Postmates: what service does it really deliver?

Dear Postmates, you’ve had a good run, but it’s time to make way for Uber.

Spearheading the on-demand movement

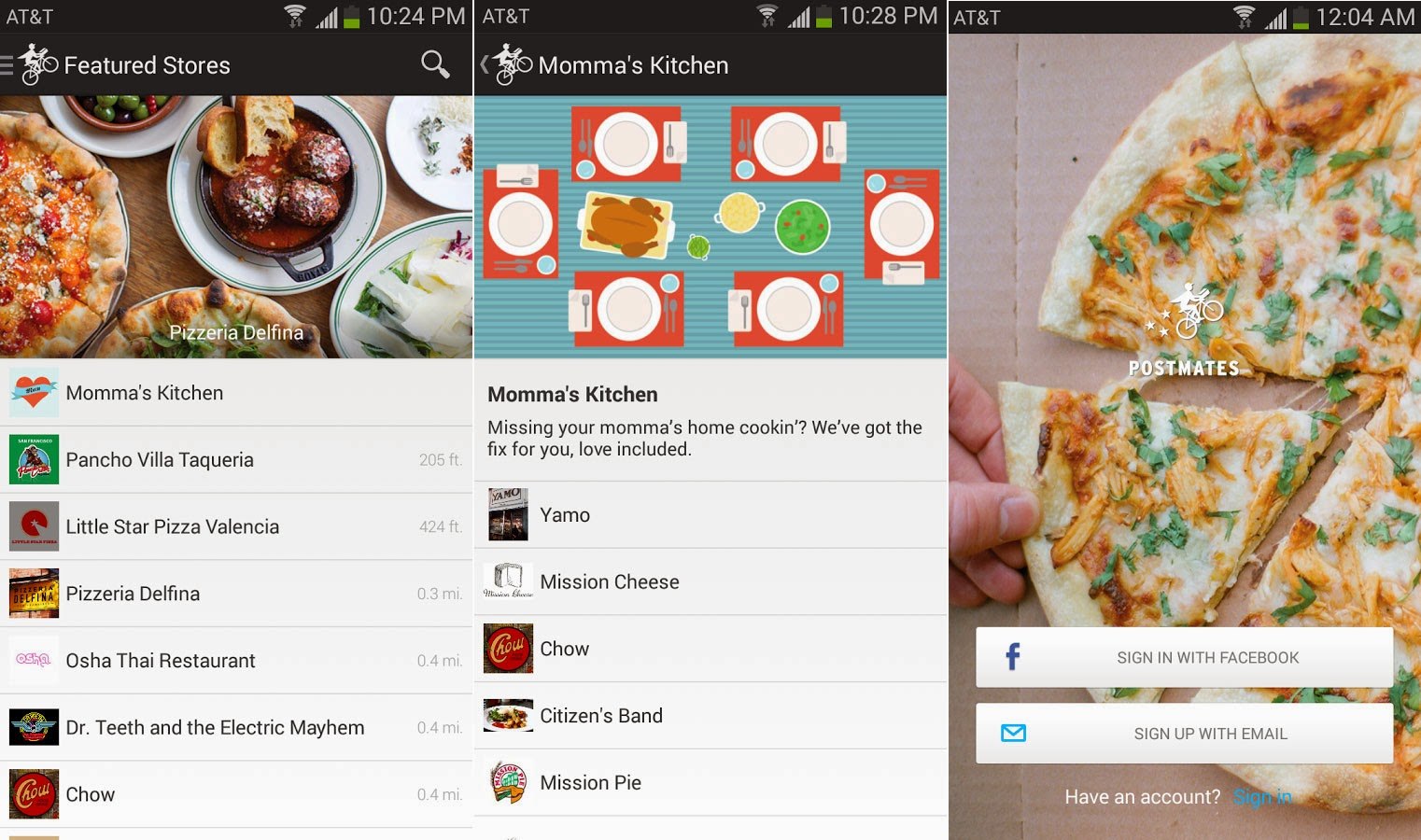

Postmates is an on-demand delivery service that delivers whatever you want to your front doorstep – whether it’s a Chipotle burrito bowl for lunch, your prescription from Walgreens or last week’s dry cleaning from your neighborhood dry cleaner. Deliveries are made by a bike courier or driver, with pricing starting at $5 for delivery.

Postmates boasts an impressive roster of merchants on its platform, including Starbucks, McDonald’s, Apple and Walgreens. While the company has yet to achieve profitability (it expects to in 2017), it’s currently valued at a robust $600mm off of an estimated $200-250mm of 2016 revenue.

What value do they deliver?

First and foremost, Postmates’ value proposition is fast, reliable convenience. In being one of the earlier on-demand delivery services to launch (it was founded in 2011 ahead of competitors like DoorDash and Instacart), Postmates has built a strong brand around its “under 1 hour” delivery promise and its breadth of merchant offerings. On the merchant side, Postmates offers the ability to reach a broader, more geographically diverse customer base and promises more online visibility as a merchant through Postmates’ platform.

Postmates primarily monetizes its business model on the customer side, by charging a delivery fee (80% of which goes to the delivery person) and a 9% convenience fee. It recently launched a $9.99 / month “Plus Unlimited” subscription plan (unlimited for orders over $30) as a way to increase customer loyalty and to compete with subscription offerings from Amazon Prime and the like.

Postmates primarily monetizes its business model on the customer side, by charging a delivery fee (80% of which goes to the delivery person) and a 9% convenience fee. It recently launched a $9.99 / month “Plus Unlimited” subscription plan (unlimited for orders over $30) as a way to increase customer loyalty and to compete with subscription offerings from Amazon Prime and the like.

