e-Transferring to the future

As Interac’s e-Transfer service tries to expand beyond its personal banking clients, will it succeed?

Interac was initially started by the largest Canadian banks in 1984 to allow their customers to access money through a single shared network. Since then, it has expanded to become the country’s de facto payments network, in addition to Mastercard and Visa.

In 2003, Interac launched its e-Transfer service allowing personal banking customers to send money instantly by email or text message to one another, regardless of the bank they used. Before the Interac e-Transfer service, individuals could pay one another using cash, cheques or each bank’s individual service. Each of these were generally slower and required in-person transactions.

By contrast, Interac e-Transfer is practically instant and secure – creating significant value for consumers. Friends can split bills, renters pay their landlords, and parents send their children money all through one platform all through the convenience of their own bank – no need to download a new app. By being the first in the market, the de facto inter-bank money network, and a payments processor regulated by the Bank of Canada, Interac has cornered the market. By 2019, the Interac e-transfer service processed over 486 million transactions worth around $169 billion.

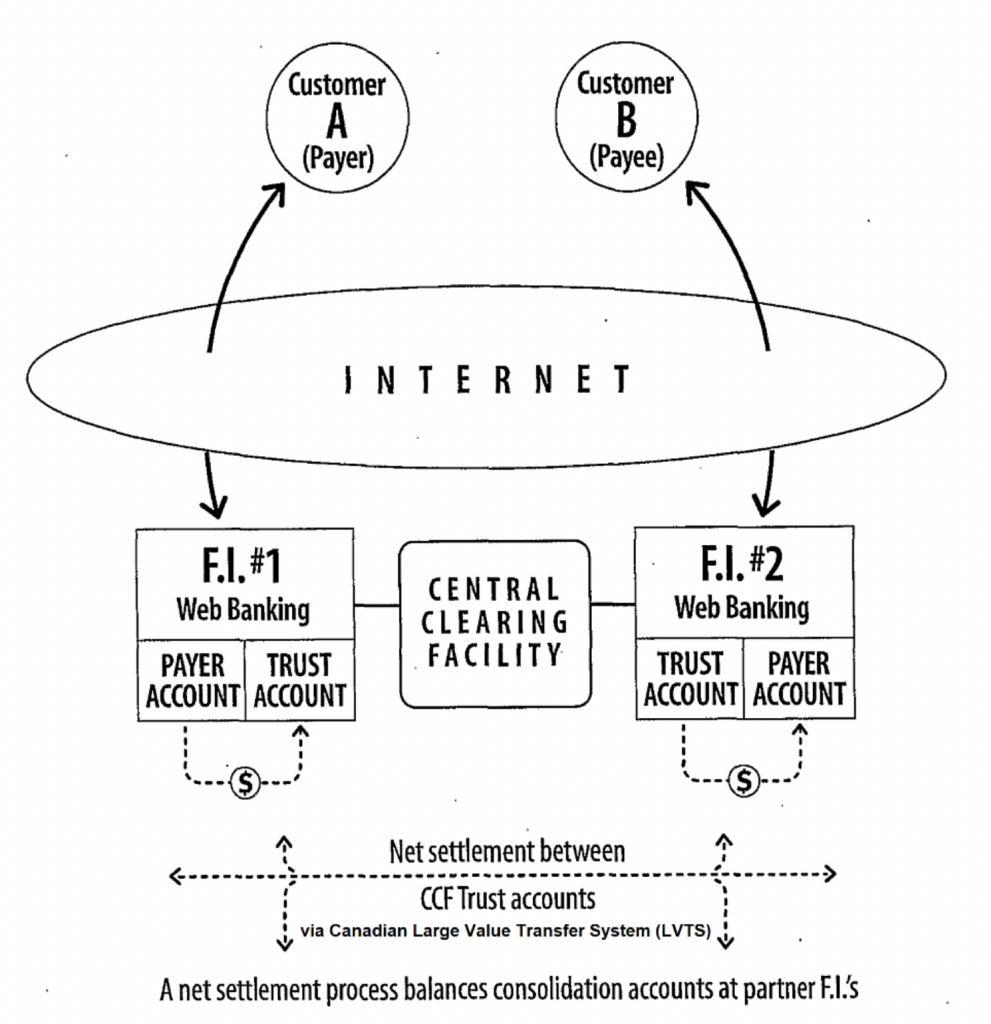

How Interac e-Transfer works

Banks each have their own interface for customers to send an e-Transfer. The sender enters the recipients phone number and/or email address to initiate a transfer. The money is immediately removed from the sender’s account to a trust account where it held until the transfer is complete. The recipient receives an email or a text message with a link to deposit the transfer. On clicking the link, the recipient answers a security question and the money is instantly deposited. If the recipient has the e-Transfer auto-deposit feature turned on, the money is deposited immediately in the recipient’s account without needing to click a link or answer a security question.

