Pandora: How the Wrong Business Model Can Lead Management to Focus on the Wrong Customer

Over the winter break, I had the pleasure to spend a few days with my twin brother. Like all healthy sibling relationships, we don’t always see eye-to-eye on issues. We do, however, share similar food preferences, and so the best debates between us occur usually over a good meal – that way, if the argument becomes too heated, we can always talk about something we agree on, “the food sure is delicious, right?”

One such dinner debacle we had was on whether Pandora or Spotify was a better music streaming service. A die-hard, paying Spotify user, I thought Pandora was long on its way out. After all, over the past couple years, Pandora’s monthly active users (MAUs) have declined. In December 2014, Pandora reported 81.5 million MAUs while in September 2016 the company announced having only 77.9 million MAUs.

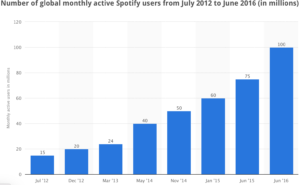

Conversely, Spotify’s MAUs have risen to record levels.

However, my brother remained unconvinced. A long-time, free-tiered Pandora listener, he stated, “Pandora identifies the songs that I like to listen to, and best of all, I don’t pay anything for it. In the U.S., I would say Pandora is more popular than Spotify.”

Curious, later that evening, I researched how many other individuals were like my brother and preferred Pandora over Spotify. I was surprised to find that the answer wasn’t as clear-cut as I had initially thought.

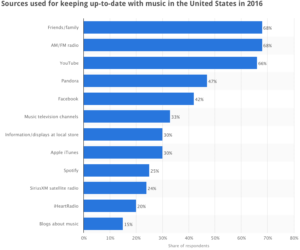

Last year, a study by Edison Research and Triton Digital revealed that nearly twice as many people in the U.S. used Pandora over Spotify to keep up-to-date with music.

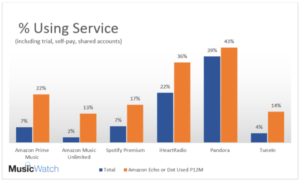

Additionally, earlier this month, MusicWatch reported in its 15th Annual Music Survey that among the approximately 14 million Amazon Echo users in 2016, Pandora was the most-listened to streaming service.

SO, WHY IS PANDORA LOSING?

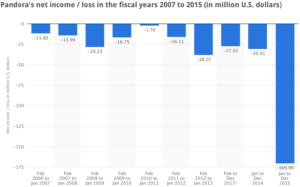

Fundamentally, Pandora is operating on a highly unsustainable business model that has yet to turn an annual profit. Of course, some may say, but Spotify also has yet to turn a profit. The difference between the two companies, however, is that Pandora may never turn a profit whereas, Spotify just might one day, assuming it can continue to scale.

To better understand why this is so, it’s worth first going over several key aspects about Pandora’s business model.

- Customers. Pandora has two types of customers: users who stream music for free (free-tier users) and Pandora Plus subscribers (paid-tier users). Subscribers receive benefits such as no ads between songs, fewer skips, and fewer timeouts[i].

- Value creation. For both customer types, Pandora creates value by providing individuals with a unique, personalized music experience, promising an easy-to-use interface, and for paid-tier listeners, offering an affordable product.

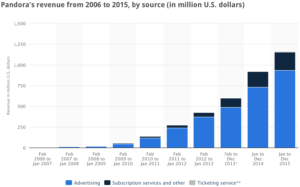

- Value capture. Pandora uses advertising dollars to pay for content consumed by free-tier users and charges $5 per month to subscribers, which is half the price of most other music streaming services. The company also generates a small amount of revenue from TicketFly, which it purchased for $450 million in 2015.

- Operating model. At the heart of Pandora is its technology, which stems from the Music Genome Project, an endeavor by the company’s founders to create a music recommendation system based on complex algorithms and over 450 musical attributes. Other important attributes to Pandora’s operating model include content right holders (labels and publishers), artists, and other platforms such as TicketFly, Rdio[ii], and Next Big Sound[iii], all of which were acquired in 2015

The problem with this business model is its dependence on advertising revenue to capture value for the company. In fact, Pandora has always relied on a significant portion of revenues to come from advertising.

