Squaring off the Competition: How Square is Changing Transactions

Square: we’ve all seen it. Every farmer’s market, every craft fair, every food truck. But this revolutionary piece of hardware has exploded into a network of innovative solutions infiltrating all parts of the transaction sector. Ranging from near invisible hardware solutions, to elegant software interfaces, Square has the potential to revolutionize the future of transactions.

White Space: White Square

Square initially started as a solution to a growing problem: mobile businesses without mobile payments. In 2009, the connectivity offered by social media and the Internet offered more accessibility for people to start businesses, but the necessities of running one were still grounded in the mindset of “brick and mortar.” Because credit card machines could only work with grounded connections, remote merchants could not access digital payments. This was where Square was key. They entered the market with a solution; replace the clunky, permanent hardware of the credit card machine, with a sleek, agile accessory that was inserted into the audio jack of any smartphone. With free hardware, and only a 2.75% transaction fee, they quickly divorced the merchant from the shackles of digital wires. What once was a mess of antiquated hardware and opaque pricing, was now as simple as the swipe.

“Start Selling Now”

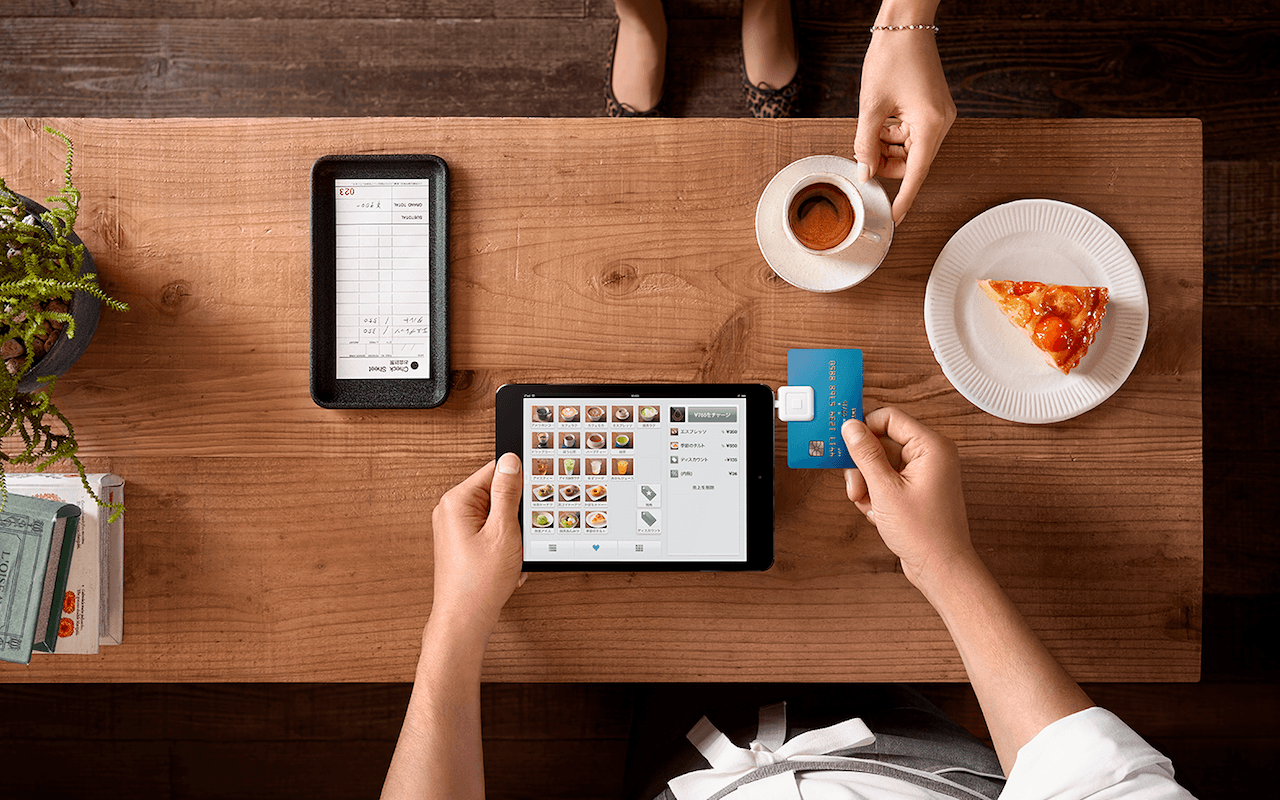

Square could have easily continued to operate as merely a hardware mediator for credit card access, but the company co-founders, Jack Dorsey and Jim McKelvey realized there was an untapped opportunity; untangling the convoluted world of commercial transactions. And was the moment in 2011 that Square launched Register; a small piece of hardware that fit onto the iPad, and transformed it into an instant register. This shift to dominate another piece of the transaction landscape led Square to go from only operating in the world of micromerchants, to emerging as a disruption in the restaurant space. Initially processing $1 billion annual payments with the phone Reader, the inception of Register exploded its sales to $12 billion.

The successes of these innovations were multi-faceted. As hardware, the infrastructure for payment processing was no longer a large investment for a specialized machine, but an add-on to digital real estate we already own (iPads, iPhones, etc.). This also meant that as long as someone had the Square app, they could be a transaction node as well; any employee could serve as a point-of-sale. No longer were the moments of selling confined to a static piece of infrastructure.

