OfferUp: The used goods marketplace of the future

OfferUp is transforming how we sell used goods online and is termed a “Craiglist killer”. This post discusses how they ended up creating and capturing this value

Many of us would have things at home that we no longer need and want to get rid off. Craiglist is still the most popular channel to sell or buy these goods. However, Craiglist has not changed much since its launch and its interface is hardly suited for smartphone users. Enter OfferUp – a firm that has become the “Craiglist” of the smartphone generation.

OfferUp is a mobile app that allows users to (1) sell and (2) discover used goods using their smartphones. Users can post a “listing” by taking a few pictures of the object and setting an asking price. The listing then gets exposed to millions of OfferUp users.

OfferUp was launched in 2011 and is headquartered in Seattle. It is the latest “Unicorn” and recently raised ~$120Mn at a $1.2Bn valuation.

What value does OfferUp creates?

Used goods marketplace is not a “glamorous” space. Used goods are not even accounted in a country’s GDP. However, the size of the used goods market in US is $300Bn (without including used automobile sales) [1]. According to Warburg Pincus’s MD Justin Sadrian:

“People literally have billions of dollars of value sitting unused and unmonetized in their closets”

For sellers, used goods marketplace creates value in 2 ways. Firstly, it frees up space in their homes. This is important in cities with high property prices and small houses (like in SF or NYC). Secondly, it provides them with cash, which they can use for upgrading to newer items. For buyers, it creates value by providing them with affordable access to things that they need. It creates value for the environment also by reducing the number of objects that are sent to the landfill or are thrown away.

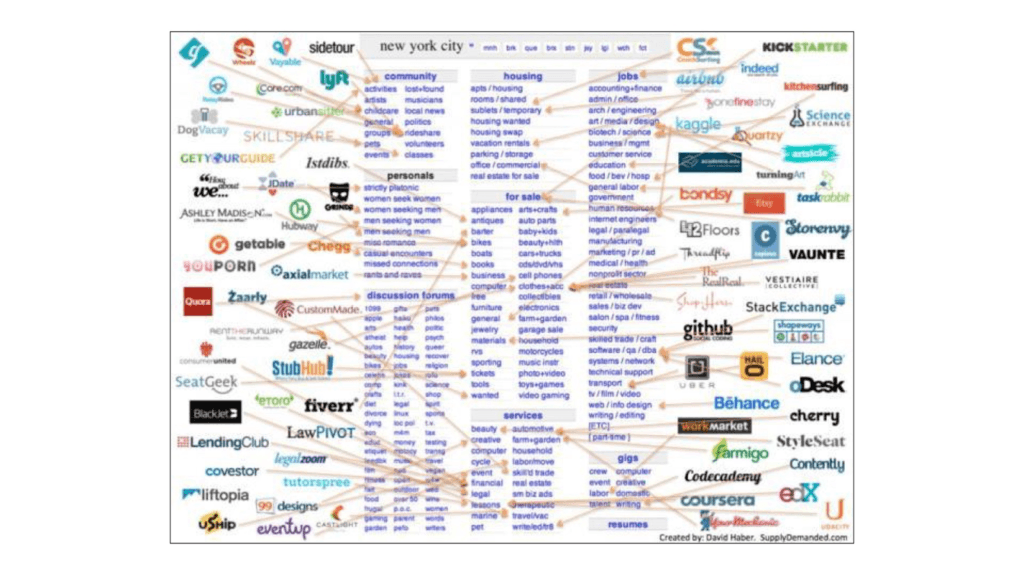

The image below shows how various firms are competing to capture the value that a used goods marketplace can create [2]:

Source: http://a16z.com/2015/11/04/offerup/

How is OfferUp capturing this value?

OfferUp is the largest mobile first player in the used goods space. Let us look at its business model that allowed it to achieve a position where it is well poised to capture this value.

Customer Value Proposition:

OfferUp has 3 clear advantages over competitors like Craiglist. First, its interface is mobile first. Users generally take pictures of objects they want to sell on their phones. OfferUp removes friction from the process as the user doesn’t have to transfer the pictures to his laptop first. Second, it has an integrated messaging feature that allows users to complete the negotiation process within the app. Third, it has very strong background verification process which allows transactions to happen in a safe environment.

Resources:

