Digit: Saving you from Not Saving

Is micro saving a thing? Digit and its venture capital investors seem to think it is. Micro saving is better than no saving, particularly when you seem to live paycheck-to-paycheck. Having a digital assistant that can go through your bank account and find money pockets that you can put away for a holiday or a rainy day might be a great solution when you don’t have the habit to save, or simply don’t know how.

Is micro saving a thing? Digit and its venture capital investors seem to think it is. Micro saving is better than no saving, particularly when you seem to live paycheck-to-paycheck. Having a digital assistant that can go through your bank account and find money pockets that you can put away for a holiday or a rainy day might be a great solution when you don’t have the habit to save, or simply don’t know how.

Go Banking Rates say that “57% of Americans have less than $1,000 in savings. In fact, 39% of survey respondents said they had no money set aside in savings at all.”[1] The personal finance platform uses Artificial Intelligence (AI) to tap into your bank account, evaluate your income and spending habits and find a way to withdraw small amounts of money every other day, to make a constant saving flow that will pay in the future.

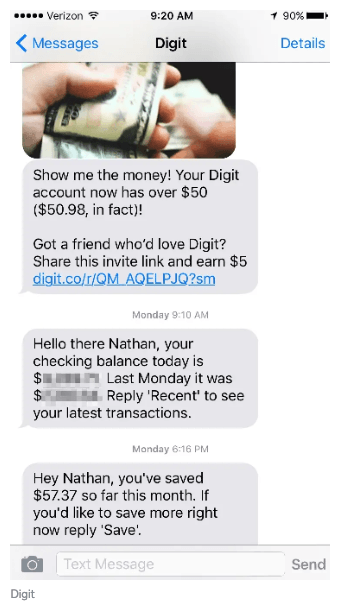

So when you download the app, you are basically opening a savings account that will automatically put spare change for an emergency or a future treat. Think about it like your old penny jar in the kitchen, except that it is digital, you know how much money there is in the jar because it will give you an updated balance, you carry it on your smartphone, you can chat with it, and it will help you find extra cash to upgrade that holiday with friends.

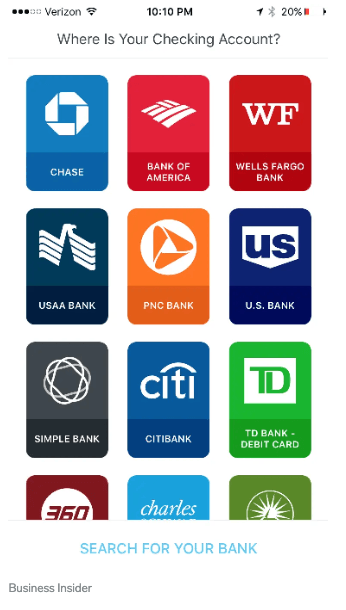

You will give the app your identifying information and your checking account information, and for the next couple of days it analyzes your transactions (pay day, bills and spending patterns), and finally it suggests the best alternative to withdraw money for your savings account.

You will give the app your identifying information and your checking account information, and for the next couple of days it analyzes your transactions (pay day, bills and spending patterns), and finally it suggests the best alternative to withdraw money for your savings account.

