additionally, Zelle is offered as the default service amongst banks now. Even for those die-hard venmo users, the switching costs to Zelle are so low that circumstances that compel you to do a bank transfer once or twice might be enough to get you to see no additional value in using Venmo.

Our case and class discussion on Ant Financial got me to revisit your blogpost on Venmo. Both Venmo and Ant Financial started as a pure-play peer-to-peer payment solution that aimed to disrupt incumbents through affordability, mobile-friendliness, and convenience. Fast forward to today, and Venmo is still “product” company while Ant Financial has evolved into a platform business with multiple growth opportunities and valuable data assets. To me, the key difference was the presence of an “ecosystem partner” to sustain the growth and competitive advantage of the product of interest. Without a channel partner (e.g., Alibaba for Ant Financial), Venmo may find it difficult to differentiate and grow in the increasingly commoditized peer-to-peer payment market.