Mastercard: The Best Kept Platform Secret

Mastercard survived through many financial technology disruptions because of the strengths in its core business model, but will it finally be tested by cryptocurrencies?

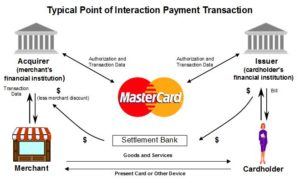

Mastercard has been around as a platform business before the most well-known incumbents like Airbnb, Google, and Uber. From its nascent beginnings, it has served to connect merchants and customers through their respective banking institutions. While buying your morning bagel on your credit card feels like an incredibly simple process, your credit card network is working diligently behind the scenes to make the process seamless. These various actions can be summarized in three stages: authorization, authentication, and clearing and settlement(1). Some of the data processed along with your bagel includes: your credit card details, sufficient funds in your account, and “approvals” sent back to the merchant that your transaction can take place. Credit card networks, like Mastercard, ensure that all transaction data is quickly and securely processed. These transactions have costs, which typically include interchange fees (set by the credit card network) and assessment fees. Without getting too in the weeds, essentially the merchant has to bear the cost of a customer paying via credit card by giving a portion of the customer’s payment to each of the financial institutions and the credit card network. Credit card networks typically receive a fixed fee for each transaction that a merchant conducts.

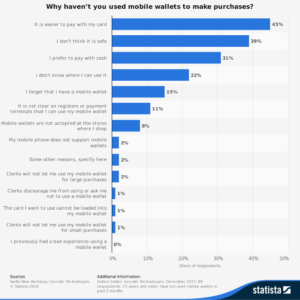

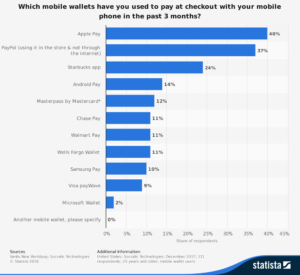

The combination of a complicated “behind the scenes” process and a seamless customer experience has thus far shielded Mastercard from disruption. The infrastructure required for data processing and security isn’t easy to build overnight. Thus, while Apple, Google, and Amazon have all introduced digital wallets, they still rely on customers loading their bank card into their solutions, maintaining Mastercard as the payments processor. Adoption of digital payments has also been slow amongst customers because of safety concerns and the already convenient nature of paying with a credit card. This slow progress has allowed Mastercard to catch up and introduce its own digital offering, Masterpass. In addition, digital payment solutions have thus far only bolstered Mastercard’s business, as they decrease friction in checkouts and lead to more purchases by consumers using the Mastercard platform. In fact, Mastercard’s largest barrier to increased growth is payments by cash, especially as ~85% of the world still transacts in this traditional mode(2).

Mastercard continues to innovate in the payments space to position itself as the “network of networks”, effectively building on its core business model by increasing the possibilities in volume of transactions. Some examples of Mastercard partnerships and innovations worth checking out: Qkr, Selfie Pay, Dream Payments, Vocalink.

Why is Mastercard experimenting so vigorously in digital payments? As the world begins to move towards cashless payments, Mastercard wants to control the flow of data. As a fairly agnostic player and with a brand perception associated with security, it also is in a good position to do so. For instance, Apple’s business model relies on selling hardware and their value is derived from customers buying into the Apple design. Apple Pay, thus, only serves to promote the sales of Apple devices. However, non-Apple customers need other payments solutions in the market. Additionally, merchants will need to accommodate a variety of payment methods. A solution like Masterpass is device and platform agnostic, which can serve as a value proposition for consumers who only want to load all their credit details into one app or offering. Unlike many other tech players, Mastercard benefits by being open and willing to serve everyone.

As an incumbent in the payments space, Mastercard will also be a preferred partner for ecommerce businesses, especially as identity theft becomes increasingly prioritized amongst consumers in the wake of cybersecurity breaches.

Building digital solutions also provides Mastercard more control over consumers. In the traditional plastic world, consumers don’t care about their credit card network. While multihoming (between credit cards) often occurs, consumers typically have one primary card they use based on their bank relationship or the rewards offered on their card. Mastercard can begin to take control of both the multihoming and apathy towards credit card networks by offering direct digital solutions. By building a strong brand, Mastercard can encourage customers to choose Masterpass as their primary network during checkout.

The largest threat to Mastercard now lives in cryptocurrencies. As cryptography becomes an increasingly secure method to verify and conduct transactions, Mastercard may find it’s century old payments infrastructure to be more of a liability than a competitive advantage. Mastercard has already introduced its own blockchain solution. While cryptocurrencies have a long way to go in becoming more secure, it is unclear whether Mastercard’s blockchain solution will be able to keep up with the rapid pace of change.

References:

- https://wallethub.com/edu/credit-card-transaction/25511/

- https://worldcore.eu/blog/cashless-nations-world-consumers-still-prefer-cash-despite-heavy-fines/

- https://www.morganstanley.com/ideas/fintech-finds-traditional-payments-hard-to-disrupt

- https://www.mastercard.us/en-us/about-mastercard/what-we-do/interchange.html

- https://www.pymnts.com/news/merchant-innovation/2017/mastercard-2017-payments-milestones/

- http://www.businessinsider.com/the-credit-card-industry-is-enormously-powerful-and-complex-but-payments-startups-are-beginning-to-shake-it-up-2014-4

- https://intelligence.businessinsider.com/post/digital-disruption-2017-4

- https://intelligence.businessinsider.com/post/the-payments-ecosystem-a-ground-up-overview-of-the-industry-today-2017-7

- https://www.entrepreneur.com/article/292256

- https://www.statista.com/statistics/541245/us-small-business-digital-mobile-payments/

- https://www.statista.com/statistics/306828/us-users-not-using-digital-wallets-reasons/

- https://www-statista-com.ezp-prod1.hul.harvard.edu/statistics/712881/instore-mobile-wallet-usage-usa/

- https://www-statista-com.ezp-prod1.hul.harvard.edu/statistics/640063/trustworthiness-of-payment-system-providers-usa/

- http://www.livemint.com/Industry/M6SPyd4vUcC7QIQRnjBqaO/Digital-payments-in-India-seen-touching-500-billion-by-2020.html

- https://www.barrons.com/articles/why-amazons-a-threat-to-mastercard-and-visa-1501012943

- https://www.theguardian.com/technology/2014/jan/15/10-things-u-need-to-know-digital-payments

- http://www.bankingtech.com/2016/05/why-itll-be-visa-and-mastercard-not-tech-start-ups-that-truly-disrupt-banking/

I thoroughly enjoyed this article. It is evident that Master Card and Visa have both done quite well in the past and I agree that data processing and security makes it difficult for incumbents to disrupt players with such big market global market shares. While it may seem to many that bitcoin and cryptocurrencies will dominate the 21st-century financial markets, I am a bit skeptical due to the processing power required and KYCs. Also, it is worth noting that neither Mastercard nor Visa have lost market value despite the anticipated disruption. It will be interesting to see how the G20 crypto regulatory talks turn out.