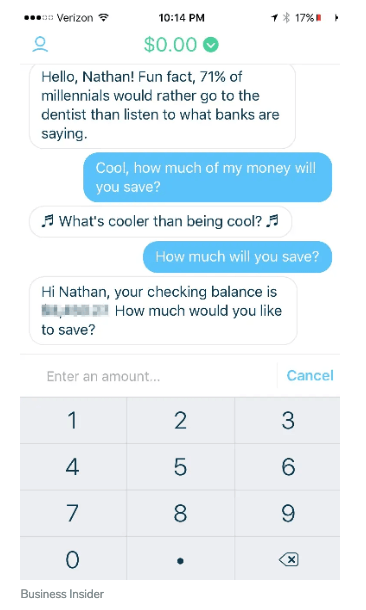

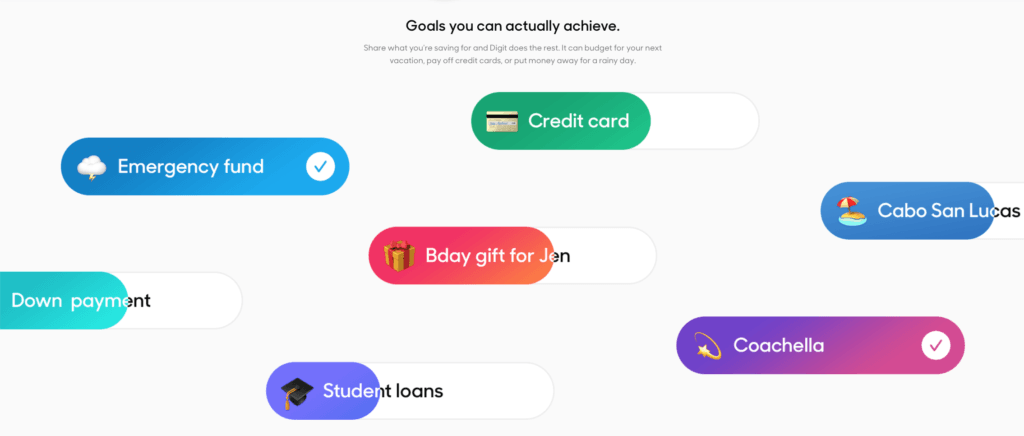

The automated saving tool chats with you, through phone messaging, so you can decide your saving ranges—that can go from pennies to hundreds of dollars—and set specific goals with end dates. After this, the tool will find a way to meet your goal(s) by withdrawing money every two or three days. Their purpose is to “make saving as easy, stress-free, and automatic as possible.”[2]

Safety measures and other concerns

Fee. Digit charges a monthly subscription fee of $5.00 each month and also make money from interest earned on your savings.[3]

Security. “The data is secured by 256-bit encryption, that’s the same level of security as the military, and uses the funds in your Digit Account are held with our FDIC insured banking partners for your benefit and are insured up to a balance of $250,000.”[4]

Credit Card. Digit doesn’t have access to your credit card, but can see your monthly payments and factor that into your expenses.

Credit Card. Digit doesn’t have access to your credit card, but can see your monthly payments and factor that into your expenses.

Saving Bonus. If you save with the app for three consecutive months, you will be rewarded with a1% annualized Savings Bonus.[5]

Goals. There is not a limit on the number of goals, but if you don’t have any, the app will send the money by default to a rainy day fund, with an umbrella emoji.

Overdrafting. The platform promises the algorithm will avoid overdrafting your account, and gives you a free overdraft reimbursement if it saves too much.

Overdrafting. The platform promises the algorithm will avoid overdrafting your account, and gives you a free overdraft reimbursement if it saves too much.

Customer service. It wants to make it easy and simple, by doing most of your operations through chat; even withdrawals (that are on a 24/7/365 basis) are done by phone chat.

BBB Rating. The Better Business Bureau has given Digit a rating of A- (on a scale of A+ to F), and only 11 complaints have been filed against the company.[6]

There is much value capture from same-side network effects, customer experiences improve the cost structure benefits from the data feed of its users. The more users they have, the more data they acquire and the better it is for its Application Programing Interface (API), and hence the more accurate their financial services will be. The app could benefit form more banking partners, additional checking account information, and diverse demographics; this will help them access a more varied set of data, that in return will help the algorithm learn other economic habits and offer more and better financial products, maybe personally or regionally tailored. It could grow to other services, other than just savings—within the range of financial inclusion and financial education—such as personalized financial coaching and budget tracking with spending caps (you don’t want to overspend in coffee, retail therapy, or apps you don’t use).

[1] https://www.gobankingrates.com/about/press-releases/americans-less-1000-savings/

[2] https://dollarsprout.com/digit-review/

[4] https://help.digit.co/hc/en-us/articles/210583978-Is-my-money-FDIC-insured-

Excited to see Digit featured in your blog post! I’ve been a huge fan of the application and been able to save thousands without a single thought. Unlike many other financial applications, Digit is barely noticeable in your everyday life. We are inherently wired to dislike saving (pain now, reward later), so the more it happens without my attention the better. Every had Mint reprimand your for going over-budget in five spending-categories a day? It sucks. So kudos to Digit for understanding consumer psychology and taking a step back.

Two things to add for folks worried about overdrafts: Aside from the guarantee Digit also anticipates if other services (e.g. your phone bill) will overdraft your account. In response, the app transfers money back into your account, just in time. Lastly, you can also set a minimum threshold you want Digit to stay above.