(Turn) Off the Press: The New York Times is Winning with Digital

The New York Times has used digital innovation to maintain its quality and reached new subscription highs despite significant headwinds in the newspaper industry.

NEWS…PAPER(?)

Newspapers and the news media industry more broadly stands as one of the top sectors facing digital disruption today. The rise of free, digital-only news sites and a shift in eyeballs toward social media is significantly hurting newspapers’ circulation and advertising revenues. According to The Atlantic, print newspaper advertising revenue fell from $60B to about $20B between 2000 and 2015 [1]. Print newspaper subscriptions declined 32% over the same time period, falling from 56M to 38M [2]. Despite some gains in digital circulation and revenues, the impact of these changes is been net negative, with overall newspaper revenues declining 90% from 2000 to 2015 [3]. As the chart to the right shows, this decline has made circulation revenue, especially digital circulation revenue, an increasingly important component of newspapers’ overall top line.

Amidst these headwinds, The New York Times (NYT) has risen above its incumbent competitors as an example of a successful digital transformation. This post will will explore the key elements of NYT’s transformation, analyze the resources, processes, and priorities that made it possible, and assess how its strategy has outperformed competitors.

A HEADLINE-WORTHY TRANSFORMATION

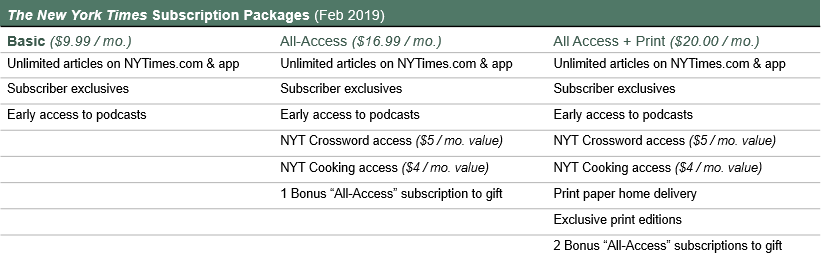

The New York Time‘s digital transformation began with its highly-publicized decision to create a digital paywall in 2011. This was followed by a proliferation of subscription packages and products, including the three tiers of news subscriptions seen below and separate subscriptions options for Crossword and Cooking content [4]. The NYT Cooking app is a prime example of the company’s growing competence as a digital digital creator; a digital recipe book, access to 19,000 recipes, easy-to-follow cooking guides, and a constantly growing number of technique videos are all provided to subscribers for a small monthly fee. Other notable digital moves include the company’s 2015 distribution of VR cardboard headsets to subscribers, the start of its first podcast, The Daily, in 2017, and the launch of three TV series through Hulu and Amazon [5].

This transformation was made possible by a digital strategy with a clear focus on subscribers (over advertisers), strong leadership support for digital priorities, investment in key resources, and a revamping of company processes. The company’s digital strategy and priorities were formally outlined in 2015 by the paper’s leadership in a plan called Project 2020 , which emphasized using innovative, high-quality digital content to attract and retain subscribers and double digital revenue to “at least $800M” by the end of 2020. This plan was and is important to the Times’ digital success because it made clear that digital innovation beyond the company’s print news core was the company’s top priority, and outlined specific goals to get there (e.g. mobile innovation, the development of new multi-media skills, and integrated ad development) [6]. Without such a clear, leadership-supported plan, the transformation would likely have failed.

Investments in people and technology made reaching these goals possible. The company has invested heavily in modernizing and integrating its data environment to enable data-driven decision making, and has also invested in machine learning capabilities [7]. On the people side, the company has focused on hiring more tech talent and boasts that “no other newsroom in the world has more journalists who can code.” [8] All these resources are leveraged on cross-functional agile teams that operate on two week sprints to develop MVPs for rapid testing. Legacy practices (e.g. a totally independent newsroom, consistent front page formatting) continue to pose challenges to new ways of thinking, but a clear culture shift is happening as cross-disciplinary teams are beginning to co-locate and innovation is flourishing off the front page, such as on the Cooking app show to the right [9].

