ClassPass: Uncertain future for boutique fitness platform

ClassPass’s two-sided platform connecting fitness studios and gym-goers operates in an environment of unfavorable network properties

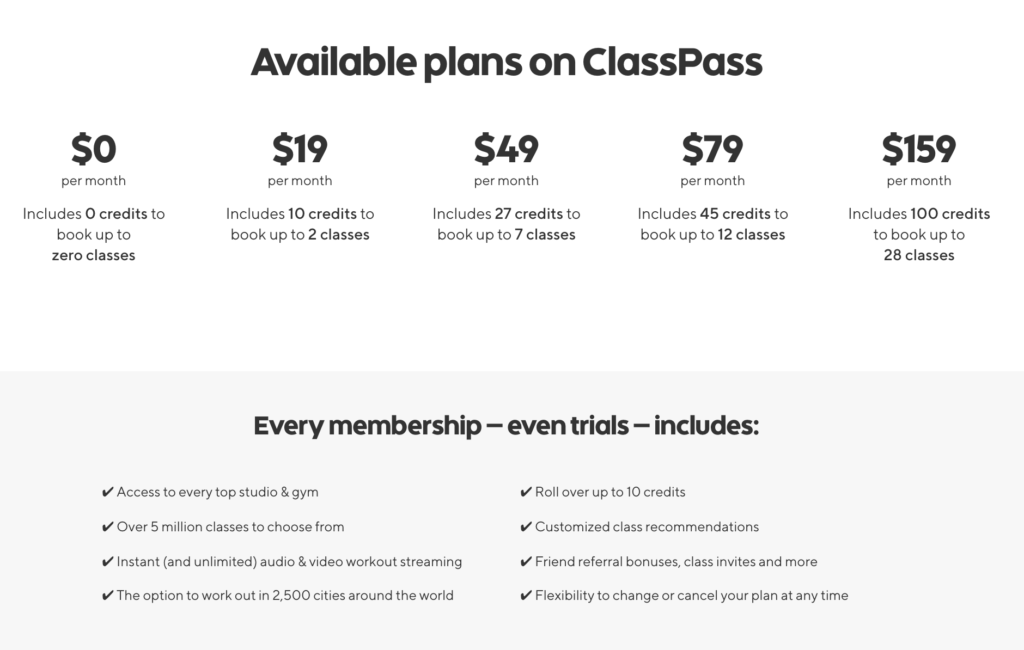

ClassPass is a two-sided platform that connects fitness studios and wellness providers with consumers. Users pay a monthly subscription fee to ClassPass in exchange for an allotment of virtual “credits” that they can spend on fitness classes and wellness experiences offered by a variety of in-network studios across major metropolitan areas. Memberships are offered in tiers that scale according to the number of credits included and varies depending on the home city of the member (e.g., in NYC, there are 4 tiers, the lowest at $19 per month for 10 credits and the highest at $159 per month for 100 credits, with limits on the number of times a member can go to the same studio per month). Launched in 2013, ClassPass operates in 28 countries with 30,000 studio partners, ranging from hourly gym reservations, to boutique fitness classes, to meditation and wellness treatments. In January 2020, ClassPass reached unicorn status with a $285 million Series E funding round led by L Catterton, Apax Digital, and Temasek.[1]

The ClassPass model

ClassPass creates value for consumers by allowing them to access a diverse variety of fitness and wellness classes each month without committing to membership at a particular studio, and at lower prices than studios’ standard rates. Classes are dynamically priced according to demand and the studio’s pricing, taking into account factors like popularity of the class, studio, instructor, and time slot. ClassPass also offers a service for on-demand video workouts called “ClassPass Go” that is free for ClassPass members or $7.99/month for non-members.

ClassPass creates value for fitness and wellness studios by serving as a marketing engine to attract new consumers through its online directory and booking portal. The platform integrates directly with studios’ existing booking API’s ((MindBody, zingFit, Front Desk). ClassPass pays studios a percentage discount to their standard rates on a per-visit basis, claiming to fill in spaces in classes that would otherwise be empty. This percentage discount is negotiated on a studio-by-studio basis (around 50% or less), and can vary through dynamic pricing that matches supply and demand. In particular, ClassPass offers two yield management “SmartTools”, SmartRate and SmartSpot, which analyze a studio’s booking patterns and determines the number of spots and pricing rates to make available to members. According to one news report, “studios on ClassPass typically experience a 30 percent increase in reservation volume and a 15-20 percent increase in revenue when they move to SmartTools.”[2] Most studios are highly subscribed during certain times of the day and undersubscribed at other times yet must contend with high fixed costs such as rent and equipment; ClassPass serves a studio’s need for customer acquisition. However, studios have also voiced their discontent that while partnering with ClassPass may deliver a short-term boost, the platform takes away the studios’ control over how much members pay, does not offer transparency, eats into the client base paying full rates, hurts customer experience, and ultimately degrades financial viability.[3]

ClassPass captures value through the spread between the discounted price charged to consumers through the monthly membership and the even more discounted per-visit payments to studios, as well as on cancellation fees and consumers’ low subscription usage.

