SHAZAM – The Rhythm of Music and Data

The tradeoff between one’s privacy and an enhanced user experience is often considered within the context of such large corporations but there are much smaller companies that also rely on big data to enhance and monetize their business. One such company is Shazam.

Today, most consumers have heard about ‘big data’ and how it can be leveraged to the benefit, detriment, or no effect to the user. The ubiquity of this awareness is largely due to the recent techlash against large corporations like Facebook and Google and their handling of data.

The tradeoff between one’s privacy and an enhanced user experience is often considered within the context of such large corporations but there are much smaller companies that also rely on big data to enhance and monetize their business. One such company is Shazam.

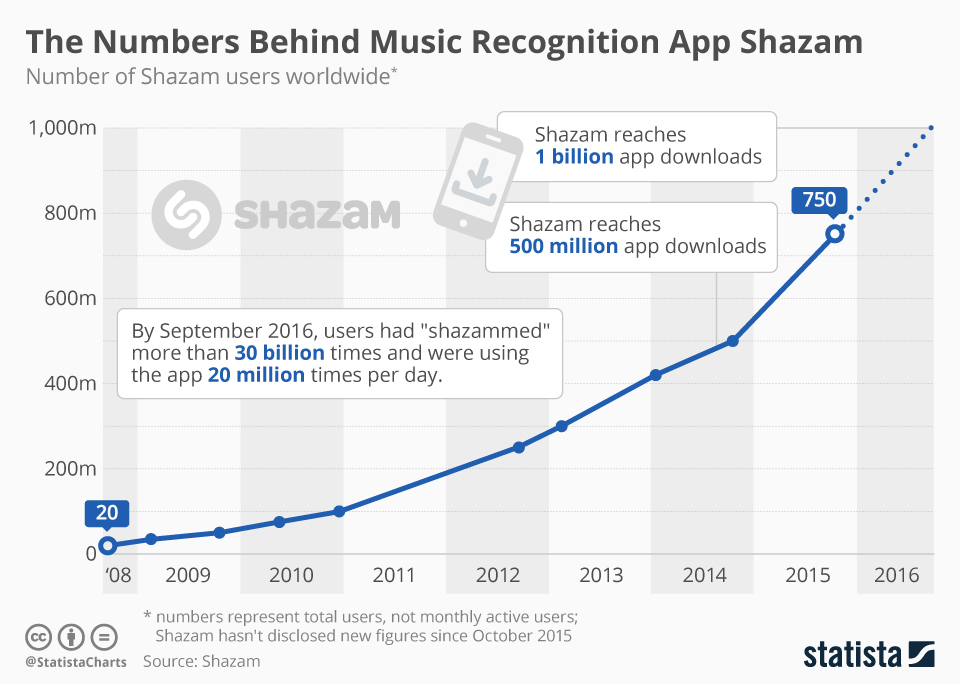

Shazam was founded in 1999 by four entrepreneurs determined to perfect and offer music recognition service on mobile devices. The company began before smartphones like the iPhone and initially relied on calls. Users would call Shazam as they heard a song, and then receive a text after the software combed through the database of 1 million songs. The process took 15-30 seconds. Shazam was able to reinvent themselves and amass 1 billion app downloads (as of 2019) because of their usage of big data. Shazam leverages data in two ways:

- Music Recognition: Shazam’s value proposition to users is simple. The application allows users to identify songs simply by opening the application. Shazam’s evolution from a service similar to hotline to an app that requires 5 seconds or less of audio to iterate through 30 million song was made catalyzed by the data collected from users. The release of the first iPhone in 2007 created a huge pool of data which allowed Shazam to better train and optimize its software.

- Predictive Analytics: the ability to predict the rise and fall of artists has typically been at the discretion of music executives, streaming trends, and individual hunches. Shazam’s technology, however, allows them to track much more than simply what people are listening to. Shazam can also determine which songs users hear around them, which songs pique their interest enough to use Shazam, and which songs are added to the user’s music library. The value of this ability is only increasing as Shazam expands to allows users to Shazam images, television shows, etc.

Benefits:

- Music recognition: the basic functionality of Spotify is its greatest value for users. The experience of hearing a song and being unable to remember its origin is very common. The value add here is both obvious and seamless.

- Song Recommendations: Shazam offers recommendations to users based on songs trending in their vicinity and songs the user has listened to. This is not offered by competitors like Spotify or Pandora.

- Playlist curation: based on the songs users choose to Shazam and, subsequently, add to their music library, Shazam curates playlists for users. Competitors like SPotify offer similar services.

- Media purchases/deals: through partnerships, Shazam has leveraged the ability to pair deals / marketing promotions with the songs, TV shows, etc. that users are listening to. For example, some television advertisements encourage viewers to Shazam the ad to receive a deal or to get more information. This service benefits both users and marketers.

- Specificity in trends: while apps like Spotify show national tends, Shazam enables users to see city trends in song choices.

Challenges and Opportunities:

- Competitors: surprisingly, Shazam has not faced many comparable competitors in its 15 year lifetime but that will likely change. As predictive analytics become easier to implement, it is very reasonable for competitors like Shazam or Pandora to invest in similar technology.

- Adaptability: the execution of Shazam’s primary use case (identifying songs) is not diminished based on the hardware the user is operating on. As wearable technologies expand, Shazam is in a good position to continue its market dominance.