It also monetizes its merchant side by charging a 15-30% commission from certain merchants in its Merchant Partner program. On the cost side, Postmates is able to receive some bulk discounts on certain orders.

In billing themselves as a logistics company, Postmates is relying on its logistical know-how to appropriately and efficiently match customers, merchants and delivery people on the back-end of their platform.

Why it all won’t last – logistics, logistics, logistics (also, data)

The reality is that delivery services operate in a winner-takes-all market within each city – network effects will prevail as the company with the most market share will be able to deliver the best service. Customer loyalty is difficult to achieve in a market where the offerings are largely the same and switching costs are low; customer convergence is inevitable as it becomes a race to achieve the lowest cost. Margins will continue to get squeezed as merchants show up on multiple delivery services. The winner will be the one with the most customer and merchant touch points, and thus, the best logistics platform.

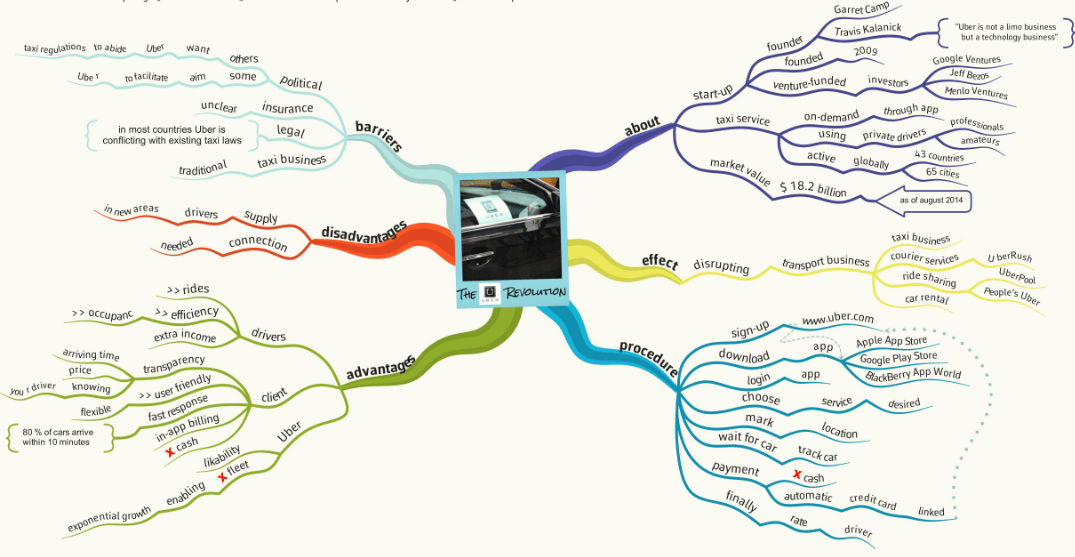

While Postmates has done a decent job of slowly building up its logistics capabilities, there are much larger players that are better equipped for this herculean task. Uber has the largest network of drivers in the U.S. and is well-positioned to utilize its excess capacity on its huge asset base with delivery services, which they have already begun testing out with UberEats and UberRush. Uber’s heavy investment in autonomous vehicles – which will allow for even more efficient and optimized demand and supply matching – will further give it an incredible advantage in building out the biggest and best logistics platform.

Uber’s sprawling logistics network

Amazon is another formidable company that can easily enter the space to directly compete with Postmates. With its same-day delivery capabilities and its foray into grocery delivery through AmazonFresh, Amazon has the customer base, scale and capital to effectively compete in a more localized delivery market alongside Postmates.

Even beyond these obvious behemoths, Postmates faces fierce competition from Grubhub, Instacart, DoorDash, and many more local delivery companies. While there is some “product” differentiation currently (in that Instacart focuses on groceries and Grubhub focuses on restaurants), it is only a matter of time until the offerings converge and the delivery service becomes largely commoditized and unit economics get squeezed. Is a 9% convenience fee in a rapidly commoditizing market defensible? Unlikely.

Much like the growing importance of data for GE and Samsung, it’s all about logistics (and ultimately, data from those logistics) for the on-demand delivery service industry. Postmates operates in a challenging industry with head-on competition from both logistics giants and undifferentiated local competitors. In the world of logistics, scale (and the deep pockets to achieve that scale) really does matter.

References:

http://nextjuggernaut.com/blog/postmates-business-model-revenue-how-postmates-works/

http://nextjuggernaut.com/blog/postmates-new-subscription-plans-business-model-free-delivery/

https://www.zoplay.com/how-postmates-works-postmates-business-model/

I agree with your analysis. Key thing that stands out for me is the network effect at play here. Without enough route density, the unit economics of Postmates simply collapse. If you were to bet on a horse here – would it be Uber or another player?

Thanks so much for the post. I’m curious about your autonomous vehicle argument and how that will play a key role in Uber’s ability to potentially overcome Postmates’ value proposition. Postmates and Doordash are both testing out self-driving delivery robots from Starship Technologies (https://techcrunch.com/2017/01/18/postmates-and-doordash-are-testing-delivery-by-robot-with-starship-technologies/). I bet Uber’s exploration into this space (i.e. self-driving cars that would deliver food, groceries, dry cleaning, etc.) is farther out in the future (I’d assume that they are first testing out self-driving cars for people and that they aren’t conducting both types of “content” delivery concurrently). Accordingly, do you think Postmates and/or Doordash will realize any kind of first mover advantage in this space?