Meet Thumbtack: Your Local Handyperson Reimagined

From guitar lessons to bed bug extermination to dunk tank rentals, Thumbtack offers services from over 250,000 providers to millions of customers via its online marketplace platform.

Thumbtack, a multi-sided platform launched in 2009, connects customers to service professionals and has raised over $273M, valuing it at $1.3B. [1] Despite its size, Thumbtack has relatively limited brand recognition, perhaps as a result of its decision to quickly roll out across the entire United States – CEO Marco Zappacosta claims there’s a paying professional in every U.S. county – rather than first building a significant user base in a single city or region. Regardless, Thumbtack reportedly has revenues exceeding $100M and a uniquely low burn rate, fueling investor confidence in the company’s potential, especially given its growth has been almost entirely organic to date. [2]

What’s perhaps most interesting about Thumbtack is the sheer breadth of services offered on the platform. There are many examples of platforms connecting consumers to providers of a single type of service (e.g., Airbnb for lodging or Uber for ride services), but Thumbtack’s value hinges on providing customers with access to professionals for virtually any need, a proposition that adds significant complexity to the effort of scaling. With that said, Thumbtack experiences significant cross-side network effects since the more consumers that use the platform, the more valuable the platform becomes for professionals and vice versa.

How does Thumbtack create and capture value?

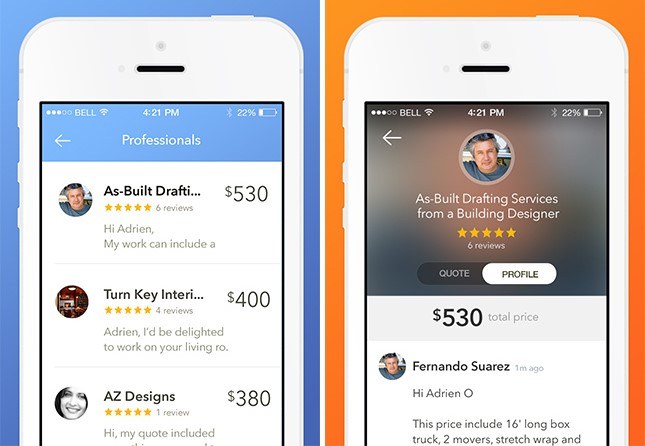

Customers answer several questions that capture the specifics of the job they need done. Within hours, available professionals send quotes to customers that include an estimate for the job and details about the business. Customers can follow-up directly with the professionals before selecting the one that is best for them. Customers are also provided with user reviews for each professional. Reviews are an important aspect of Thumbtack’s offering: 85% of professionals that get hired have at least one review, and professionals with over 5 reviews are over 5x more likely to be hired. [3]

Professionals, when they signup for Thumbtack, indicate what type of work they are interested in providing, how far they are willing to travel, and other relevant details. The platform matches the professionals with customers, and the professionals can choose to send the customer a quote. Thumbtack charges professionals for each quote the professional sends, the primary way Thumbtack earns revenue and captures value. Professionals are only refunded if the customer doesn’t view the quote within 48 hours. If a customer views the quote and chooses not to respond for any reason, the professional is still out the fee. [4]

Customers value the ability to source local service providers in a quick and convenient manner, to see user reviews before selecting, and to receive multiple quotes to choose from. Professionals benefit from the access to more customers.

Figure 1: Comparing Quotes from Different Professionals [5]

What are some of the challenges Thumbtack faces?

Despite its success raising capital, there are several persistent issues that have plagued Thumbtack since it first launched in 2009.

- Disintermediation. Thumbtack, like many marketplace platforms, is vulnerable to disintermediation from its two sides – professionals and customers. To reduce the impact of this, Thumbtack has structured its revenue strategy to monetize professionals exclusively on their first encounters with clients rather than monetizing subsequent interactions. In contrast, TaskRabbit, a similar service to Thumbtack, charges a 30% fee on first transactions between professionals and customers as well as a 15% fee subsequently. [6] By taking what’s essentially a “pay for leads” approach, Thumbtack has attempted to limit the impact of disintermediation. However, this strategy does beg the question of whether revenue from lead generation alone is truly substantial and sustainable enough to drive meaningful growth for the company well into the future.

