Energy Management Systems: a digital transformation that’s leaving electric utility companies by the wayside

Energy management systems are enabling a transformation to a new, digital energy era. And those with the best energy management systems and financing models are poised to win as we switch to a decentralized model of energy production.

Today, most residents and organizations receive their electricity from the grid, through cables running underground and into their properties. That electricity is fed into the grid by a few big centralized energy producers – typically coal- and gas-fired power stations in the US[1]. And consumers pay a monthly bill for the electricity they consume, at prices set by the local energy producers and/or regulators.

Our electricity markets have functioned like this for decades. A transformation is underway, though, and it’s accelerating at a rate that’s posing an enormous and existential threat to incumbent electricity providers.

With recent technological improvements to newer, renewable forms of energy production, the cost of producing renewable energy has come down to levels nearing the more traditional methods[2], and they’re only continuing to fall further. Solar and wind are pretty modular ways to produce electricity – that is, they don’t require scale to achieve high efficiency. As such, consumers now have the option to install their own renewable energy assets – solar panels or wind turbines – instead of sourcing their electricity from the grid.

There’s still the issue that renewable sources of energy only produce electricity when the sun is shining or the wind is blowing. But with storage technologies, such as batteries, also coming down in price, consumers can now produce electricity when conditions are favorable, and consume it when they need it.

The last thing needed to tie this system together into a fully-functioning microgrid is an energy management system. The energy management system controls when you charge or discharge your battery, how your renewable energy assets are calibrated, when you switch on your back-up generator, and generally keeps the system balanced.

Now that generation and storage is cheap enough, the advent of advanced energy management systems has made it feasible for any residential or commercial and industrial consumer of electricity to own their own microgrid. And this enables them to produce their own energy, and no longer procure it from big electricity producers via the grid.

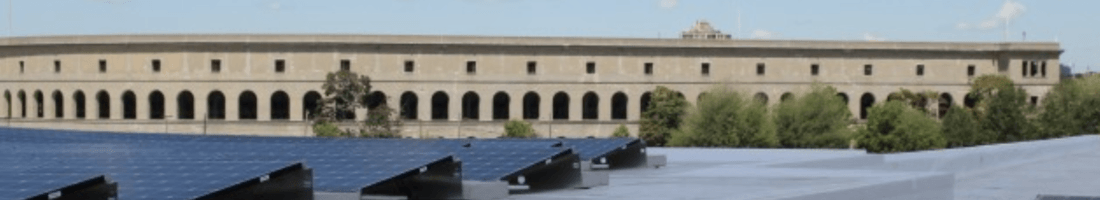

Harvard University is in fact one of the early pioneers in adopting microgrid technology[3]. Solar panels cover the rooftops of most of Harvard’s campuses, and the wind turbines on top of OWA are gathering data on whether there is an opportunity to add wind to Harvard’s energy portfolio. And to service spikes in demand and troughs in supply, Harvard is building a state-of-the-art 9MWh thermal storage tank: that big yellow cylinder that’s under construction across the road from HBS[4].

Microgrids create value for energy consumers in 3 ways. First, microgrids are a much cheaper way to source electricity than buying it from electric utility companies. The capital needs to be purchased upfront but, over the life of the assets, microgrids are anywhere between 20% and 30% cheaper than electricity sourced from the grid[5].

Second, microgrids increase the resiliency of consumers’ energy supply. The grid is prone to blackouts from bad weather or technological faults, due to its centralized and expansive nature. Microgrids, on the other hand, are decentralized and therefore have fewer points of failure and are much less prone to electricity outages. This is especially important for industries that can’t afford to lose electricity, e.g. hospitals, military bases, etc.

And third, because microgrids’ generation comes mostly from renewable sources, they produce significantly less CO2 per kWh of electricity than electricity produced from centralized power stations. This is valuable to consumers who are naturally conscious about their carbon footprint, as well as those who are trying to comply with ever-more stringent regulations concerning CO2 emissions.

As a result, value capture in the energy industry is switching from the electric utility companies who own power stations, to OEMs who provide the infrastructure for microgrids, companies that provide the energy management systems, and companies that provide financing for microgrid owners who don’t want to buy all the capital upfront.

As energy assets become increasingly commoditized, the winners in this industry are likely to be the companies who can differentiate their energy management systems and their financing models. The energy management systems are important for two reasons. First, the customers of microgrids are likely to be the people in an organization who are responsible for energy procurement and supply. They will be using the energy management systems day in, day out, and any improvement on UX or functionality that you can offer them is likely to have a big impact on their day-to-day work. And second, a good energy management system optimally calibrates all parts of a microgrid, which can drastically improve the yield on a microgrid’s assets, as well as increase the lifespan of these assets.

Switching to a microgrid also requires a big change to a company’s business model, as well as to its energy procurement processes. Few companies are prepared to make such big capital outlays, especially before they have tested a new technology. So financing models are an important component to bringing customers along this change curve, so that companies can reap the benefits of microgrids, whilst stretching out the payment for their electricity over a longer timeframe. Companies that innovate effectively in this space and have the ability to provide financing will therefore be at an advantage, and likely become winners in this new era of energy.

There are a few frontrunners emerging in the microgrid space, including ABB and Schneider Electric, who provide the microgrid infrastructure, energy management system and often financing, too. I predict that Siemens will end up becoming the winner in this space, though. Not only are they an OEM who can provide the full package of microgrid services. But their energy management system is consistently ranked as the most comprehensive and user-friendly on the market[6]. And through its partnership with Siemens Financial Services, it can offer very competitive financing off its own balance sheet[7].

It’s quite easy to determine the losers of this digital transformation. It will be those electric utility companies that fail to completely overhaul their business models for the new era of decentralized energy. Any company that keeps on its core strategy of operating centralized power plants will find itself seriously struggling for market share in 10-20 years’ time.

- https://www.eia.gov/tools/faqs/faq.php?id=427&t=3

- https://www.eia.gov/outlooks/aeo/pdf/electricity_generation.pdf

- https://microgridknowledge.com/microgrids-and-distributed-energy/

- https://green.harvard.edu/news/highly-efficient-energy-system-power-harvards-allston-campus

- A well-managed microgrid could shave 20% to 30% percent off energy costs for a building or a campus” – Microgrids: Technologies and Global Markets, BCC Research, 2018

- http://comunicazione.inxserver.it/NLROD/2018/02/ROTW_20190118/Navigant_Leaderboard%20DERMS%20vendors_Jan19.pdf

- https://en.wikipedia.org/wiki/Siemens_Financial_Services

Alex,

Thanks for a very insightful post! In addition to the mechanisms that you described (and their positive impact on resilience and green energy use), I am also fascinated by the impact that IoT and more powerful climate processors are having on commercial building climate controls. For example, one of my friends is working for a startup that is installing weather sensors throughout New York City lampposts to modify building temperature controls (on a room by room basis, in lieu of a central or floor control) based on outside temperature and sunlight. As you said, I feel that this space has great potential to impact companies by both greatly reducing their costs (providing an economic incentive) and by consuming less conventional energy (providing environmental and PR benefits).