Developing a Digital Farmers’ Network to Create Pricing Transparency

FBN has created a platform to share data and make pricing more transparent in one of the most opaque markets left in the US. In doing so, they are taking on some of the largest players who have a lot to lose.

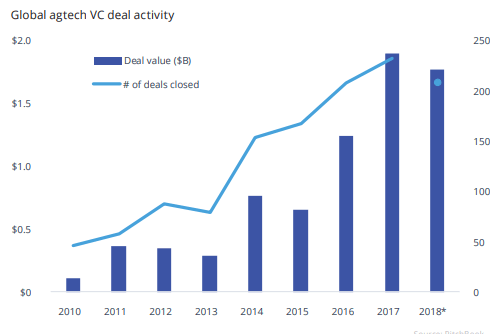

The agriculture industry has been transformed by numerous digitalization trends over the last 20-30 years. These include the adoption of IoT devices, drones, big data analysis, precision agriculture, and what Farmers Business Network (FBN) refers to as the “democratizing of data”.[1][2] The industry has also seen a huge influx of capital and investments in technology:[3]

AgTech Financing via VC (2010-2018)[4]

*As of October 2018

FBN, which has received almost $200mm of those investments over the past few years,[5] has created a digital platform that allows farmers to input data on local prices for inputs and then compare those prices across regions and vendors, creating more price transparency. They have also moved into buying the materials directly from manufacturers and selling them to farmers (they own nine warehouses across the US).[6] In addition to providing an anonymous platform to compare prices, they also provide several analytical tools and services to help farmers make better decisions and create value.

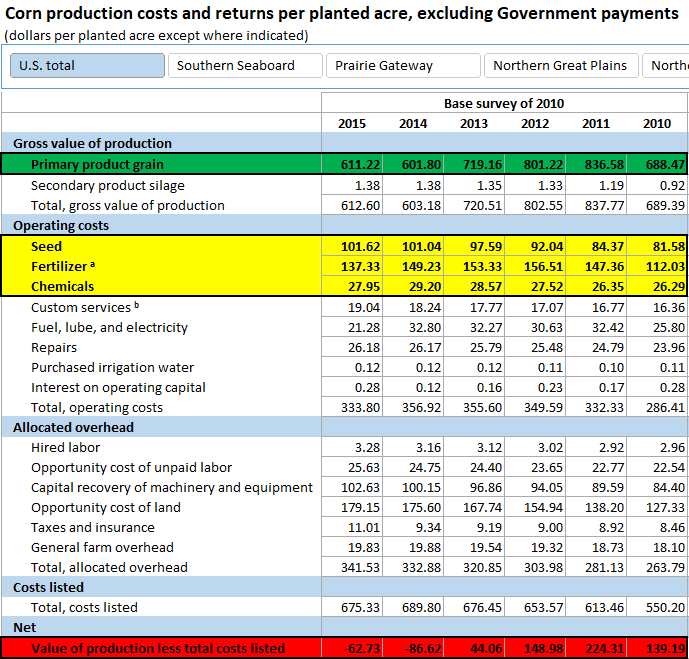

Historically, farmers relied on local distributors to purchase all their inputs (the key ones being seed, fertilizer, and chemicals). Prices of these inputs have risen dramatically in recent years (see the yellow highlighted area below) despite gross revenues declining (see the green area below) and net income also declining (see the red area). As an example, recent numbers from the US Department of Agriculture (USDA) for Corn are provided below. This trend, coupled with the complexity of new genetic seed varieties (the same genetics can be sold under different labels at different prices)[7] and chemicals coming to market, has created an opportunity for FBN to enter the marketplace and provide a valuable service for those in the industry.