- Customer acquisition. Thumbtack has spent little on growing its customer base with most growth having occurred organically through word of mouth. As a result, the brand suffers from relatively low recognition. As noted earlier, due to the strong network effects inherent in this business, it is critical that customer volume is high in order to make the platform attractive to professionals and initiate the growth flywheel. There are dozens of comments online from disgruntled professionals complaining that they have spent hundreds of dollars on quotes but have received few, if any, jobs. More customers are necessary to keep critical professionals satisfied with the platform. If professionals are unable to convert quotes to jobs, the entire system collapses. Thumbtack has recently launched television campaigns to grow its customer base, but it’s not clear yet what effects these efforts have had. [7]

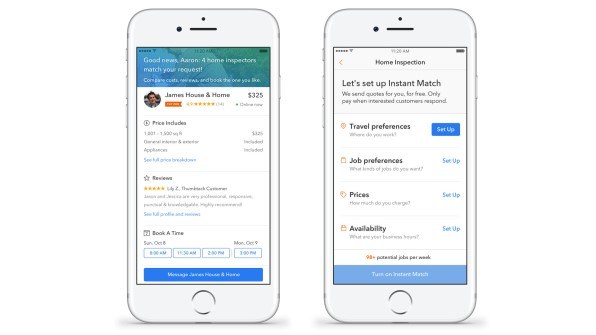

- Delay receiving quotes. Although the website advertises that customers receive quotes from professionals “within hours” of posting their job, the reality is that some customers are waiting up to two days or more. Seeking to address this delay, Thumbtack launched its Instant Match feature in late 2017. Instant Match immediately provides customers with a list of professionals who are available and interested in the job (based off information those professionals have provided). Professionals then get charged when customers respond to their auto-generated quote. [8]

Figure 2: Instant Match Feature [8]

Thumbtack has quietly grown its multi-sided platform into one of the most valuable marketplace startups in the world. With that said, the company is almost a decade old and has yet to become profitable while continuing to encounter challenges that threaten to derail the business. It will be fascinating to see if Thumbtack, armed with enough cash to sustain itself for years to come, can effectively address the critical challenges that have baffled other marketplace platforms around them.

Sources

[1] https://www.crunchbase.com/organization/thumbtack, accessed March 2018.

[2] Sarah Lacy, “Thumbtack is Unlike Any Other Unicorn You Know,” PandoDaily, May 27, 2016, https://pando.com/2016/05/27/thumbtack-unlike-any-other-unicorn-you-know-and-i-mean-compliment/, accessed March 2018.

[3] “Get Reviews to Win,” https://www.youtube.com/watch?v=pZ-rptxzQPM, accessed March 2018.

[4] “When You’re Charged on Instant Match,” https://www.youtube.com/watch?v=XQCmIHf0kWA, accessed March 2018.

[5] https://www.pinterest.com/pin/263742121902543699, accessed March 2018.

[6] Laurie Claire Reillier and Benoit Reillier, “Platform Strategy: How to Unlock the Power of Communities and Networks to Grow Your Business,” accessed March 2018.

[7] Marco Zappacosta, “What’s Ahead for Thumbtack in 2017,”, Thumbtack Journal, January 10, 2017, https://www.thumbtack.com/blog/whats-ahead-thumbtack-2017/, accessed March 2018.

[8] Emily Price, “How Thumbtack Plans to Become the Amazon for Home Services,” Fast Company, September 26, 2017, https://www.fastcompany.com/40472921/how-thumbtack-plans-to-become-the-amazon-for-home-services, accessed March 2018.

Thanks for writing! I had a few thoughts on some of the challenges you’ve described in Thumbtack’s business model. It seems like Thumbtack operates as a horizontal marketplace, as opposed to companies like Uber that operate in a specific vertical (e.g., transportation). As a horizontal marketplace, I think you either need to believe that there are transferrable network effects across verticals (e.g., suppliers can serve multiple verticals), or that there are significant benefits to the initial scale you can reach on the platform such that you create those network effects more easily. It seems to me that Thumbtack is betting on the latter, where they can get a larger corpus of users onto the platform initially by offering a wide variety of services they can be matched with. I think horizontal marketplaces are more difficult to get right, but they can be incredibly valuable if it works out.

A second thought is on disintermediation. It sounds like the model is quite unique in that it only charges a one-time fee for matching – this probably really helps them with the disintermediation problem, but without the ability to monetize an ongoing relationship, the long-term economics may not work very well – they’ll have to keep supporting the relationship through their tech platform, but gain no fee off of it. Maybe they can price high enough such that the fee from the initial transaction is enough to cover initial and ongoing expenses, but higher initial fees will also reduce the propensity to adopt. I think it’s likely they’ll have to tweak this part of their revenue model going forward.

A last thought is on customer acquisition. It’s actually pretty remarkable that they have spent very little on growing their base of users – it sounds like most of it is organic growth, and VCs love that type of trajectory where you can reach 9-figure scale with little investment. This strikes me as a positive – there must be something compelling about the model that drives users to adopt even with little prodding, and is a positive signal for the long-term unit economics of the business.

Great post and interesting insights about Thumbtack’s challenges! I have used Thumbtack a couple of times for building Ikea furniture was well as for moving between apartments, and found the quoting process to be very confusing. I agree that the Instant Match feature might help with some of the quoting issues and would also be interested to see if the platform would get more repeat customers if Thumbtack steps up efforts to prevent hidden fees a lot of the professionals try to sneak in after a quote has already been accepted.