Nike: Overcoming the Coronavirus Crisis with Digital Ecosystem

Nike is outperforming its peers during this challenging period due to the biggest shifts they’ve made to leverage the strength of their digital ecosystem to help consumers maintain their physical and mental well-being while at home

Nike, the world’s largest sportswear company, has thus far seemed like one of the more obvious companies to be affected by the coronavirus pandemic.

It was first forced to close stores in China, one of its key markets, and has now shuttered them in North America and Europe as the epidemic has moved to the West. Nike shares gave up as much as 40% during the COVID-19-related sell-off that began on Feb. 24, but after the company delivered an earnings report that soothed its investors’ nerves, the stock has regained half of those losses.

The reason why Nike can outperform its peers during this challenging period is the biggest shifts they’ve made to leverage the strength of their digital ecosystem to help consumers maintain their physical and mental well-being while at home

- Overcoming the coronavirus impact on its China business

By mid-February, as Covid-19 disrupted daily life across China, Nike had shut more than 5,000 of its roughly 7,000 directly owned and partner-operated stores in the country, according to the company. Businesses in those locations froze. But Nike’s online operations did not.

In the three months through Feb. 29, Nike reported more than 30% growth in its online sales in greater China versus the same period last year. Total business in the country still fell 5%, limiting Nike’s global sales growth in the quarter to about 5%.

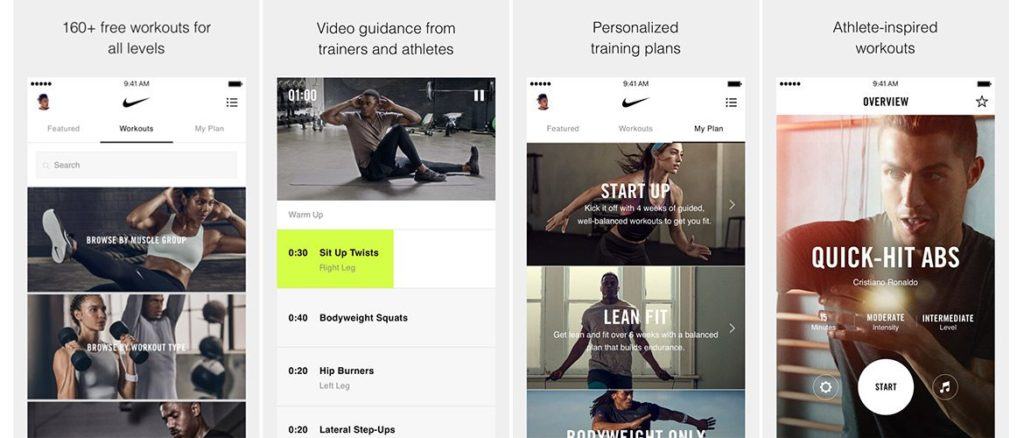

After the new coronavirus confined Chinese shoppers to their homes, Nike quickly shifted focus to connecting with them digitally, and not just by pushing products on them. It continued its messaging to shoppers and engaged them with apps such as Nike Training Club, which offers members at-home workouts. The result was an 80% increase in engagement from the beginning of the third quarter to the end, and digital sales jumped more than 30% in China for the quarter.

