H&M – Nowhere to Turn

H&M is one of the three largest fashion brands in the world, with $23 Billion in sales and over 10,000 stores worldwide. 3 decades ago, H&M and Inditex (Zara) disrupted the fashion industry with a rapid supply chain and “just-in-time” inventory.

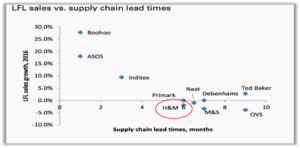

So, what do they have to worry about? In recent years, H&M has had negative like-for-like sales growth, the curse of a brick-and-mortar franchise. Their business is under siege from pure-play online retailers who are disrupting their dominance in much the same way that they disrupted the fashion industry in the 1980’s. Companies like Asos and Boohoo are using data-driven product design, pure e-commerce distribution, and a blended supply chain (mix of Asia and onshore, with smaller batch sizes) to flip the fast-fashion industry on its head, once again. H&M is aware of the explosive emergence of these digital-focused competitors, but thus far they have been unable to reason an effective way to respond. The company was built on rapid store growth and China manufacturing, with very little focus on technology, and it has had a hard time shaking that DNA.

H&M suffers from a Dual Cost Problem, in that their online sales represent a channel shift that cannibalizes in-store sales, so the costs of maintaining retail footprint and an online presence are magnified. The growth in online fashion sales has been at the expense of in-store, not in addition to it. This has been a problem for all brick-and-mortar retailers, but it is especially problematic for H&M because of their uniquely vast portfolio of stores.

It costs on average 18% of sales to operate a physical retail operation, and for pure online players, the investments in distribution and technology also require around 20% of sales. Therefore, if H&M wants to respond with an online presence (which they have shown an inability to deliver from a technical standpoint), it will require a major hit on costs until they figure out the right balance.

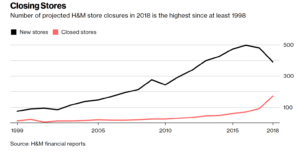

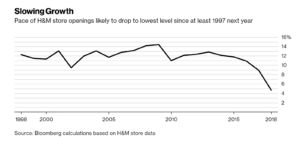

H&M’s position is magnified by the fact that they recognized the problem later than their peers (Inditex), and thus while others have slowed their pace of store expansion, H&M has continued to expand store footprint by ~15% annually for the last decade. This glut of stores is forcing H&M to invest in endless discounts, which is another cost preventing them from investing in an effective online offering.

So How Should H&M Respond?

For years, the wrap on H&M in the fashion industry has been that they are stubbornly doubling down on the strategy of store expansion. However, it seems that Wall Street has finally convinced H&M that they need to dramatically change their strategy in the face of digital disruption (see stock chart below)

The Swedish retailer has started to pull back on store openings, but that will not be enough.

In order to save their business, H&M will need to dramatically change their business, probably starting with shuttering thousands of stores, and heavily investing in an omni-channel model. If they do this, earnings will take a major hit, and the markets are surely to hammer them for years.

Will their leadership have the courage and the job security to make these moves?

Sources

- Goldman Sachs (LFL sales Chart)

- https://www.bloomberg.com/news/articles/2018-01-31/h-m-s-store-closures-to-surge-as-fashion-giant-shifts-strategy

- businessoffashion.com

Great post, Rob. I have never heard of Asos or Boohoo and wasn’t aware of the impact that these business models are having on companies such as H&M. Do you think these new pure digital business models will be able to scale well enough to become category leaders?

Good post Rob, H&M is a great case of how the a company that disrupted an industry years ago can now be disrupted by digital technology. You recommend to swift to an omni-channel model, in addition to reducing store openings, do you believe that they should reduced the overall number of stores? or should they keep the amount of physical presence to support their brand? Regarding the omni-channel model, I am wondering how difficult it will be to develop the required capabilities to compete in the e-commerce space.