Advertising dollars may create value for free-tier users by making content free, but it doesn’t create much value for paid-tier users. Further, it encourages management to focus on Pandora’s free-tier. After all, it would seem logical to focus on advertisements which bring in 80% of revenue and create value for 95%[i] of customers. Right? NO!

Pandora’s business model misses why paid-tier users are critical to the company’s survival. Subscribers pay Pandora for a personalized music experience, which is driven by Pandora’s technology. The fact that only 5% of Pandora active users are paid-subscribers, compared with 25% of Spotify active users, suggests that although Pandora’s technology may create enough value to keep free-tier users, it may not create enough value for them to justify Pandora’s monthly subscription fee.

Pandora and Spotify are very different technologies. Pandora is an internet radio music service (songs are recommended to the user), while Spotify is an on-demand music service (users select their songs). If Pandora active users find Spotify’s technology to be better, then Pandora’s business model is bound to stay unprofitable due to switching costs. This could explain why Pandora’s MAUs having been decreasing while Spotify’s have been increasing.

CONCLUSION

Pandora’s business model is attractive to free-tier users such as my brother, but underlying the model may not be a technology that’s good enough to convert free-tier users into paying subscribers. Spotify, however, focuses on creating value for paying customers, and in doing so, is able to offer individuals an incredible app with all the music that I love whenever I want it.

—

ENDNOTES:

[i] In 2015, only 3.9 million individuals were Pandora Plus subscribers, representing 5% of total active users.

[i] Fewer timeouts result from being given longer listening times before a station pauses.

[ii] Rdio is an on-demand music streaming service similar to Spotify that Pandora acquired on Oct. 6, 2015 for $75 million in cash.

[iii] Next Big Sound is an online music analytics platform that was acquired on May 19, 2015.

Edit:

“CONCLUSION

Pandora’s business model is attractive to free-tier users such as my brother, but underlying the model may not be a technology that’s good enough to convert free-tier users into paying subscribers. Spotify, however, focuses on creating value for paying customers, and in doing so, is able to offer individuals an incredible app with all the music that I love whenever I want it.”

Alex – I really enjoyed your post. I think your analysis on the importance of focusing on paid-users is spot on. It is interesting to see that despite the fact that both streaming services offer free and paid tiers, Pandora focuses on free-tier customers as a result of its dependence on advertising revenues, while Spotify deploys a “freemium” approach: leveraging the free tier as a gateway to drive people into becoming paid subscribers. I also find it very interesting that Pandora has been very successful in monetizing the assets acquired in the TicketFly acquisition. Many observers believed that Pandora would be able to vertically integrate the data generated from listener preferences to push targeted concert advertisements to consumers depending on geography, preferences, etc. However, it does not seem that Pandora has fully leveraged the value embedded within the TicketFly assets

Ian- First and foremost, excellent job writing your post and presenting in class. I really enjoyed learning about Trump’s digital strategy today. Regarding your comment, I totally agree — I’m surprised Pandora hasn’t done more with their TicketFly and Next Big Sound acquisitions. You probably know this, but Next Big Sound is a data analytics company that focuses specifically on the music industry. I don’t think it was coincidence that Pandora acquired a concert-ticketing company and a data analytics company at the same time, so I think they were on the same wave-length as you to carry-out some sort of vertical integration strategy in the live music space. The fact that they haven’t been able to put all the pieces together gives me pause about the company’s management and internal processes.

Hi Alex, great post.

A few questions though:

1) Do you have a sense of the revenue mix between advertising and paid subscription for Spotify? Even with 25% paid subscribers, it seems unlikely that Spotify’s revenue would be majority driven by subscription? I think there may be a confusion of correlation with causation here. I think there is a correlation between high advertising revenue and a focus on free subscribers. But I think the causality is a poor business strategy/value creation choice of not identifying the proper experience that will convert users to paid subscribers.

