Kreditech: Loans based on Facebook posts?

By using new data sources and employing up-to-date machine learning technology, online loan provider Kreditech hopes to better understand applicant’s financial situation and personality.

Kreditech, an online loan provider headquartered in Germany, uses data analysis to assess the creditworthiness of individuals. By assessing the likelihood of an individual defaulting on a loan, the company is able to lend money, particularly to those who would not have access to a loan otherwise—for example, due to a bad credit history. The company was founded in 2012 and projects that it will reach €1 billion in revenues by 2025 [1].

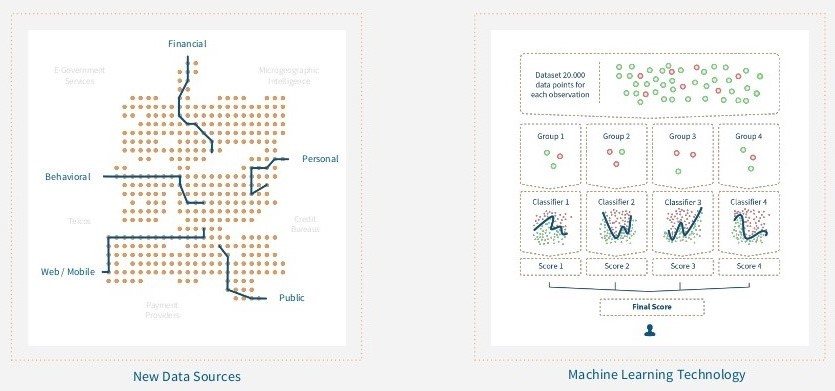

Instead of using conventional credit scores and focusing on the applicant’s past, Kreditech uses any available datapoints that describe an applicant’s characteristics and behavior today to better understand his or her financial situation and personality [2]. From that, the company infers ability and willingness to pay back a loan and the pricing at which Kreditech can make a profit providing such. Starting with the information shared by the applicant in the application form, the company screens the web for any valuable piece of information it can feed into its algorithm, such as speech and content of social media postings, social media connections, the way the applicant interacts with the company website (e.g., going straight to the application form), location data, e-commerce activity, and hardware specifics (e.g., which device is used to visit the website) [2]. Additionally, the applicant can grant full access to his or her browsing history, which is used by Kreditech to reveal supporting or potentially adverse personality traits. In 2012, Kreditech claimed that it processed up to 8,000 datapoints in real time [3]. Since then, this number has increased to more than 20,000 [4]. Using real-time data and employing fully automated machine learning technology, the company is able to calculate a creditworthiness score within less than a minute and make real-time credit decisions [4].

By using new data sources and employing up-to-date machine learning technology, Kreditech hopes to make superior credit decisions [4].

Conventional credit scores used by banks are backward-looking, inaccurate, and often outdated, meaning they do not reflect the true creditworthiness of an individual at a given point in time. This is especially burdensome for individuals who once defaulted on a loan but have since changed their habits. Kreditech is able to offer this customer group loans at attractive prices due to the company’s “near-instant credit risk assessment” [5] that generates an updated credit score at any second. Since Kreditech is often the only accessible source of loans for these customers, the company can take above-market interest rates [6]. Thus, by eliminating inefficiencies in the system, Kreditech is able to capture a large share of value.

Kreditech is very discreet about the exact functionality of their machine learning algorithm. However, given the relatively high number of datapoints, quickly rising user base, near-instant decision-making capability, and the autonomy of the algorithm without human supervision, it is likely that a considerable share of the ~$500 million [7] in funding the company received is used to set up and professionalize its data analytics platform. This includes constant recruiting of additional personnel with big-data backgrounds to “run machine learning tests and experiments” and “improve heterogenous, asynchronous and high-performance large-data processing pipelines” [8]. Every little improvement that is made in forecasting the credit risk also improves the company’s profitability.

Kreditech is constantly looking for data scientists to strengthen their data analytics platform.

https://www.youtube.com/watch?time_continue=19&v=7AgNy92JOr8&feature=emb_title

One of the major challenges for the company has been the concern about privacy. Essentially, the would-be borrower needs to give Kreditech full access to any online activity without exactly knowing how these datapoints act in conjunction and how the machine learning algorithm makes sense of them. The black-box character of Kreditech’s algorithm, which makes credit decisions without obvious causal relationships, still feels odd for consumers. Even the company’s experts cannot always explain how the algorithm arrives at the conclusion [9]. This is one of the reasons why Kreditech, as a German company, headquartered in Germany, has still not penetrated the German market, which is particularly cautious about privacy protection. Instead, the company focuses on developing nations where customers have even fewer alternatives.

As the market potential for online consumer loans grows, Kreditech will face more and more competition, both from new market entrants and established players such as banks that build their own data tools. Most of these players will have more resources and deeper pockets then Kreditech. Therefore, the company needs to continue capturing market share and building a robust technological advantage to keep competition at a distance or becoming an attractive acquisition target. By scaling the business, Kreditech pushes not only the boundaries in the field of machine learning and data science but also provides financial services to more people without alternatives.

[2] https://www.ft.com/content/12dc4cda-ae59-11e5-b955-1a1d298b6250

[3] https://techcrunch.com/2012/12/17/kreditech/

[4] https://www.slideshare.net/NOAHAdvisors/kreditech-noah17-london

[7] https://www.disruptordaily.com/microloans-9-platforms-changing-game-2018/

[8] https://www.kreditech.com/careers/job/1743697

Great post! I think its very telling that the company is focusing on developing nations where credit scores are less prevalent. I wonder whether this is their long term strategy or a means of showing a proof of concept/gaining validation. I’ve spoken to people in insurance for instance in the US and did not get this sense that this would be adopted given the many privacy concerns and regulatory requirements for transparency. Is it the same in Germany and if so what does it mean for Kreditech’s growth strategy?