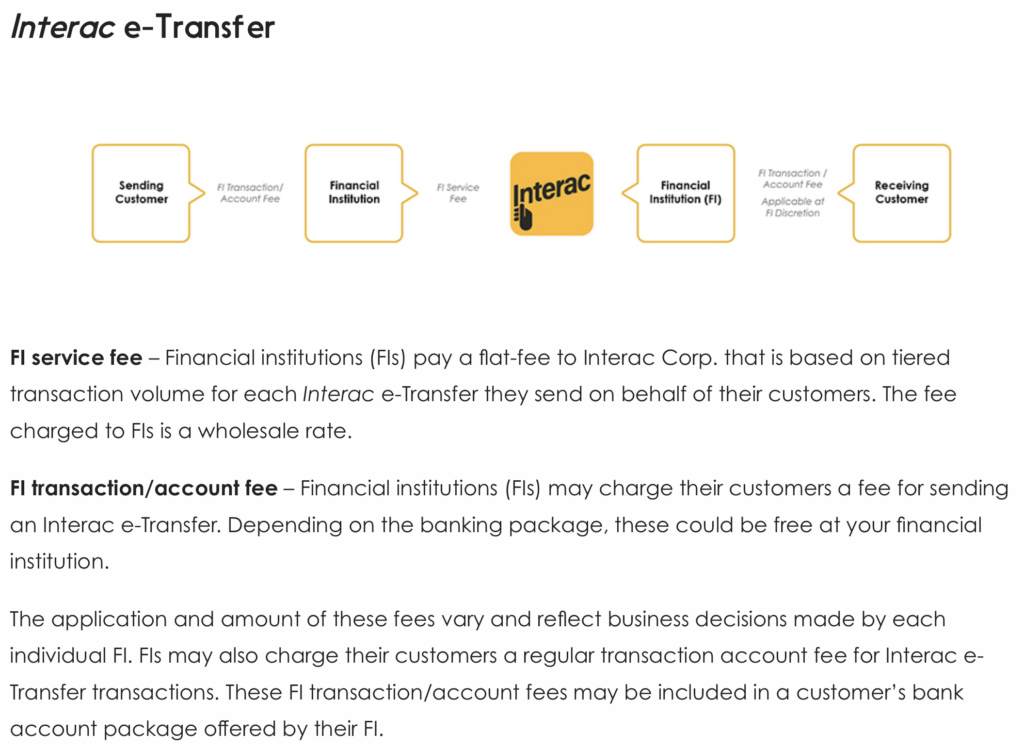

As a for-profit entity, Interac captures value by charging banks a small regulated cost-recovery fee per e-Transfer transaction. Most banks offer the service free of charge to their customers given the low cost.

e-Transfer grows

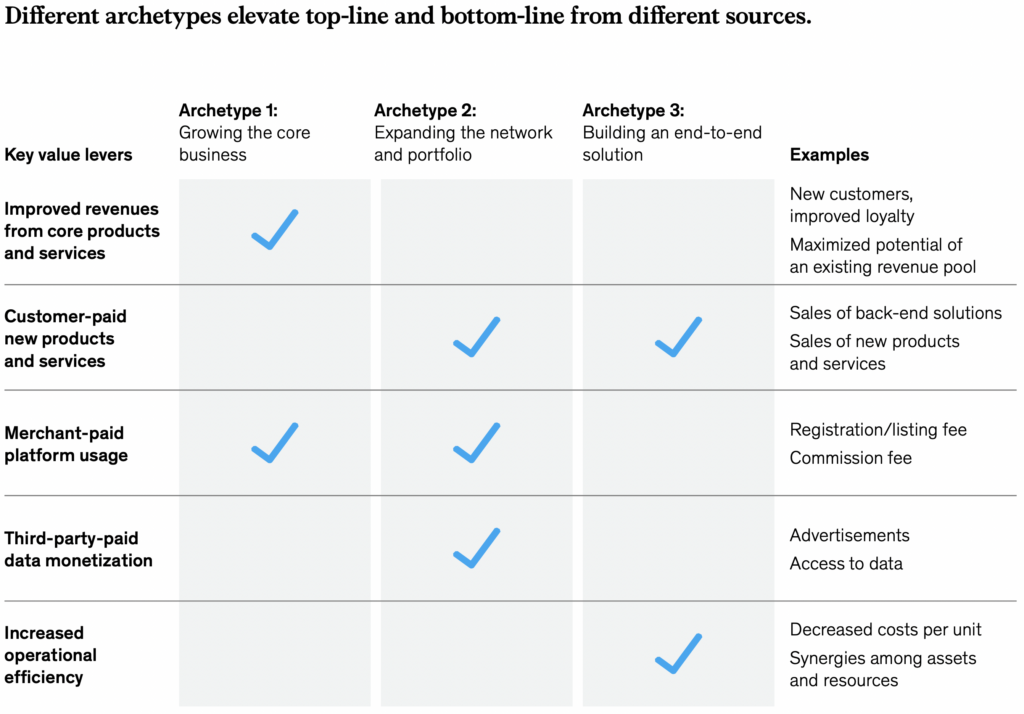

As the COVID-19 pandemic ravaged the world, Interac was seeing significant growth in transactions as more and more people shunned cash. According to McKinsey’s framework, there are three archetypes by which companies can grow their businesses. Given the regulated nature of financial institutions, Archetype 3 to build end-to-end solutions would be unlikely to succeed and would erode the goodwill Interac has built up with its banking partners. Archetype 1 could be possible, but again given the regulated nature and 10 year contracts of Interac’s service fees, Interac would be hard pressed to raise fees. This leaves Archetype 1 as the most logical route by which to expand its business – growing the core business.