Another moment of value was in Square’s offering of transparency. Unlike previous processing solutions where a contractor had to come and install the credit card machine, and its software was managed by the card company, Square allowed the merchant to be able to control their point of sale, and clearly understand the process to every transaction; they removed the black curtain. Naturally, this gave them the opportunity to innovate in the backend, and start to utilize the data collected to provide analytic solutions for merchants. Cue an entirely suite of new Square services: Dashboard, Employee Management, and Payroll. Now, there was finally a marriage between sales and management. And because of the interoperability of all the software, all steps required to run the business could finally speak to each other.

The Future of Transactions

Perhaps the most innovative moment in Square’s trajectory though, wasn’t their ability to innovate in the merchant sale space but rather their shift away from sales and to new types of transactions; effectively allowing them to “own both sides of the counter.”

The beauty of digital transactions is their nature to be trackable, interoperable and fluid. The newest group of Square products strive to achieve this in the consumer market. Square Cash, is a peer to peer payment application, that is linked to your debit card or bank account, and allows for direct payments to other users, and receiving payments from non-users as well. Venmo-like easy payments, but with the use of “cashtags (linked usernames)” and the brand of Square. Now Square has digital real-estate in the phones of its consumers, the same people who used its interface to pay their merchants.

What is interesting in this shift is not Square’s desire to have a stake in the consumer transaction market, but the possible marriage of the payment infrastructure two players; the customer and merchant. Currently, that symbiosis is the credit card, but a physical piece of plastic seems antiquated when looking at the new relationships formed by a digital transfer. Because now, for the first time, Square has the possibility of eliminating the intermediary, the credit card, and serving as a point of value exchange between a user’s mobile phone, and the merchant’s digital interface, without the need for extra hardware. This is the future of transactions.

Fair and Square

Square has attempted to innovate in this middle space with products such as Caviar (an ordering app that allows pre-ordering and instant restaurant pick-up), Square Payroll (an tool for business owners to process payroll for employees), and the newest piece of hardware, Square Contactless and Chip Reader (hardware that accepts Apple Pay and chip cards). Although the credit card has yet to disappear, and some of Square’s products have discontinued (Square Order in 2015), it seems like the company has set itself up in an opportunistic space to become the forefront leader in dominating the entire transaction cycle.

http://www.fastcompany.com/3033412/internet-of-things/back-to-square-one

http://www.fastcompany.com/3033453/match-or-mismatch

Beautiful post! Would you argue that Square’s innovations beyond the credit card reader have been successful? As a user, I am indifferent to whether the merchant swipes my card with Square or something else. Is Square well-positioned to take advantage of NFC technology, if that really takes off?

Other than the investment in the card reader, are merchants really tied to Square as a platform? Are they getting more from them than they do from other payment processing platforms? That seems like a good place to offer differentiation if you’re Square. Otherwise, I could see merchants having no problem switching hardware to whatever the latest greatest option is (e.g. paying via ApplePay + AppleWatch via NFC). Thank you for sharing 🙂

Fantastic that you mentioned that actually….http://techcrunch.com/2015/06/08/square-apple-pay/

I think what’s happening is that Square is realizing exactly that, and trying to be as invisible and inclusive as it can in the payment process. And if that means the addition of incorporating Apple Pay, might be a good move. I think what’s interesting is that they’re viewing other payment processes the same way they do credit cards; additional interfaces to be processed and interpreted by their software and hardware. So I’m not sure how their payment services will take off (seems like they’re struggling a bit now actually), but they seem to be trying to set up the web from now regardless.

Thanks for the comment!!

I’m really interested in the evolution of payments, so I loved your article. I liked how you proposed that we may not need or use credit cards in the future if technology like Square and Venmo continue grow. This is an awesome way to think about the progression of payments. I think most users are indifferent to payment method except when it comes to rewards. Most credit card companies and banks compete on points, miles, reward cash, no international transaction fees, etc to get users to sign up for their card and use it. Right now it seems that services like Square Cash and Venmo are really competing on convenience. As you’re able to buy more things with these services (Pay with Venmo is coming in the future), do you think they will begin to offer rewards? Do you think they’ll target the low credit or under banked population?

Thank you! You bring up a fantastic point about the perks of credit cards that currently seem to be missing in the landscape of other payment interfaces. I think that companies like Square and Venmo have such a good opportunity for tapping into really specific data collection and offering much more curated rewards, points, discounts etc. because if they can really start to serve as full-stack payment methods, they might be able to make connections between merchants and vendors that weren’t otherwise possible. Plus, the ability to tap into the organic relationships we have with our phones, instead of laying dormant in a piece of plastic could give them even greater digital real-estate to utilize for the benefit of both the customer and merchant; rewards as advertising perhaps? Great thought Anndrea!

I really enjoyed your post, and I agree with you your assessment of how square is changing the way we generate transactions. Furthermore, coming from a developing country I can see huge potential to increase non cash transactions in regions where smartphone penetration is high, but there is low banking penetration (e.g. most countries in Latin America). I wonder which company will win that battle in emerging markets. The question I have for you is if you think that square will be able to remain as the winner of this new market or competitors like Amazon and PayPal will take a large portion of sales with lower prices.

Thanks Ximena! Great point. I think you’re right to ask your question about developing countries and access to capital. I wonder if Square’s hardware offerings could help or hurt them in these economies. Because the largest part of their business currently is through the hardware used to process credit card payments, in countries where people don’t have credit cards, this model seems useless. If they head in this direction of direct payments, and provide cheap infrastructure for that, then maybe they have a chance against the bigger names in person to person sales, especially since Amazon and PayPal are still predominately only online transactions. Thanks for the comment!