USDA Corn Production Costs and Returns 2010-2015[8]

Value Creation & Transfer

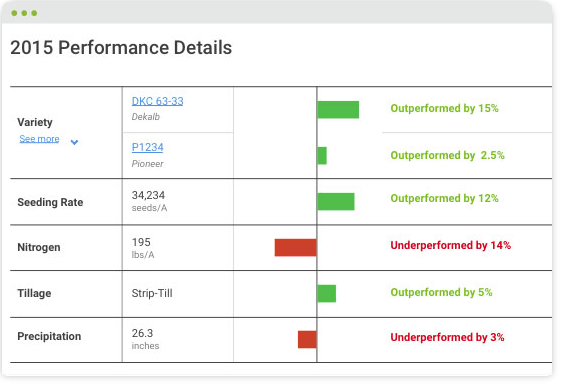

FBN creates value in several ways. The platform provides data that shows the results of various seed types and the management practices used to produce those results. This allows farmers to compare their results to other farmers, drastically increasing the amount of data available to compare and analyze across years, geographies, and conditions. These “digital assets” have historically only been available to seed producers and to farmers on a local level who choose to share data with each other.

Screenshot from the FBN Website[9]

As this space has grown more complex and biotech/agrochemical companies have created more characteristics to differentiate their products, the increasing complexity makes it naturally more difficult for farmers to compare products. An example of a popular corn variety’s “technical sheet” can be seen below, along with the various traits and attributes that differentiate it from others on the market:[10]

FBN allows farmers to publish and share the actual results vs having to rely on just the marketing material that is controlled and distributed directly by the company (the variety above came from Syngenta’s website).

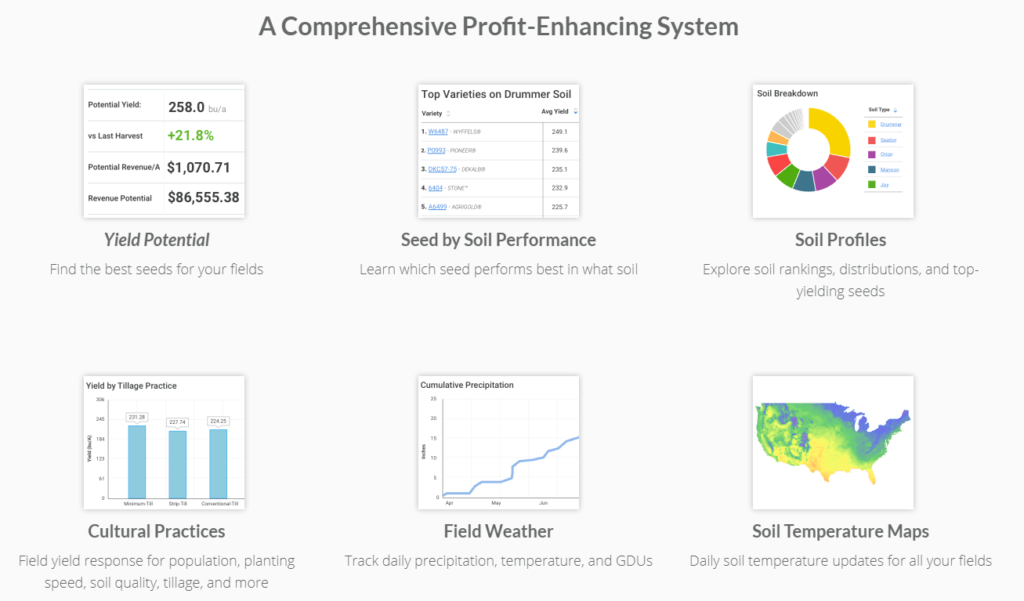

It also provides customized data on each field across 12+ metrics.[11] This data can then be used by the farmer to make better decisions to maximize their yield each year through better operational planning and decision making.

Screenshot from the FBN Website[12]

In the past, most marketing materials for each seed type, fertilizer, and chemical were produced and distributed by the manufacturers themselves, raising some concerns about transparency. The selling process for these inputs was incredibly relationship driven, as Charles Baron (founder and HBS ’13), explained to Forbes in a 2017 article:

Longtime relationships and free trips to Disney; a heavily consolidated market of suppliers that thrives on a lack of information – that’s how sales have operated for decades in U.S. agriculture, the startup cofounder argues. It’s also why Farmer’ Business Network’s data-driven, pro-transparency approach has taken off so fast since launching just two years ago.[13]