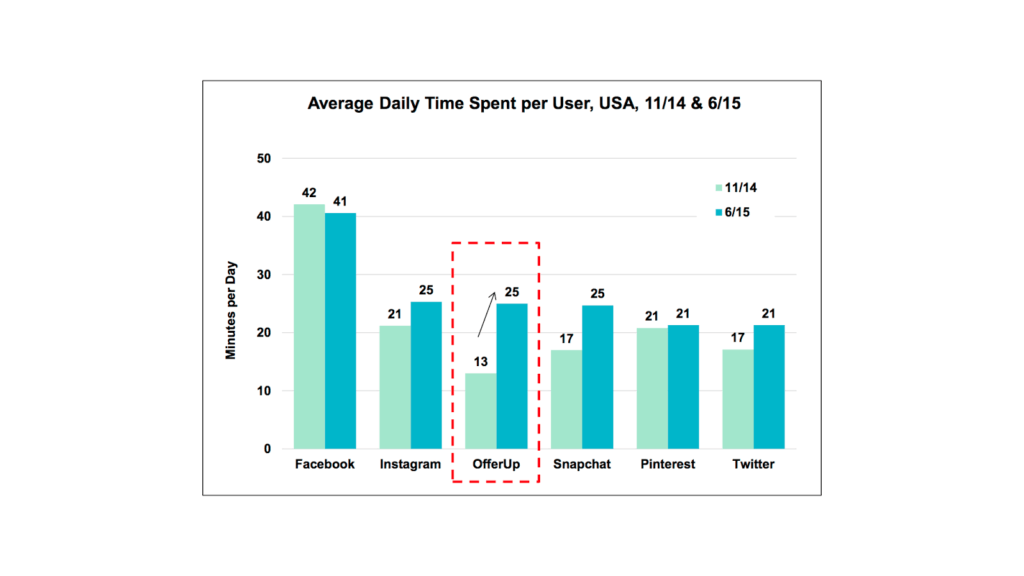

Marketplaces display strong network effects and need to be “dense” to succeed (i.e. should have many listings and an optimal ratio of sellers and buyers). OfferUp has achieved a strong position for 2 reasons. First, it has achieved massive scale – 29Mn installations in US [3]. Second, it has a very engaged community that spends a lot of time on the app. An average user spends 25 mins on the app daily – engagement level that rivals social platforms like Snapchat, Instagram [4]. More users spending more time translate into more listings and a higher probability for people buying the objects posted.

Source: Mary Meeker’s internet trends 2016

Processes:

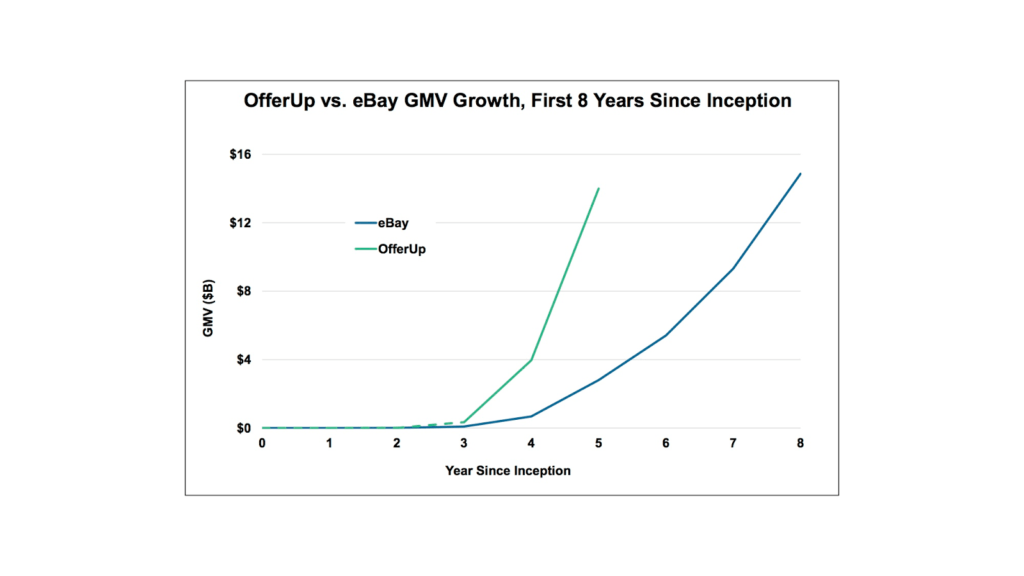

OfferUp employed innovative marketing techniques to rapidly gain scale. It provided a budget to celebrity blog writers to try the platform and write an authentic review on their blogs. This has allowed the firm to reach the same scale as eBay in half the time [5]. The company is also obsessed with employee talent and is selective in hiring. At the end of 2016, the firm had only 100 employees – a very small base for a fast-growing startup of their scale [6].

Source: Mary Meeker’s internet trends 2016

Profit formula:

OfferUp does not monetize its platform currently. It processed ~$14Bn worth of transactions in 2016 [7]. This would go up as it continues its expansion across US and international markets. In the future, it can probably move to a commission based model. Assuming a 5% commission on every transaction implies a revenue potential of $700Mn (actual revenue is expected to be lower as the volume will go down when OfferUp will start charging its users).

****************************************************************************************************************

The competition in the used goods marketplace is heating up. Competitors like Letgo and Carousell recently raised $175Mn and $35Mn respectively [8][9]. It would be interesting to see how this space evolves and whether OfferUp continues being a winner in the future.

Sources:

[2] http://a16z.com/2015/11/04/offerup/

[4] and [5] http://www.kpcb.com/internet-trends

[6] http://www.geekwire.com/2016/mobile-marketplace-offerup-raises-119m-confirms-unicorn-status/

[7] http://www.geekwire.com/2016/offerup-was-down-once-down-to-350-now-its-value-may-be-over-1b/

Nice analysis Bipul – with such a phenomenal growth and now being in the unicorn club why do you think OfferUp is not so well know more so when it is in the consumer tech space?