Spotify made a different choice – interpreting customer desire for on-demand songs available through mobile as an experience that could create paid subscribers. Pandora on the other hand – interpreted customer desire as wanting to discover new music – apparently this customer value proposition is not strong enough to create paid users.

One other thought – do you think the Music Genome Project is easily replicated now through user generated music listening patterns? Streaming services like Spotify simply collecting music listening habits and running big data analytics to create music recommendations and discovery stations. In this way, perhaps Pandora’s investment in the MGP was simply a waste of time and energy. What do you think?

Hi Alex- Sorry for the late response. I loved your questions and just wanted to get back to you. As changeme_43 commented, Spotify’s revenue has always been driven by paid-subs. Here’s the information I was using: https://www.statista.com/statistics/245125/revenue-distribution-of-spotify-by-segment/. Also, sorry if it was not clear from the post, but I definitely think the main flaw underlying Pandora’s BM is its technology. At the same time, I am not so sure we can fault them for making bold bets on internet-radio. They entered into the market a few years before Spotify launched in the US, so it’s not as if on-demand music was a big deal then (at least not in the US). What I meant in my post was that Pandora’s focus on generating revenue to support free-tier users distracted them from realizing that, as you pointed out, their technology may not be creating as much value to customers as they originally thought it would. I think if Pandora focused on capturing more value from paid-subs (as Spotify does) they would have quickly noticed their technology wasn’t good enough to get people to pay. However, it seemed they made a bet on the free-tier, and by doing so, lost sight of what really drives their BM (the technology). Interestingly, they are just realizing that on-demand streaming may be the way to go. The company announced in December that they will be launching an on-demand product, Pandora Premium, to go head-to-head against Spotify Premium very soon (couldn’t they have been at least a little more creative with the name?). In case you’re interested, here’s the teaser: http://blog.pandora.com/us/coming-soon-pandora-premium/

Oh, and to directly respond to your last question about MGP, I don’t think it was a waste of time. Again, Spotify didn’t come into the market with on-demand music streaming until a little later, so I can’t fault Pandora for gunning after internet-radio if they didn’t even know there could be an alternative solution. At that time, using analytics to predict what customers want to listen to was really innovative! In fact, even today, I’d say Pandora’s algorithm is better than the one Spotify uses for their “Discover Weekly” feature or Stations (although, I must say, I’m a big fan of Discover Weekly — because when Spotify gets the playlist right, boy do they get it right!). Also, I want to confess that I’m not entirely convinced Pandora is going to go completely away. Their technology has been good enough to keep around a good number of users for while. If they can leverage the expertise that they’ve gained over the past several years, as well as their knowledge about customers, they may just have an amazing on-demand product — maybe Pandora Premium is just what the company needs to convert free-tier users to paid-subs. It should be interesting to see if Pandora will create a separate freemium model for its on-demand product, of if it intends to use their freemium model for internet-radio to upsell individuals on Pandora Premium.

Great post Alex!

I just wrote about Taobao driving eBay out of China by offering NINE YEARS of free service, while eBay tried to charge users from day one. How does my story compare to your music-delivery story? Here’s my attempted analyses.

I learned that for industries with strong network effects, early investment in user capture until reaching market dominance does pay off eventually. This happens to online marketplace, where numerous sellers and buyers congregate to a platform, and find switching difficult. Pandora, on the other hand, has a weak network effect. Adding a few more listeners bring very little benefit to the existing listener. It is also relatively easy to switch or even multi-home on two platforms at once. This renders it impossible for Pandora to capture the majority of the market simply by offering free services.