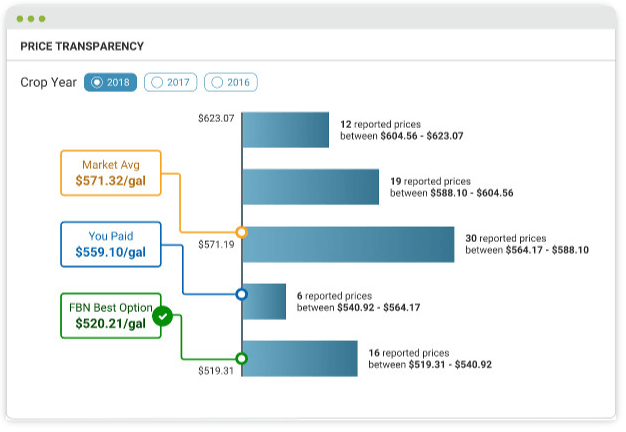

The core tenet of FBN is to provide pricing transparency for farmers and purchasers of agricultural inputs. In this case, the platform is really transferring value from one part of the value chain to another. Farmers are a highly fragmented portion of the value chain and historically have been very limited in their ability to “price discover”. FBN shifts that value from the large agrochemical and seed companies (and notably their distributors) to the farmers themselves by creating transparency around prices.

Screenshot from the FBN Website[14]

Value Capture

FBN uses a very straight forward pricing model to capture value – it charges members of the platform $600/year. This price seems low, given the benefits and potential windfalls the average farmer can expect (one farmer reported saving almost $4,000 on a single transaction using the platform)[15], but the technology is also very new and being introduced to an industry that has historically been very skeptical of new platforms not marketed by the traditional big players. They have experimented with several pricing points over the years – starting at $500 in 2016, then moving to $700 in 2017, and finally to $600 where it currently stands.[16][17] This model starkly contrasts with others in the AgTech industry who charge by the acre/scale. Subscription based pricing makes revenue streams more predictable and a [low] set price point encourages adoption by the largest farms – those with the most to gain, who likely already do some analysis themselves. It also prices out some of the smaller farmers, who are less likely to contribute to the platform.

The Loser(s)

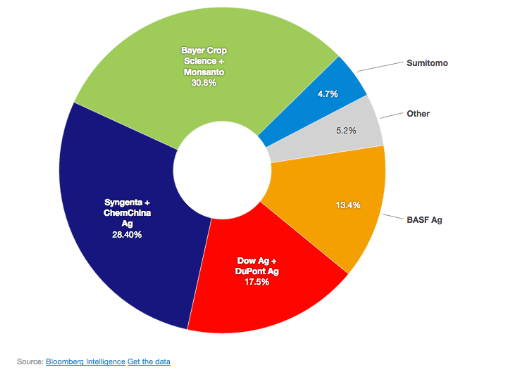

The losers in this digital transformation will be the local distributors and large crop protection/seed companies producing these inputs (DowDuPont, Bayer/Monsanto, ChemChina/Syngenta, BASF, etc.). These companies have all recently gone through their own consolidation and only a few large players dominate the market:

Crop Protection/Seeds Market Share

The Top 3 Players Control 77% of the Industry[18]

As farmers have more information to compare results with each other in a centralized location that makes sorting and analyzing easier, these companies’ marketing materials will lose some of their influence. To effectively respond, they will have to compete on price and product quality vs relationships and brand names.

Conclusion

In addition to providing price transparency, a data analytics platform, and a system to benchmark performance, FBN also provides financing, insurance, hedging strategies, and market analysis directly on their platform.[19][20] Each of these are key elements of the average farmers’ day-to-day operations and it seems FBN is seeking to provide a one-stop-shop to satisfy the farmer’s “job to be done”.[21]

FBN’s success will ultimately depend on their ability to get more farmers on their network to increase the platform’s network effects; without farmers inputting pricing data and sharing data from their operations, the value proposition falls apart.

[1] Accenture. “Digital Agriculture: Improving Profitability.” https://www.accenture.com/us-en/insight-accenture-digital-agriculture-solutions, accessed March 2019.

[2] Farmers Business Network. “Farmer’s Experience.” https://www.fbn.com/about#farmer-experience, accessed March 2019.

[3] Karthee Madasamy. “AgTech Investment Overview.” June 3, 2018. https://kartheepan.com/agtech-investment-overview-c4add2900834, accessed March 2019.