REPORTING WINS (FOR NOW)

So far, The New York Times‘ digital bet is paying off. In 2019, the company added more than 1 million net new digital-only subscribers, reached an all-time high of 5.2M total subscribers, and met it’s $800M digital revenue target a year earlier than expected [10]. The company’s stock price has responded accordingly, increasing 60% in the last six months to a nine-year high [11]. These successes come just a year after unexpected layoffs at digital natives, BuzzFeed, AOL, Yahoo, and HuffPost led to questions about the financial feasibility of any digital news organization [12]. With operating profit down from last year and ongoing concerns about how to cover their cost-intensive reporting style, The New York Times is by no means done with its digital transformation – but it has set itself up for success to continue innovating in the years to come.

[1] Thompson, Derek. 2016. “The Print Apocalypse Of American Newspapers”. The Atlantic. https://www.theatlantic.com/business/archive/2016/11/the-print-apocalypse-and-how-to-survive-it/506429/.

[2] “Trends And Facts On Newspapers | State Of The News Media”. 2020. Pew Research Center’s Journalism Project. https://www.journalism.org/fact-sheet/newspapers/.

[3] Ibid.

[4] “The New York Times: Digital And Home Delivery Subscriptions”. 2020. Nytimes.Com. https://www.nytimes.com/subscription/multiproduct/lp8XKGC.

[5] “1835—2018 | The New York Times Company”. 2020. The New York Times Company. https://www.nytco.com/company/history/our-history/.

[6] Nytco-Assets.Nytimes.Com. https://nytco-assets.nytimes.com/2018/12/Our-Path-Forward.pdf.

[7] “The New York Times Is Winning At Digital”. 2020. FROM, The Digital Transformation Agency. https://www.from.digital/insights/new-york-times-is-winning-digital.

[8] “Journalism That Stands Apart”. 2020. Nytimes.Com. https://www.nytimes.com/projects/2020-report/index.html.

[9] “The New York Times Is Winning At Digital”. 2020. FROM, The Digital Transformation Agency. https://www.from.digital/insights/new-york-times-is-winning-digital.

[10] “New York Times Sets Company Record For Digital Subscriptions In 2019 | Subscription Insider”. 2020. Subscription Insider. https://www.subscriptioninsider.com/news/new-york-times-sets-company-record-for-digital-subscriptions-in-2019-6827-1.html.

[11] Ibid.

[12] “Digital Media: What Went Wrong”. 2020. Nytimes.Com. https://www.nytimes.com/2019/02/01/business/media/buzzfeed-digital-media-wrong.html.

Excellent post – I find it more impressive that this type of digital innovation was able to happen in an industry that is notoriously slow to catch up with digital trends. I think one additional factor to the NYT’s success was the changing consumer behavior. There was a time when free content was what online consumers, especially young consumers, expected. Why pay for a subscription when I can get my information for free (and just a click away)? But NYT saw this trend changing – they knew free 1) wouldn’t last forever and 2) couldn’t beat quality. They were willing to bet on quality content AND on the consumers who first starting buying into the notion of pay-for-digital-content, who believed quality content creators deserved to be compensated. Now, that payment/subscription model seems to be the norm and NYT excellently set themselves up for success as more and more individuals are willing to pay.

Great post – I wonder how its digital transformation has impacted the content of their journalism. While its subscription-based, I would imagine that they would still need to publish ‘buzz-worthy’ content to keep their audiences engaged, and retain their paid users. Has this come at the expense of journalism that is perhaps not the most ‘sexy’, but nevertheless important for the public and integrity of the press?

It’s so impressive to see how the NYTimes really was able to switch gears and update their traditional business model by really investing in getting the digital strategy right and then backing it up with the appropriate resources, priorities and processes to execute on their strategy. Looking forward, as their competitors similarly expand towards paid premium and curated content, I’m curious as to how the NYTimes will look to differentiate itself and continue to get share of the customer wallet. This post reminds me a lot of the streaming wars in TV right now where many of the TV channels have launched their own subscription based platforms. One big question remains on how customers will react – will they be willing to have multiple subscriptions with specialized content or look for a more general content provider. I see NYTimes potentially having to compete not only with it’s more traditional sector players (Wall Street Journal, etc), specialized players (Financial Times, The Economist, etc), but also with overall content subscription (Netflix, Spotify, etc). What if Netflix launches a news channel? Will consumers be willing to have all of these platforms as the lines between content blurs?