TrueCar: data-driven car buying

Overview

TrueCar’s missions is to transform the car-buying experience through a platform to improve transparency. The driving force shaping this new experience is the consumer’s perception of the stereotypical “used car salesperson” and the inevitable information asymmetry associated with used car buying. TrueCar’s aim is to mitigate these issues by providing reliable information to consumers and at the same time, offering a better online car browsing/selling tool for dealerships. The TrueCar platform is built around market data – intelligently using market data to analyze and see what others paid in the area for a new or used car of a given make/model/trim/mileage. The bell curve below shows TrueCar’s car search and the price report output for a Honda Civic Hybrid, indicating 3 certified dealers in the area that will honor the guaranteed savings off of MSRP. Note: only TrueCar Certified Dealers are shown.

Interestingly enough, the average market price paid for this Honda was actually roughly $250 less than the TrueCar Estimate, indicating the TrueCar certified dealers are not pricing at or below the market. However, TrueCar also provides price trends – the graph below shows that since June 2015, TrueCar dealers have beat the average market price, on average, by more than $1,000.

TrueCar is driven by petabyte-levels of big data run on Apache Hadoop to analyze data on car sales from a number of third parties. Residual values of leased cars are also monitored. Up-to-the-minute market data feeds an algorithm and integrates with other proprietary data (likely data related to pricing information from certified networks and external networks) to produce a pricing bell curve and trends over time. They claim they have 99.1% statistical confidence that the projected average price paid in a given week is within $20 of the average of all nationwide sales during that week for a particular car.

Value Creation

TrueCar creates values for consumers by creating a no surprises car buying experience. Automotive ecommerce is traditionally a poor experience but TrueCar’s elegant search and visualization tools give the user an ability to browse across dealerships. TrueCar touts an average savings of $3,221 off MSRP for consumers and 60 minutes of time saved. On top of that, users spend less time browsing inventory for a fair price, less time with pushy salespeople, and less time negotiating. The service gives users piece of mind with upfront pricing power which, when taken to the dealer, translates to guaranteed savings off MSRP.

On the other hand, dealers can sell more cars, cost-effectively. TrueCar creates value for their dealer network by giving them access to a saavy, informed consumer market that is typically ready-to-buy and not interested in a prolonged sales process. Auto sales are competitive, new car margins are low, and customers are highly-informed on price – TrueCar’s additional marketing channel helps dealers set prices to push inventory when necessary.

Value Capture

TrueCar is free for consumers to register and browse. Two million cars have been bought through TrueCar to date. TrueCar captures value by charging dealers $299-$399 to join the Certified Dealer network. Currently more than 10,000 dealers participate. TrueCar also integrates with USAA, Consumer Reports and Amercian Express to give their members better car-buying experiences. It is unclear how much value is captured from this segment.

Operating Model and the Future

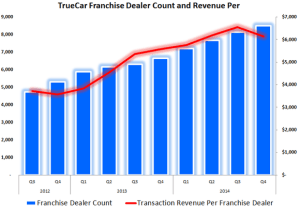

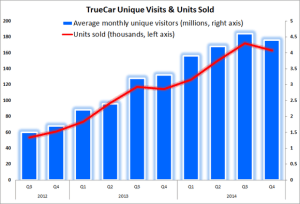

TrueCar’s operating model has shifted over the years. Initially, they alienated some dealers by effectively creating a platform to pit dealers against one another to sell vehicles at the lowest price. While this was great for TrueCar’s early adopting consumers, dealers were squeezed and TrueCar altered the operating model so dealers can no longer see each other’s offering price. Today, they have an extensive network of dealers participating and there has been steady growth in both users as well (see graphs below from the company’s 4Q 2014 presentation). Some dealers are threatened by TrueCar’s digital business model but they now have a third of all U.S. dealers in their network and their TrueCar-associated sales is increasing as shown below.

TrueCar exhibits great network effects, however, I’m worried about keeping consumers satisfied. Historically they spend >50% of revenues on marketing but consumers demand increasing transparency and it is unclear how much TrueCar actually saves consumers over other means of search and negotiation available. There are similar buying/pricing services emerging which give consumers a price guarantee or “what’s fair” benchmark. Search costs are increasingly lower with these new digital services and multi-homing is a problem.

TrueCar’s business model is a challenging one. Since its founding, the company has raised more than $200M in VC funding. They aren’t cash flow positive and struggling financially. Moving forward they should focus on leadership in the market for automotive data now that they have been at this since 2005. I think significant opportunities exist to monetize their data moving forward and perhaps pursue adjacent business models and encroach on Edmunds or KBB. They can also continue to monetize their data model through more B2B partnerships with banks and employers.

Love the idea of bringing transparency to an opaque market. Car sales are so deeply entrenched in gov’t legislation that only wide-spread transparency can make purchasing a car feel less dirty.

I like the idea of TrueCar, but I agree with you that the main benefit to car buyers seems to be the process efficiency as opposed to a better deal. That being said, CarMax took off based on transparency in this industry, so I hope TrueCar can leverage its network effects and similarly become a household name due to the many customers looking for an easy process. It will be difficult in an industry with repeat purchases only happening every 5-10 years or more in most cases, but if TrueCar can leverage its network effects, it seems like it might become a key piece of the car buying process.