[4] Finistere Ventures LLC. “2018 Agtech Investment Review.” 2018. https://files.pitchbook.com/website/files/pdf/Finistere_Ventures_2018_Agtech_Investment_Review_xeO.pdf, accessed March 2019.

[5] Amy Feldman. “Farmers Business Network Raises $110 Million to Help Squeezed Farmers Cut Costs, Increase Profits.” Forbes, November 20, 2017. https://www.forbes.com/sites/amyfeldman/2017/11/30/farmers-business-network-raises-110-million-to-help-squeezed-farmers-with-help-from-technology/#4cd8389ca6db, accessed March 2019.

[6] Connie Loizos. “Farmers Business Network just raked in a whopping $110 million in Series D funding.” TechCrunch, 2018. https://techcrunch.com/2017/11/30/farmers-business-network-just-raked-in-a-whopping-110-million-in-series-d-funding/, accessed March 2019.

[7] Dan Gunderson. “Startup using tech to pull back curtain on seed, fertilizer prices.” MPR News, December 17, 2018. https://www.mprnews.org/story/2018/12/17/startup-using-silicon-valley-tech-pull-back-curtain-on-seed-fertilizer-prices, accessed March 2019.

[8] USDA Economic Research Service. “Commodity Costs and Returns.” February 5, 2019. https://www.ers.usda.gov/data-products/commodity-costs-and-returns/commodity-costs-and-returns/#Current%20Costs%20and%20Returns, accessed March 2019.

[9] Farmers Business Network. “Seed Agronomics.” https://www.fbn.com/analytics/seed-agronomics, accessed March 2019.

[10] Syngenta. “CORN G12w66 Technical Sheet.” June 8, 2018. http://syngentaebiz.com/ProductPage/Upload_pdf/techsheets/G12W66_180608.pdf, accessed March 2019.

[11] Farmers Business Network. “Seed Agronomics.” https://www.fbn.com/analytics/seed-agronomics, accessed March 2019.

[12] Farmers Business Network. “Seed Agronomics.” https://www.fbn.com/analytics/seed-agronomics, accessed March 2019.

[13] Alex Konrad. “How Farmers Business Network Plans to Disrupt Big Agra, One Farm At A Time.” Forbes, March 7, 2017. https://www.forbes.com/sites/alexkonrad/2017/03/07/farmers-business-network-takes-on-big-agra-with-funding-from-gv/#1b568f3f5d86, accessed March 2019.

[14] Farmers Business Network. “Input Price Transparency.” https://www.fbn.com/analytics/input-price-transparency, accessed March 2019.

[15] Dan Gunderson. “Startup using tech to pull back curtain on seed, fertilizer prices.” MPR News, December 17, 2018. https://www.mprnews.org/story/2018/12/17/startup-using-silicon-valley-tech-pull-back-curtain-on-seed-fertilizer-prices, accessed March 2019.

[16] Farmers Business Network. “Get 2016 Membership Prices Before They Rise.” https://emergence.fbn.com/get-2016-membership-pricing-before-12/31/16, accessed March 2019.

[17] Farmers Business Network. “Hoe can FBN make moeny on only a $700 membership fee.” https://faq.farmersbusinessnetwork.com/hc/en-us/articles/206924827-How-can-FBN-make-money-on-only-a-700-membership-fee-, accessed March 2019.

[18] Garrett Stoerger. “Farm Journal: Bayer, Monsanto discuss ‘Obvious Overlaps’ Possible Divestments.” Verdant Partners, September 5 , 2016. https://www.verdantpartners.com/farm-journal-bayer-monsanto-discuss-obvious-overlaps-possible-divestments/, accessed March 2019.

[19] Farmers Business Network. “Get the Capital You Need to Succeed.” https://www.fbn.com/financing, accessed March 2019.

[20]Farmers Business Network. “Are you confident in your insurance coverage?” https://www.fbn.com/insurance, accessed March 2019.

[21] Clayton Christensen. “Know Your Customers’ ‘Jobs to be Done’.” HBR, September 2016. https://hbr.org/2016/09/know-your-customers-jobs-to-be-done, accessed March 2019.