- Digital Strategies

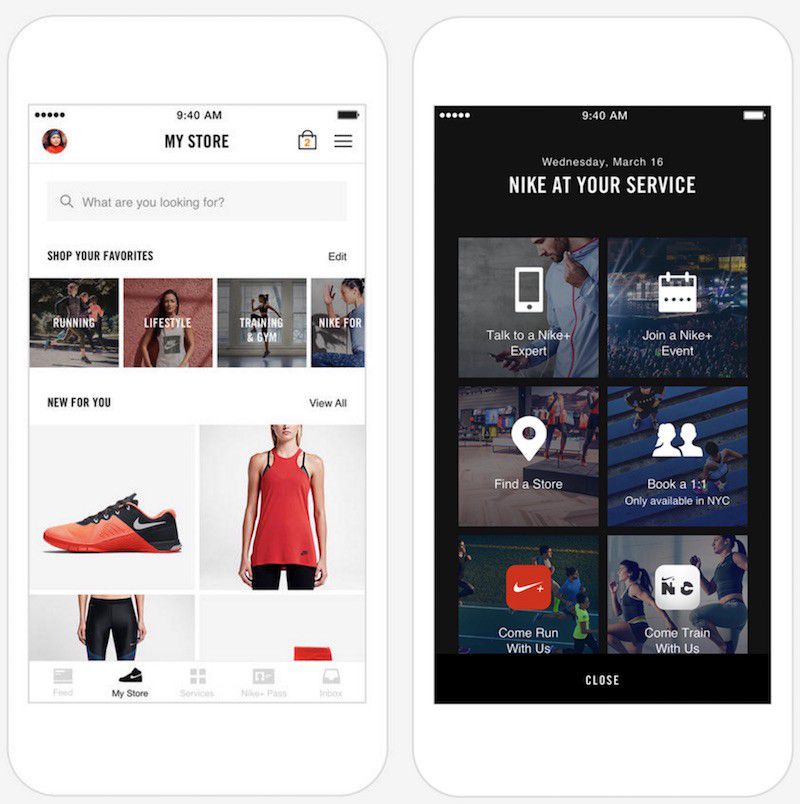

In 2017, Nike launched its Consumer Direct Offense, a controversial move that included laying off staff, reorganizing the company, and focusing on the direct-to-consumer channel as well as few dozen key retail partners like Foot Locker and Nordstrom. That strategy has helped the company accelerate its growth and led to surge in the stock before the COVID-19 outbreak hit, and no component of the strategy is been more successful than its digital initiative. The company invested significantly in its apps, including SNKRS and Nike, as well as its website to drive engagement, demand, and online sales.

With stores around the world now closed because of the coronavirus outbreak, the digital strategy is clearly paying off. In the third quarter, currency-neutral digital sales jumped 36%; online sales remained strong in China, as the numbers above indicate, despite much of the country being under lockdown. Owned and partnered digital sales now represent more than 20% of total revenue

Nike dropped the subscription fee for its NTC Premium service that provides streaming workout videos, training programs and expert tips from trainers, the sportswear giant announced in a blog post. NTC Premium includes its Nike App, the Nike Running Club (NRC) app, the Nike Training Club (NTC) app, social channels, nike.com and its “Trained” podcast, it will be offering customers tips on movement, nutrition, and more. Like many others, Nike is also offering shoppers discounts to keep them buying. The strong engagement of consumers with the activity apps translated into strong engagement with the Nike commerce app. Weekly active users rose 80% in China over the course of the third quarter, as people were confined to their homes. That in turn drove them to purchase new workout gear, boosting digital sales by more than 30%. It also helps that fitness equipment is still in demand when people are stuck at home.

By making its content freely accessible, Nike can reach more potential customers, showcase its content and support positive associations with its brand among consumers. The company may be able to convert those consumers into paying subscribers when the crisis ends.

- Conclusion

Nike is proving that, even amidst this crisis where consumers are pulling back their spending on discretionary items, there are still ways to stay connected with customers. Right now, retailers are better off trying to build “human connections” with consumers. Even if for product companies, they have got to be service companies right now. Coronavirus is encouraging a shift in consumers to more digital activity. Nike, which has invested in its digital capabilities, is prepared for the change. With digital sales soaring, e-commerce could offset the losses from global store closures. Nike will be in an even stronger competitive position when the COVID-19 situation ends.

Hi Dora! Thanks for your interesting post!

I fully agree that the Covid-19 outbreak gives retailers an opportunity to build “human connections”, as you call it, with consumers – just as Nike has done. I wonder though what will happen after the crisis when brands again have an opportunity to focus on sales. Of course, they will leverage their human connections for conversion into buying customers, but I am hoping that businesses can realize a strong benefit from focusing on human connections also when sales are good.

For example, when Nike dropped the subscription fee for their streaming workout videos it led to a spike in engagement – it seems plausible that a spike -although perhaps less extreme- and possibility of conversion would have happened also before Covid-19. Instead of waiting for external circumstances to force a “connectedness” strategy, continuously considering and implementing such strategy to some extent could likely contribute to a more loyal existing customer base as well as attract new customers – some of which may switch from competitors. I personally believe that demand for more “humane” brands is trending and becoming increasingly important for the growth and success of a brand.

Thanks for this interesting post! I’d bet that we see a lot of retailers trying to supplement their businesses with digital connection and, ideally for them, revenue streams.

I found it especially interesting that you pointed out the fact that Nike has a substantial presence in China and therefore was forced to confront the pandemic from the onset. It’s interesting to think how the earliest-impacted by these sorts of crises are also those who have the first opportunity to innovate, experiment, and potentially “win”. Nike obviously has a lot of resources to draw upon, but I can’t help but think that their early experiences is China gave them a potential advantage among U.S. retailers!