A pain point that was identified was transactions between businesses, especially during the pandemic with 83% of business leaders indicating interest for a new payments processing system. e-Transfer was historically a personal banking solution with daily sending limits of $10 000, which is not suitable for small or medium enterprises. Businesses continued to pay and receive invoices using cheques, which took 5-10 business days to settle.

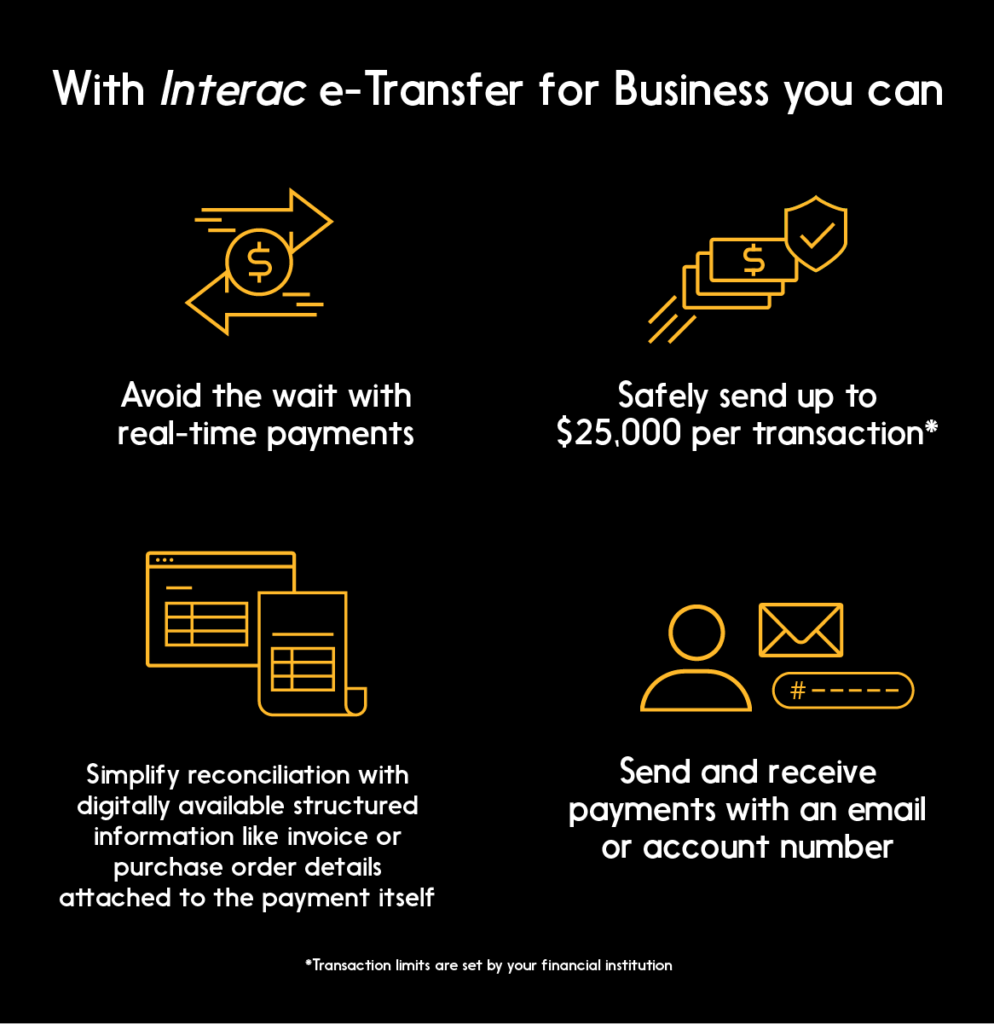

Interac for business introduced value through four main ways:

- using fewer cheques: reducing administrative inefficiencies

- instantly receiving payments: cashflow improves for businesses since payments are settled immediately. The transaction limit for businesses was also raised to $25 000.

- conveniently sending money: by tying into the existing Interac payments system, companies can pay one another using their Interac account numbers in addition to sending money through email or text messages.

- data connected to accounting processes: the transactions are data-rich and ISO 20022 compliant, containing the structured information needed for accounting processes.

In addition, e-Transfer for Business allowed bulk payables and receivables, allowing companies to invoice and automatically remind clients to pay and to send to multiple recipients at once. For example, companies could now integrate their payroll into the e-Transfer system allowing them to pay their employees instantly and with fewer administrative work required. In addition, there were high volume and limits allowing 10 000 transactions per file and higher dollar value per transaction further improving operating efficiencies.

Its sustainable platform fees and stable customer base has allowed Interac to leverage its popular e-Transfer network to grow from personal banking services to enterprise-level transactions. With so much financial data flowing though its network, could tapping into that data be the next growth edge for the company?