Hi Hao- TERRIFIC. I loved your example, because as I was writing my post, I wondered if focusing on capturing value from free-tier users at the expense of creating value to paid-subs could ever be a winning strategy. In addition to your excellent example, there’s Facebook to think about too. How is Facebook able to capture value from advertisers and yet create so much value to users, who pay absolutely nothing. I thought that competition could play a role in thinking about a winning business model focused on free-tier users. That is, if a competitor to FB could offer a better social network experience (so, better technology) and monetize on it, then FB would be compelled to focus on how to capture value from paid users. If it continued to focus on free-tier users, then like Pandora it would lose focus on the fact its technology wasn’t as great as its competitor.

Maybe competition is a factor, but I think your idea about network effects is MUCH more compelling, and I like it a lot. Thanks for sharing your comment!

Great post Alex! @Alex Mahylis’ comment we had a case on Spotify in SMICI last semester. Roughly 25% of Spotify’s 60M customers in 2015 were paying customers but subscription revenue makes up about 80% of Spotify revenue compared to advertising revenue. Alex – you were spot on that Pandora’s bet on an advertising business model wasn’t sustainable and has pushed them to be a lost leader. I agree with your analysis. In addition, as Ian comments, I don’t believe Pandora has been able to leverage data on it’s customers listening habits as Spotify has done to push out relevant customized content / concerts to it’s users.

Hi! Thanks so much for commenting. I wasn’t as fortunate as you were to get into SMICI, so I’m happy my post made some sense. 😉 Also, regarding your thoughts about Pandora not leveraging its data to create value for its concert-ticketing platform, I also wonder the same. I mentioned a few of my thoughts toward the end of my reply to Ian, but in essence, what the heck is Pandora doing with Next Big Sound, the music industry-focused data analytic company that it acquired in 2015?! Of course, they must be doing SOMETHING, but from an outsider’s perspective, it’s really hard to see. Thanks again for offering your insights from SMICI and validating my analysis!

Thanks for the post, Alex.

I also think that Pandora has not been as successful in monetization because they have not developed the appropriate technology to track ad efficacy for advertisers and have a difficult time justifying the high CPMs that they charge. I used to work in Customer Acquisition at Tapulous / Disney Mobile in 2012, and I remember that at the time, Pandora was attempting to charge CPMs of $7-8+, which is ridiculously high compared with other customer acquisition channels. Moreover, at the time they didn’t have the ability for advertisers to track their campaigns with Pandora through clicks or installs, which were critical to mobile user acquisition efforts.

Hi Sij (or Sijia?)- Very interesting. Gosh, that’s a really high rate! After writing this post, I guess it doesn’t surprise me that Pandora’s technology for advertisers underperformed / didn’t exist. After all, the company’s acquisition of Next Big Sound in 2015 suggests Pandora was in need of some serious help to develop tech that would better support marketers and advertisers. You would think that if you could build technology to predict music for users, you could also create solutions to measure ad efficacy. I’m wondering, though, how better marketing technology would have brought in more revenue. Since Pandora probably couldn’t have charged advertisers more, then the only way they could have increased revenue would have been to bring in higher volume — would free-tier Pandora users still have stuck around with more ads? Or, were you thinking Pandora could have upsold advertisers on different ad solutions (so not necessarily advertisements, but marketing analyses and reports)? Regardless, it’s amazing Pandora was able to get away with charging advertisers premium prices despite offering mediocre ad-based technology. Thanks again for sharing your experience at Tapulous. Very cool — would love to hear more about it!

Interesting post, Alex – thanks! Your point about switching costs brings to mind a conversation I had with a friend who simply subscribed to Pandora’s premium service first and just never entertained the idea of exploring Spotify’s premium service as a result. I used to use Pandora’s free service before trying Spotify’s free and paid services but stopped using Pandora altogether because I believed Spotify premium’s value proposition to be a better fit for me and the way I use streaming services (on-demand listening, playlists, friends’ recommendations).

I noticed that my car sound system lists Pandora, but not Spotify, as an option for listening and was thinking that perhaps Pandora may have done a better job than Spotify early on in partnerships with automakers, etc. Do you know if that is the case, and if so, whether Spotify has been able to overcome this? It seems like it, given that Uber and Spotify are linked, but I was curious if you had more detail!