MercadoLibre: Latin America’s Free Market

Similar to Rakuten in Japan or Alibaba in China, MercadoLibre, which translates to “Free Market”, is an online commerce platform that currently operates in 18 countries in Latin America.

Similar to Rakuten in Japan or Alibaba in China, MercadoLibre, which translates to “Free Market”, is an online commerce platform that currently operates in 18 countries in Latin America. It was started in 1999 by Marcos Galperin, a Stanford MBA from Buenos Aires.

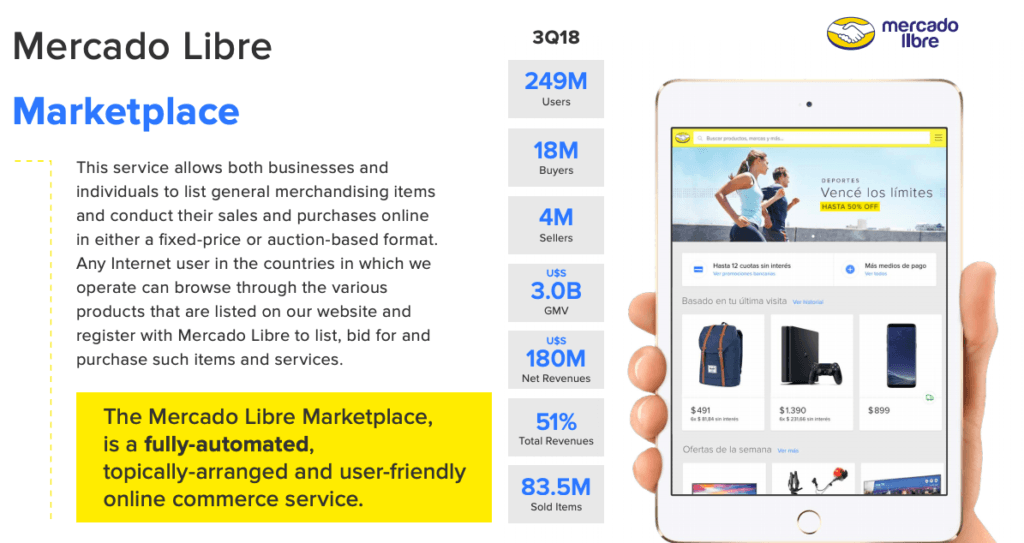

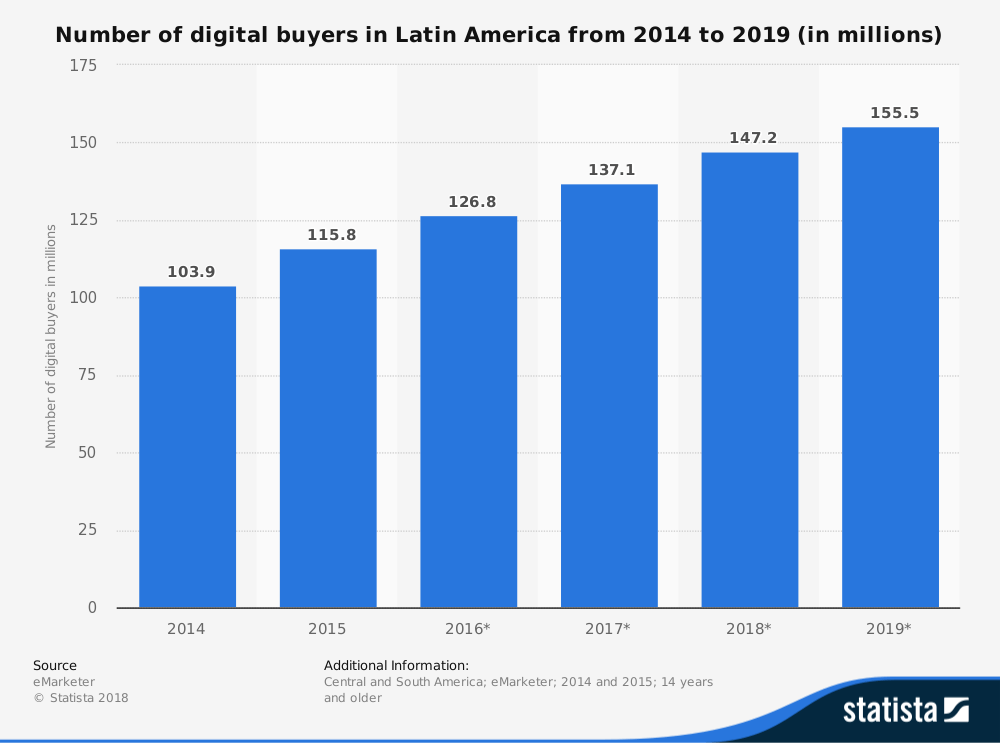

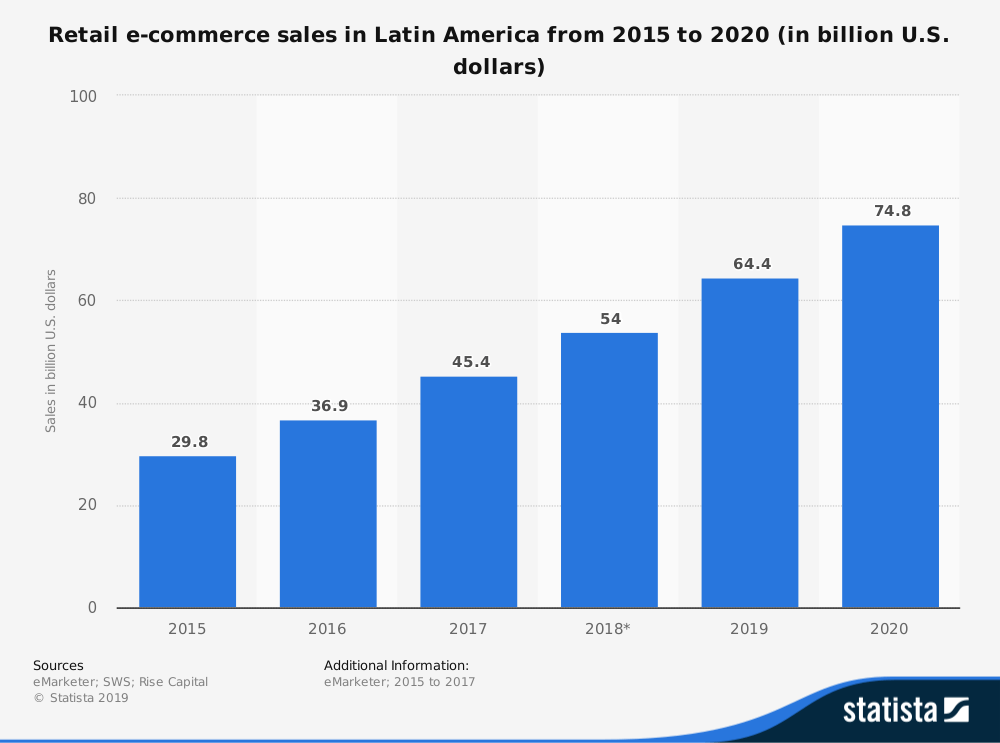

It offers multiple products. The MercadoLibre Marketplace, an automated online commerce service for businesses and individuals to list items and conduct sales in a fixed-price or auction-based format much like Amazon. It’s Advertising platform enables brands to promote their offerings on its webpages and provides marketing performance services. It also provides MercadoLibre Classifieds service that allows users to list their offerings related to goods and services outside the Marketplace platform. The MercadoPago facilitates transactions on and off the MercadoLibre Marketplace by providing a mechanism that allows its users to send and receive payments online. Furthermore, MercadoShops, enables users to set-up, manage, and promote their own Webstores; and finally, MercadoEnvios provides shipping service for the marketplace users.[1] More than half of our items sold are shipped with our solution [2] Given the shift from brick and mortar to e-commerce continues, there are strong indications that MercadoLibre will continue to grow. The e-commerce market is expected to grow to more than $70 billion by 2020 [3] The number of buyers online is hence, expected to grow.[4]

MercadoLibre, much like Amazon has established a two-sided marketplace where network effects come to play. By offering a wide array of products at competitive prices (supply), more consumers are drawn (demand) which in turn increases suppliers further. In 2016, their decision to remove placement fee for suppliers and adopting a freemium model which removed the risk of up-front payment for the supplier in the case of no sales helped in the uptake by more suppliers. This volume and availability of choice is one of the reasons why no other competitor has been able to poach their customers.

The end to end integration with MercadoPago, the payment arm, builds trust and provides convenience to suppliers. MercadoPago processes close to 70% of total transaction volume on MercadoLibre, compared with 80% of eBay’s transaction volume processed by PayPal.[5] This is likely to continue growth in offline transactions and hence, become a growth channel into financial services opportunities like mobile payments, digital wallets and extending credit.