Unfavorable network properties point to improbable long-term sustainability

Disintermediation is a significant risk for ClassPass, as the most popular studios (e.g., SoulCycle) do not need ClassPass and actually compete for customers, and super-users who are frustrated with the 3-visit monthly maximum per studio will opt for a direct membership with the studio instead of purchasing through ClassPass. ClassPass has mitigated this somewhat with the dynamic credit-pricing model, although it now results at times in classes that cost more on ClassPass than through the studio directly. Nonetheless, supplier bargaining power causes disintermediation to remain a real risk.

Cross-side network effects are relatively strong, as more studios attracts more users and vice versa. (However, this fails once users find studios they like and exit ClassPass to engage directly with the studio.) Same-side network effects on the user side are encouraged by ClassPass’s feature to allow booking classes with friends, but are minimal overall. On the studio side, same-side network effects are also limited.

Fitness and gym-going are localized activities, and ClassPass is no exception in that it is fragmented into local clusters, which makes it more vulnerable to new entrants and competitors. Multi-homing is uncommon as there are few competitors (varies geographically) and ClassPass has done little in terms of networking bridging and building a self-reinforcing ecosystem.

In light of the above, the basic properties of the network are relatively unfavorable and businesses like ClassPass are not naturally scalable and sustainable. Since its pivot to its credit-buying model in 2018, it seems ClassPass has managed to stay afloat through a laser-focused pricing strategy, and sheer lack of supplier and buyer power. ClassPass’s strategy recently has been focused on International growth, both organically (e.g., entry in December 2019 into Brazil[4], to contend with incumbent unicorn Gympass) and through acquisition (acquisition of MuvPass in Chile and Clickypass in Argentina[5]). This is an expensive and unsustainable path for growth. Additionally, the company is looking to entrench its customer base by growing its corporate business, in which companies subsidize the memberships of employees who are ClassPass members (companies like Google, Facebook, Southwest are partners).[4] This will help to address the risk of disintermediation by consumers and ultimately consumers, and may have a chance at success. Further, while the rising tide of consumer wellness and health consciousness may lift the industry overall, competitors like Peloton and other forms of live-streaming and AR / VR may likely disrupt the industry in the future.

References:

[1] https://techcrunch.com/2020/01/08/classpass-finally-a-unicorn-raises-285-million-in-new-funding/

[2] https://www.forbes.com/sites/yolarobert1/2019/12/18/classpass-smarttools-are-driving-millions-in-revenue-to-fitness-studios/#6b14fcbb14ed

[3] https://www.vice.com/en_us/article/akwnng/classpass-said-angry-studios-are-a-vocal-minorityhere-are-35-more-of-them

[4] https://labs.ebanx.com/en/articles/business/classpass-arrives-in-brazil/

[5] https://www.contxto.com/en/chile/classpass-acquires-clickypass-muvpass/

The SmartTools that ClassPass offers is an interesting benefit I hadn’t necessarily considered. I do wonder with the increased competition of boutique studios out there (it seems like a new studio line is the new fad every other day), how that will affect ClassPass’s business. I would guess that as competition increases on the supplier side, ClassPass’s ability to span across the many different offerings will only become more and more valuable to customers and may actually increase demand for the platform and drive less disintermediation

In addition to the challenge you mentioned about the dynamic credit-pricing strategy making classpass classes more expensive than going directly through the studio, this strategy causes two additional issues for the platform.

1) when class prices drop substantially, the perceived future value of that class is lower making a user less willing to pay the standard rate for the class

2) they are also testing different pricing strategies depending on the booking site, app or the web, making use of the platform for users who know of these differences clunkier and more time consuming

While I appreciate the general premise of ClassPass, they have implemented a number of strategies that reduce the value of their platform and I agree the long term success remains unclear. 🙁

Thanks for sharing – interesting to hear how ClassPass works with studios! It’s interesting that they have incorporated some value-add services such as SmartTools in an effort to make the platform more valuable for studios to prevent disintermediation. It’s also interesting to see ClassPass moving into network bridging as they have more wellness classes included, such as massages and spa treatments. It looks like ClassPass has attempted to improve their platform, which was previously only fitness classes, by bridging their fitness network with a wellness network.

Interesting post – thanks for sharing!

I’m a long-time ClassPass customer – and the disintermediation risk you mentioned resonates with me. I frequently buy classes directly from a studio as either: 1) I’ve hit the monthly limit via ClassPass or 2) the times / instructors available on ClassPass are inferior. As a result, I’m not overly optimistic about ClassPass’ future prospects either.

However, I actually didn’t even know about the on-demand ‘ClassPass Go’ service – I just checked my app and found it there! This could be a way that ClassPass improves its defensibility. If they can make this a social experience – such that multiple friends can log-on and do an on-demand class together via video call, then this may enhance the same-side network effects. The on-demand classes have a low marginal cost – so leveraging them to create network effects could be a route forward for ClassPass.