Thanks Sidharth! Your question is very relevant. From what I understand, OfferUp has always tried to be very secretive. As I mentioned at the end of my post, a lot of VC money is flowing into this space and OfferUp does not want to attract too much attention to itself as it is still expanding across US. Also their target audience is married couples that are slightly older than most of us (35yr+), which might explain why some of us might not know about the company . In fact, one of the main reasons why the founders started the company was that they had both become fathers and because of the new child in their home, they had a lot of extra stuff that they wanted to get rid off. That explains why a lot of their marketing is still targeted at this audience (the celebrity blog posts that I alluded to in my post is generally targeted at families and married couples).

However, I completely agree with you that if they want to penetrate other audience segments like millennials then they would need to work on their marketing.

Nice post Bipul, couple of follow-up questions –

1. Do you think they will capture value by commission based model or the advertising model that most players in this space make money from?

2. What is the core reason that they were able to grow so big in such a crowded market with large incumbents like ebay, craigslist etc. Given this is a marketplace, how were they so successful to get inventory on their platform away from Ebay/craigslist?

3. Given they authenticate using Facebook and use that social network to facilitate transactions, have they seen any effect of FB marketplace? My assumption being, facebook is much better placed to using the network effect if they are able to get the inventory on their platform.

Hi Anish. Thanks for your questions. My thoughts are below:

Q1: I think commission model has a high probability for sure. Some other competitors like Poshmark in US uses a commission based model (details here: https://poshmark.com/faq). Poshmark in fact charges a pretty high commission of 20%. When firms start charging a higher commission, what we typically notice is that sellers increase the asking price of their products so as to still keep the returns to them the same. Therefore, a 5% commission expectation is not too optimistic.

Q2: One of the core reason for their rapid growth has been their mobile first approach. Users have to complete quite a few steps before posting on eBay or craiglist while the posting process is really seamless on OfferUp and one can post an object in less than 30 seconds

Q3: I agree that FB marketplace is a big threat. However, I think that FB marketplace will always be a feature of the main Facebook app and that decreases the threat from it substantially. For e.g. Facebook separated out the messenger feature from the Facebook main app because messenger was not getting the attention that it deserved within the main app. Messenger has seen an explosive growth after this separation. Therefore, I think unless Facebook carves out Marketplace as a separate app, the competitive threat from it to OfferUp might be limited.

Super interesting Bipul. I’ve always wondered how Craiglist has been able to maintain its dominance given its poor user experience. Obviously there are network effects, but Craigslist is SO BAD and switching costs are low for users that the network effects don’t seem insurmountable. I think this could be a great example of amazing UX winning out. A couple thoughts / questions.

1. In contrast to the comments above, I believe that Offer Up and Craiglist offer a pretty different value proposition from ebay. I think of eBay as a market place for fairly new / recently lilquidated items, and I think of it as fairly globalized. it’s not a platform I would use to sell my old couch to other people in Cambridge, for instance. In that sense, I don’t think of Ebay as a competitor. I’d be more worried about the FB threat as you allude to above.

2. I’d be curious how the class conversation today about indirect vs. direct network effects impacts your thinking on Offer Up. Right now it seems like as they continue to amass users on both sides of the platform, they develop indirect network effects. But as Professor Lakhani mentioned, platforms really want to think about how they move from indirect to direct effects. Any thoughts on how Offer Up could do that, and create more stickiness on one (or both) sides of the platform?

Thanks again for sharing.

Hi Kyla! Thanks a lot for your comment. I am really surprised too at how Craiglist has been able to dominate the market for so long despite its poor UX.

1. I agree that eBay has a very different model compared to Craiglist or OfferUp and that FB marketplace would be the bigger threat. However, given eBay (or for that matter Amazon marketplace) already has the basic tech and brand recognition in place, I think that they can probably become a big player in this space in the future. However, I agree that their focus is elsewhere right now

2. I agree with you that OfferUp is benefitting from indirect network effects right now. However, i think there are some ways in which they can benefit from direct network effects as well. For e.g. a company called Poshmark (very similar to OfferUp but it deals in used luxury goods) is focusing a lot on creating “communities” of users in which users can share style tips with each other. A user could also follow other users (like bookmarking boards of Pinterest users) and see the items that they are interested in. Therefore, addition of new users to this community would be beneficial for all users (as new users could share styling tips with existing users). Another used goods marketplace app example called VarageSale. They follow a model in which they create closed groups based on geographical proximity. Therefore, a small town might have its own closed community (mostly to ensure that there is enough trust and transactions can take place easily. They are also trying to replace the traditional “garage sales” in rural America). In these closed groups, most buyers are sellers and vice versa. Therefore, in this case if a new buyer joins the platform then the probability is quite high that he/she might become a seller in a few days (which will then benefit all the other buyers on the platform). I feel that in the future OfferUp might start doing something like this.