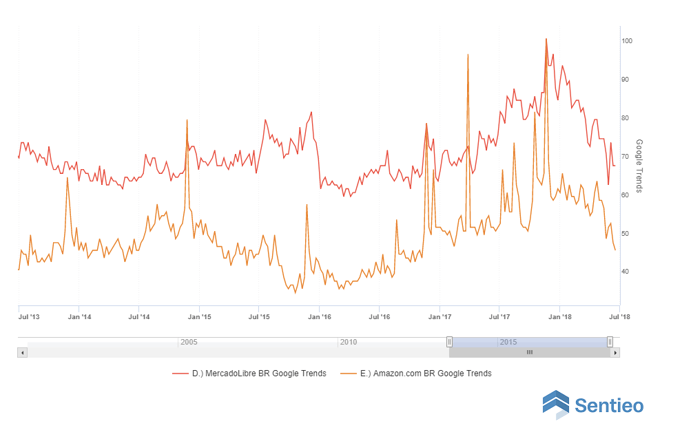

Despite the margin contraction due to certain decisions, they have continued to focus on driving volume and on customer service. It now offers loyalty programs and free shipping, which as witnessed with Amazon, increases customer LTV. Despite Amazon’s announcement to expand in Brazil more aggressively, MercadoLibre maintains a solid lead. Below you can see how the gap between MercadoLibre and Amazon in terms of searches on Google hasn’t changed significantly in recent times and besides a few spikes here and there, Amazon remains well below MercadoLibre [6]. The focus on improving customer service and convenience has led to growth in total and new users.

Despite the margin contraction due to certain decisions, they have continued to focus on driving volume and on customer service. It now offers loyalty programs and free shipping, which as witnessed with Amazon, increases customer LTV. Despite Amazon’s announcement to expand in Brazil more aggressively, MercadoLibre maintains a solid lead. Below you can see how the gap between MercadoLibre and Amazon in terms of searches on Google hasn’t changed significantly in recent times and besides a few spikes here and there, Amazon remains well below MercadoLibre [6]. The focus on improving customer service and convenience has led to growth in total and new users.

Given the growing market, users and growing geographical expansion and penetration, the right design and process decisions, cultural understanding, focus on customer service I am optimistic that this platform will continue to grow in the next few years.

Citations

[1] Yahoo finance, “MELI”, https://finance.yahoo.com/quote/MELI/, Accessed 24 Feb 2019

[2] MercadoLibre Ltd., “Business Overview 2018 MecadoLibre”, http://investor.mercadolibre.com/static-files/2f0b7f2d-abb4-4e1f-939e-30ca4ab91e23, Accessed 24 Feb 2019

[3] SWS, and Rise Capital. “Retail E-commerce Sales in Latin America from 2015 to 2020 (in Billion U.S. Dollars).” Statista – The Statistics Portal, Statista, www.statista.com/statistics/445860/retail-e-commerce-sales-latam/, Accessed 24 Feb 2019

[4] eMarketer. “Number of Digital Buyers in Latin America from 2014 to 2019 (in Millions).” Statista – The Statistics Portal, Statista, www.statista.com/statistics/251657/number-of-digital-buyers-in-latin-america/, Accessed 24 Feb 2019

[5] Morning star equity research, “Economic Moat Source Series: Network Effect”, published October 5 2017

[6] Seeking Alpha, “MercadoLibre remains good growth pick, offers buy dip opportunity”, https://seekingalpha.com/article/4184744-mercadolibre-remains-good-growth-pick-offers-buy-dip-opportunity, Accessed 24 Feb 2019

Thanks for your post!

Mercado Libre is a super interesting case of study from many angles!

One of the main challenges that they are facing today is how to move from a C2C platform to a traditional B2C marketplace platform like Amazon, with the objective of monetizing the strong brand awareness and traffic that they have built in the region in the last 15 years. A B2C marketplace has higher average tickets, driving higher revenues.

As you described one of the drivers of this change has been the rapid expansion of MercadoPago, a solution targeted to medium and small online business that at the same are the target suppliers on the B2C marketplace. MercadoPago has been able to offer a simple but efficient solution in highly complex banking environments in the region.

Looking forward, one the main challenges for the company will be in Mexico, where is competing face to face against Amazon (with its retail and marketplace model). This battle is crucial to determine if Amazon will decide to expand its presence to LatinAmerica or not in the next few years.